TIDMSOU

RNS Number : 3276V

Sound Energy PLC

09 August 2022

The information communicated within this announcement is deemed

to constitute inside information as stipulated under the Market

Abuse Regulations (EU) No. 596/2014. Upon the publication of this

announcement, this inside information is now considered to be in

the public domain.

9 August 2022

Sound Energy plc

("Sound Energy" or the "Company")

Update re Phase 2 Development Financing and Launch of Farm-Out

Process

Exploration and Appraisal Portfolio

Sound Energy, the transition energy company, is pleased to

provide an update on the Phase 2 development financing of its

Tendrara Production Concession, an update on the Company's

exploration and appraisal activities and the launch of a farm-out

process for the Tendrara Production Concession and the surrounding

Greater Tendrara and Anoual exploration permits.

Phase 2 Development Financing and Farm-Out Update

As announced on 23 June 2022, the Company mandated Attijariwafa

bank, a Moroccan multinational bank and one of the leading banks in

Morocco, to arrange a long-term project senior debt facility of up

to c.US$250 million for the partial financing (the "Phase 2 Senior

Debt") of the currently estimated approximately US$330 million

Phase 2 development costs (gross, 100%) of the Tendrara Production

Concession. Progress continues to be made with a number of external

banking advisers and data review and, as previously announced, the

parties are seeking to negotiate binding terms for the Phase 2

Senior Debt within 120 days under the 8 month exclusivity.

In addition, the Company is continuing to mature industry and

alternative financing solutions for the remaining Phase 2

development costs of approximately US$60 million net to Sound's 75%

working interest in the Tendrara Production Concession. A number of

industry counterparties capable of providing the required financing

have expressed interest in pursuing discussions in respect of both

of the Company's Tendrara Production Concession and surrounding

Greater Tendrara and Anoual exploration permits.

As a result, the Company announces that it has initiated a

formal farm-out process for the Tendrara Production Concession and

the surrounding Greater Tendrara and Anoual exploration permits and

has appointed Gneiss Energy Limited, a leading energy corporate

finance advisory firm, to manage the farm-out process.

The objective of the area-wide farm-out is to seek a

co-investing partner in each licence to both fund the expected

balance of Phase 2 development costs and also to progress an

exploration and appraisal drilling programme in the Greater

Tendrara and Anoual exploration permit areas.

Exploration Update

Following the Company's announcement on 14 April 2022, the

Company has continued to re-evaluate the extensive exploration

portfolio within the Greater Tendrara and Anoual exploration

permits surrounding the Tendrara Production Concession. The Company

had high graded several potential near term subsalt drilling

opportunities within the Trias Argilo-Gréseux Inférieur ("TAGI")

gas reservoir, the proven reservoir of the TE-5 Horst gas

accumulation within the Tendrara Production Concession.

These drilling opportunities include the exploration prospect

'M5' located on the Anoual exploration permit, together with the

SBK-1 and TE-4 structures previously drilled on the Greater

Tendrara exploration permit.

The Company has published an updated presentation detailing the

Company's planned exploration and appraisal activities which can be

accessed on our corporate website,

https://www.soundenergyplc.com/.

Both SBK-1 and TE-4, drilled in 2000 and 2006 respectively,

encountered gas shows in the TAGI reservoir. SBK-1 flowed gas to

surface during testing in 2000 at a peak rate of 4.41 mmscf/d post

acidification, but was not tested with mechanical stimulation. TE-4

was tested in 2006 but did not flow gas to the surface. Mechanical

stimulation has proven to be a key technology to commercially

unlock the potential of the TAGI gas reservoir in the TE-5 Horst

gas accumulation and, accordingly, the Company believes this offers

potential to unlock commerciality elsewhere in the basin.

Commercial discoveries in the Greater Tendrara and Anoual

exploration permits would have the potential to be commercialised

through the proposed development infrastructure centred on the TE-5

Horst, with sufficient capacity in the planned Tendrara Export

Pipeline or as standalone projects.

The Company is pleased to announce the exploration potential in

these three planned drilling targets. The table below summarises

the exploration potential, expressed as Gas Initially-in-Place.

Target name Unrisked Volume Potential Chance of

Gas Initially-in-Place (Bcf) Success

Gross (100%) basis

------------------------------------

Low Best High Mean

------- -------- -------- -------

TE-4 Horst Appraisal 153 260 408 273 36%

------- -------- -------- ------- ----------

SBK-1 Appraisal 71 130 225 140 50%

------- -------- -------- ------- ----------

M5 Exploration 332 800 1728 943 21%

------- -------- -------- ------- ----------

The Company cautions that notwithstanding its internal estimates

for the exploration potential of the three planned exploration

drilling targets, further exploration activity, including drilling,

will be required to substantiate the estimated exploration

potential and that general exploration in the oil and gas industry

contains an element of risk and there can be no guarantee that the

Company's current estimates of volumes of gas originally in place

will be substantiated by exploration drilling or that any volumes

encountered would actually be available for extraction.

Graham Lyon, Sound Energy's Executive Chairman, commented:

"We are making good progress on the senior debt facility for the

Tendrara project, which is planned to fund the majority of the

Phase 2 development costs.

In parallel, we have now commenced a farm-out process to secure

partner participation in both the development of the Tendrara

Production Concession and exploration and appraisal in the

surrounding exploration permits.

Our re-evaluation of the potential of the Greater Tendrara and

Anoual exploration permits has high-graded three drilling targets,

two of which have previously encountered gas shows. We believe

mechanical stimulation is the key to unlocking the potential of the

TAGI gas reservoir, as we have done at the TE-5 Horst discovery.

Importantly, future discoveries in this area have the potential to

be commercialised through the planned infrastructure that will be

built at the TE-5 Horst development.

We look forward to updating shareholders on progress as we move

forward."

For further information please contact:

Vigo Consulting - PR Adviser Tel: 44 (0)20 7390 0230

Patrick d'Ancona

Finlay Thomson

Sound Energy chairman@soundenergyplc.com

Graham Lyon, Executive Chairman

Cenkos Securities - Nominated Adviser Tel: 44 (0)20 7397 8900

Ben Jeynes

Peter Lynch

SP Angel Corporate Finance LLP Tel: 44 (0)20 3470 0470

- Broker

Richard Hail

Gneiss Energy Limited - Financial Tel: 44 (0)20 3983 9263

Adviser

Jon Fitzpatrick / Paul Weidman

The information contained in this announcement has been reviewed

by Sound Energy's Vice President, Geoscience, Dr John Argent, who

is a Chartered Geologist, a Fellow of the Geological Society of

London and a Member of the Petroleum Exploration Society of Great

Britain, with 25 years of experience in petroleum geology and

management and who is the qualified person as defined in the

guidance note for mining, oil and gas companies issued by the

London Stock Exchange in respect of AIM companies.

Bcf means billion standard cubic feet of gas; Tcf means trillion

standard cubic feet of gas; and best case, high case and low case

estimates are consistent with SPE (The Society of Petroleum

Engineers) 2018 PRMS (Petroleum Resource Management System)

guidelines.

Petroleum is defined as a naturally occurring mixture consisting

of, but not limited to, hydrocarbons in the gaseous, liquid, or

solid phase. Petroleum may also contain non-hydrocarbon compounds,

common examples of which are carbon dioxide, nitrogen, hydrogen

sulfide, and sulfur.

Reservoir is a subsurface rock formation that contains an

individual and separate natural accumulation of petroleum that is

confined by impermeable barriers, pressure systems, or fluid

regimes (conventional reservoirs), or is confined by hydraulic

fracture barriers or fluid regimes (unconventional reservoirs).

Resources are all quantities of petroleum (recoverable and

unrecoverable) naturally occurring on or within the earth's crust,

discovered and undiscovered, plus those quantities already

produced.

Gas Initially-in-Place (GIIP) is the total quantity of gaseous

petroleum that is estimated to exist originally in naturally

occurring reservoirs, as of a given date.

Forward looking statements

Certain statements in this announcement are forward-looking

statements which are based on the Company's expectations,

intentions and projections regarding its future performance,

anticipated events or trends and other matters that are not

historical facts. Generally, the words 'will', 'may', 'should',

'continue', 'believes', 'targets', 'plans', 'expects', 'aims',

'intends', 'anticipates' or similar expressions or negatives

thereof identify forward-looking statements. These statements are

not guarantees of future performance and are subject to known and

unknown risks, uncertainties and other factors that could cause

actual results to differ materially from those expressed or implied

by such forward-looking statements. Factors that would cause actual

results or events to differ from current expectations, intentions

or projections might include, amongst other things, changes in oil

prices, changes in equity markets, failure to establish estimated

petroleum reserves, political risks, changes to regulations

affecting the Company's activities, delays in obtaining or failure

to obtain any required regulatory approval, failure of equipment,

uncertainties relating to the availability and costs of financing

needed in the future, the uncertainties involved in interpreting

drilling results and other geological, geophysical and engineering

data, delays in obtaining geological results and other risks

associated with exploration, development and production. Given

these risks and uncertainties, readers should not place undue

reliance on forward-looking statements.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDGGDIRXGDGDI

(END) Dow Jones Newswires

August 09, 2022 02:00 ET (06:00 GMT)

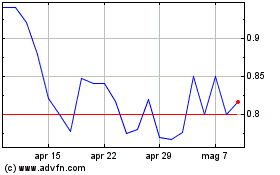

Grafico Azioni Sound Energy (LSE:SOU)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Sound Energy (LSE:SOU)

Storico

Da Apr 2023 a Apr 2024