Current Report Filing (8-k)

19 Gennaio 2023 - 10:51PM

Edgar (US Regulatory)

NETFLIX INC0001065280false00010652802023-01-132023-01-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

__________________________________

FORM 8-K

__________________________________

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported):

January 13, 2023

__________________________________

NETFLIX, INC.

(Exact name of registrant as specified in its charter)

__________________________________ | | | | | | | | | | | | | | |

| Delaware | 001-35727 | 77-0467272 |

(State or other jurisdiction

of incorporation) | (Commission

File Number) | (I.R.S. Employer

Identification No.) |

|

121 Albright Way, Los Gatos, California | | 95032 |

| (Address of principal executive offices) | | (Zip Code) |

(408) 540-3700

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

__________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common stock, par value $0.001 per share | NFLX | NASDAQ Global Select Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02 Results of Operations and Financial Condition.

On January 19, 2023, Netflix, Inc. (the “Company”) announced its financial results for the quarter ended December 31, 2022. The Letter to Shareholders, which is attached hereto as Exhibit 99.1 and is incorporated herein by reference, includes reference to the non-GAAP financial measures of F/X neutral revenue and operating margin, free cash flow, last twelve months ("LTM") EBITDA, and adjusted EBITDA. Generally, a non-GAAP financial measure is a numerical measure of a company’s performance, financial position, or cash flows that either excludes or includes amounts that are not normally excluded or included in the most directly comparable measure calculated and presented in accordance with generally accepted accounting principles in the United States. Management believes that the non-GAAP measures of free cash flow, LTM EBITDA and adjusted EBITDA are important liquidity metrics because they measure, during a given period, the amount of cash generated that is available to repay debt obligations, make strategic acquisitions and investments and for certain other activities like stock repurchases. Management believes that F/X neutral revenue and operating margin allows investors to compare our projected results to our actual results absent intra-year currency fluctuations. However, these non-GAAP measures should be considered in addition to, not as a substitute for or superior to, net income, operating income, operating margin, diluted earnings per share and net cash provided by (used in) operating activities, or other financial measures prepared in accordance with GAAP. Reconciliation to the GAAP equivalent of this non-GAAP measure is contained in tabular form in Exhibit 99.1.

The information contained in this Item 2.02 and the accompanying Exhibit 99.1 are “furnished” and shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference in such filing.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On January 13, 2023, Reed Hastings was appointed as Executive Chairman of the Board of Directors (the “Board”) of the Company, effective immediately. At that time, Mr. Hastings resigned his role as co-Chief Executive Officer and President of the Company, but remains an employee of the Company in his new role as Executive Chairman. Also on January 13, 2023, Greg Peters, age 52, was appointed as co-Chief Executive Officer of the Company. Mr. Peters will serve as co-Chief Executive Officer with Ted Sarandos, the Company’s co-Chief Executive Officer. Additionally, Mr. Peters has been appointed to the Board and will hold office as a Class I director. He has not yet been appointed to serve as a member of any Board committee. Both appointments were effective as of January 13, 2023.

Biographical and other information about Mr. Peters can be found in the section of Netflix’s 2022 Proxy Statement, filed with the Securities and Exchange Commission on April 22, 2022, entitled "Our Company-- Executive Officers–Greg Peters", which is incorporated by reference herein. Mr. Peters brings to the Board a deep understanding of the Company’s business, including its technology and worldwide operations, as well as executive leadership experience.

There is no family relationship between Mr. Peters and any other person that would require disclosure under Item 401(d) of Regulation S-K. Mr. Peters is also not a party to any transactions that would require disclosure under Item 404(a) of Regulation S-K.

In connection with the above appointments and resignation, on January 13, 2023, the Compensation Committee of the Board of the Company made the following modifications to the 2023 compensation for Mr. Peters and Mr. Hastings:

| | | | | | | | | | | | | | | | | | | | |

| | ANNUAL SALARY

| | ANNUAL STOCK OPTION ALLOCATION | | ESTIMATED TARGET BONUS |

| Greg Peters, Co-Chief Executive Officer | | $ | 3,000,000 | | | $ | 17,325,000 | | | $ | 14,325,000 | |

| Reed Hastings, Executive Chairman of the Board | | 500,000 | | | 2,500,000 | | | N/A |

All other terms relating to the 2023 compensation for Mr. Peters and Mr. Hastings remain consistent with those disclosed in the Company’s Current Report on Form 8-K filed on December 23, 2022.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | |

| Exhibit Number | Description of Exhibit |

| |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | NETFLIX, INC. |

| Date: | January 19, 2023 | |

| | /s/ Spencer Neumann |

| | Spencer Neumann |

| | Chief Financial Officer |

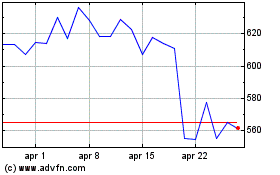

Grafico Azioni Netflix (NASDAQ:NFLX)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Netflix (NASDAQ:NFLX)

Storico

Da Apr 2023 a Apr 2024