Nasdaq, Inc. (Nasdaq: NDAQ) today reported financial results for

the fourth quarter and year 2022.

- 2022 net revenues1 were $3,582 million, an increase of 5% over

2021. Solutions businesses2 revenues increased 9%, including 10%

organic growth and 1% from the net impact of an acquisition,

partially offset by a negative 2% FX impact. Trading Services net

revenues decreased 2%, including a negative 3% FX impact, partially

offset by 1% organic growth.

- Fourth quarter 2022 net revenues1 increased 2% compared to the

fourth quarter of 2021. Solutions businesses2 revenues increased

3%, including 5% organic growth, partially offset by a negative 2%

FX impact. Trading Services net revenues increased 1% including 4%

organic growth, partially offset by a negative 3% FX impact.

- Annualized Recurring Revenue (ARR)3 increased 8% compared to

the fourth quarter of 2021. Annualized SaaS revenues increased 13%

and represented 36% of ARR.

- GAAP diluted earnings per share decreased 4% in 2022 and 6% in

the fourth quarter 2022.

- Non-GAAP4 diluted earnings per share increased 6% in 2022 and

was unchanged in the fourth quarter 2022.

The company returned $1,016 million to

shareholders in 2022: $633 million in share repurchases and $383

million in dividends. Fourth Quarter and

Year 2022 Highlights

|

(US$ millions, except per share) |

4Q22 |

% Change (YoY) |

2022 |

% Change (YoY) |

|

Solutions Segments Revenues |

$652 |

3% |

$2,552 |

9% |

|

Market Services Net Revenues |

$253 |

1% |

$1,019 |

(2)% |

|

Net Revenues* |

$906 |

2% |

$3,582 |

5% |

|

ARR |

$2,007 |

8% |

|

|

|

GAAP Diluted EPS |

$0.48 |

(6)% |

$2.26 |

(4)% |

|

Non-GAAP Diluted EPS |

$0.64 |

—% |

$2.66 |

6% |

|

*Net revenues include Other revenues of $1 million in the fourth

quarter of 2022 and $11 million in 2022. |

|

|

|

|

|

|

Adena Friedman, Chair and CEO

said, “We delivered another year of strong growth

against an uncertain macroeconomic backdrop, illustrating the

strength of our diversified business and our ability to deliver on

our longer-term objectives. As we look to 2023, our new corporate

structure positions us to deliver greater liquidity, transparency,

and integrity solutions to our clients throughout the financial

system.”

Ann Dennison, Executive Vice President and

CFO said, “In 2022 we successfully executed our capital

plan to minimize the impact of rising rates, reduce net leverage

and support our long-term growth strategy. We enter 2023 with a

strong capital position and the flexibility to adapt to varying

operating environments. Additionally, we raised our dividend growth

potential with an expectation for a rising payout ratio over the

next five years, amplifying our ability to continue delivering a

compelling dividend growth story.”

FINANCIAL REVIEW

- 2022 net revenues were $3,582 million, an increase of $162

million, or 5% over 2021. Net revenues reflected a $239 million, or

7%, positive impact from organic growth, a $70 million decrease

from the impact of changes in FX rates and a $7 million decrease

from the net impact of acquisitions and divestitures.

- Fourth quarter 2022 net revenues were $906 million, an increase

of $21 million, or 2%, from $885 million in the prior year period.

Net revenues reflected a $41 million, or 5%, positive impact from

organic growth, including positive contributions from all segments,

partially offset by an $18 million decrease from the impact of

changes in FX rates and a $2 million decrease from the net impact

of an acquisition and divestiture.

- Solutions businesses revenues were $652 million in the fourth

quarter of 2022, an increase of $21 million, or 3%. The increase

reflects a $30 million, or 5%, positive impact from organic growth,

and a $1 million increase from an acquisition, partially offset by

a $10 million decrease from the impact of changes in FX rates.

- Trading Services net revenues were $253 million in the fourth

quarter of 2022, an increase of $3 million, or 1%. The increase

reflects an $11 million, or 4%, positive impact from organic

growth, partially offset by an $8 million decrease from the impact

of changes in FX rates.

- 2022 GAAP operating expenses were $2,018 million, an increase

of $39 million, or 2% over 2021. Fourth quarter 2022 GAAP operating

expenses increased $16 million, or 3%, versus the prior year

period. The increases in both periods primarily reflect increased

expenses associated with the continued investment in our people and

our businesses, and higher travel costs. The increase in 2022 GAAP

operating expenses are partially offset by lower regulatory and

amortization expenses reflecting one-time charges in 2021 as well

as lower restructuring charges for the year. The increase in fourth

quarter 2022 GAAP operating expense includes higher merger and

strategic initiatives expense and restructuring charges.

- 2022 non-GAAP operating expenses were $1,721 million, an

increase of $105 million or 6%, over 2021. Fourth quarter 2022

non-GAAP operating expenses increased $26 million, or 6% versus the

prior year period. The increase in both periods primarily reflects

increased expenses associated with the continued investment in our

people and our businesses, and higher travel costs, partially

offset by lower marketing and advertising expense due to lower

capital markets activity and changes in FX rates.

- The company repurchased $633 million in shares of its common

stock during 2022. As of December 31, 2022, there was $650

million remaining under the board authorized share repurchase

program, following an approval by the Board of Directors in

December 2022 to increase the authorized amount of the share

repurchase program.

INITIATING 2023 EXPENSE AND TAX

GUIDANCE5

- The company is initiating its 2023 non-GAAP operating expense

guidance to a range of $1,770 to $1,850 million. Nasdaq expects its

2023 non-GAAP tax rate to be in the range of 24% to 26%.

STRATEGIC AND BUSINESS

UPDATES

- Nasdaq implemented its new corporate structure during

the fourth quarter of 2022 to amplify strategy. Nasdaq’s

new corporate structure took effect during the fourth quarter of

2022 with business units organized into three divisions: Market

Platforms, Capital Access Platforms, and Anti-Financial Crime. The

new structure aligns the company more closely with evolving client

needs and global financial system.

- Nasdaq’s annualized SaaS revenues in the fourth quarter

of 2022 increased 13% year over year. Annualized SaaS

revenues totaled $725 million in the fourth quarter of 2022,

representing 36% of total company ARR, up from 34% in the fourth

quarter of 2021. The 13% year over year increase in annualized SaaS

revenues primarily reflects strong growth in the fraud detection

and anti-money laundering solutions and Workflow and Insights

businesses.

- Nasdaq maintained listings leadership in the U.S. and

Nordics during 2022. The Nasdaq Stock Market led U.S.

exchanges for operating company IPOs with a 92% total win rate

during 2022 and 100% win rate in the fourth quarter of 2022. During

2022, the Nasdaq Stock Market featured six of the largest ten U.S.

IPOs by capital raised, attracted 74% of all proceeds raised

through U.S. IPOs and welcomed 14 listing switches. In the Nordic

and Baltic regions, Nasdaq maintained its leadership positioning

with 38 IPOs.

- Nasdaq led all exchanges in total multiply-listed

options traded and set a record for U.S. equities trading during

the December expiration. In the fourth quarter and full

year 2022 periods, Nasdaq led all exchanges during the period in

total volume traded for multiply-listed equity options, and in

December, achieved record U.S. equities volume for a triple witch

expiration event during the fourth quarter.

- Nasdaq cloud progress continued with completing a

migration of one of our options exchanges and further customer

adoption. Nasdaq successfully completed the migration of

Nasdaq MRX options market onto our new global derivative platform

and Amazon Web Services (AWS), our preferred cloud provider. The

migration marks a major milestone in Nasdaq’s journey to modernize

and build the next-generation infrastructure for the world’s

capital markets. Nasdaq also signed an agreement with Bolsa

Electronica de Chile in January 2023 to upgrade its current

on-premise Nasdaq trading technology to Nasdaq’s SaaS-based

Marketplace Services Platform through a full cloud migration

strategy.

- Nasdaq named to the Dow Jones Sustainability North

America Index and received approval by The Science Based Targets

Initiative for net-zero targets. Nasdaq received key

recognitions by several third-party validators during 2022,

including being named for the seventh consecutive year to the Dow

Jones Sustainability North America Index. Additionally, Nasdaq’s

near and long-term science-based emissions reductions targets were

approved by The Science Based Targets initiative. Nasdaq has

pledged to reduce absolute Scope 1 and Scope 2 greenhouse gas

emissions 100% and absolute Scope 3 GHG emissions 50% by 2030, and

pledged to reduce Scope 3 GHG emissions 95% to reach net-zero by

2050.

____________1 Represents revenues less transaction-based

expenses.2 Constitutes revenues from our Capital Access Platforms

and Anti-Financial Crime segments and Marketplace Technology

business within Market Platforms.3

Annualized Recurring Revenue (ARR) for a given

period is the annualized revenue derived from subscription

contracts with a defined contract value. This excludes contracts

that are not recurring, are one-time in nature or where the

contract value fluctuates based on defined metrics. ARR is

currently one of our key performance metrics to assess the health

and trajectory of our recurring business. ARR does not have any

standardized definition and is therefore unlikely to be comparable

to similarly titled measures presented by other companies. ARR

should be viewed independently of revenue and deferred revenue and

is not intended to be combined with or to replace either of those

items. ARR is not a forecast and the active contracts at the end of

a reporting period used in calculating ARR may or may not be

extended or renewed by our customers.4 Refer to our reconciliations

of U.S. GAAP to non-GAAP net income, diluted earnings per share,

operating income and operating expenses, included in the attached

schedules.5 U.S. GAAP operating expense and tax rate guidance are

not provided due to the inherent difficulty in quantifying certain

amounts due to a variety of factors including the unpredictability

in the movement in foreign currency rates, as well as future

charges or reversals outside of the normal course of business.

ABOUT NASDAQ

Nasdaq (Nasdaq: NDAQ) is a global technology

company serving the capital markets and other industries. Our

diverse offering of data, analytics, software and services enables

clients to optimize and execute their business vision with

confidence. To learn more about the company, technology solutions

and career opportunities, visit us on LinkedIn, on Twitter @Nasdaq,

or at www.nasdaq.com.

NON-GAAP INFORMATION

In addition to disclosing results determined in

accordance with U.S. GAAP, Nasdaq also discloses certain non-GAAP

results of operations, including, but not limited to, non-GAAP net

income attributable to Nasdaq, non-GAAP diluted earnings per share,

non-GAAP operating income, and non-GAAP operating expenses, that

include certain adjustments or exclude certain charges and gains

that are described in the reconciliation table of U.S. GAAP to

non-GAAP information provided at the end of this release.

Management uses this non-GAAP information internally, along with

U.S. GAAP information, in evaluating our performance and in making

financial and operational decisions. We believe our presentation of

these measures provides investors with greater transparency and

supplemental data relating to our financial condition and results

of operations. In addition, we believe the presentation of these

measures is useful to investors for period-to-period comparisons of

results as the items described below in the reconciliation tables

do not reflect ongoing operating performance.

These measures are not in accordance with, or an

alternative to, U.S. GAAP, and may be different from non-GAAP

measures used by other companies. In addition, other companies,

including companies in our industry, may calculate such measures

differently, which reduces their usefulness as a comparative

measure. Investors should not rely on any single financial measure

when evaluating our business. This information should be considered

as supplemental in nature and is not meant as a substitute for our

operating results in accordance with U.S. GAAP. We recommend

investors review the U.S. GAAP financial measures included in this

earnings release. When viewed in conjunction with our U.S. GAAP

results and the accompanying reconciliations, we believe these

non-GAAP measures provide greater transparency and a more complete

understanding of factors affecting our business than U.S. GAAP

measures alone.

We understand that analysts and investors

regularly rely on non-GAAP financial measures, such as those noted

above, to assess operating performance. We use these measures

because they highlight trends more clearly in our business that may

not otherwise be apparent when relying solely on U.S. GAAP

financial measures, since these measures eliminate from our results

specific financial items that have less bearing on our ongoing

operating performance.

Organic revenue and expense growth, organic change

and organic impact are non-GAAP measures that reflect adjustments

for: (i) the impact of period-over-period changes in foreign

currency exchange rates, and (ii) the revenues, expenses and

operating income associated with acquisitions and divestitures for

the twelve month period following the date of the acquisition or

divestiture. Reconciliations of these measures are described within

the body of this release.

Foreign exchange impact: In countries with

currencies other than the U.S. dollar, revenues and expenses are

translated using monthly average exchange rates. Certain

discussions in this release isolate the impact of year-over-year

foreign currency fluctuations to better measure the comparability

of operating results between periods. Operating results excluding

the impact of foreign currency fluctuations are calculated by

translating the current period’s results by the prior period’s

exchange rates.

Divisional alignment program: In October 2022,

following our September announcement to realign our segments and

leadership, we initiated a divisional alignment program with a

focus on realizing the full potential of this structure. In

connection with the program, we expect to incur pre-tax charges

principally related to employee-related costs, consulting, asset

impairments and contract terminations over a two-year period. We

expect to achieve benefits in the form of both increased customer

engagement and operating efficiencies. Costs related to the

divisional alignment program will be recorded as “restructuring” in

our consolidated statements of income. We will exclude charges

associated with this program for purposes of calculating non-GAAP

measures as they are not reflective of ongoing operating

performance or comparisons in Nasdaq's performance between

periods.

CAUTIONARY NOTE REGARDING FORWARD-LOOKING

STATEMENT

Information set forth in this communication

contains forward-looking statements that involve a number of risks

and uncertainties. Nasdaq cautions readers that any forward-looking

information is not a guarantee of future performance and that

actual results could differ materially from those contained in the

forward-looking information. Such forward-looking statements

include, but are not limited to (i) projections relating to our

future financial results, total shareholder returns, growth,

dividend program, trading volumes, products and services, ability

to transition to new business models or implement our new corporate

structure, taxes and achievement of synergy targets, (ii)

statements about the closing or implementation dates and benefits

of certain acquisitions, divestitures and other strategic,

restructuring, technology, environmental, de-leveraging and capital

allocation initiatives, (iii) statements about our integrations of

our recent acquisitions, (iv) statements relating to any litigation

or regulatory or government investigation or action to which we are

or could become a party, and (v) other statements that are not

historical facts. Forward-looking statements involve a number of

risks, uncertainties or other factors beyond Nasdaq’s control.

These factors include, but are not limited to, Nasdaq’s ability to

implement its strategic initiatives, economic, political and market

conditions and fluctuations, geopolitical instability, government

and industry regulation, interest rate risk, U.S. and global

competition, and other factors detailed in Nasdaq’s filings with

the U.S. Securities and Exchange Commission, including its annual

reports on Form 10-K and quarterly reports on Form 10-Q which are

available on Nasdaq’s investor relations website at

http://ir.nasdaq.com and the SEC’s website at www.sec.gov. Nasdaq

undertakes no obligation to publicly update any forward-looking

statement, whether as a result of new information, future events or

otherwise.

WEBSITE DISCLOSURE

Nasdaq intends to use its website, ir.nasdaq.com,

as a means for disclosing material non-public information and for

complying with SEC Regulation FD and other disclosure

obligations.

Media Relations Contacts:

Will Briganti (646) 964-8169

william.briganti@nasdaq.com

David Lurie (914) 538-0533

david.lurie@nasdaq.com

Investor Relations Contact: Neil

Stratton, CFA (212) 401-8769 neil.stratton@nasdaq.com

NDAQF

|

Nasdaq, Inc. |

|

Condensed Consolidated Statements of Income |

|

(in millions, except per share amounts) |

|

|

|

|

Three Months Ended |

|

Year Ended |

|

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

|

|

Revenues: |

|

|

|

|

|

|

|

|

Market Platforms |

$ |

1,079 |

|

|

$ |

975 |

|

|

$ |

4,225 |

|

|

$ |

4,048 |

|

|

Capital Access Platforms |

|

420 |

|

|

|

420 |

|

|

|

1,684 |

|

|

|

1,568 |

|

|

Anti-Financial Crime |

|

82 |

|

|

|

68 |

|

|

|

306 |

|

|

|

231 |

|

|

Other Revenues |

|

1 |

|

|

|

4 |

|

|

|

11 |

|

|

|

39 |

|

|

|

Total revenues |

|

1,582 |

|

|

|

1,467 |

|

|

|

6,226 |

|

|

|

5,886 |

|

|

Transaction-based expenses: |

|

|

|

|

|

|

|

|

Transaction rebates |

|

(488 |

) |

|

|

(526 |

) |

|

|

(2,092 |

) |

|

|

(2,168 |

) |

|

Brokerage, clearance and exchange fees |

|

(188 |

) |

|

|

(56 |

) |

|

|

(552 |

) |

|

|

(298 |

) |

|

Revenues less transaction-based expenses |

|

906 |

|

|

|

885 |

|

|

|

3,582 |

|

|

|

3,420 |

|

|

|

|

|

|

|

|

|

|

|

Operating Expenses: |

|

|

|

|

|

|

|

|

Compensation and benefits |

|

252 |

|

|

|

238 |

|

|

|

1,003 |

|

|

|

938 |

|

|

Professional and contract services |

|

43 |

|

|

|

43 |

|

|

|

140 |

|

|

|

144 |

|

|

Computer operations and data communications |

|

56 |

|

|

|

49 |

|

|

|

207 |

|

|

|

186 |

|

|

Occupancy |

|

26 |

|

|

|

28 |

|

|

|

104 |

|

|

|

109 |

|

|

General, administrative and other |

|

32 |

|

|

|

19 |

|

|

|

125 |

|

|

|

85 |

|

|

Marketing and advertising |

|

20 |

|

|

|

26 |

|

|

|

51 |

|

|

|

57 |

|

|

Depreciation and amortization |

|

63 |

|

|

|

80 |

|

|

|

258 |

|

|

|

278 |

|

|

Regulatory |

|

9 |

|

|

|

41 |

|

|

|

33 |

|

|

|

64 |

|

|

Merger and strategic initiatives |

|

41 |

|

|

|

17 |

|

|

|

82 |

|

|

|

87 |

|

|

Restructuring charges |

|

15 |

|

|

|

— |

|

|

|

15 |

|

|

|

31 |

|

|

|

Total operating expenses |

|

557 |

|

|

|

541 |

|

|

|

2,018 |

|

|

|

1,979 |

|

|

Operating income |

|

349 |

|

|

|

344 |

|

|

|

1,564 |

|

|

|

1,441 |

|

|

Interest income |

|

4 |

|

|

|

— |

|

|

|

7 |

|

|

|

1 |

|

|

Interest expense |

|

(33 |

) |

|

|

(31 |

) |

|

|

(129 |

) |

|

|

(125 |

) |

|

Net gain on divestiture of business |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

84 |

|

|

Other (loss) income |

|

(6 |

) |

|

|

39 |

|

|

|

2 |

|

|

|

81 |

|

|

Net income (loss) from unconsolidated investees |

|

8 |

|

|

|

(38 |

) |

|

|

31 |

|

|

|

52 |

|

|

Income before income taxes |

|

322 |

|

|

|

314 |

|

|

|

1,475 |

|

|

|

1,534 |

|

|

Income tax provision |

|

82 |

|

|

|

55 |

|

|

|

352 |

|

|

|

347 |

|

|

Net income |

|

240 |

|

|

|

259 |

|

|

|

1,123 |

|

|

|

1,187 |

|

|

Net loss attributable to noncontrolling interests |

|

1 |

|

|

|

— |

|

|

|

2 |

|

|

|

— |

|

|

Net income attributable to Nasdaq |

$ |

241 |

|

|

$ |

259 |

|

|

$ |

1,125 |

|

|

$ |

1,187 |

|

|

|

|

|

|

|

|

|

|

|

Per share information: |

|

|

|

|

|

|

|

|

Basic earnings per share |

$ |

0.49 |

|

|

$ |

0.52 |

|

|

$ |

2.28 |

|

|

$ |

2.38 |

|

|

Diluted earnings per share |

$ |

0.48 |

|

|

$ |

0.51 |

|

|

$ |

2.26 |

|

|

$ |

2.35 |

|

|

Cash dividends declared per common share |

$ |

0.20 |

|

|

$ |

0.18 |

|

|

$ |

0.78 |

|

|

$ |

0.70 |

|

|

|

|

|

|

|

|

|

|

|

Weighted-average common shares outstanding |

|

|

|

|

|

|

|

|

for earnings per share: |

|

|

|

|

|

|

|

|

Basic |

|

491.3 |

|

|

|

501.2 |

|

|

|

492.4 |

|

|

|

497.7 |

|

|

Diluted |

|

497.0 |

|

|

|

509.1 |

|

|

|

497.9 |

|

|

|

505.1 |

|

| |

|

|

|

|

|

|

|

|

|

Nasdaq, Inc. |

|

Revenue Detail |

|

(in millions) |

|

|

| |

|

|

|

Three Months Ended |

|

Year Ended |

| |

|

|

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

(unaudited) |

|

(unaudited) |

|

(unaudited) |

|

|

|

MARKET PLATFORMS |

|

|

|

|

|

|

|

| |

Trading Services revenues |

$ |

929 |

|

|

$ |

832 |

|

|

$ |

3,663 |

|

|

$ |

3,503 |

|

| |

Transaction-based expenses: |

|

|

|

|

|

|

|

| |

|

|

Transaction rebates |

|

(488 |

) |

|

|

(526 |

) |

|

|

(2,092 |

) |

|

|

(2,168 |

) |

| |

|

|

Brokerage, clearance and exchange fees |

|

(188 |

) |

|

|

(56 |

) |

|

|

(552 |

) |

|

|

(298 |

) |

| |

|

Total net Trading Services revenues |

|

253 |

|

|

|

250 |

|

|

|

1,019 |

|

|

|

1,037 |

|

| |

|

|

|

|

|

|

|

|

|

|

| |

Marketplace Technology |

|

150 |

|

|

|

143 |

|

|

|

562 |

|

|

|

545 |

|

| |

|

Total Market Platforms revenues |

|

403 |

|

|

|

393 |

|

|

|

1,581 |

|

|

|

1,582 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

CAPITAL ACCESS PLATFORMS |

|

|

|

|

|

|

|

| |

Data and Listing Services revenues |

|

183 |

|

|

|

178 |

|

|

|

729 |

|

|

|

680 |

|

|

|

Index revenues |

|

116 |

|

|

|

130 |

|

|

|

486 |

|

|

|

459 |

|

| |

Workflow and Insights revenues |

|

121 |

|

|

|

112 |

|

|

|

469 |

|

|

|

429 |

|

| |

|

Total Capital Access Platforms revenues |

|

420 |

|

|

|

420 |

|

|

|

1,684 |

|

|

|

1,568 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

ANTI-FINANCIAL CRIME |

|

82 |

|

|

|

68 |

|

|

|

306 |

|

|

|

231 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

OTHER REVENUES |

|

1 |

|

|

|

4 |

|

|

|

11 |

|

|

|

39 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

REVENUES LESS TRANSACTION-BASED EXPENSES |

$ |

906 |

|

|

$ |

885 |

|

|

$ |

3,582 |

|

|

$ |

3,420 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

Nasdaq, Inc. |

|

Condensed Consolidated Balance Sheets |

|

(in millions) |

| |

|

|

|

|

|

| |

|

|

December 31, |

|

December 31, |

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

Assets |

|

(unaudited) |

|

|

|

Current assets: |

|

|

|

|

| |

Cash and cash equivalents |

|

$ |

502 |

|

|

$ |

393 |

|

| |

Restricted cash and cash equivalents |

|

|

22 |

|

|

|

29 |

|

| |

Default funds and margin deposits |

|

|

7,021 |

|

|

|

5,911 |

|

| |

Financial investments |

|

|

181 |

|

|

|

208 |

|

| |

Receivables, net |

|

|

677 |

|

|

|

588 |

|

| |

Other current assets |

|

|

201 |

|

|

|

294 |

|

|

Total current assets |

|

|

8,604 |

|

|

|

7,423 |

|

|

Property and equipment, net |

|

|

532 |

|

|

|

509 |

|

|

Goodwill |

|

|

8,099 |

|

|

|

8,433 |

|

|

Intangible assets, net |

|

|

2,581 |

|

|

|

2,813 |

|

|

Operating lease assets |

|

|

444 |

|

|

|

366 |

|

|

Other non-current assets |

|

|

608 |

|

|

|

571 |

|

|

Total assets |

|

$ |

20,868 |

|

|

$ |

20,115 |

|

| |

|

|

|

|

|

|

Liabilities |

|

|

|

|

|

Current liabilities: |

|

|

|

|

| |

Accounts payable and accrued expenses |

|

$ |

185 |

|

|

$ |

185 |

|

| |

Section 31 fees payable to SEC |

|

|

243 |

|

|

|

62 |

|

| |

Accrued personnel costs |

|

|

243 |

|

|

|

252 |

|

| |

Deferred revenue |

|

|

357 |

|

|

|

329 |

|

| |

Other current liabilities |

|

|

122 |

|

|

|

115 |

|

| |

Default funds and margin deposits |

|

|

7,021 |

|

|

|

5,911 |

|

| |

Short-term debt |

|

|

664 |

|

|

|

1,018 |

|

|

Total current liabilities |

|

|

8,835 |

|

|

|

7,872 |

|

|

Long-term debt |

|

|

4,735 |

|

|

|

4,812 |

|

|

Deferred tax liabilities, net |

|

|

456 |

|

|

|

406 |

|

|

Operating lease liabilities |

|

|

452 |

|

|

|

386 |

|

|

Other non-current liabilities |

|

|

226 |

|

|

|

234 |

|

|

Total liabilities |

|

|

14,704 |

|

|

|

13,710 |

|

|

|

|

|

|

|

|

Commitments and contingencies |

|

|

|

|

|

Equity |

|

|

|

|

|

Nasdaq stockholders' equity: |

|

|

|

|

| |

Common stock |

|

|

5 |

|

|

|

5 |

|

| |

Additional paid-in capital |

|

|

1,445 |

|

|

|

1,949 |

|

| |

Common stock in treasury, at cost |

|

|

(515 |

) |

|

|

(437 |

) |

| |

Accumulated other comprehensive loss |

|

|

(1,991 |

) |

|

|

(1,587 |

) |

| |

Retained earnings |

|

|

7,207 |

|

|

|

6,465 |

|

|

Total Nasdaq stockholders' equity |

|

|

6,151 |

|

|

|

6,395 |

|

| |

Noncontrolling interests |

|

|

13 |

|

|

|

10 |

|

|

Total equity |

|

|

6,164 |

|

|

|

6,405 |

|

|

Total liabilities and equity |

|

$ |

20,868 |

|

|

$ |

20,115 |

|

| |

|

|

|

|

|

|

Nasdaq, Inc. |

|

Reconciliation of U.S. GAAP Net Income, Diluted Earnings

Per Share, Operating Income and |

|

Operating Expenses to Non-GAAP Net Income, Diluted Earnings

Per Share, Operating Income, and Operating Expenses |

|

(in millions, except per share amounts) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Year Ended |

| |

|

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

U.S. GAAP net income attributable to Nasdaq |

|

$ |

241 |

|

|

$ |

259 |

|

|

$ |

1,125 |

|

|

$ |

1,187 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

| |

Amortization expense of acquired intangible assets (1) |

|

|

38 |

|

|

|

54 |

|

|

|

153 |

|

|

|

170 |

|

| |

Merger and strategic initiatives expense (2) |

|

|

41 |

|

|

|

17 |

|

|

|

82 |

|

|

|

87 |

|

| |

Restructuring charges (3) |

|

|

15 |

|

|

|

— |

|

|

|

15 |

|

|

|

31 |

|

| |

Net gain on divestiture of business (4) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

(84 |

) |

| |

Net (income) loss from unconsolidated investees (5) |

|

|

(7 |

) |

|

|

37 |

|

|

|

(29 |

) |

|

|

(52 |

) |

| |

Regulatory matters (6) |

|

|

1 |

|

|

|

33 |

|

|

|

1 |

|

|

|

33 |

|

| |

Extinguishment of debt (7) |

|

|

— |

|

|

|

— |

|

|

|

16 |

|

|

|

33 |

|

| |

Other (8) |

|

|

8 |

|

|

|

(36 |

) |

|

|

27 |

|

|

|

(71 |

) |

| |

Total non-GAAP adjustments |

|

|

96 |

|

|

|

105 |

|

|

|

265 |

|

|

|

147 |

|

| |

Non-GAAP adjustment to the income tax provision (9) |

|

|

(20 |

) |

|

|

(36 |

) |

|

|

(66 |

) |

|

|

(61 |

) |

| |

Total non-GAAP adjustments, net of tax |

|

|

76 |

|

|

|

69 |

|

|

|

199 |

|

|

|

86 |

|

|

Non-GAAP net income attributable to Nasdaq |

|

$ |

317 |

|

|

$ |

328 |

|

|

$ |

1,324 |

|

|

$ |

1,273 |

|

| |

|

|

|

|

|

|

|

|

|

|

U.S. GAAP diluted earnings per share |

|

$ |

0.48 |

|

|

$ |

0.51 |

|

|

$ |

2.26 |

|

|

$ |

2.35 |

|

| |

Total adjustments from non-GAAP net income above |

|

|

0.16 |

|

|

|

0.13 |

|

|

|

0.40 |

|

|

|

0.17 |

|

|

Non-GAAP diluted earnings per share |

|

$ |

0.64 |

|

|

$ |

0.64 |

|

|

$ |

2.66 |

|

|

$ |

2.52 |

|

| |

|

|

|

|

|

|

|

|

|

|

Weighted-average diluted common shares outstanding for

earnings per share: |

|

|

497.0 |

|

|

|

509.1 |

|

|

|

497.9 |

|

|

|

505.1 |

|

| |

|

|

|

|

|

|

|

|

|

|

(1) We amortize intangible assets acquired in connection with

various acquisitions. Intangible asset amortization expense can

vary from period to period due to episodic acquisitions completed,

rather than from our ongoing business operations. |

|

|

|

|

|

|

(2) We have pursued various strategic initiatives and completed

acquisitions and divestitures in recent years which have resulted

in expenses which would not have otherwise been incurred. These

expenses generally include integration costs, as well as legal, due

diligence and other third party transaction costs. The frequency

and amount of such expenses vary significantly based on the size,

timing and complexity of the transaction. |

| |

|

|

|

|

|

|

|

|

|

|

(3) The 2022 charges relate to our divisional alignment program

that was initiated in October 2022, following our September

announcement to realign our segments and leadership, with a focus

on realizing the full potential of this structure. In connection

with the program, we expect to incur pre-tax charges principally

related to employee-related costs, consulting, asset impairments

and contract terminations over a two-year period. The charges in

2019, 2020 and 2021 are associated with our restructuring program

initiated in September 2019 with the goal of transitioning certain

technology platforms to advance Nasdaq’s strategic opportunities as

a technology and analytics provider and continuing our re-alignment

of certain business areas. The 2019 program was completed as of

June 30, 2021. |

|

|

|

|

|

|

|

|

|

|

|

|

(4) For the year ended December 31, 2021, we recorded a pre-tax net

gain of $84 million on the sale of our U.S. Fixed Income business,

which is included in net gain on divestiture of business in the

Condensed Consolidated Statements of Income. |

|

|

|

|

|

|

|

|

|

|

|

|

(5) Represents the earnings and losses recognized from our equity

interest in the Options Clearing Corporation, or OCC. We will

continue to exclude the earnings and losses related to our share of

OCC's earnings for purposes of calculating non-GAAP measures as our

income on this investment may vary significantly period to period.

This provides a more meaningful analysis of Nasdaq's ongoing

operating performance or comparisons in Nasdaq's performance

between periods. |

|

|

|

|

|

|

|

|

|

|

|

|

(6) In December 2021, we recorded a $33 million charge related to a

decision made by the Swedish Administrative court rejecting an

appeal by Nasdaq Clearing to dismiss an administrative fine imposed

by the Swedish Financial Supervisory Authority, or SFSA, associated

with the default of a member of the Nasdaq Clearing commodities

market that occurred in 2018. Nasdaq Clearing has appealed the

court’s recent decision and firmly believes in the merits of its

appeal. The charge was recorded to regulatory expense in our

Condensed Consolidated Statements of Income. |

|

|

|

|

|

|

|

|

|

|

|

|

(7) For the years ended December 31, 2022 and December 31, 2021, we

recorded a loss on early extinguishment of debt. The charge for

both periods is recorded in general, administrative and other

expense in our Condensed Consolidated Statements of Income. |

|

|

|

|

|

|

|

|

|

|

|

|

(8) We have excluded certain other charges or gains, including

certain tax items, that are the result of other non-comparable

events to measure operating performance. For the three months and

year ended December 31, 2022 and the three months and year ended

December 31, 2021, other significant items included net gains and

losses from strategic investments entered into through our

corporate venture program recorded in other income in our Condensed

Consolidated Statements of Income. For the year ended December 31,

2022, other significant items also included accruals related to

legal matters recorded in general, administrative and other expense

in our Condensed Consolidated Statements of Income. |

|

|

|

|

|

|

|

|

|

|

|

|

(9) The non-GAAP adjustment to the income tax provision primarily

includes the tax impact of each non-GAAP adjustment. In addition,

for the three months and year ended December 31, 2021, we recorded

a tax benefit related to state and local provision to return

adjustments and a release of tax reserves due to statute of

limitation expiration. For the year ended December 31, 2021, we

also recorded a prior year tax benefit, net of reserve. |

|

|

|

Nasdaq, Inc. |

|

Reconciliation of U.S. GAAP Net Income, Diluted Earnings

Per Share, Operating Income and |

|

Operating Expenses to Non-GAAP Net Income, Diluted Earnings

Per Share, Operating Income, and Operating Expenses |

|

(in millions) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Year Ended |

| |

|

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

U.S. GAAP operating income |

|

$ |

349 |

|

|

$ |

344 |

|

|

$ |

1,564 |

|

|

$ |

1,441 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

| |

Amortization expense of acquired intangible assets (1) |

|

|

38 |

|

|

|

54 |

|

|

|

153 |

|

|

|

170 |

|

| |

Merger and strategic initiatives expense (2) |

|

|

41 |

|

|

|

17 |

|

|

|

82 |

|

|

|

87 |

|

| |

Restructuring charges (3) |

|

|

15 |

|

|

|

— |

|

|

|

15 |

|

|

|

31 |

|

| |

Extinguishment of debt (4) |

|

|

— |

|

|

|

— |

|

|

|

16 |

|

|

|

33 |

|

| |

Regulatory matters (5) |

|

|

1 |

|

|

|

33 |

|

|

|

1 |

|

|

|

33 |

|

| |

Other (6) |

|

|

2 |

|

|

|

3 |

|

|

|

30 |

|

|

|

9 |

|

| |

Total non-GAAP adjustments |

|

|

97 |

|

|

|

107 |

|

|

|

297 |

|

|

|

363 |

|

|

Non-GAAP operating income |

|

$ |

446 |

|

|

$ |

451 |

|

|

$ |

1,861 |

|

|

$ |

1,804 |

|

|

|

|

|

|

|

|

|

|

|

|

Revenues less transaction-based expenses |

|

$ |

906 |

|

|

$ |

885 |

|

|

$ |

3,582 |

|

|

$ |

3,420 |

|

| |

|

|

|

|

|

|

|

|

|

|

U.S. GAAP operating margin

(7) |

|

|

39 |

% |

|

|

39 |

% |

|

|

44 |

% |

|

|

42 |

% |

| |

|

|

|

|

|

|

|

|

|

|

Non-GAAP operating margin

(8) |

|

|

49 |

% |

|

|

51 |

% |

|

|

52 |

% |

|

|

53 |

% |

| |

|

|

|

|

|

|

|

|

|

|

(1) We amortize intangible assets acquired in connection with

various acquisitions. Intangible asset amortization expense can

vary from period to period due to episodic acquisitions completed,

rather than from our ongoing business operations. |

|

|

|

|

|

|

(2) We have pursued various strategic initiatives and completed

acquisitions and divestitures in recent years which have resulted

in expenses which would not have otherwise been incurred. These

expenses generally include integration costs, as well as legal, due

diligence and other third party transaction costs. The frequency

and amount of such expenses vary significantly based on the size,

timing and complexity of the transaction. |

| |

|

|

|

|

|

|

|

|

|

|

(3) The 2022 charges relate to our divisional alignment program

that was initiated in October 2022, following our September

announcement to realign our segments and leadership, with a focus

on realizing the full potential of this structure. In connection

with the program, we expect to incur pre-tax charges principally

related to employee-related costs, consulting, asset impairments

and contract terminations over a two-year period. The charges in

2019, 2020 and 2021 are associated with our restructuring program

initiated in September 2019 with the goal of transitioning certain

technology platforms to advance Nasdaq’s strategic opportunities as

a technology and analytics provider and continuing our re-alignment

of certain business areas. The 2019 program was completed as of

June 30, 2021. |

|

|

|

|

|

|

|

|

|

|

|

|

(4) For the years ended December 31, 2022 and December 31, 2021, we

recorded a loss on early extinguishment of debt. The charge for

both periods is recorded in general, administrative and other

expense in our Condensed Consolidated Statements of Income. |

|

|

|

|

|

|

|

|

|

|

|

|

(5) In December 2021, we recorded a $33 million charge related to a

decision made by the Swedish Administrative court rejecting an

appeal by Nasdaq Clearing to dismiss an administrative fine imposed

by the SFSA, associated with the default of a member of the Nasdaq

Clearing commodities market that occurred in 2018. Nasdaq Clearing

has appealed the court’s recent decision and firmly believes in the

merits of its appeal. The charge was recorded to regulatory expense

in our Condensed Consolidated Statements of Income. |

|

|

|

|

|

|

|

|

|

|

|

|

(6) We have excluded certain other charges or gains, including

certain tax items, that are the result of other non-comparable

events to measure operating performance. For the year ended

December 31, 2022, other significant items primarily included

accruals related to legal matters recorded in general,

administrative and other expense in our Condensed Consolidated

Statements of Income. |

| |

|

|

|

|

|

|

|

|

|

|

(7) U.S. GAAP operating margin equals U.S. GAAP operating income

divided by revenues less transaction-based expenses. |

| |

|

|

|

|

|

|

|

|

|

|

(8) Non-GAAP operating margin equals non-GAAP operating income

divided by revenues less transaction-based expenses. |

| |

|

|

|

|

|

|

|

|

|

|

Nasdaq, Inc. |

|

Reconciliation of U.S. GAAP Net Income, Diluted Earnings

Per Share, Operating Income and |

|

Operating Expenses to Non-GAAP Net Income, Diluted Earnings

Per Share, Operating Income, and Operating Expenses |

|

(in millions) |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

|

|

Three Months Ended |

|

Year Ended |

| |

|

|

December 31, |

|

December 31, |

|

December 31, |

|

December 31, |

|

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

|

2021 |

|

| |

|

|

|

|

|

|

|

|

|

|

U.S. GAAP operating expenses |

|

$ |

557 |

|

|

$ |

541 |

|

|

$ |

2,018 |

|

|

$ |

1,979 |

|

|

Non-GAAP adjustments: |

|

|

|

|

|

|

|

|

| |

Amortization expense of acquired intangible assets (1) |

|

|

(38 |

) |

|

|

(54 |

) |

|

|

(153 |

) |

|

|

(170 |

) |

| |

Merger and strategic initiatives expense (2) |

|

|

(41 |

) |

|

|

(17 |

) |

|

|

(82 |

) |

|

|

(87 |

) |

| |

Restructuring charges (3) |

|

|

(15 |

) |

|

|

— |

|

|

|

(15 |

) |

|

|

(31 |

) |

| |

Extinguishment of debt (4) |

|

|

— |

|

|

|

— |

|

|

|

(16 |

) |

|

|

(33 |

) |

| |

Regulatory matters (5) |

|

|

(1 |

) |

|

|

(33 |

) |

|

|

(1 |

) |

|

|

(33 |

) |

| |

Other (6) |

|

|

(2 |

) |

|

|

(3 |

) |

|

|

(30 |

) |

|

|

(9 |

) |

| |

Total non-GAAP adjustments |

|

|

(97 |

) |

|

|

(107 |

) |

|

|

(297 |

) |

|

|

(363 |

) |

|

Non-GAAP operating expenses |

|

$ |

460 |

|

|

$ |

434 |

|

|

$ |

1,721 |

|

|

$ |

1,616 |

|

| |

|

|

|

|

|

|

|

|

|

|

(1) We amortize intangible assets acquired in connection with

various acquisitions. Intangible asset amortization expense can

vary from period to period due to episodic acquisitions completed,

rather than from our ongoing business operations. |

|

|

|

|

|

|

(2) We have pursued various strategic initiatives and completed

acquisitions and divestitures in recent years which have resulted

in expenses which would not have otherwise been incurred. These

expenses generally include integration costs, as well as legal, due

diligence and other third party transaction costs. The frequency

and amount of such expenses vary significantly based on the size,

timing and complexity of the transaction. |

| |

|

|

|

|

|

|

|

|

|

|

(3) The 2022 charges relate to our divisional alignment program

that was initiated in October 2022, following our September

announcement to realign our segments and leadership, with a focus

on realizing the full potential of this structure. In connection

with the program, we expect to incur pre-tax charges principally

related to employee-related costs, consulting, asset impairments

and contract terminations over a two-year period. The charges in

2019, 2020 and 2021 are associated with our restructuring program

initiated in September 2019 with the goal of transitioning certain

technology platforms to advance Nasdaq’s strategic opportunities as

a technology and analytics provider and continuing our re-alignment

of certain business areas. The 2019 program was completed as of

June 30, 2021. |

|

|

|

|

|

|

|

|

|

|

|

|

(4) For the years ended December 31, 2022 and December 31, 2021, we

recorded a loss on early extinguishment of debt. The charge for

both periods is recorded in general, administrative and other

expense in our Condensed Consolidated Statements of Income. |

|

|

|

|

|

|

|

|

|

|

|

|

(5) In December 2021, we recorded a $33 million charge related to a

decision made by the Swedish Administrative court rejecting an

appeal by Nasdaq Clearing to dismiss an administrative fine imposed

by the SFSA, associated with the default of a member of the Nasdaq

Clearing commodities market that occurred in 2018. Nasdaq Clearing

has appealed the court’s recent decision and firmly believes in the

merits of its appeal. The charge was recorded to regulatory expense

in our Condensed Consolidated Statements of Income. |

|

|

|

|

|

|

|

|

|

|

|

|

(6) We have excluded certain other charges or gains, including

certain tax items, that are the result of other non-comparable

events to measure operating performance. For the year ended

December 31, 2022, these significant items primarily included

accruals related to legal matters recorded in general,

administrative and other expense in our Condensed Consolidated

Statements of Income. |

| |

|

|

|

|

|

|

|

|

|

|

Nasdaq, Inc. |

|

Quarterly Key Drivers Detail |

|

(unaudited) |

| |

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Year Ended |

| |

|

December 31, |

|

December 31, |

|

December 31, |

December 31, |

|

|

|

|

2022 |

|

|

|

2021 |

|

|

|

2022 |

|

|

2021 |

|

|

Market Platforms |

|

|

|

|

|

|

|

|

Annualized recurring revenues (in millions) (1) |

$ |

503 |

|

|

$ |

479 |

|

|

$ |

503 |

|

$ |

479 |

|

|

Trading Services |

|

|

|

|

|

|

| |

Equity Derivative Trading and Clearing |

|

|

|

|

|

|

| |

U.S. equity options |

|

|

|

|

|

|

| |

Total industry average daily volume (in millions) |

|

39.3 |

|

|

|

38.6 |

|

|

|

38.2 |

|

|

37.2 |

|

| |

Nasdaq PHLX matched market share |

|

12.0 |

% |

|

|

11.8 |

% |

|

|

11.6 |

% |

|

12.4 |

% |

| |

The Nasdaq Options Market matched market share |

|

7.0 |

% |

|

|

8.1 |

% |

|

|

8.0 |

% |

|

8.1 |

% |

| |

Nasdaq BX Options matched market share |

|

3.3 |

% |

|

|

2.0 |

% |

|

|

2.8 |

% |

|

1.4 |

% |

| |

Nasdaq ISE Options matched market share |

|

6.0 |

% |

|

|

6.6 |

% |

|

|

5.7 |

% |

|

6.6 |

% |

| |

Nasdaq GEMX Options matched market share |

|

2.2 |

% |

|

|

2.5 |

% |

|

|

2.3 |

% |

|

4.3 |

% |

| |

Nasdaq MRX Options matched market share |

|

1.4 |

% |

|

|

1.8 |

% |

|

|

1.6 |

% |

|

1.6 |

% |

| |

Total matched market share executed on Nasdaq's exchanges |

|

31.9 |

% |

|

|

32.8 |

% |

|

|

32.0 |

% |

|

34.4 |

% |

| |

Nasdaq Nordic and Nasdaq Baltic options and futures |

|

|

|

|

|

|

| |

Total average daily volume of options and futures contracts

(2) |

|

277,521 |

|

|

|

288,327 |

|

|

|

296,626 |

|

|

287,182 |

|

| |

|

|

|

|

|

|

|

| |

Cash Equity Trading |

|

|

|

|

|

|

| |

Total U.S.-listed securities |

|

|

|

|

|

|

| |

Total industry average daily share volume (in billions) |

|

11.2 |

|

|

|

10.8 |

|

|

|

11.9 |

|

|

11.4 |

|

| |

Matched share volume (in billions) |

|

121.7 |

|

|

|

118.6 |

|

|

|

522.8 |

|

|

491.9 |

|

| |

The Nasdaq Stock Market matched market share |

|

16.1 |

% |

|

|

16.0 |

% |

|

|

16.2 |

% |

|

15.8 |

% |

| |

Nasdaq BX matched market share |

|

0.5 |

% |

|

|

0.6 |

% |

|

|

0.5 |

% |

|

0.6 |

% |

| |

Nasdaq PSX matched market share |

|

0.7 |

% |

|

|

0.6 |

% |

|

|

0.8 |

% |

|

0.7 |

% |

| |

Total matched market share executed on Nasdaq's exchanges |

|

17.3 |

% |

|

|

17.2 |

% |

|

|

17.5 |

% |

|

17.1 |

% |

| |

Market share reported to the FINRA/Nasdaq Trade Reporting

Facility |

|

36.6 |

% |

|

|

34.8 |

% |

|

|

35.2 |

% |

|

34.9 |

% |

| |

Total market share (3) |

|

53.9 |

% |

|

|

52.0 |

% |

|

|

52.7 |

% |

|

52.0 |

% |

| |

Nasdaq Nordic and Nasdaq Baltic securities |

|

|

|

|

|

|

| |

Average daily number of equity trades executed on Nasdaq's

exchanges |

|

778,057 |

|

|

|

1,045,996 |

|

|

|

908,813 |

|

|

1,036,523 |

|

| |

Total average daily value of shares traded (in billions) |

$ |

4.6 |

|

|

$ |

6.5 |

|

|

$ |

5.4 |

|

$ |

6.4 |

|

| |

Total market share executed on Nasdaq's exchanges |

|

69.7 |

% |

|

|

75.6 |

% |

|

|

71.5 |

% |

|

76.9 |

% |

| |

|

|

|

|

|

|

|

|

|

Fixed Income and Commodities Trading and

Clearing |

|

|

|

|

|

|

|

|

Fixed Income |

|

|

|

|

|

|

|

|

Total average daily volume of Nasdaq Nordic and Nasdaq Baltic fixed

income contracts |

|

97,405 |

|

|

|

119,738 |

|

|

|

111,901 |

|

|

115,308 |

|

|

|

Commodities |

|

|

|

|

|

|

|

|

Power contracts cleared (TWh) (4) |

|

76 |

|

|

|

181 |

|

|

|

413 |

|

|

813 |

|

| |

|

|

|

|

|

|

|

|

Marketplace Technology |

|

|

|

|

|

|

|

|

Order intake (in millions) (5) |

$ |

106 |

|

|

$ |

123 |

|

|

$ |

264 |

|

$ |

304 |

|

| |

|

|

|

|

|

|

|

|

Capital Access Platforms |

|

|

|

|

|

|

|

|

Annualized recurring revenues (in millions) (1) |

$ |

1,192 |

|

|

$ |

1,113 |

|

|

$ |

1,192 |

|

$ |

1,113 |

|

| |

Initial public offerings |

|

|

|

|

|

|

| |

The Nasdaq Stock Market (6) |

|

18 |

|

|

|

195 |

|

|

|

161 |

|

|

752 |

|

| |

Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic |

|

5 |

|

|

|

63 |

|

|

|

38 |

|

|

174 |

|

| |

Total new listings |

|

|

|

|

|

|

| |

The Nasdaq Stock Market (6) |

|

74 |

|

|

|

266 |

|

|

|

366 |

|

|

1,000 |

|

| |

Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic (7) |

|

10 |

|

|

|

75 |

|

|

|

63 |

|

|

207 |

|

| |

Number of listed companies |

|

|

|

|

|

|

| |

The Nasdaq Stock Market (8) |

|

4,230 |

|

|

|

4,178 |

|

|

|

4,230 |

|

|

4,178 |

|

| |

Exchanges that comprise Nasdaq Nordic and Nasdaq Baltic (9) |

|

1,251 |

|

|

|

1,235 |

|

|

|

1,251 |

|

|

1,235 |

|

| |

Index |

|

|

|

|

|

|

| |

Number of licensed exchange traded products (ETPs) |

|

379 |

|

|

|

362 |

|

|

|

379 |

|

|

362 |

|

| |

Period end ETP assets under management (AUM) tracking Nasdaq

indexes (in billions) |

$ |

315 |

|

|

$ |

424 |

|

|

$ |

315 |

|

$ |

424 |

|

| |

Quarterly average ETP assets under management (AUM) tracking Nasdaq

indexes (in billions) |

$ |

326 |

|

|

$ |

400 |

|

|

|

|

| |

TTM (10) net inflows ETP AUM tracking Nasdaq indexes (in

billions) |

$ |

34 |

|

|

$ |

74 |

|

|

$ |

34 |

|

$ |

74 |

|

| |

TTM (10) net (depreciation) appreciation ETP AUM tracking Nasdaq

indexes (in billions) |

$ |

(142 |

) |

|

$ |

83 |

|

|

$ |

(142 |

) |

$ |

83 |

|

| |

|

|

|

|

|

|

|

|

Anti-Financial Crime |

|

|

|

|

|

|

|

|

Annualized recurring revenues (in millions) (1) |

$ |

312 |

|

|

$ |

269 |

|

|

$ |

312 |

|

$ |

269 |

|

| |

Total signed ARR (11) |

$ |

338 |

|

|

$ |

288 |

|

|

$ |

338 |

|

$ |

288 |

|

| |

|

|

|

|

|

|

|

| |

(1) Annualized Recurring Revenue, or ARR, for a given period is the

annualized revenue of support services and SaaS subscription

contracts. ARR is currently one of our key performance metrics to

assess the health and trajectory of our recurring business. ARR

does not have any standardized definition and is therefore unlikely

to be comparable to similarly titled measures presented by other

companies. ARR should be viewed independently of revenue and

deferred revenue and is not intended to be combined with or to

replace either of those items. ARR is not a forecast and the active

contracts during the reporting period used in calculating ARR may

or may not be extended or renewed by our customers. |

| |

(2) Includes Finnish option contracts traded on Eurex for which

Nasdaq and Eurex have a revenue sharing arrangement. |

| |

(3) Includes transactions executed on The Nasdaq Stock Market's,

Nasdaq BX's and Nasdaq PSX's systems plus trades reported through

the Financial Industry Regulatory Authority/Nasdaq Trade Reporting

Facility. |

| |

(4) Transactions executed on Nasdaq Commodities or OTC and reported

for clearing to Nasdaq Commodities measured by Terawatt hours

(TWh). |

| |

(5) Total contract value of orders signed during the period. |

| |

(6) New listings include IPOs, including issuers that switched from

other listing venues, closed-end funds and separately listed ETPs.

For the three months ended December 31, 2022 and 2021, IPOs

included 8 and 123 SPACs, respectively. For the years ended

December 31, 2022 and 2021, IPOs included 74 and 433 SPACs,

respectively. |

| |

(7) New listings include IPOs and represent companies listed on the

Nasdaq Nordic and Nasdaq Baltic exchanges and companies on the

alternative markets of Nasdaq First North. |

| |

(8) Number of total listings on The Nasdaq Stock Market at period

end, includes 528 ETPs as of December 31, 2022 and 441 as of

December 31, 2021. |

| |

(9) Represents companies listed on the Nasdaq Nordic and Nasdaq

Baltic exchanges and companies on the alternative markets of Nasdaq

First North. |

| |

(10) Trailing 12-months. |

| |

(11) Signed ARR includes ARR recognized as revenue in the current

period as well as ARR for new contracts signed but not yet

commenced. |

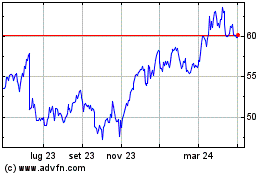

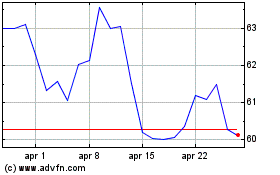

Grafico Azioni Nasdaq (NASDAQ:NDAQ)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Nasdaq (NASDAQ:NDAQ)

Storico

Da Apr 2023 a Apr 2024