Marathon Digital Holdings, Inc.

(NASDAQ:MARA) ("Marathon"

or "Company"), one of the largest enterprise Bitcoin

self-mining companies in North America, today published unaudited

bitcoin (“BTC”) production and miner installation updates for

February 2022.

Historical and Potential Hash Rate Growth Based on

Current Shipment Schedules of Previously Purchased Miners (Subject

to Change)

Corporate Highlights as of March 1, 2022

- Produced 360.3 self-mined bitcoin during February 2022, a 729%

increase from 43.4 self-mined bitcoin in February 2021

- Increased total bitcoin holdings to approximately 8,956 BTC

with a fair market value of approximately $386.8 million

- Cash on hand was

approximately $106.4 million and total liquidity, defined as cash

and bitcoin holdings, was approximately $493.2 million

- Increased hash rate 8% from the prior month after successfully

deploying and energizing 2,800 miners in the month of February

- Received approximately 7,600 top-tier ASIC miners from BITMAIN

during the month of February

- Existing mining fleet consists of 35,510 active miners

producing approximately 3.8 EH/s

- After successfully breaking the mold on deploying behind the

meter at scale, deployments are expected to continue to accelerate

throughout the rest of 2022

- The Company continues to expect its

mining operations to be 100% carbon neutral by the end of 2022

Bitcoin Production UpdateSince January 1, 2021,

Marathon’s mining fleet has produced approximately 4,019 bitcoin.

Since January 1, 2022, Marathon’s mining fleet has produced

approximately 822 bitcoin. By month, the Company’s bitcoin

production was as follows:

*Note: Upgrades and maintenance to the power generating station

in Hardin, MT caused Marathon’s bitcoin mining operations in

Hardin, MT to operate at substantially reduced capacity in November

2021, negatively impacting the Company’s bitcoin production for the

month. For further information, see the press release issued on

12/03/2021.

Total Network Hash Rate Source:

https://www.blockchain.com/charts/hash-rate

The Company last sold bitcoin on October 21, 2020, and since

then, has been accumulating or “hodling” all bitcoin generated. As

a result, Marathon currently holds approximately 8,956 BTC,

including the 4,813 BTC the Company purchased in January 2021 for

an average price of $31,168 per BTC. On March 1, 2022, the fair

market value of one bitcoin was approximately $43,193, implying

that the approximate fair market value of Marathon’s current

bitcoin holdings is approximately $386.8 million.

Miner Installations and Hash Rate GrowthIn

February 2022, Marathon and Compute North received permission to

begin energizing miners at new locations. As a result, the Company

increased its hash rate 8% from the prior month as approximately

2,800 miners were brought online. As of March 1, 2022, Marathon has

successfully deployed 35,510 miners, and the Company’s hash rate

was approximately 3.8 EH/s. Now that Marathon has broken the mold

on deploying behind the meter at scale, deployments have begun in

earnest, and the Company expects deployments to continue

accelerating throughout the rest of 2022.

Construction of Compute North’s new facilities, which are

predominantly “behind the meter” at wind and solar farms, remain

underway. These facilities are at multiple locations and include a

280-megawatt (MW) site in west Texas. Marathon continues to expect

all of its purchased miners to be deployed by early 2023, at which

point, the Company’s mining operations are expected to consist of

approximately 199,000 bitcoin miners, producing approximately 23.3

EH/s. Additionally the Company continues to expect its mining

operations to be 100% carbon neutral by the end of 2022.

Management Commentary“In February, Compute

North received permission to begin bringing miners online at new

locations, and as a result, we increased our hash rate 8%

month-over-month after successfully energizing 2,800 miners,” said

Fred Thiel, Marathon’s CEO. “We produced 360 bitcoin in February,

which is a 729% increase year-over-year. Relative to the prior

months of January and December, our February production was

impacted by increasing network difficulty, continued fluctuations

at the power station in Montana, and voluntary curtailment of our

miners in Texas to support the grid during a recent storm. We

expect our monthly production reliability to improve as we

diversify deployments across new locations.

“Deploying behind the meter at scale is a method that required

additional permitting and coordination from the various parties

involved. Now that we have broken the mold on this process, we

expect deployments at new facilities to continue to accelerate into

the second quarter and throughout the rest of the year. Our primary

objectives for 2022 are to effectively deploy our miners, achieve

our growth targets, and continue expanding our competitive moat,

and we believe we are well positioned to achieve each of those

goals. We look forward to supporting the adoption, security, and

evolution of Bitcoin by growing our mining operations to 23.3 EH/s

and achieving 100% carbon neutrality over the coming quarters.”

Investor Notice Investing in our

securities involves a high degree of risk. Before making an

investment decision, you should carefully consider the risks,

uncertainties and forward-looking statements described under "Risk

Factors" in Item 1A of our most recent Annual Report on Form 10-K

for the fiscal year ended December 31, 2020. If any of these

risks were to occur, our business, financial condition or results

of operations would likely suffer. In that event, the value of our

securities could decline, and you could lose part or all of

your investment. The risks and uncertainties we describe are not

the only ones facing us. Additional risks not presently known to us

or that we currently deem immaterial may also impair our business

operations. In addition, our past financial performance may not be

a reliable indicator of future performance, and historical trends

should not be used to anticipate results in the future. Future

changes in the network-wide mining difficulty rate or

Bitcoin hash rate may also materially affect the future

performance of Marathon's production of Bitcoin. Additionally, all

discussions of financial metrics assume mining difficulty rates as

of March 2022. The total network’s hash rate data is calculated

from a third-party source, which is available here:

https://www.blockchain.com/charts/hash-rate. Data from third-party

sources has not been independently verified. See "Safe Harbor"

below.

Forward-Looking Statements Statements made

in this press release include forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements can be identified by the use of words

such as “may,” “will,” “plan,” “should,” “expect,” “anticipate,”

“estimate,” “continue,” or comparable terminology. Such

forward-looking statements are inherently subject to certain risks,

trends and uncertainties, many of which the Company cannot predict

with accuracy and some of which the Company might not even

anticipate and involve factors that may cause actual results to

differ materially from those projected or suggested. Readers are

cautioned not to place undue reliance on these forward-looking

statements and are advised to consider the factors listed above

together with the additional factors under the heading “Risk

Factors” in the Company's Annual Reports on Form 10-K, as may be

supplemented or amended by the Company's Quarterly Reports on Form

10-Q. The Company assumes no obligation to update or supplement

forward-looking statements that become untrue because of subsequent

events, new information or

otherwise. About Marathon Digital

Holdings Marathon is a digital asset technology

company that mines cryptocurrencies with a focus on the blockchain

ecosystem and the generation of digital assets.

Marathon Digital

Holdings Company Contact: Charlie

SchumacherTelephone:

800-804-1690Email: charlie@marathondh.com

Two figures accompanying this announcement are

available at:

https://www.globenewswire.com/NewsRoom/AttachmentNg/2396abd4-98c4-41e2-9a1d-215f3378b10f

https://www.globenewswire.com/NewsRoom/AttachmentNg/92e3d107-ba22-4310-84df-a97d058c4cbe

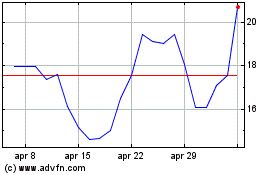

Grafico Azioni Marathon Digital (NASDAQ:MARA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Marathon Digital (NASDAQ:MARA)

Storico

Da Apr 2023 a Apr 2024