Apple Rolls Out Payment Plans for Apple Pay Service

28 Marzo 2023 - 8:00PM

Dow Jones News

By Dean Seal

Apple Inc. is rolling out a feature that allows users of its

Apple Pay mobile-payment service to split their purchases into

payments that can be spread out over multiple weeks.

The new feature, called Apple Pay Later, was introduced in the

U.S. on Tuesday and permits users to break their purchases into

four payments and spread those payments out over six weeks with no

interest and no fees, Apple said.

The Pay Later loans can be managed and repaid via the Apple

Wallet on users' devices. Customers can apply for loans ranging

from $50 to $1,000 that can be used at merchants that accept Apple

Pay, the company said.

Apple has started inviting randomly selected users to access a

prerelease version of the feature and plans to offer it to all

users in the coming months.

The feature is enabled through Mastercard Installments, a

buy-now-pay-later program from Mastercard Inc., with Goldman Sachs

Group Inc. acting as issuer of the Mastercard payment credential

used to complete Apple Pay Later purchases.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

March 28, 2023 13:45 ET (17:45 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

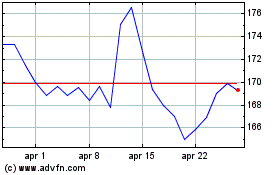

Grafico Azioni Apple (NASDAQ:AAPL)

Storico

Da Mar 2024 a Apr 2024

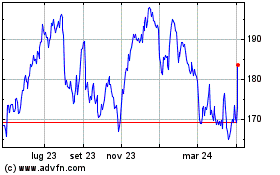

Grafico Azioni Apple (NASDAQ:AAPL)

Storico

Da Apr 2023 a Apr 2024