TIDMSMWH

RNS Number : 0403N

WH Smith PLC

18 January 2023

18 January 2023

WH Smith PLC - The global travel retailer

Ahead of its Annual General Meeting, the Company announces its

trading update

for the 20 week period to 14 January 2023

Strong performance; significantly ahead of last year

Commenting on today's announcement, Carl Cowling, Group Chief

Executive said:

"The Group has made a strong start to the financial year, with

our global travel retail business growing strongly across all

regions.

"Our strategy to transform our customer offer continues at pace

through broadening our categories and expanding our ranges, to

include health and beauty and tech accessories, and is underpinned

by a forensic approach to retail.

"We continue to make good progress with our store opening

programme and, in the year to date, we have opened over 40 new

stores. We have also won significant tenders at Reagan National

airport in Washington and Palm Springs airport in the US, as well

as a further three InMotion stores in Italy at Rome Fiumicino

airport. This takes the total number of stores we have won and yet

to open to over 130.

"I would like to take this opportunity to thank our team across

the globe and, in particular, our store colleagues who have worked

exceptionally hard serving our customers throughout this busy

trading period.

"The Group is in its strongest ever position as a global travel

retailer. This strength, combined with the ongoing improvement in

passenger numbers across the globe, means that we are confident of

another year of significant growth in 2023."

Trading Update

The Group has delivered a strong performance over the 20 week

period with total Group revenue up 41% compared to the prior year

and up 20% versus 2019. Across our global Travel business, we have

seen continued momentum since the start of the financial year

resulting in a strong 20 week performance up 48% on 2019 and up 77%

on 2022. This is despite passenger numbers remaining well below

2019 levels. Our UK High Street division delivered a good

performance, in line with our expectations.

Revenue 20 Weeks to 14 January 2023

Total Total LFL (3) LFL (3)

versus versus versus versus

2022 2019 (1) 2022 2019 (1)

-------- ---------- -------- ----------

UK 70% 18% 52% 2%

North America(2) 31% 20% 21% (2)%

Rest of the

World(3) 198% 30% 126% (1)%

-------- ---------- -------- ----------

Total Travel(4) 77% 48% 48% 1%

-------- ---------- ----------

High Street(5) (2)% (14)% -% (10)%

-------- ---------- ----------

Group 41% 20% 26% (4)%

-------- ---------- -------- ----------

(1) Equivalent month in 2019; (2) Proforma, constant currency;

(3) Constant currency; (4) As reported; (5) Includes internet

businesses

TRAVEL

Travel UK

In Travel UK, total revenue was up 70% compared to the prior

year for the 20 week period and up 18% versus 2019. We continue to

see improving passenger numbers across UK air, a strong performance

in hospitals, and rail performing well.

We continue to focus on initiatives that position us well for

future growth. We have increased average transaction values and

broadened our categories during the period, for example, by ranging

more health and beauty and wellbeing products, providing customers

with a one-stop-shop for all their travel essentials. Our market

leading tech accessories stores, InMotion, are performing

strongly.

In the UK, we are on track to open 15 stores in the year across

all channels.

Revenue 20 Weeks to 14 January 2023

Total Total LFL LFL

versus versus versus versus

2022 2019 (1) 2022 2019 (1)

-------- ---------- -------- ----------

Air 132% 35% 92% 4%

Hospitals 32% 18% 28% 8%

Rail 24% (13)% 26% (9)%

-------- ---------- -------- ----------

Total Travel

UK 70% 18% 52% 2%

-------- ---------- -------- ----------

Travel - North America

Overall revenue for the 20 week period was up 31% compared to

the prior year and on a proforma basis was up 20% versus 2019. Air

passenger numbers continued to improve through the key Thanksgiving

and holiday season with Transportation Security Administration

('TSA') data for the key three week holiday period down only 4%

compared to 2019.

The growth opportunities in North America are substantial and

our strong track record of tender wins continues. We have recently

won a further eight new stores across Reagan National airport in

Washington and Palm Springs airport. We now have over 60 stores won

and due to open in North America over the next three years, with 37

due to open in the current financial year.

Travel - Rest of the World (ROW)

Total revenue was up 198% compared to the prior year for the 20

week period and up 30% versus 2019. Outside of the UK and North

America, we have seen notable improvements in Australia and Asia,

with Europe the best performing region in the period.

There are very good opportunities to win new business under the

WHSmith brand and our tech accessories brand, InMotion, outside of

the UK and the US. Since our last trading update in November 2022,

we have opened 12 new stores including at Brussels and Kuala Lumpur

airports and the Gold Coast and Melbourne in Australia. In

addition, we have won three InMotion stores at Rome Fiumicino

airport which brings the total number of stores won and yet to open

in ROW to over 60.

HIGH STREET

LFL revenue was flat on the prior year in line with our

expectations. Through the peak period, we maintained good stock

availability and we exited Christmas with a clean stock position.

Our cost savings target for the full year is on track.

Outlook

We had a strong start to the year and, while there is economic

uncertainty, passenger numbers globally continue to improve and

this, combined with the strength of the Group's growth

opportunities, means that we are confident of a year of significant

progress in 2023.

Interim Results Announcement

WH Smith PLC, the global travel retailer, will announce its 2023

Interim results on Thursday 20 April 2023.

Enquiries:

WH Smith PLC

Nicola Hillman Media Relations 01793 563 354

Mark Boyle Investor Relations 07879 897 687

Brunswick

Tim Danaher 020 7404 5959

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTEAXFXFSPDEFA

(END) Dow Jones Newswires

January 18, 2023 02:00 ET (07:00 GMT)

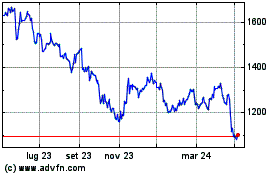

Grafico Azioni Wh Smith (LSE:SMWH)

Storico

Da Mar 2024 a Apr 2024

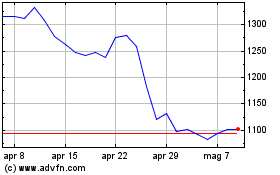

Grafico Azioni Wh Smith (LSE:SMWH)

Storico

Da Apr 2023 a Apr 2024