Will Tech Stocks and the S&P 500 Continue to Rally In June 2023?

05 Giugno 2023 - 11:54AM

Finscreener.org

Tech stocks took quite the tumble

in 2022, but it looks like theyU+02019re bouncing back, giving

investors who weathered the storm a reason to smile.

With its sixth consecutive weekly

rally, the Nasdaq Composite - home to many tech giants - rose 2% last week.

The last time we saw such consistency was before the Covid-19

pandemic turned our world upside down in early 2020.

Wall Street got a big lift from

FridayU+02019s strong jobs report for May and the SenateU+02019s

approval of a debt ceiling bill on Thursday night. The bill keeps

the U.S. from defaulting on its debt, which is a huge

relief.

The prior weekU+02019s gains were

boosted by NvidiaU+02019s (NASDAQ:

NVDA) impressive earnings

report and a wave of

optimism around AI

technology. Last week,

however, didnU+02019t have any standout news from the major

tech players, but their

shares continued to climb regardless.

Tesla took the lead out of all

the Nasdaq heavyweights, surging 11% over the last four trading

sessions. After taking a big hit in 2022,

TeslaU+02019s (NASDAQ: TSLA)

shares have made a remarkable turnaround, skyrocketing 74% this

year.

Tesla, alongside Nvidia - which

has seen a 169% surge this year - are the superheroes that have

propelled the Nasdaq to a 27% rise in 2023, leaving the

S&P 500 and

Dow Jones Industrial Average in the dust.

The Nasdaq took a 33% nosedive -

the worst since the financial crisis. Fearing inflation and rising

interest rates had investors running for the hills. While

itU+02019s making a commendable comeback, itU+02019s still about

18% shy of its all-time high.

Apple expected to launch a virtual reality headset on

Monday

Get ready to step into the future

as Apple (NASDAQ: AAPL)

gears up to reveal its first virtual reality headset next week. It

will be the first significant product line since the Apple Watch

was launched in 2014.

Rumor

has it this gadget will boast high-definition screens right before

your eyes. But thatU+02019s not all, as high-tech cameras on the

device could create a U+02019passthroughU+02019 or mixed reality

experience, allowing you to interact with the real

world.

AppleU+02019s Wearable, Home, and Accessories

revenue surpassed $41 billion in fiscal 2022. Apple AirPods

generates $10 billion in sales yearly, while the Apple Watch rakes

in between $14 billion and $18 billion annually.

In

fiscal 2022 the company sold:

53.9

million Apple Watches

82

million AirPods

13.6

million HomePods

Will the VR headset, which might be priced at a

lofty $3,000, unlock another multi-billion-dollar revenue stream

for the tech giant?

Macro-data to watch out for

This Wednesday, weU+02019re set

to get the scoop on the U.S. trade deficit from the U.S. Department

of Commerce folks. If forecasts hit the bullseye, we could see the

trade gap in April stretch to a hefty $75 billion, up from

MarchU+02019s $64.2 billion. The trade deficit is like the

thermometer of the economy – a shrinking deficit can give our

nationU+02019s GDP a nice little boost.

The Federal Reserve is due to

dish out the details on consumer credit this week, giving us a

glimpse into U.S. consumer borrowing in April. In March, consumers

added $26.5 billion to their borrowing, zipping along at the

fastest pace weU+02019ve seen in four months. Credit card balances

leaped too, jumping up by 17.3%.

The March report indicates that

consumers havenU+02019t been shy about spending, despite borrowing

costs climbing up the ladder due to the Federal ReserveU+02019s

interest rate hikes. Expect consumer borrowing to dial back a bit

in April, likely landing around the $20 billion mark.

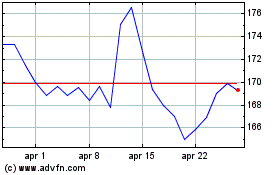

Grafico Azioni Apple (NASDAQ:AAPL)

Storico

Da Mar 2024 a Apr 2024

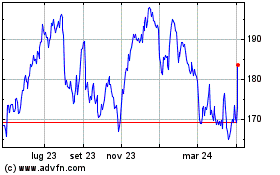

Grafico Azioni Apple (NASDAQ:AAPL)

Storico

Da Apr 2023 a Apr 2024