TIDMTPT

RNS Number : 2725E

Topps Tiles PLC

10 March 2022

10 March 2022

Topps Tiles Plc (the "Group")

Acquisition of Pro Tiler Ltd & Q2 Trading Update

Topps Tiles, the UK's leading tile specialist, announces the

acquisition of 60% of the issued share capital of Pro Tiler Ltd

("Pro Tiler"), an online specialist supplier of tiling-related

consumables and equipment to trade customers, and a trading update

for the second quarter of the financial year ending 1 October

2022.

Acquisition of Pro Tiler

The Group has acquired 60% of the issued share capital of Pro

Tiler, an online specialist supplier of tiling-related consumables

and equipment to trade customers (the "Initial Acquisition"). The

Group and Pro Tiler have also agreed put and call options relating

to the purchase by the Group of the remaining 40% of the issued

share capital of Pro Tiler, which are exercisable from March 2024

(the "Subsequent Acquisition", and together with the Initial

Acquisition, the "Acquisition").

Pro Tiler is a recognised and respected brand within the tiling

market which operates three online businesses: protilertools.co.uk,

northantstools.co.uk and premiumtiletrim.co.uk. Pro Tiler was

established in 2010 by Andy Bucknall, his wife Wendy, and their two

sons Sam and Todd. Andy, Sam and Todd all previously worked as

professional tilers and are well respected within the industry. As

part of this transaction, Andy and Wendy will retire from the

business while Sam and Todd will continue to run the day-to-day

operations of Pro Tiler.

Pro Tiler has delivered rapid growth in recent years through an

expansion of its product range and a focus on high quality service,

which has enabled it to serve an increasingly wide customer base.

In the financial year ended 31 March 2021, Pro Tiler reported

turnover of GBP9.3 million and profit before tax of GBP1.1

million(1) . In the current year, the business has continued to

grow and the turnover in the twelve months to 31 January 2022 was

GBP11.9 million. Pro Tiler is expected to benefit from the Group's

buying scale, flexible supply chain and financial resources to

support its further growth.

Consideration of GBP5.3 million (plus a GBP0.3 million closing

adjustment) was paid in cash on completion of the Initial

Acquisition for 60% of the issued share capital of the business.

The Group intends to acquire the remaining 40% of the issued share

capital from March 2024, based on an agreed multiple of profits for

the 12 month period to March 2024. Consideration for the Initial

Acquisition was financed from the Group's existing cash

balances.

The acquisition of Pro Tiler is a significant development in the

Group's growth strategy and an important first step into operating

a specialist online business alongside its award winning

omni-channel Retail business and Commercial brands. The Board

expects the Acquisition of Pro Tiler to be accretive to adjusted

earnings in the current financial year and beyond(2) .

Q2 Trading update

Retail trading in the second quarter to date has progressed

well, with sales for the first nine weeks growing by 18.2% on a two

year like-for-like basis and 45.6% on a one year like-for-like

basis (against a period of trading restrictions last year).

Q1 FY21 Q2 FY21 Q3 FY21 Q4 FY21 Q1 FY22 Q2 FY22

first 9

weeks

Two-year Retail

like-for-like

sales +13.0% -23.1% +12.9% +21.7% +21.0% +18.2%

-------- -------- -------- -------- -------- ---------

One-year Retail

like-for-like

sales +19.9% -17.3% +131.0% +3.0% +1.0% +45.6%

-------- -------- -------- -------- -------- ---------

Retail gross margins have also improved following management

actions on pricing, our costs remain well controlled despite

significant inflation and operating cash flows are in line with

expectations. The Group is confident of delivering adjusted profit

before tax in line with its expectations for the year as a

whole.

Our Commercial business has continued to deliver encouraging

sales growth, the order book is strong and we remain confident that

we will deliver an improved performance in the Commercial business

this year.

Rob Parker, Chief Executive, said: "Pro Tiler is a

well-respected brand with a strong customer service ethic, which

fits closely with our core values. The acquisition of an online

specialist supplier to trade customers complements our omni-channel

Retail business and Commercial brands. It also moves us closer to

our 20% market share goal of '1 in 5 by 2025' while maintaining our

specialism of tiling and related products. I look forward to

working with Sam and Todd Bucknall and helping them to take this

successful business forward into the next stage of its growth. The

development of our digital offer remains an important area of focus

for the Group and we have plans in place to expand this further in

2022.

"Trading for the year to date is in line with our plan and we

are confident of delivering performance in line with our

expectations."

The Group will announce its interim results for the 26 weeks to

2 April 2022 on 24 May 2022.

(1) Unaudited financial information: For the year to 31 March

2021, Pro Tiler delivered revenue of GBP9.3 million (FY20: GBP4.4

million) and a profit before tax of GBP1.1 million (FY20: GBP0.4

million). Pro Tiler's gross assets as at 31 March 2021 were GBP3.2

million (31 March 2020: GBP1.0 million).

(2) The accounting for the Acquisition will be under IFRS 3. As

required under this Standard, the consideration for the Subsequent

Acquisition will be expensed as employee remuneration over a

two-year period as opposed to being part of the acquisition

accounting due to certain requirements placed on Sam and Todd

Bucknall to remain employed by the Group during this period. This

income statement expense and any fair value adjustments will be

excluded from adjusted profits over this time period.

For further information please contact:

Topps Tiles Plc

Rob Parker, CEO

Stephen Hopson, CFO 0116 282 8000

Citigate Dewe Rogerson

Kevin Smith

Ellen Wilton 020 7638 9571

Notes to editors

Topps Tiles Plc is the UK's largest specialist supplier of tiles

and associated products, targeting the UK domestic refurbishment

and commercial market and serving a retail and trade customer base

from 314 nationwide Retail stores, 5 Commercial showrooms and three

trading websites: www.toppstiles.co.uk , www.parkside.co.uk and

www.stratatiles.co.uk .

Since opening its first store in 1963, Topps has maintained a

simple operating philosophy -- inspiring customers with unrivalled

product choice and providing exceptional levels of customer

service. For further information on the Group, please visit

http://www.toppstilesplc.com/

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

ACQEAADNEDAAEAA

(END) Dow Jones Newswires

March 10, 2022 02:00 ET (07:00 GMT)

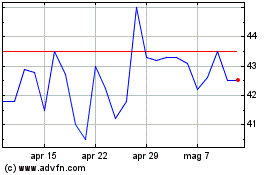

Grafico Azioni Topps Tiles (LSE:TPT)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Topps Tiles (LSE:TPT)

Storico

Da Apr 2023 a Apr 2024