Tower Resources PLC Cameroon Financing Update (9823G)

21 Novembre 2022 - 8:00AM

UK Regulatory

TIDMTRP

RNS Number : 9823G

Tower Resources PLC

21 November 2022

21 November 2022

Tower Resources plc

("Tower" or the "Company")

Cameroon Financing Update

Tower Resources plc (AIM: TRP.L), the Africa-focused energy

company, is pleased to provide an update on its financing activity

in respect of its Thali Production Sharing Contract (PSC), in the

Rio Del Rey sedimentary basin offshore Cameroon.

Cameroon Financing:

Tower is pleased to announce that its subsidiary, Tower

Resources Cameroon S.A ("TRCSA"), has been notified by BGFI Bank

Group ("BGFI"), the largest bank group in Central Africa, that the

medium term loan of approximately US$7 million for which TRCSA and

BGFI agreed a term sheet at the end of June 2022 (the "Loan"), has

been approved by the credit committee of the Cameroon bank. Further

approval is still required at the BGFI group level and discussions

are now turning to the details of the structure and documentation,

as well as a potential modest enlargement of the facility.

Whilst the Company aims to complete these discussions as quickly

as possible, it cannot be certain of when final approval will be

received, if it is successful.

As previously disclosed, the Loan should cover around 40% of the

approximate US$18 million cost of the well, with a further amount

of 25% already having been paid for by TRCSA. The balance of 35% of

the cost of the well is also to be funded by TRCSA. This balance

may be funded by further financing at the asset level, or with

corporate funds.

The Company is continuing to discuss additional financing

options at the asset level, including with BGFI. The Company's

current plan is to complete the Loan financing documentation, if

possible, before seeking to conclude any further bank

discussions.

Jeremy Asher, Tower's Chairman and CEO, commented:

"We are very happy with the progress in our discussions with

BGFI Bank Group, and the support that the local bank has shown

towards our project in Cameroon.

"Discussions regarding the rig options with suppliers and other

operators are also continuing as expected. As previously announced,

long lead items for the well have already been purchased, and the

environmental and social impact assessment, site survey and site

debris survey are complete. Therefore, we are in a position to move

quickly once a rig slot is finalised.

"We remain very confident that we will be able to drill the

NJOM-3 well in good time and thank our shareholders for their

patience while we seek to conclude these discussions."

Market Abuse Regulation (MAR) Disclosure

The information contained within this announcement is deemed by

the Company to constitute inside information as stipulated under

the Market Abuse Regulations (EU) No. 596/2014 as it forms part of

UK domestic law by virtue of the European Union (Withdrawal) Act

2018 ('MAR'). Upon the publication of this announcement via

Regulatory Information Service ('RIS'), this inside information is

now considered to be in the public domain.

Contacts:

Tower Resources plc

Jeremy Asher

Chairman & CEO

Andrew Matharu

VP - Corporate Affairs +44 20 7157 9625

BlytheRay

Financial PR

Tim Blythe

Megan Ray +44 20 7138 3208

SP Angel Corporate Finance

LLP

Nominated Adviser and Joint

Broker

Stuart Gledhill

Caroline Rowe +44 20 3470 0470

Novum Securities Limited

Joint Broker

Jon Beliss

Colin Rowbury +44 20 7399 9400

Panmure Gordon (UK) Limited

Joint Broker

John Prior

Hugh Rich +44 20 7886 2500

Notes:

BGFI Bank Group is a large financial services conglomerate in

Central, West and East Africa, with subsidiaries in ten countries,

including Gabon, where the Group was founded, and Cameroon. The

member institutions serve both individuals and businesses, with

emphasis on small-to-medium enterprises (SMEs). As of December

2020, the Group's assets were in excess of EUR5 billion, and BGFI

Bank Group is described as the largest bank group in Central Africa

(the CEMAC zone).

About Tower Resources

Tower Resources plc is an AIM listed energy company building a

balanced portfolio of energy opportunities in Africa across the

exploration and production cycle in oil and gas and beyond. The

Company's current focus is on advancing its operations in Cameroon

to deliver cash flow through short-cycle development and rapid

production with long term upside, and de-risking attractive

exploration licenses through acquiring 3D seismic data in the

emerging oil and gas provinces of Namibia and South Africa, where

world-class discoveries have recently been made.

Tower's strategy is centred around stable jurisdictions that the

Company knows well and that offer excellent fiscal terms. Through

its Directors, staff and strategic relationship with EPI Group,

Tower has access to decades of expertise and experience in Cameroon

and Namibia, and its joint venture with New Age builds on years of

experience in South Africa.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCFLFSELFLIFIF

(END) Dow Jones Newswires

November 21, 2022 02:00 ET (07:00 GMT)

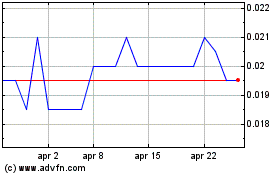

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tower Resources (LSE:TRP)

Storico

Da Apr 2023 a Apr 2024