Additional Proxy Soliciting Materials (definitive) (defa14a)

28 Aprile 2022 - 11:14PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

| ☐ |

Preliminary Proxy Statement |

| ☐ |

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☐ |

Definitive Proxy Statement |

| ☒ |

Definitive Additional Materials |

| ☐ |

Soliciting Material Pursuant to (§)240.14a-12

|

Nasdaq, Inc.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s)

Filing Proxy Statement, if Other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| ☐ |

Fee paid previously with preliminary materials. |

| ☐ |

Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules

14a-6(i)(1) and 0-11. |

On April 28, 2022, Nasdaq, Inc. posted the following Frequently Asked Questions document to

its internal website accessible by employees of Nasdaq, Inc.

* * *

Nasdaq, Inc.

Proposed Stock Split -

Frequently Asked Questions

| |

1. |

What did Nasdaq announce? |

We announced that Nasdaq’s Board of Directors have authorized a proposed

three-for-one stock split in the form of a stock dividend, subject to approval by Nasdaq’s shareholders and the U.S. Securities & Exchange Commission

(SEC).

| |

2. |

Why is Nasdaq doing a stock split? |

The trading price of Nasdaq’s common stock has risen, or appreciated, in recent years. The stock split will reduce the trading price per share,

thereby making direct ownership of the stock more accessible to investors. In addition, stock splits have been shown to reduce spreads (i.e., the difference between the “bid” and “ask” of a security), making trading less

expensive for investors.

| |

3. |

Why does the proposed stock split need regulatory and shareholder approval? |

The stock split cannot occur without both SEC and shareholder approval since the proposal includes an amendment to Nasdaq’s current certificate of

incorporation, or charter, to increase the total number of authorized shares of our common stock to have sufficient shares to declare the stock dividend. Nasdaq’s shareholders will vote on a proposal to amend the charter to increase the total

number of authorized shares during our Annual Shareholder Meeting on June 22, 2022. The approval of the SEC is required due to our operation of national securities exchanges. Without both approvals, the stock split cannot take effect.

| |

4. |

What is a three-for-one stock split in

the form of a stock dividend? |

A stock dividend is a common way to implement a stock split. On the distribution date, holders

of the company’s common stock will receive two shares for every one share they hold as of the record date. The result will be a stock split, meaning that if a shareholder held one share, such holder now holds three shares,

and the trading price of Nasdaq’s stock will be divided by three.

Example:

|

|

|

|

|

|

|

|

|

| |

|

Pre-Split |

|

Post-Split |

|

Effect |

|

|

| Shares Held |

|

100 shares |

|

300 shares |

|

Shares are multiplied by 3 |

|

|

| Share Price |

|

$300/share |

|

$100/share |

|

Share price is divided by 3 |

|

|

| Total $ Value |

|

$30,000 |

|

$30,000 |

|

Total value is unchanged |

|

|

| |

5. |

Does the stock split dilute or in any way change the value of my Nasdaq stock by increasing the number of shares?

|

No, the stock split will not dilute or change the value of our common stock. Each shareholder will have the same value

before, and after, the stock split.

| |

6. |

How many additional shares from the stock dividend will I receive? |

Shareholders will receive a stock dividend of two additional shares for every one share held after trading closes on the record

date.

| |

7. |

Will future declared quarterly cash dividends apply to my new shares? |

Yes, the quarterly cash dividend will apply to all outstanding common stock. However, if the Board of Directors authorizes future dividends, the

dividend amount per share would be one-third of the current per share amount.

| |

8. |

Will I have tax consequences as a result of the stock split? |

Generally, a stock split in the form of a stock dividend is not taxed in most jurisdictions. The total value of your shares won’t change due to

the split, but you are encouraged to confirm with your tax advisor regarding any tax implications.

| |

9. |

Do I need to take any action to receive the additional stock dividend shares? |

No action is required by you.

| |

10. |

What happens to fractional shares? |

Investors who trade in fractional shares should consult their brokerage firms. Nasdaq will not issue any fractional shares in connection with the stock

split.

| |

11. |

What are the consequences of the stock split for my equity awards? |

Your equity awards will be mechanically adjusted to reflect the stock split without any action by you. There will be adjustments to the number of

shares underlying the equity awards to reflect the stock split. For example: if you were granted 100 shares on April 1, 2022 that vest in the future, you will now have 300 unvested shares. The vesting and settlement terms of equity awards will

not be affected.

| |

12. |

How does this impact my shares in the ESPP? |

Your ESPP shares will be adjusted automatically without any required action by you.

| |

13. |

How do I log on to E*Trade? |

For information on how to enroll and log onto E*Trade navigate to Program Enrollment Instructions in the online guide:

https://onfirstup.com/nasdaq/Nasdaq/contents/26838584

| |

14. |

When will the stock split take place? |

If approved by shareholders and the SEC, the stock split is expected to occur during the third quarter of 2022. Further details on timing will be

provided to all shareholders after such approvals are obtained and the Board of Directors declares the dividend.

| |

15. |

Where will I receive my new shares? |

If your shares are held in a brokerage account, such as your E*Trade account, the additional shares will be deposited into that account. Please contact

E*Trade with any questions. If your shares are certificated, in book entry with our transfer agent (Computershare), or a combination of both, the additional shares that you are entitled to receive in connection with the stock dividend will be

deposited in book entry into your Computershare account.

| |

16. |

What do I do with my existing Nasdaq stock certificate? |

Existing stock certificates are still valid.

| |

17. |

I have more questions – who can I talk to? Is there more information in the Proxy Statement?

|

Please contact the People team at People@Nasdaq.com. You may also read about the stock split proposal, and management’s

recommendation, in our Definitive Proxy Statement, which is being filed this afternoon and will be available on our website.

Additional Information and Where to

Find It

Nasdaq has filed a preliminary proxy statement and form of proxy card with the SEC in connection with the solicitation of proxies for Nasdaq’s

2022 Annual Meeting of shareholders (the “Proxy Statement” and such meeting the “2022 Annual Meeting”). Nasdaq, its directors and certain of its executive officers will be participants in the solicitation of proxies from

shareholders in respect of the 2022 Annual Meeting. Information regarding the names of Nasdaq’s and executive officers and their respective interests in Nasdaq by security holdings or otherwise is set forth in the Proxy Statement. To the extent

holdings of such participants in Nasdaq’s securities have changed since the amounts described in the Proxy Statement, such changes have been reflected on Initial Statements of Beneficial Ownership on Form 3 or Statements of Change in Ownership

on Form 4 filed with the SEC. Additional information can also be found in Nasdaq’s Annual Report on Form 10-K for the fiscal year ended December 31, 2021, filed with the SEC on

February 23, 2022. Details concerning proposed amendment to Nasdaq’s certificate of incorporation to be voted on at the 2022 Annual Meeting are included in the Proxy Statement. BEFORE MAKING ANY VOTING DECISION, INVESTORS AND SHAREHOLDERS

OF NASDAQ ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH OR FURNISHED TO THE SEC, INCLUDING THE

PROXY STATEMENT AND ANY SUPPLEMENTS THERETO BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and shareholders will be able to obtain a copy of the definitive Proxy Statement and other

documents filed by Nasdaq free of charge from the SEC’s website, www.sec.gov. Nasdaq’s shareholders will also be able to obtain, without charge, a copy of the definitive Proxy Statement and other relevant filed documents by directing a

request by mail to Nasdaq Investor Relations Department, Attention: Edward Ditmire, 151 W. 42nd Street, New York, New York 10036, in writing, or by email at investor.relations@nasdaq.com

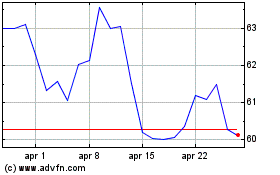

Grafico Azioni Nasdaq (NASDAQ:NDAQ)

Storico

Da Mar 2024 a Apr 2024

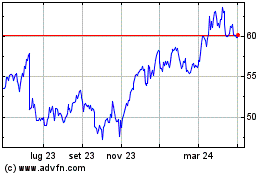

Grafico Azioni Nasdaq (NASDAQ:NDAQ)

Storico

Da Apr 2023 a Apr 2024