TIDMTRP

RNS Number : 4424N

Tower Resources PLC

30 September 2021

30 September 2021

Tower Resources plc

Interim Results to 30 June 2021

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN)),

the AIM-listed oil and gas company with its focus on Africa,

announces its Interim Results for the six months ended 30 June

2021.

HIGHLIGHTS

-- January 2021 Placing of 384,615,384 new ordinary shares at

0.325p to raise GBP1.25 million (gross), together with issuance of

one placing warrant for every three placing shares exercisable for

two years at 0.65 pence per share and repayment of the US$500,000

Shard Merchant Capital Ltd loan facility;

-- Up dated resource estimates for the Algoa-Gamtoos license,

offshore South Africa, following the reprocessing of additional 2D

seismic data from Tower's 50% partner and license Operator, New Age

Energy Algoa (Pty) Ltd. The updated resource estimate identified

three separate reservoir targets in the deep-water (Outeniqua

basin) section of the license with a total of 1,411 million boe

Pmean recoverable resources (unrisked). A new lead in the submarine

fan complex in the shallower Gamtoos area of the license was also

identified and is estimated to contain 135 million boe Pmean

recoverable resources (unrisked);

-- March 2021 extension to the US$750,000 Pegasus Petroleum Loan

Facility ("Facility") to 30 November 2021 in exchange for an

increase in production-based payments due to Pegasus from the

Company's Thali license, offshore Cameroon. Interest continued to

accrue at 12% per annum, and the production-based payments were

increased to 3.75% of the contractor share of production if the

Facility was repaid prior to July 15 2021 and 5.00% otherwise.

-- In March 2021 through the Company's subsidiary, Tower

Resources Cameroon SA, Tower received Presidential approval of a

further extension to the First Exploration Period of the Thali PSC,

offshore Cameroon, to May 2022 following the Company having

declared Force Majeure with respect to the PSC a year earlier due

to the Covid-19 pandemic.

-- In May 2021, Tower Resources Cameroon SA received formal c

onfirmation from the Cameroon Minister of Mines, Industry and

Technological Development ("MINMIDT") of the formal extension of

the First Exploration Period of the Thali PSC, offshore Cameroon,

to May 2022. The extension enables the Company to finalise the

schedule for the drilling and testing of the NJOM-3 well;

-- A ruling by the UK's VAT Upper-Tier Tax Tribunal, which

upheld the First-Tier Tribunal's decision in favour of Tower in the

Company's dispute with HMRC regarding its decision to deny the

Company credit for input VAT, was announced in May 2021;

-- June 2021 Subscription for 20,000,000 new ordinary shares at

0.25p to raise GBP50,000 (gross) by the Company's Chairman and CEO,

Jeremy Asher. At the same time the terms of the Facility were

modified so that the higher level of production-based payments due

to Pegasus from the Thali PSC would only come into force if the

Facility were not repaid by 15 August 2021 as opposed to 15 July

2021.

POST REPORTING PERIOD EVENTS

-- In August 2021 the Company announced binding Heads of

Agreement ("HoA") in respect of a farm-out to Beluga Energy Limited

("Beluga") of a 49% non-operating working interest in its Thali PSC

in Cameroon.

The key economic elements of the transaction set out in the HoA

were:

o The farm-out covers US$15 million towards the cost of the

NJOM-3 well that Tower is planning to drill on the Thali block;

o Beluga will receive a 49% working interest in the PSC, subject

to production-based payments to Tower's subsidiary TRCSA amounting

to 10% of the contractor share of production accruing to Beluga

under the PSC;

o The well cost is currently expected to be approximately

US$16.8 million, of which approximately US$3 million has already

been spent;

o Each party will recover costs actually funded and recoverable

under the PSC, pari-passu;

o Tower will effectively contribute its non-recoverable costs in

consideration of the production-based payments referred to

above;

o Costs in excess of U$15 million, and future costs, will be

funded pro-rata with respect to Tower's and Beluga's working

interests.

The HoA were binding subject only to final documentation, a

financing contingency requiring Beluga's shareholders' approval,

and approval of the Minister of Mines, Industry and Technological

Development ("MINMIDT");

-- August 2021 Placing of 352,941,176 new ordinary shares at

0.425p to raise GBP1.5 million (gross). Net proceeds of the Placing

were used to repay the US$750,000 Facility, together with accrued

interest and fees of US$102,500, and to cover working capital

requirements; the repayment of the Facility was made in time to

avoid the higher level of production-based payments which would

have been due had repayment been delayed to November 2021.

-- Finalisation of documentation relating to the farm-out to

Beluga Energy Limited of a 49% non-operating working interest in

the Company's Thali PSC in Cameroon and submission of the

documentation the Minister of Mines, Industry and Technological

Development ("MINMIDT") as per the Cameroon Petroleum Code.

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

Contacts

Tower Resources plc +44 20 7157 9625

Jeremy Asher

Chairman and CEO

Andrew Matharu

VP - Corporate Affairs

SP Angel Corporate Finance

LLP

Nominated Adviser and Joint

Broker

Stuart Gledhill + 44 20 3470

Caroline Rowe 0470

Novum Securities Limited

Joint Broker

Jon Bellis + 44 20 7399

Colin Rowbury 9400

Panmure Gordon (UK) Limited

Joint Broker

Nick Lovering + 44 20 7886

Hugh Rich 2500

CHAIRMAN AND CHIEF EXECUTIVE OFFICER'S STATEMENT FOR THE SIX

MONTHSED 30 JUNE 2021

Dear Shareholder,

The first six months of 2021 have been very positive for our

Company, in marked contrast to the first six months of 2020, and

the progress we have made during this period has, so far, been

carried through the third quarter.

We were delighted to agree the farm-out to Beluga Energy Limited

("Beluga"), and over the last two months we have moved forward with

negotiation of a fresh rig contract and with resumption of

discussions with the service companies to finalise both terms and

schedule for the drilling and testing of the NJOM-3 well.

It took a little longer to finalise the full documentation of

the farm-out than we had hoped but this was still achieved quite

rapidly, and the documents are now with the relevant Cameroon

Government bodies, and also with Beluga's financiers. Beluga

yesterday requested, and we have agreed, a 30-day extension to the

financing contingency which, together with the Cameroon government

approval, are conditions precedent for completion of the farmout,

and we also still have to finalise the escrow agreement with our

lawyers, Watson, Farley & Williams LLP, for funds to be held

prior to disbursements. So although we now expect completion will

not be before the end of October at the earliest, we believe the

transaction remains on track.

At the time of writing, while spudding the well before the

year-end remains theoretically possible, we believe that the most

likely timing for the well is in the first quarter 2022, and we are

still working on the dates which will best fit the combination of

rig and service company schedules and lead times. I should note

that we are presently considering two rigs, one available early in

Q1 2022 and one available later in Q1 2022, in addition to other

rig possibilities, and so we are confident of both rig and service

availability in this period. But we are obviously keen to spud

earlier rather than later if possible.

We have also already begun work on planning the next steps to

reach oil production assuming a successful test result from NJOM-3.

As presently conceived, this would involve the design and drilling

of three further wells deviated into different parts of the Njonji

structure from the NJOM-3 well location, and the completion of the

four wells with wellheads above the water on a simple steel

structure which would also brace the four well conductors. This

would allow easy access to the wellheads for a Mobile Oil

Production Unit ("MOPU") and shuttle tanker.

A significant element on the critical path to oil production is

the specification and procurement of the MOPU, and until it is

secured this also probably represents the largest operational risk

to both schedule and budget for reaching first oil. Therefore we

have already begun discussions with contractors about cooperation

to secure or build a suitable unit as a joint venture, including

the possibility of securing an option on a unit, to be declared

after we have the result of the NJOM-3 well. These negotiations

will reduce significantly the lead time for the next stage of the

Njonji project, assuming the current well achieves its objectives

successfully.

Looking forward outside Cameroon, in South Africa we anticipate

making decisions over the coming months with our joint venture

partner NewAge regarding the timing, specification and financing of

further 3D seismic acquisition over our Algoa-Gamtoos license in

South Africa, with our preferred focus being the leads in the deep

water Outeniqua basin section of the block that contain a combined

unrisked potential recoverable resource of over 1.4 billion boe. We

are also engaging in further basin modelling on our Namibian

blocks, while waiting with interest for the results from Shell and

Total's upcoming wells in the Namibian Orange Basin.

Finally, we were very gratified by the decision of the Upper

Tier Tribunal, which we received in May, to uphold the First Tier

Tribunal's 2019 decision in our favour regarding our eligibility

for VAT and our entitlement to refunds of input VAT, which HMRC now

accepts. This ruling covers our current and future VAT returns and

also the past returns up to the period covered by our original

appeal to the FTT. There are a number of returns for periods after

those covered by the original FTT appeal that are covered by two

further appeals that remain with the FTT, which is why we have not

yet completed eliminated the provision for VAT in our accounts, but

we are hopeful that these will also be resolved satisfactorily in

due course.

Jeremy Asher

Chairman and Chief Executive

30 September 2021

INTERIM CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

Six months ended Six months ended

30 June 2021 30 June 2020

(unaudited) (unaudited)

Note $ $

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Revenue - -

Cost of sales - -

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Gross profit - -

Other administrative expenses (276,150) (364,019)

VAT provision 519,912 135,907

Share-based payment charges incurred on incentivisation of staff

and consultants 9 (153,039) (148,924)

Pre-licence expenditures (274) -

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Total administrative expenses 90,449 (377,036)

Group operating loss 90,449 (377,036)

Finance expense (129,907) (80,651)

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Loss for the period before taxation (39,458) (457,687)

Taxation - -

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Loss for the period after taxation (39,458) (457,687)

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Other comprehensive income - -

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Total comprehensive expense for the period (39,458) (457,687)

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Basic loss per share (USc) 3 (0.00c) (0.04c)

-------------------------------------------------------------------- ----- ----------------- --- -----------------

Diluted loss per share (USc) 3 (0.00c) (0.04c)

-------------------------------------------------------------------- ----- ----------------- --- -----------------

INTERIM CONSOLIDATED STATEMENT OF FINANCIAL POSITION

30 June 2021 31 December 2020

(unaudited) (audited)

Note $

----------------------------------- ----- -------------- -----------------

Non-current assets

Exploration and evaluation assets 4 27,942,083 27,080,202

----------------------------------- ----- -------------- -----------------

27,942,083 27,080,202

Current assets

Trade and other receivables 5 23,275 8,805

Cash and cash equivalents 125,030 10,054

----------------------------------- ----- -------------- -----------------

148,305 18,859

Total assets 28,090,388 27,099,061

----------------------------------- ----- -------------- -----------------

Current liabilities

Trade and other payables 6 3,256,877 3,796,111

Borrowings 7 870,645 1,262,937

----------------------------------- ----- -------------- -----------------

4,127,522 5,059,048

Non-current liabilities

Borrowings 7 54,906 68,763

----------------------------------- ----- -------------- -----------------

54,906 68,763

Equity

Share capital 8 18,259,833 18,254,040

Share premium 8 147,107,600 145,343,446

Retained losses (141,459,473) (141,626,236)

----------------------------------- ----- -------------- -----------------

23,907,960 21,971,250

----------------------------------- ----- -------------- -----------------

Total liabilities and equity 28,090,388 27,099,061

----------------------------------- ----- -------------- -----------------

Signed on behalf of the Board of Directors

Jeremy Asher

Chairman and Chief Executive

29 September 2021

INTERIM CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

Share Share (1) Share-based Retained Total

capital premium payments losses

reserve

$ $ $ $ $

At 1 January 2020 18,251,117 144,294,128 7,659,308 (148,452,837) 21,751,716

-------------------------------------------- ----------- ------------ ---------------- -------------- -----------

Shares issued for cash 1,748 653,757 - - 655,505

Shares issued on settlement of third-party

fees 70 26,150 - - 26,220

Shares issued on settlement of staff - - - - -

remuneration

Share issue costs - (58,996) - - (58,996)

Total comprehensive income for the period - - 177,107 (457,687) (280,580)

At 30 June 2020 18,252,935 144,915,039 7,836,415 (148,910,524) 22,093,865

-------------------------------------------- ----------- ------------ ---------------- -------------- -----------

Shares issued for cash 517 202,838 - - 203,355

Shares issued on settlement of third-party - - - - -

fees

Shares issued in settlement of loan

interest 588 225,568 - - 226,156

Share issue costs - 1 - - 1

Total comprehensive expense for the period - - 350,922 (903,049) (552,127)

At 31 December 2020 18,254,040 145,343,446 8,187,337 (149,813,573) 21,971,250

-------------------------------------------- ----------- ------------ ---------------- -------------- -----------

Shares issued for cash 5,521 1,767,869 - - 1,773,390

Shares issued on settlement of third-party

fees 273 88,330 - - 88,603

Shares issue costs - (92,045) - - (92,045)

Total comprehensive income for the period - - 206,221 (39,458) 166,763

At 30 June 2021 18,259,833 147,107,600 8,393,558 (149,853,031) 23,907,960

-------------------------------------------- ----------- ------------ ---------------- -------------- -----------

(1) The share-based payment reserve has been included within the retained loss reserve and is a non-distributable reserve.

INTERIM CONSOLIDATED STATEMENT OF CASH FLOWS

Six months ended Six months ended

30 June 2021 30 June 2020

(unaudited) (unaudited)

Note $ $

----------------------------------------------------------------------- ----- ----------------- -----------------

Cash outflow from operating activities

Group operating profit / (loss) for the period 90,449 (377,036)

Share-based payments 9 206,221 148,924

Finance costs 4 (769) -

----------------------------------------------------------------------- ----- ----------------- -----------------

Operating cash flow before changes in working capital 295,901 (228,112)

(Increase) / decrease in receivables and prepayments (14,470) 6,993

(Decrease) / increase in trade and other payables (539,234) 861,314

----------------------------------------------------------------------- ----- ----------------- -----------------

Cash used in operating activities (257,803) 640,195

----------------------------------------------------------------------- ----- ----------------- -----------------

Investing activities

Exploration and evaluation costs 4 (861,881) (1,290,678)

Net cash used in investing activities (861,881) (1,290,678)

----------------------------------------------------------------------- ----- ----------------- -----------------

Financing activities

Cash proceeds from issue of ordinary share capital net of issue costs 8 1,769,947 622,729

Proceeds from drawdown of borrowing facilities 7 - 61,596

Repayment of borrowing facilities (501,154) -

Repayment of interest on borrowing facilities (35,142) -

Effects of foreign currency movements on borrowing facilities 1,010 (476)

----------------------------------------------------------------------- ----- ----------------- -----------------

Net cash from financing activities 1,234,660 683,849

----------------------------------------------------------------------- ----- ----------------- -----------------

Increase in cash and cash equivalents 114,976 33,366

Cash and cash equivalents at beginning of period 10,054 38,662

----------------------------------------------------------------------- ----- ----------------- -----------------

Cash and cash equivalents at end of period 125,030 72,028

----------------------------------------------------------------------- ----- ----------------- -----------------

NOTES TO THE INTERIM FINANICAL INFORMATION

1. Accounting policies

a) Basis of preparation

This interim financial report, which includes a condensed set of

financial statements of the Company and its subsidiary undertakings

("the Group"), has been prepared using the historical cost

convention and based on International Financial Reporting Standards

("IFRS") including IAS 34 'Interim Financial Reporting' and IFRS 6

'Exploration for and Evaluation of Mineral Reserves', as adopted by

the European Union ("EU").

The condensed set of financial statements for the six months

ended 30 June 2021 is unaudited and does not constitute statutory

accounts as defined in Section 434 of the Companies Act 2006. They

have been prepared using accounting bases and policies consistent

with those used in the preparation of the audited financial

statements of the Company and the Group for the year ended 31

December 2020 and those to be used for the year ending 31 December

2021. The comparative figures for the half year ended 30 June 2020

are unaudited. The comparative figures for the year ended 31

December 2020 are not the Company's full statutory accounts but

have been extracted from the financial statements for the year

ended 31 December 2020 which have been delivered to the Registrar

of Companies and the auditors' report thereon was unqualified and

did not contain a statement under sections 498(2) and 498(3) of the

Companies Act 2006.

This half-yearly financial report was approved by the Board of

Directors on 29 September 2021.

b) Going concern

The Group will need to raise further funds sufficient to meet

its financial and operating commitments for the 12-month period

commencing immediately subsequent to the date of signature of these

interim financial statements and is planning to do this

through:

-- Completion of the Beluga Energy Limited farmout transaction

for which heads of agreement were signed and announced on 10 August

2021; and

-- A farm-out of its South African license sufficient to cover

its share of 3D acquisition work programme costs which are

approximately GBP2 million; or

-- Receipt of further funds from the exercise of warrants or the

issuance of shares in order to provide partial funding of the

proposed 3D acquisition work programme in South Africa.

The Directors are confident that the above initiatives will be

concluded satisfactorily within the necessary timeframes and the

financial statements have, therefore, been prepared on a going

concern basis.

There can, however, be no guarantee that the required funds may

be raised or transactions completed within the necessary

timeframes. Consequently, a material uncertainty exists that may

cast doubt on the Group's ability to continue to operate and to

meet its commitments and discharge its liabilities in the normal

course of business for a period of not less than twelve months from

the date of this report. The financial statements do not include

the adjustments that would result if the Group was unable to

continue in operation such as the impairment of the exploration

assets.

2. Operating segments

The Group has two reportable operating segments: Africa and Head

Office. Non-current assets and operating liabilities are located in

Africa, whilst the majority of current assets are carried at Head

Office. The Group has not yet commenced production and therefore

has no revenue. Each reportable segment adopts the same accounting

policies. In compliance with IAS 34 'Interim Financial Reporting'

the following table reconciles the operational loss and the assets

and liabilities of each reportable segment with the consolidated

figures presented in these Financial Statements, together with

comparative figures for the period-ended 30 June 2020.

Africa Head Office Total

Six months Six months Six months Six months Six months Six months

ended ended ended ended ended ended

30 June 2021 30 June 2020 30 June 2021 30 June 2020 30 June 2021 30 June 2020

$ $ $ $ $ $

---------------------- -------------- -------------- -------------- -------------- -------------- --------------

Loss by reportable

segment (65,611) 11,608 105,069 446,079 39,458 457,687

Total assets by

reportable segment

(1) 27,954,857 25,624,797 135,531 100,180 28,090,388 25,724,977

---------------------- -------------- -------------- -------------- -------------- --------------

Total liabilities by

reportable segment

(2) (2,384,500) (1,313,963) (1,797,928) (2,317,149) (4,182,428) (3,631,112)

---------------------- -------------- -------------- -------------- -------------- -------------- --------------

(1) Carrying amounts of segment assets exclude investments in

subsidiaries.

(2) Carrying amounts of segment liabilities exclude intra-group

financing.

3. Loss per ordinary share

Basic & Diluted

30 June 2021 31 December 2020

(unaudited) (audited)

$ $

----------------------------------------------------------------------- ---- -------------- -----------------

Loss for the period 39,458 457,687

Weighted average number of ordinary shares in issue during the period 1,699,278,182 1,190,700,446

Dilutive effect of share options outstanding - -

Fully diluted average number of ordinary shares during the period 1,699,278,182 1,190,700,446

Loss per share (USc) 0.00c 0.04c

----------------------------------------------------------------------------- -------------- -----------------

4. Intangible Exploration and Evaluation (E&E) assets

Exploration and evaluation assets Goodwill Total

Period-ended 30 June 2021 $ $ $

---------------------------------- ------------ -------------

Cost

At 1 January 2021 99,088,664 8,023,292 107,111,956

Additions during the period 861,881 - 861,881

At 30 June 2021 99,950,545 8,023,292 107,973,837

------------------------------- ---------------------------------- ------------ -------------

Amortisation and impairment

At 1 January 2021 (72,008,462) (8,023,292) (80,031,754)

At 1 January and 30 June 2021 (72,008,462) (8,023,292) (80,031,754)

------------------------------- ---------------------------------- ------------ -------------

Net book value

At 30 June 2021 27,942,083 - 27,942,083

At 31 December 2020 27,080,202 - 27,080,202

------------------------------- ---------------------------------- ------------ -------------

In accordance with the Group's accounting policies and IFRS 6

the Directors' have reviewed each of the exploration license areas

for indications of impairment. Having done so, based on the

financial constraints on the Group, and specific issues associated

with each license it was concluded that a full ongoing impairment

was only necessary in the case of the Zambian licenses 40 and 41,

the circumstances of which have not changed since previous

reporting period.

The additions during the period represent $600k (2020: $1.2

million), $197k in South Africa (2020: $80k), $77k in Namibia

(2020: $21k) and $nil in Zambia (2020: $nil). The focus of the

Group's activities during this period has been on preparing for and

acquiring inventory and services with respect to the anticipated

drilling of the Njonji-3 appraisal well.

5. Trade and other receivables

30 June 2021 31 December 2020

(unaudited) (audited)

$ $

----------------------------- -------------- -----------------

Trade and other receivables 23,275 8,805

----------------------------- -------------- -----------------

Trade and other receivables comprise prepaid expenditures.

6. Trade and other payables

30 June 2021 31 December 2020

(unaudited) (audited)

$ $

--------------------------------- -------------- -----------------

Trade and other payables 512,810 531,253

Work programme-related accruals 1,982,683 1,882,999

Other accruals 122,968 149,930

VAT payable 638,416 1,231,929

3,256,877 3,796,111

--------------------------------- -------------- -----------------

The future ability of the Group to recover UK VAT was confirmed

by the Upper Tier Tribunal in its judgement in favour of the

Company on 20 May 2021 and is no longer the subject of a dispute

with HMRC. Previously, on 8 July 2019, the Company had received an

initial judgement in its favour from the First-Tier Tribunal (Tax

Chamber). HMRC have chosen not appeal this latest ruling against

them.

This ruling covers the Group's current and future VAT returns

and also the past returns up to the period covered by our original

appeal to the First Tier Tribunal ("FTT"). There are a number of

returns for periods after those covered by the original FTT appeal

that are covered by two further appeals that remain with the FTT,

which is why the Directors have made the judgement to continue to

provide against certain recoverable amounts until such time as the

case has been formally closed. The Company has, therefore,

continued to provide against $638k / GBP461k (2020: $1.2 million /

GBP903k) of VAT recoverable within these financial statements.

Work programme-related accruals of $2.0 million (2020: $1.9

million) comprise $1.1 million with respect to Cameroon (2020: $1.1

million) and $900k with respect to South Africa (2020: $758k).

7. Borrowings

Group

30 June 2021 31 December 2020

(unaudited) (audited)

$ $

-------------------------------------------- -------------- -----------------

Principal balance at beginning of period 1,338,726 770,480

Amounts drawn down during the period - 561,742

Amounts repaid during the period (501,154) -

Currency revaluations at year end 1,004 6,504

-------------------------------------------- -------------- -----------------

Principal balance at end of period 838,576 1,338,726

Financing costs at beginning of year (7,026) 70,010

Changes to financing costs during the year 47,383 (3,013)

Interest expense 81,755 152,372

Interest paid (35,142) (226,382)

Currency revaluations at year end 6 (13)

-------------------------------------------- -------------- -----------------

Financing costs at the end of the year 86,976 (7,026)

Carrying amount at end of period 925,552 1,331,700

-------------------------------------------- -------------- -----------------

Current 870,645 1,262,937

Non-current 54,906 68,763

Repayment dates

30 June 2021 31 December 2020

(unaudited) (audited)

$ $

-------------------------- -------------- -----------------

Due within 1 year 870,645 1,270,960

Due within years 2-5 42,171 55,010

Due in more than 5 years 12,735 5,730

925,552 1,331,700

-------------------------- -------------- -----------------

During the period, the Group and Company entered into no new

facilities (2020: $562k) and repaid its Shard Merchant Capital Ltd

loan in January 2021.

On 21 January 2021, the Company repaid in full the $500k loan

facility with Shard Merchant Capital Ltd. The terms of the Shard

Facility included the issue of 31,446,541 attached three-year

warrants at a strike price of 0.6 pence and 5,761,198 shares to

pre-pay interest charged at 12% per annum. The loan was secured by

a fixed and floating charge over the Company's assets in favour of

Shard Merchant Capital Ltd. The repayment of the loan included

facility transaction costs of $35k. During the period the Company

recognised interest charges totalling $21k (2020: $43k) and made

repayments totalling $535k (2020: $30k).

On 4 March 2021, the Pegasus Petroleum Limited loan facility, to

which Jeremy Asher is a controlling party, was extended to the end

of November 2021. Consideration for the extension comprised an

increase in the production-based payments, the amount depending on

whether the loan would be repaid by 15 July or only in November

2021. Additionally, simple interest would accrue at 12% per annum

pro rata, commencing on 4 March 2021, and would only be paid at the

end of the facility period. The 15 July date was subsequently

extended to 20 August 2021, with the production-based payments

effectively limited to 3.75% of the Contractor share of revenues

from the production sharing contract, net of the Government share

and net of all Petroleum Taxes, and the facility was fully repaid

on 20 August 2021.

8. Share capital

30 June 2021 31 December 2020

(unaudited) (audited)

$ $

--------------------------------------------------------------- ---- -------------- -----------------

Authorised, called up, allotted and fully paid

1,749,911,416 (2020: 1,325,296,032) ordinary shares of 0.001p 18,259,833 18,251,117

--------------------------------------------------------------------- -------------- -----------------

The share capital issues during the period are summarised

below:

Number of shares Share capital at nominal value Share premium

Ordinary shares $ $

-------------------------------------------------- ----------------- ------------------------------- --------------

At 1 January 2021 1,325,296,032 18,254,040 145,343,446

Shares issued for cash 404,615,384 5,521 1,767,869

Shares issued on settlement of third-party fees 20,000,000 273 88,330

Share issue costs - - (92,045)

At 30 June 2021 1,749,911,416 18,259,833 147,107,600

-------------------------------------------------- ----------------- ------------------------------- --------------

9. Share-based payments

In the Statement of Comprehensive Income, the Group recognised the following charge in r 30 June 2021 30 June 2020

espect

of its share-based payment plan:

(unaudited) (unaudited)

----------------------------------------------------------------------------------------

$ $

---------------------------------------------------------------------------------------- ------------- -------------

Share-based payment charges incurred on incentivisation of staff included within

administrative

expenses (153,039) (148,924)

Share-based payment charges incurred on incentivisation of consultants included within

administrative

expenses (11,066) -

Share-based payment charges recharged to subsidiary undertakings on incentivisation of

staff

and consultants (42,116) -

----------------------------------------------------------------------------------------

(206,221) (148,924)

---------------------------------------------------------------------------------------- ------------- -------------

Share-based payment charges incurred on issue of options and warrants as part of loan

financing

facilities included within finance expense - (28,183)

Total share-based payment plan charges for the period (206,221) (177,107)

---------------------------------------------------------------------------------------- ------------- -------------

Options

Details of share options outstanding at 30 June 2021 are as

follows:

Number in issue

--------------------------- ----------------

At 1 January 2021 157,552,800

Awarded during the period 88,000,000

Lapsed during the period (52,800)

----------------------------- ----------------

At 30 June 2021 245,500,000

----------------------------- ----------------

Date of grant Number in issue Option price (p) Latest exercise date

--------------- ---------------- ----------------- ---------------------

26 Oct 16 1,500,000 0.023 25 Oct 21

24 Jan 19 70,000,000 1.250 24 Jan 24

18 Dec 20 86,000,000 0.450 18 Dec 25

01 Apr 21 88,000,000 0.450 01 Apr 26

245,500,000

--------------- ---------------- ----------------- ---------------------

These options vest in the beneficiaries in equal tranches on the

first, second and third anniversaries of grant.

Warrants

Details of warrants outstanding at 30 June 2021 are as

follows:

Number in issue

At 1 January 2021 620,444,335

Awarded during the period 169,939,544

----------------

At 30 June 2021 790,383,879

----------------------------- ----------------

Date of grant Number in issue Warrant price (p) Latest exercise date

--------------- ---------------- ------------------ ---------------------

09 Nov 17 31,853,761 1.000 09 Nov 22

01 Jan 18 2,542,372 1.000 01 Jan 23

01 Apr 18 2,083,333 1.500 01 Apr 23

01 Jul 18 2,272,726 1.780 30 Jun 23

01 Oct 18 4,687,500 1.575 30 Sep 23

24 Jan 19 112,211,999 1.250 23 Jan 24

16 Apr 19 90,000,000 1.000 14 Apr 24

30 Jun 19 4,285,714 1.000 28 Jun 24

30 Jul 19 3,000,000 1.000 28 Jul 24

15 Oct 19 191,347,084 1.000 13 Oct 24

31 Mar 20 49,816,850 0.200 30 Mar 25

29 Jun 20 19,719,338 0.350 28 Jun 25

28 Aug 20 78,616,352 0.600 28 Aug 23

01 Oct 20 10,960,907 0.390 30 Sep 25

01 Dec 20 4,930,083 0.375 30 Nov 25

31 Dec 20 12,116,316 0.450 30 Dec 25

01 Apr 21 16,998,267 0.450 31 Mar 26

01 Jul 21 24,736,149 0.250 30 Jun 26

14 Jan 21 128,205,128 0.325 14 Jan 23

790,383,879

--------------- ---------------- ------------------ ---------------------

10. Subsequent events

10 August 2021: Execution of a binding Heads of Agreement in

respect of a farm-out to Beluga Energy Limited ("Beluga") of a 49%

non-operating working interest in its Thali Production Sharing

Contract in Cameroon, conducted through its wholly-owned subsidiary

Tower Resources Cameroon S.A. The farm-out covers $15 million

towards the cost of the NJOM-3 well that Tower is planning to drill

on the Thali block. Beluga will receive a 49% working interest in

the Production Sharing Contract, subject to production-based

payments of 10%. The well cost is currently expected to be

approximately $16.8 million, of which approximately $3 million has

already been spent. Costs in excess of $15 million, and future

costs, will be funded pro-rata with respect to each party's working

interest.

11 August 2021 : Placing for cash of GBP1.5 million via a

placing of 352,941,176 new ordinary shares of 0.001p each at a

price of 0.425 pence per share, a discount of 14% to the closing

share price on 10 August 2021. Novum Securities Limited ("Novum"),

acted as sole broker on this Placing was appointed to serve as

Joint Broker to the Company going forwards. The Company has used

the net proceeds of the Placing to repay the $750,000 loan facility

from Pegasus Petroleum Ltd (whose ultimate beneficial owner is the

Company's Chairman and CEO, Jeremy Asher) together with accrued

interest and fees of $102,500, and to cover working capital

requirements going forward, which will include; work programme

costs in Namibia (for license PEL 96); South Africa (for the

Algoa-Gamtoos license operated by 50% partner New Age Energy Algoa

(Pty) Ltd and which adjoins the Total-operated blocks 11B/12B);

funding maintenance and planning expenditure in Cameroon to

maintain the long-lead items inventory ready for the commencement

of drilling and testing of the NJOM-3 well, pending completion of

the farm-out with Beluga; and general working capital purposes.

21 September 2021 : Documentation of its farm-out to Beluga of a

49% non-operating working interest in its Thali Production Sharing

Contract in Cameroon, conducted through its wholly-owned subsidiary

Tower Resources Cameroon S.A was finalised, and the package of

documents submitted to the Minister of Mines, Industry and

Technological Development per the Cameroon Petroleum Code.

Completion of the farm-out is still subject to two conditions

precedent: the financing contingency requiring Beluga's

shareholders' approval, and the Minister of Mines, Industry and

Technological Development's approval. The Company would notify the

market when both conditions precedent have been met.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR LLMFTMTBTBPB

(END) Dow Jones Newswires

September 30, 2021 02:00 ET (06:00 GMT)

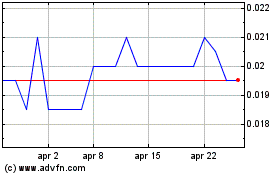

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Apr 2023 a Apr 2024