Tower Resources PLC Cameroon Update (7929K)

09 Maggio 2022 - 7:12PM

UK Regulatory

TIDMTRP

RNS Number : 7929K

Tower Resources PLC

09 May 2022

9 May 2022

Tower Resources plc

Cameroon Update

Tower Resources plc (the "Company" or "Tower" (TRP.L, TRP LN),

the AIM-listed oil and gas company with a focus on Africa, is

pleased to provide an update on activity in respect of its Thali

Production Sharing Contract (PSC), in the Rio Del Rey sedimentary

basin offshore Cameroon.

Tower is pleased to announce that the Minister of Mines,

Industry and Technological Development (MINMIDT) has, with the

support of the President of the Republic, agreed to grant a further

extension of the First Exploration Period of the Thali PSC to 11

May 2023.

Tower is also pleased to announce that it expects to complete

shortly a letter of intent (LOI) with Shelf Drilling to cover the

drilling and testing of the NJOM-3 well in the fourth quarter of

2022, using the Shelf Drilling Trident VIII jack-up drilling unit.

The terms of the draft LOI are confidential, but in line with

market levels and the Company's current budget for the well. With

rig day-rates, fuel and other costs all having risen during the

past year, the overall budget for the well is around 20% higher

than the original figure of around US$15 million, but with some

US$4 million of the cost already incurred and all long lead items

already purchased, Tower currently estimates the remaining cost at

around US$14 million. It should be stressed that among the budget

uncertainties is the number of separate zones that the Company will

wish to test, however it should also be understood that if we

choose to test more productive zones separately, then this will be

because the well prognosis is closer to the upper end of

expectations.

During the last six months the Company has also continued to

work on both the subsurface dataset and also the plans for

additional wells and early production from the Njonji structure,

following the drilling of the NJOM-3 well. The updated dataset has

allowed to further clarify the NJOM-3 well objectives, and Tower

has also had the opportunity to discuss alternative platform and

Mobile Offshore Production Unit (MOPU) designs with potential

contractors and partners, which it is hoped will accelerate the

next steps following a successful NJOM-3 well test.

The Company has still not received an approval of the Beluga

Energy (Beluga) farmout as presented to MINMIDT in September 2021.

However, the Company has now informed the Minister that, upon

receiving the extension of the First License Period, it will no

longer be seeking approval of the farmout in its current form.

There are a number of reasons for this, but the most important is

that during the last six months while the Government of Cameroon

was conducting due diligence on the proposed transaction, the

market environment has changed considerably. In particular, the

Company has been in discussion with local banks in Cameroon

(including the bank with which it previously discussed this

transaction in 2019) and the Company now believes that debt

financing may be available to cover a significant portion of the

well cost. This should allow a restructured transaction which would

require less of the equity in the project to be given up in return

for the well funding, to the advantage of all parties. It should

also be noted that a restructured transaction (as contemplated in

the original farmout documents) does not require government

approval.

The Company intends to work with the banks with whom it

presently has discussions, and with Beluga and other interested

parties, to restructure the well financing over the next few

months, with the objective of concluding a revised transaction in

the third quarter of 2022, that is less dilutive to Tower

shareholders than the present farmout structure. The Company does

not intend to comment further on these discussions until they are

completed.

Next steps will include the finalisation of the well financing

and the rig contract and other service contracts in the third

quarter of 2022, by which time a narrower range for the planned

mobilisation of the rig will also be announced.

Jeremy Asher, Tower's Chairman and CEO, commented:

"We are pleased that we can finally share concrete news

regarding the progress on the NJOM-3 well on the Thali PSC area,

and we are grateful as always to MINMIDT, and to the President and

Prime Minister of the Republic of Cameroon, as well as our partners

at SNH, for their continued support. We realise that it has taken

longer than any of us would have liked to reach this point, but we

also feel that we have been able to make good use of the extra time

both to enhance our understanding of the subsurface and our plans

for the next steps on Thali, and also (we hope) to improve the

terms of the well financing. We continue to believe that Thali has

the potential to produce millions of barrels of oil over the next

few years, which will provide great benefit to both the Republic of

Cameroon and to our shareholders."

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

Contacts:

Tower Resources plc +44 20 7157 9625

Jeremy Asher

Chairman and CEO

Andrew Matharu

VP - Corporate Affairs

SP Angel Corporate Finance

LLP

Nominated Adviser and Joint

Broker

Stuart Gledhill

Caroline Rowe +44 20 3470 0470

Novum Securities Limited

Joint Broker

Jon Beliss

Colin Rowbury +44 20 7399 9400

Panmure Gordon (UK) Limited

Joint Broker

Nick Lovering

Hugh Rich +44 20 7886 2500

Notes:

In accordance with the guidelines for the AIM market of the

London Stock Exchange, Dr Mark Enfield, BSc, PhD, and a member of

the Board of Tower Resources plc, who has over 30 years' experience

in the oil & gas industry, is the qualified person that has

reviewed and approved the technical content of this

announcement.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFEIERIAIIF

(END) Dow Jones Newswires

May 09, 2022 13:12 ET (17:12 GMT)

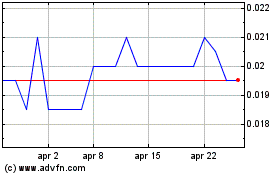

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Apr 2023 a Apr 2024