WH Smith PLC Trading update (8661O)

15 Giugno 2022 - 8:00AM

UK Regulatory

TIDMSMWH

RNS Number : 8661O

WH Smith PLC

15 June 2022

WH Smith PLC

15 June 2022

Trading update for the 15 week period to 11 June 2022

Q3 trading ahead of 2019 revenue; strong performance from

Travel

Full year outturn expected to be at the higher end of

expectations

Further to the Group's Interim results announcement on 27 April

2022, the business continues to benefit from the ongoing recovery

across all our key travel markets, with Group revenue in the 15

weeks to 11 June 2022 ahead of 2019 levels for the first time at

107%, with a particularly strong performance from Travel.

We remain in a strong position to benefit from the significant

growth opportunities across the global travel retail market and

currently have over 125 stores won and yet to open. In addition,

there are a large number of ongoing tenders across our markets.

Total Group revenue in the period as a percentage of 2019 total

revenue has been:

% of 2019 Revenue (1)

Q1 Q2 15 weeks to

11 June 2022

---- ---- --------------

Travel 83% 81% 123%

---- ---- --------------

High Street(2) 87% 84% 79%

---- ---- --------------

Group 85% 83% 107%

---- ---- --------------

Travel

% of 2019 Revenue (1)

Q1 Q2 15 weeks to

11 June 2022

---- ---- --------------

UK 69% 72% 104%

---- ---- --------------

North America(3) 91% 91% 111%

---- ---- --------------

Rest of the World(4) 41% 48% 88%

---- ---- --------------

Total Travel (5) 83% 81% 123%

---- ---- --------------

Our UK business is performing strongly. As passenger numbers

recover, we continue to see strong ATV growth and higher

penetration driven by our ongoing focus to significantly enhance

our ranges and develop our categories, such as health and beauty

and technology. Our recently opened InMotion stores across UK

airports are performing well. In the 15 weeks to 11 June 2022,

Travel UK total revenue was at 104% versus 2019. By channel in the

UK, air was 114%, hospitals were 102% and rail was 87% compared to

2019 levels.

Our North America business continues to show strong momentum

with total revenue during the 15 week period at 111%(3) of 2019

levels. TSA (Transportation Security Administration) data recorded

passenger numbers for the month of May at c.90% of 2019 levels.

During the period we have won further stores, including 4 stores at

Chicago O'Hare airport. Las Vegas continues to perform

strongly.

1 Equivalent month in 2019

2 Includes internet businesses

3 P roforma, constant currency

4 Constant currency

5 As reported

In our Rest of the World division, we are now seeing recovery

across all our markets, including Asia and Australia, with the

strongest recovery in Europe. The first two stores (both in

Majorca) from our recent tender win in Spain have now opened and

are trading well. We anticipate opening a further 20 of the 31 new

stores won in Spain in time for our peak summer trading period this

year. We are in a strong position to capitalise on new space

opportunities. We have a strong tender pipeline and are in active

discussions regarding a number of tenders.

High Street

In High Street, total revenue in the 15 week period to 11 June

2022 versus 2019 was at 79%. This includes the impact from the

cyber incident on Funky Pigeon. We saw a good performance from our

Platinum Jubilee ranges which resonated well with customers, and

our focus on front of store mega deals is delivering good

results.

Outlook

While the broader global economy remains uncertain, the Group is

well positioned to capitalise on the ongoing recovery in our key

markets and take advantage of the many opportunities ahead,

including the 125 new stores won and yet to open, and our new store

formats and category development across multiple geographies.

Travel continues to perform strongly across all three divisions and

we expect this to be maintained into the peak summer trading

period. As a result, we now anticipate the full year outturn to be

at the higher end of analysts' expectations.

Enquiries:

WH Smith PLC

Mark Boyle Investor Relations 07879 897687

Nicola Hillman Media Relations 01793 563354

Brunswick

Tim Danaher 0207 404 5959

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBUGDLCGBDGDS

(END) Dow Jones Newswires

June 15, 2022 02:00 ET (06:00 GMT)

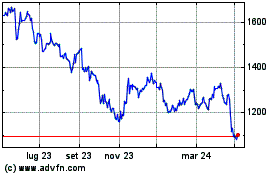

Grafico Azioni Wh Smith (LSE:SMWH)

Storico

Da Mar 2024 a Apr 2024

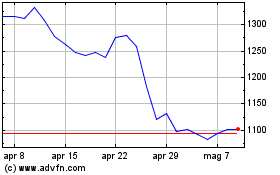

Grafico Azioni Wh Smith (LSE:SMWH)

Storico

Da Apr 2023 a Apr 2024