TIDMWRKS

RNS Number : 1809M

TheWorks.co.uk PLC

20 May 2022

20 May 2022

TheWorks.co.uk plc

("The Works", the "Company" or the "Group")

Trading update for the 52 weeks ended 1 May 2022

TheWorks.co.uk plc, the multi-channel value retailer of arts,

crafts, toys, books and stationery, announces a trading update for

the 52 weeks ended 1 May 2022 (the "Period" or "FY22").

Highlights

-- Strong trading performance; two-year LFL(1) sales increase of 10.4% and total two-year sales

growth of 12.7%(1),(2) .

-- Improved proposition helping to offset external headwinds; FY22 EBITDA forecast of GBP15.0m

is reiterated.

-- Strong financial position: net cash(3) of GBP16.3m at the Period end, an increase of GBP15.5m

during FY22.

-- Dividend re-instated; the Board expects to recommend a dividend of approximately 2.4 pence

per share alongside its FY22 results in September and maintain a progressive dividend policy

thereafter.

FY22 trading performance

The Works delivered a strong trading performance in FY22, well

ahead of pre-COVID levels. Total sales(2) for the Period increased

by 12.7 % compared to FY20 (i.e. compared to two years ago).

Two-year LFL sales increased by 10.4 %, with positive growth

continuing both online and in stores.

Sales since our last update in January 2022 have been driven by

the further development of our customer proposition, in particular

the expansion of our front list book ranges, which has coincided

with the emergence of the "BookTok" phenomenon. By capitalising on

this trend, we have been able to draw attention to previously

best-selling books and prompt renewed customer interest in them.

Branded toys and games have also continued to perform strongly,

through reinforcements to our ranges of, for example, Peppa Pig,

Paw Patrol and Cocomelon.

Following the strong first half and record Christmas trading

performance, two-year LFL sales during the final months of the

financial year remained positive although, as expected, the rate of

growth has been lower than before Christmas. Consumer spending is

widely reported to have slowed in recent months and we believe this

has had an impact on our sales. In addition, as noted in the

announcement on 5 April 2022, we experienced some limited

disruption to trading and business operations as a result of a

cyber security incident at the end of March. Despite these

headwinds, the operational and propositional improvements we have

made throughout the year have helped to offset the impact of the

external headwinds noted above, meaning that the FY22 EBITDA

forecast of GBP15.0m is retained .

Furthermore, with our strategic focus on being a "better, not

just bigger" version of ourselves, during FY22 we continued to

improve the quality of the store estate, opening 5 new stores,

closing 7 and relocating 6 stores. The business traded from 525

stores at the end of the Period.

Financial position

The Group ended the Period in a strong financial position, with

net cash(3) of GBP16.3m (FY21: GBP0.8m). This is higher than the

GBP10.0m level noted in the FY22 Interim results statement, due to

the unwinding of certain working capital timing differences taking

longer than anticipated.

Dividend

In the Interim results announcement dated 21 January 2022, the

Board noted its intention to reinstate the payment of dividends

provided the final FY22 results were as expected. Accordingly, the

Board currently expects to recommend to shareholders the payment of

a final dividend in respect of FY22, following the 2022 AGM. The

amount to be recommended will be confirmed once the audit is

completed, but is expected to be approximately 2.4 pence per share.

Once the payment of dividends has been reinstated, the Board

intends to maintain a progressive dividend policy.

Outlook

There continues to be uncertainty relating to the external

environment and how this might affect levels of consumer spending

in the months ahead. This has been taken into account in setting

the Group's internal plans for FY23.

The Board remains confident in the future prospects of the

business because of the underlying appeal and relevance of The

Works' proposition, the opportunity to grow sales profitably

through the implementation of its strategy , and the Group's strong

financial position.

Gavin Peck, Chief Executive Officer of The Works, commented:

"We are pleased to report strong trading in FY22, consistently

delivering sales well ahead of pre-COVID levels and another record

Christmas. This performance, and the resilience that our business

has shown against a challenging external backdrop, demonstrates the

positive effect of our "better, not just bigger" strategy, which

still has a lot more upside to deliver. We are delighted that our

improved trading performance will enable us to recommend

reinstating the dividend and remain optimistic that we can deliver

further sales growth in the year ahead."

"As we move into our new financial year, general trading

conditions remain challenging. We will continue to focus on the

factors within our control and ensure that, as customers face

increasing cost-of-living pressures, they can continue to rely on

The Works as a destination for great value products to inspire

reading, learning, creativity and play. None of this would be

possible without the passion, commitment and patience of our

brilliant colleagues, who have gone above and beyond to deliver for

customers."

Full year results publication

The cyber security incident in April 2022 had a limited impact

on trading, but has prompted the decision to significantly speed up

the implementation of plans to strengthen our IT security measures.

Given the additional time needed to implement these improvements,

the Group plans to allow more time to finalise its FY22 results,

which will be issued during September 2022.

Enquiries: via Sanctuary Counsel

TheWorks.co.uk plc

Gavin Peck CEO

Steve Alldridge CFO

Sanctuary Counsel +44 7944 868288 | theworks@sanctuarycounsel.com

Ben Ullmann +44 7918 606667 |

Rachel Miller

(1) The like for like (LFL) sales increase has been calculated with reference to the FY20 comparative

sales figures, or two-year LFL, because the extended periods of enforced store closures during

FY21 prevent that period from forming the basis of meaningful comparisons. For the last 5

weeks of the Period, it has been necessary to calculate the LFL percentages with reference

to the corresponding weeks in FY19, because the equivalent weeks during FY20 were also affected

by the first period of enforced store closures. Similar comparison periods are also used for

the total sales growth figures quoted.

(2) "Total sales" referred to in this statement includes VAT and is stated prior to deducting

the cost of loyalty points which are adjusted out of the sales figure in the calculation of

statutory revenue. The 52 week comparison period used for the LFL and total sales growth calculations

uses a literal mapping of calendar weeks between FY22 and the corresponding 52 weeks two/three

years prior. Due to the inclusion of a 53(rd) week in the FY21 accounting period, the FY20/FY19

statutory accounting periods are one week offset from the 52 week period used in the LFL and

total sales comparisons. A reconciliation between the figures included in this statement and

the FY22 statutory revenue will be included in the Group's Annual Report.

(3) Net cash at bank excluding finance leases and on a non-IFRS 16 basis.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

TSTBKCBNOBKDAPD

(END) Dow Jones Newswires

May 20, 2022 02:00 ET (06:00 GMT)

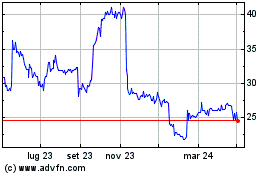

Grafico Azioni Theworks.co.uk (LSE:WRKS)

Storico

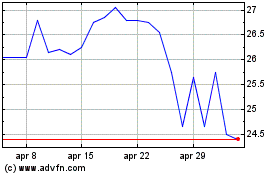

Da Mar 2024 a Apr 2024

Grafico Azioni Theworks.co.uk (LSE:WRKS)

Storico

Da Apr 2023 a Apr 2024