TIDMTLW

RNS Number : 2399B

Tullow Oil PLC

29 September 2022

NOT FOR RELEASE, PUBLICATION OR DISTRIBUTION, IN WHOLE OR IN

PART, DIRECTLY OR INDIRECTLY, IN, INTO OR FROM ANY JURISDICTION

WHERE TO DO SO WOULD CONSTITUTE A VIOLATION OF THE RELEVANT LAWS OR

REGULATIONS OF SUCH JURISDICTION.

T HIS ANNOUNCEMENT CONTAINS INSIDE INFORMATION.

FOR IMMEDIATE RELEASE .

29 September 2022

Tullow Oil plc

Statement regarding proposed all-share combination with

Capricorn Energy plc - no intention to increase offer or switch

from scheme to offer

The Board of Tullow Oil plc ("Tullow") notes the announcement

released today by Capricorn Energy plc ("Capricorn") in connection

with Capricorn's proposed combination with NewMed Energy Limited

Partnership. Following the withdrawal of the intention of the

Capricorn directors to recommend the proposed combination with

Tullow, the Board of Tullow:

-- has determined not to increase the value of Tullow's offer

for Capricorn or to elect to implement its offer by way of a

contractual offer;

-- is entitled to serve notice to terminate the Co-operation

Agreement between Tullow and Capricorn, which it intends to do;

-- accepts that without the recommendation and cooperation of

Capricorn the scheme of arrangement cannot practically be

implemented and become effective.

The Board of Tullow continues to believe the terms of the

Combination with Capricorn would create value for Tullow

shareholders. However, the successful delivery of the business

plan, strong operating and financial performance and a high

quality, opportunity-rich portfolio reinforces the Board's

confidence in Tullow's future. On 14 September 2022, Tullow issued

Half Year results in which the Group clearly demonstrated that it

is already delivering on its plan:

-- Tullow's standalone business plan for 2022-25 is expected to

deliver c.$1bn of free cash flow at $75 per barrel and nearly $2bn

over the same period at $100 per barrel;

-- The company continues to progress a number of levers for

value creation including plans for Jubilee South East and North

East, TEN Enhancement, Ghana Gas and Kenya;

-- Improved operations continue to deliver production growth

which is underpinned by 2P reserves of 242 mmboe and 2C resources

of 668 mmboe;

-- Forecast free cash flow for 2022 of c.$200 million is

expected to deliver gearing of less than 1.5x at YE 2022;

-- Material upside from contingent payments linked to previous

divestments in Uganda, Equatorial Guinea and Gabon.

Rahul Dhir, CEO of Tullow Oil plc, commented today:

"As demonstrated by our recent results, Tullow's business is

performing well following a comprehensive operational and financial

turnaround over the past two years. While the merger with Capricorn

would be value-enhancing, we have transformed our cost base, sold

non-core assets, refinanced our debt and improved our capital

efficiency. Tullow has a unique asset base and a scalable operating

platform that will deliver material value for our investors in the

coming years. I look forward to discussing our plans at a Capital

Markets Day that we will host before the end of the year."

The person responsible for making this announcement on behalf of

Tullow is Adam Holland, Company Secretary.

Enquiries:

Tullow

+44 (0)20 3249 9000

Investors

Robert Hellwig

Matthew Evans

Media

George Cazenove

PJT Partners ( Lead Financial Adviser )

+44 (0)20 3650 1100

Ben Monaghan

Basil Geoghegan

Jonathan Hall

Barclays (Financial Adviser, Corporate Broker and Sole

Sponsor)

+44 (0)20 7623 2323

Grant Porter

Robert Mayhew

Tom Macdonald

Camarco (PR advisers)

+44 (0)20 3781 9244

Billy Clegg

Rebecca Waterworth

Important Notices relating to the Financial Advisers

PJT Partners, which is authorised and regulated by the Financial

Conduct Authority in the United Kingdom, is acting exclusively for

Tullow and no-one else in connection with the matters referred to

in this announcement and will not be responsible to anyone other

than Tullow for providing the protections afforded to clients of

PJT Partners nor for providing advice in relation to the matters

referred to in this announcement. Neither PJT Partners nor any of

its subsidiaries, branches or affiliates owes or accepts any duty,

liability or responsibility whatsoever (whether direct or indirect,

whether in contract, in tort, under statute or otherwise) to any

person who is not a client of PJT Partners in connection with this

announcement, any statement contained herein or otherwise.

Barclays, which is authorised by the Prudential Regulation

Authority and regulated in the United Kingdom by the Financial

Conduct Authority and the Prudential Regulation Authority, is

acting exclusively for Tullow and no one else in connection with

the matters referred to in this announcement and will not be

responsible to anyone other than Tullow for providing advice in

relation to the matters referred to in this announcement.

In accordance with the Code, normal United Kingdom market

practice and Rule 14e-5(b) of the Exchange Act, Barclays and its

affiliates will continue to act as exempt principal trader in

Tullow securities on the London Stock Exchange. These purchases and

activities by exempt principal traders which are required to be

made public in the United Kingdom pursuant to the Code will be

reported to a Regulatory Information Service and will be available

on the London Stock Exchange website at

www.londonstockexchange.com. This information will also be publicly

disclosed in the United States to the extent that such information

is made public in the United Kingdom.

Disclosure requirements

Under Rule 8.3(a) of the Code, any person who is interested in

1% or more of any class of relevant securities of an offeree

company or of any securities exchange offeror (being any offeror

other than an offeror in respect of which it has been announced

that its offer is, or is likely to be, solely in cash) must make an

Opening Position Disclosure following the commencement of the offer

period and, if later, following the announcement in which any

securities exchange offeror is first identified. An Opening

Position Disclosure must contain details of the person's interests

and short positions in, and rights to subscribe for, any relevant

securities of each of (i) the offeree company and (ii) any

securities exchange offeror(s). An Opening Position Disclosure by a

person to whom Rule 8.3(a) applies must be made by no later than

3.30 pm (London time) on the 10th business day following the

commencement of the offer period and, if appropriate, by no later

than 3.30 pm (London time) on the 10th business day following the

announcement in which any securities exchange offeror is first

identified. Relevant persons who deal in the relevant securities of

the offeree company or of a securities exchange offeror prior to

the deadline for making an Opening Position Disclosure must instead

make a Dealing Disclosure.

Under Rule 8.3(b) of the Code, any person who is, or becomes,

interested in 1% or more of any class of relevant securities of the

offeree company or of any securities exchange offeror must make a

Dealing Disclosure if the person deals in any relevant securities

of the offeree company or of any securities exchange offeror. A

Dealing Disclosure must contain details of the dealing concerned

and of the person's interests and short positions in, and rights to

subscribe for, any relevant securities of each of (i) the offeree

company and (ii) any securities exchange offeror(s), save to the

extent that these details have previously been disclosed under Rule

8. A Dealing Disclosure by a person to whom Rule 8.3(b) applies

must be made by no later than 3.30 pm (London time) on the business

day following the date of the relevant dealing.

If two or more persons act together pursuant to an agreement or

understanding, whether formal or informal, to acquire or control an

interest in relevant securities of an offeree company or a

securities exchange offeror, they will be deemed to be a single

person for the purpose of Rule 8.3.

Opening Position Disclosures must also be made by the offeree

company and by any offeror and Dealing Disclosures must also be

made by the offeree company, by any offeror and by any persons

acting in concert with any of them (see Rules 8.1, 8.2 and

8.4).

Details of the offeree and offeror companies in respect of whose

relevant securities Opening Position Disclosures and Dealing

Disclosures must be made can be found in the Disclosure Table on

the Takeover Panel's website at www.thetakeoverpanel.org.uk ,

including details of the number of relevant securities in issue,

when the offer period commenced and when any offeror was first

identified. You should contact the Panel's Market Surveillance Unit

on +44 (0)20 7638 0129 if you are in any doubt as to whether you

are required to make an Opening Position Disclosure or a Dealing

Disclosure.

Publication of this announcement

A copy of this announcement will be available subject to certain

restrictions on Tullow's website at https://www.tullowoil.com .

The contents of Tullow's website is not incorporated into and do

not form part of this announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCQKLFLLKLLBBK

(END) Dow Jones Newswires

September 29, 2022 12:34 ET (16:34 GMT)

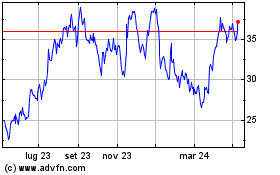

Grafico Azioni Tullow Oil (LSE:TLW)

Storico

Da Mar 2024 a Apr 2024

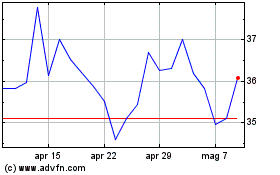

Grafico Azioni Tullow Oil (LSE:TLW)

Storico

Da Apr 2023 a Apr 2024