Should You Invest In Growth or Value Stocks In 2023?

22 Dicembre 2022 - 12:03PM

Finscreener.org

The below graph perfectly sums up

the difference between growth and value investing. While Cathie

Wood’s growth-focused

ARK Innovation ETF delivered stellar returns to shareholders amid

the pandemic, a majority of these stocks are now under the

pump.

Comparatively, Warren Buffett’s

portfolio of cash-generating blue-chip stocks have managed to hold their own

across market cycles.

During a bull run, high-flying

growth stocks tend to crush broader returns and derive outsized

gains for investors.

For instance, some of the top

holdings for the ARKK ETF include Tesla

(NASDAQ: TSLA), Roku (NASDAQ: ROKU),

and Shopify (NYSE:

SHOP). Between September 2017 (when Roku went

public) and December 2021:

Tesla UP 1,460%

Shopify UP 1,110%

Roku UP 871%

Alternatively, growth stocks

terribly underperform the markets when market sentiment turns

bearish as investors focus on companies with stronger fundamentals,

predictable cash flows, and robust balance sheets.

The triple whammy of rising

interest rates, supply chain disruptions, and surging inflation

numbers have dragged Tesla, Shopify, and Roku lower by 63%, 77%,

and 91% from all-time highs, respectively.

On the other hand,

Warren Buffett’s diversified portfolio has managed to perform

admirably amid the market chaos in 2022. While

Apple (NASDAQ: AAPL)

accounts for a majority of Berkshire Hathaway’s equity portfolio,

the Oracle of Omaha also has exposure to market leaders such

as Coca-Cola (NYSE:

KO), Kraft

Heinz (NASDAQ:

KHC),

Chevron (NYSE:

CVX), and

Bank of America (NYSE:

BAC).

Will value stocks continue to outperform growth stocks

in 2023?

According to historical data,

value investing has outpaced growth over the long term. This trend

has been observed across international equity markets, sectors, and

sizes. As seen here, the relative performance of the value index

has gained pace via a long-term downward trendline. It also

indicates the beginning of a “sustainable period of outperformance

for value stocks.

Typically, the performance of

stocks is tied to relative earnings growth. So, in a period of

economic expansion, growth stocks are well poised to accelerate

their bottom line due to multiple factors, including higher

consumer spending and lower bond yields. But as the economy

contracts, the market rewards companies that enjoy significant

pricing power and stable cash flows.

The value index comprises of

cyclical and defensive companies across sectors such as financials

and utilities, while the growth index consists of less cyclical

companies such as technology.

In 2022, value stocks have

delivered solid returns due to the outperformance in just two

sectors such as energy and materials. The Russia-Ukraine war has

driven the prices of oil and other commodities higher, resulting in

higher earnings for companies part of these

sectors.

Most value stocks also pay

investors a dividend, and the reinvestment of these payouts has

been a major driver of the historical outperformance for value

investors. Right now, the Russell 1000 Value Index has a dividend

yield of over 2%, compared to the 1% yield of the Russell

1000 Growth Index.

What percent of the S&P 500 index is growth vs.

value?

The S&P 500 does not break

down stocks into categories such as growth and value. But

growth-oriented sectors such as technology and consumer

discretionary account for 40% of the index, while financials,

energy, consumer staples, and industrials account for 29% of the

index.

The division to invest in growth

or value stocks depends on the individual investorU+02019s

preference. You must consider multiple factors, such as risk

tolerance, investment horizon, and financial

goals.

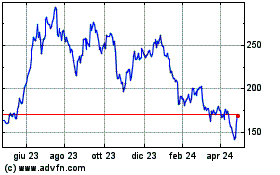

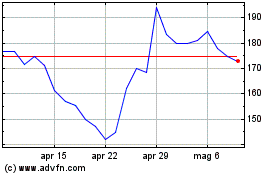

Grafico Azioni Tesla (NASDAQ:TSLA)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Tesla (NASDAQ:TSLA)

Storico

Da Apr 2023 a Apr 2024