TIDMSSE

RNS Number : 7147A

SSE PLC

27 September 2022

SSE plc

notification of closed period

27 SEPTEMBER 2022

Ahead of publication on 16 November 2022 of results for the six

months to 30 September 2022, SSE plc today updates the market on

its recent performance and outlook, including:

-- Expecting to report half-year adjusted earnings per share of

at least 40 pence, as balanced business mix continues to navigate

volatile market conditions

-- Continuing to expect full-year adjusted earnings per share of

at least 120 pence, against the backdrop of uncertainty associated

with a highly changeable operating environment

-- Investing at record levels, ahead of profits, in the clean

electricity infrastructure needed for decarbonisation and national

energy self sufficiency, including construction of the world's

largest offshore wind farm

Half Year Financial outlook

Since SSE's Q1 Trading Statement, good performance from gas

storage and flexible thermal has continued in volatile market

conditions, demonstrating their value to the energy system. At the

same time, lower-than-expected output, mainly due to weather, means

total renewable output for the year to 22 September was around 13%

below plan.

In light of this SSE expects to report half year 2022/23

adjusted earnings per share of at least 40 pence. However, as

performance over any six-month period can be variable, SSE focuses

on results for the financial year as a whole and manages its

businesses accordingly.

Developments in the execution of SSE's Net Zero Acceleration

Programme include:

-- First power from Seagreen, Scotland's largest and the world's

deepest tethered offshore wind farm, in August 2022;

-- Construction on what will be the world's largest offshore

wind farm at Dogger Bank and Viking onshore wind farm on Shetland

progressing to plan;

-- Delay to completing the commissioning of the Keadby 2 CCGT,

which is now expected to be available later this winter to help

ensure secure energy supplies;

-- Completion of the acquisition of the c.3.8GW Southern

European onshore wind development platform, with scope for up to

1.4GW of additional solar opportunities; and

-- Completion of the joint acquisition of Triton Power with

Equinor, including the 1.2GW Saltend power station which has

significant decarbonisation potential.

Adjusted net debt is expected to be around GBP10bn at 30

September 2022, with a high proportion held at fixed rates, and SSE

continues to have access to the capital markets with issuance of a

EUR1.0bn Hybrid Bond in April 2022 and a EUR650m Green Bond in July

2022. The Group's collateral requirements are within existing

facilities and SSE's GBP1.5bn of Revolving Credit Facilities

remains undrawn throughout the period.

Full Year Financial outlook

SSE's balanced portfolio of assets of electricity networks,

renewables and flexible generation and storage mean that the

Company is performing well in volatile market conditions. However,

risks remain given continuing market uncertainty and liquidity, a

fast-moving policy environment, weather variability, plant

availability and the complexity and scale of large capital projects

in which SSE is engaged. As always, SSE will seek to manage these

risks carefully through the winter period.

Despite the current highly changeable market environment, and

the resultant wide range of potential financial outcomes from

volatile future commodity prices, SSE's original full-year guidance

of adjusted earnings per share of at least 120 pence remains

unchanged. SSE expects to provide updated guidance on full-year

adjusted earnings per share later in the year, as the winter period

progresses.

SSE has been clear that any additional profit it may generate,

subject to the risks outlined above, will be reinvested in projects

that will provide long-term solutions that help reduce the UK's

exposure to volatile international gas prices. The Company remains

on course to report record 2022/23 capex in excess of GBP2.5bn

(including acquisitions) and expects leverage to be lower than the

target 4.5 times net debt to EBITDA ratio.

Finance Director, Gregor Alexander, said:

"Our balanced business mix has ensured a strong performance to

date, however in such highly volatile market conditions, financial

performance for the full year will be significantly influenced by

plant availability, weather and commodity price movements.

"SSE continues to deliver growth through its fully-funded

GBP12.5bn Net Zero Acceleration Programme that will benefit society

in the long term. Our plans include a growth enabling, rebased

dividend from 2023/24 onwards and SSE's net investment into vital

UK and Ireland infrastructure could exceed GBP25bn this decade,

creating thousands of jobs and ensuring secure, affordable, low

carbon energy systems.

"As an infrastructure company SSE's over-riding response to the

European energy crisis is to address the root cause of the problem

and we are committed to reinvesting any additional profits derived

from market variability directly back into energy infrastructure

that will prevent a repeat of the crisis in the long-term."

Enquiries

Sally Fairbairn, +44 (0)345 0760

Investors SSE Investor Relations ir@sse.com Michael Livingston 530

Sam Peacock, +44 (0)345 0760

Media SSE Media media@sse.com Glenn Barber 530

+44 (0)7885

MHP Communications Oliver Hughes 224 532

+44 (0)7709

Simon Hockridge 496 125

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCDGGDCDGDDGDL

(END) Dow Jones Newswires

September 27, 2022 02:01 ET (06:01 GMT)

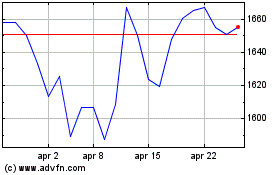

Grafico Azioni Sse (LSE:SSE)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Sse (LSE:SSE)

Storico

Da Apr 2023 a Apr 2024