Marathon Digital Holdings, Inc.

(NASDAQ:MARA) ("Marathon"

or "Company"), one of the largest enterprise Bitcoin

self-mining companies in North America, today published unaudited

bitcoin (“BTC”) production and miner installation updates for May

2022.

Management Commentary“Although we continue to

install miners at the Texas facilities, we have experienced delays

in energization as Compute North’s energy provider awaits federal

agency confirmation of its exempt status for tax purposes based

upon its arrangements with Compute North,” said Fred Thiel,

Marathon’s chairman and CEO. “While these delays have been

disappointing, our current understanding is that miners should

start to come online this month. We continue to work closely and

actively engage with Compute North to gain more insight into the

energy provider’s timeline and to ensure that these delays, once

resolved, will not impact our future deployments.

“In the meantime, installations of our miners have progressed

irrespective of the energization schedule. Currently, in addition

to our active fleet, we now have 19,000 miners, representing

approximately 1.9 EH/s, that have been installed and ready for

energization. Over 9,000 of these units, representing 0.9 EH/s, are

at Compute North’s first major facility in West Texas. The

remainder are installed at other locations. This first major

facility is being completed in four stages. Stage one is already

complete. It is our understanding that the entire facility, which

will house approximately 68,000 of our miners, will be fully

constructed with all miners in installed by the end of the third

quarter of 2022.

“These energization delays in Texas, coupled with ongoing

maintenance issues at the power generating station in Hardin, MT,

negatively impacted our bitcoin production last month. In May,

maintenance issues at the power generation station in Montana

caused us to produce approximately 47% less bitcoin than what would

have been expected based on the network’s hash rate during the

month. However, we believe that our production results will improve

over time as we move forward with our deployment plan and energize

our miners installed in Texas.

“We remain confident that Marathon is well positioned to achieve

its performance goals, and we will continue to provide updates as

they materialize. We have a strong foundation from which to build,

we have a solid pipeline of potential hosting and power

arrangements that exceeds our needs and allows us to diversify our

operations, and we have a strong balance sheet to support our

growth plans. We look forward to continuing to execute on our

strategy of achieving carbon neutrality by the end of this year and

growing to 23.3 EH/s in early 2023.”

Highlights as of June 1, 2022

- Total number of miners installed and awaiting energization

increased to 19,000 miners (c. 1.9 EH/s across all facilities.

- Current operating mining fleet consists of 36,830 active miners

producing approximately 3.9 EH/s.

- Increased total bitcoin holdings to 9,941 BTC with a fair

market value of $315.1 million.

- Produced 268 self-mined bitcoin during May 2022. Production was

lower than expected due to ongoing maintenance and downtime at the

power plant in Hardin, MT. These issues, which included problems

between the induced draft and forced draft fans, the buildup of

particulate matter that required cleaning, and GSU transformer

testing, in aggregate reduced Marathon’s potential bitcoin

production by approximately 47% during the month.

- As previously announced, Marathon plans to transition out of

Hardin, MT to more sustainable sources of power during the third

quarter of 2022.

- Cash on hand was approximately $59.6 million and total

liquidity, now defined as unrestricted cash and available credit

facilities, was approximately $86 million.

Miner Energization, Installations, and Hash Rate

GrowthMarathon was originally informed by Compute North

that energization of the Company’s miners in Texas would commence

on April 17, 2022. Marathon was then informed that energization was

rescheduled to May 2022. As of June 8, 2022, the energy provider

for Compute North’s first major site in West Texas has yet to

energize Marathon’s installed miners. Although miners continue to

be installed at the Texas facilities, Marathon has experienced

delays in energization as Compute North’s energy provider awaits

federal agency confirmation of its exempt status for tax purposes

based upon its arrangements with Compute North. It is Marathon’s

understanding that this matter is likely to be resolved this

month.

Despite changes to the energization schedule, installation of

Marathon’s miners at Compute North’s facilities in Texas have

proceeded on pace. 19,000 of Marathon’s miners (c. 1.9 EH/s) have

already been installed at various locations in Texas.

Compute North’s first major facility consists of four

substations. These substations are being constructed in phases, and

in aggregate, they represent 280 MW of capacity for bitcoin mining.

The first substation, which houses over 9,000 of Marathon’s miners

(c. 0.9 EH/s), is complete and currently awaiting energization. The

remaining substations are expected to be completed in phases with

the entire 280 MW facility expected to be constructed by the end of

the third quarter 2022. Once fully constructed, this facility will

house approximately 68,000 of Marathon’s miners, representing 6.8

EH/s. Based on construction schedules, Compute North has informed

Marathon that miners are expected to be installed at this facility

as follows:

- June 2022: 19,000 miners (includes the 9,000 miners already

installed)

- July 2022: 21,000 miners

- August 2022: 28,000 miners

Given the current construction and installation schedules

coupled with the Company’s pipeline of potential new hosting and

power arrangements, Marathon continues to expect all 199,000

miners, producing approximately 23.3 EH/s, to be installed and

energized by early 2023. Additionally, the Company continues to

expect its mining operations to be 100% carbon neutral by the end

of 2022.

Bitcoin Production UpdateYear-to-date through

May 31, 2022, Marathon’s mining fleet has produced 1,826 bitcoin, a

214% increase over the same time period in the prior year. By

month, the Company’s bitcoin production was as follows:

*Note: Upgrades and maintenance to the power generating station

in Hardin, MT caused Marathon’s bitcoin mining operations in

Hardin, MT to operate at substantially reduced capacity in November

2021, negatively impacting the Company’s bitcoin production for the

month. In April and May 2022, the Company’s bitcoin production was

similarly impacted by maintenance to the power generating station

in Hardin, MT.

Total Network Hash Rate Source:

https://www.blockchain.com/charts/hash-rate

The Company been accumulating or “hodling” its bitcoin and has

not sold bitcoin since October 2020. As of June 1, 2022, Marathon

held approximately 9,941 BTC, including the bitcoin purchased in

January 2021 for an average price of $31,168 per BTC. On June 1,

2022, the fair market value of one bitcoin was approximately

$31,641, implying that the approximate fair market value of

Marathon’s current bitcoin holdings is approximately $315.1

million.

Investor Notice Investing in our

securities involves a high degree of risk. Before making an

investment decision, you should carefully consider the risks,

uncertainties and forward-looking statements described under "Risk

Factors" in Item 1A of our most recent Annual Report on Form 10-K

for the fiscal year ended December 31, 2021, filed with the

SEC on March 10, 2022 and Quarterly Report on Form 10-Q for the

fiscal quarter ended March 31, 2022, filed with the SEC on May 5,

2022. If any of these risks were to occur, our business, financial

condition or results of operations would likely suffer. In that

event, the value of our securities could decline, and you

could lose part or all of your investment. The risks and

uncertainties we describe are not the only ones facing us.

Additional risks not presently known to us or that we currently

deem immaterial may also impair our business operations. In

addition, our past financial performance may not be a reliable

indicator of future performance, and historical trends should not

be used to anticipate results in the future. Future changes in the

network-wide mining difficulty rate or Bitcoin hash

rate may also materially affect the future performance of

Marathon's production of bitcoin. Additionally, all discussions of

financial metrics assume mining difficulty rates as of June 2022.

The total network’s hash rate data is calculated from a third-party

source, which is available here:

https://www.blockchain.com/charts/hash-rate. Data from third-party

sources has not been independently verified. See "Forward-Looking

Statements" below.

Forward-Looking Statements Statements made

in this press release include forward-looking statements within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934.

Forward-looking statements can be identified by the use of words

such as “may,” “will,” “plan,” “should,” “expect,” “anticipate,”

“estimate,” “continue,” or comparable terminology. Such

forward-looking statements are inherently subject to certain risks,

trends and uncertainties, many of which the Company cannot predict

with accuracy and some of which the Company might not even

anticipate and involve factors that may cause actual results to

differ materially from those projected or suggested. Readers are

cautioned not to place undue reliance on these forward-looking

statements and are advised to consider the factors listed above

together with the additional factors under the heading “Risk

Factors” in the Company's Annual Reports on Form 10-K, as may be

supplemented or amended by the Company's Quarterly Reports on Form

10-Q. The Company assumes no obligation to update or supplement

forward-looking statements that become untrue because of subsequent

events, new information or otherwise.

About Marathon Digital Holdings Marathon

is a digital asset technology company that mines bitcoin with a

focus on the blockchain ecosystem and the generation of digital

assets.

Marathon Digital

Holdings Company Contact: Telephone:

800-804-1690Email: ir@marathondh.com

A photo accompanying this announcement is available at

https://www.globenewswire.com/NewsRoom/AttachmentNg/d623ed18-d878-446d-bc15-a37b2a94c0aa

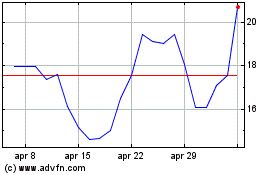

Grafico Azioni Marathon Digital (NASDAQ:MARA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Marathon Digital (NASDAQ:MARA)

Storico

Da Apr 2023 a Apr 2024