TIDMUKOG

RNS Number : 0320T

UK Oil & Gas PLC

20 July 2022

UK Oil & Gas PLC

("UKOG" or the "Company")

Operational Update

UK Oil & Gas PLC (London AIM: UKOG) is pleased to announce

the following operational updates in respect of its key Turkiye and

Portland Hydrogen/Energy Hub projects, together with an outline of

its near-term forward strategy.

Turkiye Resan Licence (UKOG 50% interest):

Further to the Company's announcement of 30(th) June 2022,

continued examination of the new phase 1 seismic data has revealed

a further potentially significant undrilled geological structure to

the south of the Basur-1 oil discovery. The feature, currently

known as Prospect B, shows the same geological structural style as

the Basur discovery, bounded on its northern extent by a

significant back-thrust fault. It appears to be of similar size to

Basur upon first review. Further phase 2 seismic lines to the west

will be required to confirm its size, prospective resource

hydrocarbon volume, and to help define any future exploration well

location. A revised top reservoir structure map and seismic line

illustrating the new feature will be made available on the

Company's website.

Additional recent oil sampling has also been undertaken by the

Resan licence's operator, Aladdin Middle East ("AME"), at the live

light 42˚ API oil seep, located to the north of the Basur oil

discovery. The oil charge to the seep appears to be continuous as

similar quantities of crude have now been recovered from the same

shallow seismic shot holes at multiple sampling events over a

one-month period. It is anticipated that a new Phase 2 seismic line

will pass over the seep to aid identification of whether it derives

from a previously unrecognised deeper Mardin/Garzan age oil

accumulation.

To help progress Basur towards drilling, members of UKOG's

technical team plan to spend next week in the field, scouting a

potential new Basur-4 location, tying Basur seismic work into

surface geology and investigating whether Prospect B has any

surface geological expression that can help define its extent.

Portland Hydrogen/Energy Hub (UKOG 100%)

Further to recent discussions with UK and international

infrastructure players in relation to the Company's planned

Portland Energy Hub as announced on 30 May 2022, the Company is now

investigating the feasibility of linking Portland's planned

hydrogen-ready salt cavern storage into an envisaged future

hydrogen hub centred in and around Southampton by a consortium

including a major energy company , whereby Portland could provide

both the interseasonal and peak demand hydrogen storage necessary

to provide the hub's resilience to fluctuating demand. Via its

planned LNG receiving facility, Portland could also help satisfy

demand for natural gas feedstock for reforming into blue hydrogen

within the hub.

As part of the Company's Portland engineering and commercial

studies it has now also received a preliminary economic model from

Xodus, which details that the updated expected capital cost to

construct the 14 salt caverns, related surface facilities and the

pipeline tie-in to the current national gas grid is GBP895 million.

Together with the capital expenditure for the envisaged LNG

receiving terminal and the project's green hydrogen generation

capability, the project's total cost will, therefore, likely exceed

GBP1 billion.

The Company continues to talk to interested parties, potential

contractors and potential strategic partners and to shape its

vision for this new long-term project which is at the planning

stage and remains subject to a number of conditions including

planning consents and financing. A diagram illustrating the

Company's current vision for Portland will be made available on the

Company's website.

Forward Strategy

Given the promising positive outlook derived from the Company's

Basur Phase 1 seismic programme, plus the confirmation from the oil

seep that the area has an active light oil petroleum system, the

Company's focus for the forthcoming 6-9 months will be firmly upon

the delivery of Phase 2 seismic and a new Basur appraisal well, now

anticipated to be able to add near-term oil production to the

Company in H1 2023, subject to necessary funding. As previously

stated, the Petroleum Law enables a successful oil well in Turkiye

to be put into full time production within days to weeks of a

successful test.

AME's desire to shoot new unbudgeted Phase 2 seismic before

continuing the Basur appraisal drilling programme (as per UKOG's

30(th) June RNS), combined with a longer than expected seismic

acquisition period over winter, has both required additional

previously unbudgeted working capital and deferred the start of the

anticipated cash flow from a successful Basur well. The Company

will, therefore, need to seek further finance before mid Q4 2022 to

fund this planned programme and for general working capital

purposes. Success at Basur is anticipated to provide additional

working capital to help fund UKOG's other significant projects

which, by their nature, have a longer lead time to cash

generation.

With respect to the June 7(th) 2022 grant of planning consent

for the Company's 100% owned Loxley gas appraisal project the

Company will now implement a pre-planned farmout programme, whereby

the Company's costs would be either fully or part carried by any

farminee. The Company believes that this is the most prudent course

of action to both manage uncertainty and to help ensure the best

use of the Company's working capital.

Qualified Person's Statement

Matt Cartwright, UKOG's Commercial Director, who has 39 years of

relevant experience in the global oil industry, has approved the

information contained in this announcement. Mr Cartwright is a

Chartered Engineer and member of the Society of Petroleum

Engineers.

For further information, please contact:

UK Oil & Gas PLC

Stephen Sanderson / Matt Gormley / Allen Tel: 01483 941493

D Howard

WH Ireland Ltd (Nominated Adviser and

Broker)

James Joyce / Andrew de Andrade Tel: 020 7220 1666

Communications

Brian Alexander Tel: 01483 941493

The information contained within this announcement is deemed to

constitute inside information as stipulated under the retained EU

law version of the Market Abuse Regulation (EU) No. 596/2014 (the

"UK MAR") which is part of UK law by virtue of the European Union

(Withdrawal) Act 2018. The information is disclosed in accordance

with the Company's obligations under Article 17 of the UK MAR. Upon

the publication of this announcement, this inside information is

now considered to be in the public domain.

Notes:

Blue hydrogen: Hydrogen produced by reforming natural gas allied

with the capture of all CO2 from the reforming process

Green hydrogen: Hydrogen produced by electrolysis of water using

renewable electricity

Hydrogen-ready: the small size of the hydrogen molecule and its

interaction with high grade steels causes the metal to become

brittle with time. Consequently, the steel and engineering

specifications currently used in today's natural gas facilities

will require modification to be fully compatible for hydrogen.

UKOG, therefore, aims to build-in hydrogen compatibility during

initial construction, thus future-proofing any Portland Energy-Hub

development.

Salt caverns: man-made caverns constructed by the physical

dissolution of naturally occurring halite (rock salt) deposits. The

dissolution provides a gas tight cavern space that is permanently

filled with gas and/or brine at an equivalent pressure to that

within the surrounding rocks i.e., it is not an empty void at any

time. Portland Port is ideally situated for the construction of

large caverns as it overlies a thick, high quality halite section

of Triassic age. Halite deposits with sufficient thickness to

accommodate significant caverns are confined to three areas of the

UK: S. Dorset (Triassic), Cheshire (Triassic) and the northeast

Yorkshire coast (Permian Zechstein age). Thinner Triassic halite

deposits are present in areas of the NW and Somerset. Active salt

cavern gas storage exists in Cheshire and the northeast.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

UPDQKLFFLDLBBBQ

(END) Dow Jones Newswires

July 20, 2022 02:00 ET (06:00 GMT)

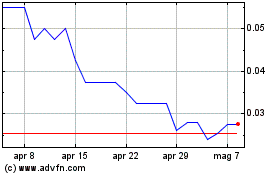

Grafico Azioni Uk Oil & Gas (LSE:UKOG)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Uk Oil & Gas (LSE:UKOG)

Storico

Da Apr 2023 a Apr 2024