UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

Form 6-K

Report of Foreign

Private Issuer

Pursuant to Rules

13a-16 or 15d-16 under

the Securities

Exchange Act of 1934

Dated February 2,

2022

Commission File Number:

001-10086

VODAFONE GROUP

PUBLIC LIMITED

COMPANY

(Translation of registrant’s

name into English)

VODAFONE HOUSE, THE

CONNECTION, NEWBURY, BERKSHIRE, RG14 2FN, ENGLAND

(Address of principal

executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F þ Form

40-F ¨

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b)

under the Securities Exchange Act of 1934.

Yes

¨ No

þ

If “Yes” is marked, indicate

below the file number assigned to the registrant in connection with Rule 12g3-2(b): 82-____.

This Report on Form 6-K

contains a Stock Exchange Announcement dated 2 February 2022 entitled ‘Vodafone - Q3 FY22

Trading Update’.

Vodafone Group

Plc

Q3 FY22 trading update

Q3 FY22 trading update

2 February 2022

Good performance

in line with expectations and on track to meet FY22 guidance

|

|

·

|

Group

service revenue growth of 2.7%* (Q2: 2.4%*) with growth in both Europe and Africa

|

|

|

·

|

Good

service revenue growth trend, especially given increase in prior year comparative

|

|

|

·

|

Consistent

service revenue growth in Germany of 1.1%* (Q2: 1.0%*)

|

|

|

|

|

Q3

FY22

|

|

|

|

Q3

FY21

|

|

|

|

Reported

|

|

|

|

Organic

|

|

|

Q3

performance summary

|

|

|

€m

|

|

|

|

€m

|

|

|

|

growth

%

|

|

|

|

growth

%1

|

|

|

Service revenue

|

|

|

9,647

|

|

|

|

9,357

|

|

|

|

3.1

|

|

|

|

2.7

|

|

|

- of which Germany

|

|

|

2,936

|

|

|

|

2,912

|

|

|

|

0.8

|

|

|

|

1.1

|

|

|

Other revenue

|

|

|

2,037

|

|

|

|

1,844

|

|

|

|

|

|

|

|

|

|

|

Total revenue

|

|

|

11,684

|

|

|

|

11,201

|

|

|

|

4.3

|

|

|

|

3.7

|

|

1. Organic growth is a non-GAAP measure.

All amounts marked in the commentary with an "*" represent organic growth. See page 8.

|

|

·

|

Good

growth in Africa, and successful launch of our VodaPay ‘super-app’ with over

1.4 million downloads

|

|

|

·

|

Vodafone

Business service revenue growth of 0.6%*, with IoT and cloud & security growing double

digits

|

|

|

·

|

Reaffirming

FY22 guidance with Adjusted EBITDAaL expected to be between €15.2 – €15.4

billion and Adjusted free cash flow of at least €5.3 billion

|

|

Nick

Read, Group Chief Executive, commented:

|

|

|

|

“Our

team has delivered another solid quarter, demonstrating the sustainability of our growth strategy and medium-term ambition. This

performance keeps us firmly on track to deliver FY22 results in line with the higher guidance we set out in November.

|

|

|

|

We

remain focused on our operational priorities to strengthen commercial momentum in Germany, accelerate our transformation in Spain

and position Vodafone Business to maximise EU recovery funding opportunities. We are also committed to creating value for our shareholders

through proactive portfolio actions and continuing to improve returns at pace.”

|

For more information,

please contact:

|

Investor Relations

|

Media Relations

|

|

Investors.vodafone.com

|

Vodafone.com/media/contact

|

|

ir@vodafone.co.uk

|

GroupMedia@vodafone.com

|

Registered Office:

Vodafone House, The Connection, Newbury, Berkshire RG14 2FN, England. Registered in England No. 1833679

A webcast Q&A

session will be held at 10am on 2 February 2022. The webcast and supporting information can be accessed at investors.vodafone.com

Operating

review

A new generation connectivity & digital services provider

A new generation connectivity & digital services provider

Our vision is to

become a new generation connectivity and digital services provider for Europe and Africa, enabling an inclusive and sustainable digital

society. We continue to make progress on the next phase of our strategy, and we are focused on three customer commitments and three enabling

strategies, all of which work together towards realising our vision.

We believe that

Vodafone has a significant role to play in contributing to the societies in which we operate and we have made further progress with respect

to our purpose strategy during the quarter, with our new ethnic diversity targets summarised on page 3.

|

Customer

commitments

|

Enabling

strategies

|

|

·

Best connectivity products and services

|

·

Simplified and most efficient operator

|

|

·

Leading innovation in digital services

|

·

Social contract shaping the digital society

|

|

·

Outstanding digital experiences

|

·

Leading gigabit networks

|

|

Customer

commitments

|

|

Units

|

|

Q3

FY22

|

|

|

Q3

FY21

|

|

|

Best connectivity

products & services

|

|

|

|

|

|

|

|

|

|

|

|

Europe

mobile contract customers1

|

|

million

|

|

|

66.3

|

|

|

|

65.4

|

|

|

Europe

broadband customers1

|

|

million

|

|

|

25.7

|

|

|

|

25.5

|

|

|

Europe

Consumer converged customers1

|

|

million

|

|

|

8.6

|

|

|

|

7.7

|

|

|

Europe mobile contract customer

churn

|

|

%

|

|

|

13.7

|

|

|

|

15.0

|

|

|

Africa

mobile customers2

|

|

million

|

|

|

187.8

|

|

|

|

175.4

|

|

|

Africa

data users2

|

|

million

|

|

|

89.8

|

|

|

|

85.8

|

|

|

Business service revenue growth*

|

|

%

|

|

|

0.6

|

|

|

|

0.7

|

|

|

Leading innovation in digital

services

|

|

|

|

|

|

|

|

|

|

|

|

Europe

TV subscribers1

|

|

million

|

|

|

22.1

|

|

|

|

22.3

|

|

|

IoT SIM connections

|

|

million

|

|

|

142

|

|

|

|

118

|

|

|

Africa

M-Pesa customers2

|

|

million

|

|

|

51.3

|

|

|

|

47.0

|

|

|

Africa

M-Pesa transaction volume2

|

|

billion

|

|

|

5.3

|

|

|

|

4.2

|

|

|

Outstanding digital experiences

|

|

|

|

|

|

|

|

|

|

|

|

Digital

channel sales mix3

|

|

%

|

|

|

27

|

|

|

|

26

|

|

|

End-to-end

TOBi completion rate4 5

|

|

%

|

|

|

47

|

|

|

|

35

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1. Including 100%

VodafoneZiggo | 2. Africa including 100% Safaricom | 3. Based on Germany, Italy, UK, Spain only | 4. Group excluding Egypt | 5. Defined

as percentage of total customer contacts resolved without human interaction through TOBi

Further detailed

information on our strategy can be found through the following links:

|

Resource

|

Link

|

|

Second phase of strategy

|

vodafone.com/ar2021

|

|

Digital services & outstanding

experience

|

investors.vodafone.com/digital-services

|

|

Leading gigabit networks

|

investors.vodafone.com/vtbriefing

|

|

Vodafone Business

|

investors.vodafone.com/vbbriefing

|

|

Vantage Towers

|

vantagetowers.com

|

Consumer

Europe (52% of service revenue)

Europe (52% of service revenue)

In Europe, we are

a leading converged connectivity provider with over 114 million mobile connections, 143 million marketable NGN broadband homes, and 8.6

million fully converged customers. We cover 98% of the population in the markets we operate in with 4G, and we have launched 5G in 274

cities in 11 markets in Europe. We have achieved this leading position by focusing on our core fixed and mobile connectivity. We are

enhancing our products through capacity and speed upgrades, unlimited mobile plans, a distinct tiered branding hierarchy and convergent

product bundles.

Consumer

Africa and Turkey (16% of service revenue)

Africa and Turkey (16% of service revenue)

In Africa, we are

the leading provider of mobile data and mobile payment services. Including Safaricom, we have over 187 million mobile customers in 8

African markets, which represent over 40% of Africa’s total gross domestic product. We cover 66% of the population in the same

markets in which we operate with 4G services.

During the quarter,

our M-Pesa financial services platform grew strongly, and the platform processed 5.3 billion transactions, an increase of 26% year-on-year.

The VodaPay ‘super-app’ launched in South Africa in October 2021, and reached over 1.4 million downloads and more than 1.0

million registered users by the end of Q3.

Vodafone Business (27% of service

revenue)

Vodafone Business

is a key growth driver for the Group, with unique scale and capabilities; strong operating momentum and a clear growth pathway.

We are working to

maximise the opportunities available for Vodafone Business from EU recovery funding programmes, including the Recovery & Resilience

facility, which combines €386 billion of loans and €338 billion of grants available to European Union Member States. Our

plans focus on five core cross-market opportunities: digitalisation of SMEs; eHealth investments; smart cities; digital initiatives for

a greener Europe; and connected education. We have an attractive and relevant suite of products and services designed to access funding

opportunities available.

Our purpose

We connect for a better future

We connect for a better future

We have continued

to make further progress with respect to our purpose strategy during the quarter, and a full update of our progress will be set out in

our FY22 Annual Report.

Our ambition is

to be a company with a global workforce that reflects the customers, communities and businesses we serve, as well as the wider societies

in which we operate. To better understand representation and inform our diversity and inclusion programmes, we launched a campaign

called ‘#CountMeIn’ in November 2020, which encourages employees to voluntarily self-declare their diversity demographics

in line with local privacy and legal requirements. The data from this campaign has formed the basis for new ethnic diversity targets,

which were announced in December 2021 and are summarised below.

|

|

·

|

Group1: By

2030, 25% of our global senior leadership team (encompassing 160 of our most senior leaders

in Europe & Africa) will come from ethnically diverse backgrounds. This compares to 18%

in December 2021.

|

|

|

·

|

UK: By

2025, 20% of UK-based senior leadership and management will come from Black, Asian, or other

diverse ethnicities, with 4% to be Black. This compares to 16% and 1% respectively in December

2021.

|

|

|

·

|

South

Africa: By 2030, 75% of South African-based senior leadership and management

will come from ethnically diverse backgrounds. This compares to 63% in December 2021.

|

Our

new targets are supported by a wider action and awareness plan that aims to achieve greater workplace inclusion through allyship and

anti-racism. More information can be found here: vodafone.com/news/inclusion/vodafone-new-targets-increase-ethnic-diversity

Note:

Performance review

Good performance in line with expectations

Good performance in line with expectations

|

|

·

|

Group

service revenue growth of 2.7%* (Q2: 2.4%*) with growth in both Europe and Africa

|

|

|

·

|

Good

service revenue growth trend, especially given increase in prior year comparative

|

|

|

·

|

Consistent

service revenue growth in Germany of 1.1%* (Q2: 1.0%*)

|

|

|

·

|

Reaffirming

FY22 guidance with Adjusted EBITDAaL expected to be between €15.2 – €15.4

billion and Adjusted free cash flow of at least €5.3 billion

|

Organic

growth

All amounts marked

with an “*” in the commentary represent organic growth which presents performance on a comparable basis, excluding the impact

of foreign exchange rates, mergers and acquisitions and other adjustments to improve the comparability of results between periods. When

calculating organic growth, the FY21 results for Vantage Towers have been adjusted to reflect a full year of operation on a pro forma

basis in order to be comparable to FY22. Organic growth figures are non-GAAP measures. See non-GAAP measures on page 8 for more information.

Segmental

reporting

Following the IPO

of Vantage Towers A.G. in March 2021, the business is a new reporting segment for the year ending 31 March 2022 (‘FY22’).

Comparative information for the year ended 31 March 2021 has not been re-presented. Total revenue is unaffected because charges from

Vantage Towers A.G. to operating companies are eliminated on consolidation. The segmental results of Vantage Towers A.G. include the

contribution from Cornerstone Technologies Infrastructure Limited as a joint operation with Telefonica in the UK.

Geographic performance summary

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other

|

|

|

|

|

|

Other

|

|

|

Vantage

|

|

|

Common

|

|

|

Elimi-

|

|

|

|

|

|

|

|

Germany

|

|

|

Italy

|

|

|

UK

|

|

|

Spain

|

|

|

Europe

|

|

|

Vodacom

|

|

|

Markets

|

|

|

Towers

|

|

|

Functions

|

|

|

nations

|

|

|

Group

|

|

|

Q3 FY22

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service revenue

|

|

|

2,936

|

|

|

|

1,107

|

|

|

|

1,292

|

|

|

|

940

|

|

|

|

1,257

|

|

|

|

1,172

|

|

|

|

867

|

|

|

|

–

|

|

|

|

136

|

|

|

|

(60

|

)

|

|

|

9,647

|

|

|

Other revenue

|

|

|

437

|

|

|

|

149

|

|

|

|

445

|

|

|

|

137

|

|

|

|

190

|

|

|

|

354

|

|

|

|

105

|

|

|

|

312

|

|

|

|

213

|

|

|

|

(305

|

)

|

|

|

2,037

|

|

|

Total

revenue (€m)

|

|

|

3,373

|

|

|

|

1,256

|

|

|

|

1,737

|

|

|

|

1,077

|

|

|

|

1,447

|

|

|

|

1,526

|

|

|

|

972

|

|

|

|

312

|

|

|

|

349

|

|

|

|

(365

|

)

|

|

|

11,684

|

|

|

Organic

service revenue growth (%)1

|

|

|

1.1

|

%

|

|

|

(1.3

|

)%

|

|

|

0.9

|

%

|

|

|

(1.6

|

)%

|

|

|

2.9

|

%

|

|

|

4.4

|

%

|

|

|

19.8

|

%

|

|

|

–

|

|

|

|

|

|

|

|

|

|

|

|

2.7

|

%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Q3 FY21

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Service revenue

|

|

|

2,912

|

|

|

|

1,125

|

|

|

|

1,216

|

|

|

|

957

|

|

|

|

1,215

|

|

|

|

1,056

|

|

|

|

806

|

|

|

|

–

|

|

|

|

115

|

|

|

|

(45

|

)

|

|

|

9,357

|

|

|

Other revenue

|

|

|

423

|

|

|

|

139

|

|

|

|

380

|

|

|

|

102

|

|

|

|

207

|

|

|

|

296

|

|

|

|

117

|

|

|

|

–

|

|

|

|

223

|

|

|

|

(43

|

)

|

|

|

1,844

|

|

|

Total

revenue (€m)

|

|

|

3,335

|

|

|

|

1,264

|

|

|

|

1,596

|

|

|

|

1,059

|

|

|

|

1,422

|

|

|

|

1,352

|

|

|

|

923

|

|

|

|

–

|

|

|

|

338

|

|

|

|

(88

|

)

|

|

|

11,201

|

|

Downloadable performance

information is available at: https://investors.vodafone.com/reports-information/results-reports-presentations

|

|

|

FY21

|

|

|

FY22

|

|

Organic

service revenue growth %1

|

|

Q1

|

|

|

Q2

|

|

|

H1

|

|

|

Q3

|

|

|

Q4

|

|

|

H2

|

|

|

Total

|

|

|

Q1

|

|

|

Q2

|

|

|

H1

|

|

|

Q3

|

|

Germany

|

|

|

–

|

|

|

|

(0.1

|

)

|

|

|

(0.1

|

)

|

|

|

1.0

|

|

|

|

1.2

|

|

|

|

1.1

|

|

|

|

0.5

|

|

|

|

1.4

|

|

|

|

1.0

|

|

|

|

1.2

|

|

|

1.1

|

|

Italy

|

|

|

(6.5

|

)

|

|

|

(8.0

|

)

|

|

|

(7.2

|

)

|

|

|

(7.8

|

)

|

|

|

(7.8

|

)

|

|

|

(7.8

|

)

|

|

|

(7.5

|

)

|

|

|

(3.6

|

)

|

|

|

(1.4

|

)

|

|

|

(2.5

|

)

|

|

(1.3)

|

|

UK

|

|

|

(1.9

|

)

|

|

|

(0.5

|

)

|

|

|

(1.2

|

)

|

|

|

(0.4

|

)

|

|

|

(0.6

|

)

|

|

|

(0.5

|

)

|

|

|

(0.8

|

)

|

|

|

2.5

|

|

|

|

0.6

|

|

|

|

1.2

|

|

|

0.9

|

|

Spain

|

|

|

(6.9

|

)

|

|

|

(1.8

|

)

|

|

|

(4.4

|

)

|

|

|

(1.1

|

)

|

|

|

(1.3

|

)

|

|

|

(1.2

|

)

|

|

|

(2.8

|

)

|

|

|

0.8

|

|

|

|

(1.9

|

)

|

|

|

(0.6

|

)

|

|

(1.6)

|

|

Other Europe

|

|

|

(3.1

|

)

|

|

|

(1.8

|

)

|

|

|

(2.4

|

)

|

|

|

(0.7

|

)

|

|

|

(0.2

|

)

|

|

|

(0.4

|

)

|

|

|

(1.4

|

)

|

|

|

4.2

|

|

|

|

2.4

|

|

|

|

3.3

|

|

|

2.9

|

|

Vodacom

|

|

|

1.5

|

|

|

|

3.2

|

|

|

|

2.3

|

|

|

|

3.3

|

|

|

|

7.3

|

|

|

|

5.3

|

|

|

|

3.9

|

|

|

|

7.9

|

|

|

|

3.1

|

|

|

|

5.4

|

|

|

4.4

|

|

Other Markets

|

|

|

9.1

|

|

|

|

9.0

|

|

|

|

9.0

|

|

|

|

12.3

|

|

|

|

13.1

|

|

|

|

12.7

|

|

|

|

10.8

|

|

|

|

18.4

|

|

|

|

19.7

|

|

|

|

19.1

|

|

|

19.8

|

|

Vantage

Towers

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

–

|

|

Group

|

|

|

(1.3

|

)

|

|

|

(0.4

|

)

|

|

|

(0.8

|

)

|

|

|

0.4

|

|

|

|

0.8

|

|

|

|

0.6

|

|

|

|

(0.1

|

)

|

|

|

3.3

|

|

|

|

2.4

|

|

|

|

2.8

|

|

|

2.7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Note:

|

|

1.

|

Organic

service revenue growth is a non-GAAP measure. See page 8 for more information.

|

Germany

Consistent service revenue growth

Consistent service revenue growth

Service revenue

increased by 1.1%* (Q2: 1.0%*). Quarterly trends remained broadly similar to Q2 FY22, as acceleration in Business was partially offset

by lower variable call usage revenue. Retail service revenue grew by 1.7%* (Q2: 1.5%*).

Fixed service revenue

increased by 0.7%* (Q2: 1.2%*) driven by continued broadband ARPU growth. This growth reflected lower variable call usage revenue following

an increase last year during the lockdown. Retail activity continued to be significantly impacted by the COVID-19 pandemic, with restrictions

tightened during the quarter. The improving trends reversed in December, and customer footfall was 50% below pre-pandemic levels. We

added 19,000 cable customers in Q3, and we lost 22,000 DSL broadband customers in the quarter. Fixed commercial performance was also

impacted by specific operational challenges related to compliance with new telecommunications law, which came into effect in December

2021. Half of our cable broadband customers now subscribe to speeds of at least 250Mbps, and Gigabit speeds are available to 23.7 million

households across our hybrid fibre cable network.

We continued to

accelerate convergence penetration following a successful campaign, and our converged customer base increased by 238,000 to over 2.2

million Consumer converged accounts. Our TV customer base declined by 75,000 reflecting lower commercial activity, following the end

of our successful ‘12-month for free’ promotion in September.

Mobile service revenue

increased by 1.7%* (Q2: 0.8%*), driven by customer base and ARPU growth. The quarter-on-quarter improvement was due to the reacceleration

in our commercial performance, as well as strong Business demand. We added 70,000 contract customers in the quarter, with strong demand

from business and public sector customers. Contract customer loyalty rates remained broadly stable year-on-year, and loyalty rates in

the Business segment reached an all-time high, with churn at 7.5%. We added a further 378,000 IoT connections in the quarter, supported

by strong demand from the automotive sector.

Italy, UK, Spain

and Other Europe ⫶ Similar trends quarter-on-quarter

Italy

Service revenue

declined by 1.3%* (Q2: -1.4%*) as a result of continued price pressure. The stable quarterly trend reflected a full quarter’s contribution

from the PostePay MVNO migration and good commercial momentum in fixed, offset by lower incoming revenue following the increase during

the COVID-19 lockdown in the prior year.

In mobile, competitive

dynamics remained broadly similar in the quarter. Despite continued pricing pressure, market mobile number portability (‘MNP’)

volumes were 17% lower than in the prior year period. Our second brand ‘ho.’ continued to grow, with 65,000 net additions

and now has 2.7 million customers.

We added 31,000

broadband customers, and we now have a customer base of over 3 million. We also added 24,000 fixed-wireless access customers in the period,

which are included in our mobile customer base. Our total Consumer converged customer base is 1.2 million, an increase of 14,000 during

the quarter, and 49% of our broadband customer base is converged.

Through our own

next generation network and partnership with Open Fiber, our broadband services are now available to almost 9 million households. We

also cover 4.3 million households and businesses with fixed-wireless access, offering speeds of up to 100Mbps.

UK

Service revenue

increased by 0.9%* (Q2: 0.6%*), driven by our continued good commercial performance in Consumer, and higher MVNO, roaming and visitor

revenue. This was partially offset by further slowdown in Business, with continued ARPU pressure on re-contracting multinational corporations,

and our decision to end an unprofitable multinational contract in the prior quarter.

Our commercial momentum

accelerated this quarter, with 152,000 mobile contract customer additions. This was driven by our new ‘Vodafone EVO’ flexible

contract proposition, which was received particularly well by higher value customers, with good iPhone demand, as well as a successful

Black Friday campaign. Digital mix remained strong, accounting for 33% of total sales in the quarter. Contract customer loyalty rates

improved, with churn down by 1.9 percentage points year-on-year to 12.5%.

In fixed, our broadband

customer base increased by 29,000 in the quarter. This was supported by good demand for our Vodafone ‘Pro Broadband’ product,

which delivers customers an in-home WiFi coverage promise and 4G back-up connectivity. We now have almost 1 million broadband customers,

of which 496,000 are converged.

Spain

Service revenue

declined by 1.6%* (Q2 -1.9%*) driven by continued price competition in the value segment. Quarterly trends remained broadly stable, despite

a tougher prior year comparative, as good Business demand for IoT and cloud & security services were partially offset by the impact

of prior period price increases. As part of our operational transformation, we concluded negotiations with the workers councils with

respect to our restructuring plan in October. In November, we completed the optimisation of our retail channel footprint, with all branded

stores now operating under a franchise model.

In mobile, our contract

customer base declined by 53,000 reflecting seasonally high promotional activity and the temporary impact of our retail channel optimisation.

Mobile contract customer loyalty rates improved, with churn reducing 3.3 percentage points year-on-year to 21.6%. This improvement was

partly due to the disconnection of non-paying customers in the prior year period following the removal of temporary restrictions. Our

second brand, ‘Lowi’, added 83,000 customers during the quarter and now has a total base of 1.4 million.

Our broadband customer

base also decreased by 50,000 and our TV customer base declined by 44,000, impacted by continued competitive intensity. We renewed our

exclusive agreement with HBO Max in October, and through our partnerships with other content providers such as Disney, we have the most

extensive library of movies and TV series in the market.

Other Europe

Service revenue

increased by 2.9%* (Q2: 2.4%*), with good growth in both mobile and fixed, given the increase in the prior year comparative. An improved

performance in Portugal and Ireland was partially offset by a reduction in mobile termination rates in some markets.

In

Portugal, commercial momentum accelerated, and we added 44,000 mobile contract customers and 17,000 fixed broadband customers. In Ireland,

our mobile contract customer base increased by 24,000 and mobile contract churn improved 2.3 percentage points year-on-year to 8.5%.

In Greece, we added 59,000 mobile prepaid customers, supported by the easing of lockdown restrictions, as well as 8,000 fixed broadband

customers.

In October, we announced

that Vodafone Portugal had acquired 2x10MHz of 700MHz and 90MHz of 3.6GHz spectrum at the cost of €133 million, with a 20-year

licence through to 2041. The spectrum will enable us to significantly expand network capacity to meet growing demand for reliable, high-quality

voice and data services.

Vodacom

Good growth in South Africa, with strong demand in international markets

Good growth in South Africa, with strong demand in international markets

Vodacom’s

total service revenue grew by 4.4%* (Q2 3.1%*) with growth in both South Africa and Vodacom’s international markets.

In South Africa,

service revenue growth accelerated in the quarter following successful summer campaigns and supported by good growth in Business. We

added 1.7 million prepaid customers and 82,000 mobile contract customers in the quarter, which was supported by our more-for-more ‘Vodafone

Red’ proposition introduced in June, as well as accelerated demand in Business. Financial Services revenue in South Africa grew

by 11.7%* to €39.2 million, reflecting the expansion of our service offerings, and 65% of our mobile customer base now uses data

services. Following the successful launch of our new VodaPay ‘super-app’ in October, we have now reached more than 1.4 million

downloads and more than 1.0 million registered users.

In Vodacom’s

international markets, service revenue growth remained strong but moderated during the quarter. This was due to mobile money levies in

Tanzania introduced during Q2 FY22, and stronger prior year comparatives in Mozambique, reflecting the reinstatement of fees on person-to-person

M-Pesa transfers in the prior year. M-Pesa revenue as a share of service revenue increased by 1.1 percentage points to 22.6%. Over 64%

of Vodacom’s international customer base is now using data services.

Further information

on our operations in Africa can be accessed here: vodacom.com.

Other Markets

Turkey, Egypt and Ghana

Turkey, Egypt and Ghana

Service

revenue growth remained broadly stable at 19.8%* (Q2: 19.7%*) as a result of strong customer base and ARPU growth. Reported service revenue

increased by 7.5%, as higher service revenue and an appreciation in the Egyptian pound was partially offset by the depreciation of the

Turkish lira versus the euro.

Service revenue

growth in Turkey was supported by higher visitor and wholesale revenue, as well as ARPU growth. We maintained our good commercial momentum,

with 332,000 mobile contract net additions in the quarter, including migrations from prepaid customers. Mobile contract churn improved

by 2.5 percentage points year-on-year to 16.2%. We also added 40,000 broadband customers during the period.

Service revenue

in Egypt continued to grow, reflecting strong customer base growth and increased data usage. During the quarter, we added 41,000 mobile

contract customers and 702,000 prepaid mobile customers.

In November, we

announced that we have agreed to transfer our 55% shareholding in Vodafone Egypt to Vodacom Group, our listed African subsidiary. As

a result, Vodafone Group’s ownership in Vodacom Group will increase from 60.5% to 65.1%. The transaction has been approved by Vodacom’s

minority shareholders, with 99% voting in favour of the acquisition at Vodacom’s general meeting held on 18 January 2022. Completion

of the transaction remains subject to a number of outstanding conditions and is expected to close by 31 March 2022. Further information

on the proposed transaction and the Vodacom Group is available here: vodacom.com/investor-relations.

Vantage Towers

Delivering on our plan

Delivering on our plan

Total revenue increased

to €312 million as more than 600 new tenancies were added during the period, bringing the tenancy ratio to 1.43x. Vantage Towers

reached a number of new partnership agreements with customers during the period. Vantage Towers reported its results on 1 February 2022.

Further information on Vantage Towers can be accessed here: vantagetowers.com.

Non-GAAP measures

In the discussion of the Group’s reported

operating results, non-GAAP measures are presented to provide readers with additional financial information that is regularly reviewed

by management. This additional information presented is not uniformly defined by all companies including those in the Group’s industry.

Accordingly, it may not be comparable with similarly-titled measures and disclosures by other companies. Additionally, certain information

presented is derived from amounts calculated in accordance with IFRS but is not itself a measure defined under GAAP. Such measures should

not be viewed in isolation or as an alternative to the equivalent GAAP measure.

The non-GAAP measures discussed in this document

are listed below.

|

Non-GAAP measure

|

|

Definition

|

|

|

Closest equivalent GAAP measure

|

|

Reconciled on page

|

|

Performance metrics

|

|

|

|

|

|

|

|

|

Organic revenue growth

|

|

Page 10

|

|

|

Revenue

|

|

Page 9

|

|

Organic service revenue growth

|

|

Page 10

|

|

|

Service revenue

|

|

Page 9

|

|

Organic mobile service revenue growth

|

|

Page 10

|

|

|

Service revenue

|

|

Page 9

|

|

Organic fixed service revenue growth

|

|

Page 10

|

|

|

Service revenue

|

|

Page 9

|

|

Organic retail service revenue growth

|

|

Page 10

|

|

|

Service revenue

|

|

Page 9

|

|

Organic Vodafone Business service revenue growth

|

|

Page 10

|

|

|

Service revenue

|

|

Page 9

|

|

Organic Financial Services revenue growth

|

|

Page 10

|

|

|

Service revenue

|

|

Page 9

|

Definition and use of organic growth measures

All amounts marked with an “*” in this

document represent organic growth which presents performance on a comparable basis, excluding the impact of foreign exchange rates, mergers

and acquisitions and other adjustments to improve the comparability of results between periods. When calculating organic growth, the FY21

results for Vantage Towers have been adjusted to reflect a full year of operation on a pro forma basis in order to be comparable to FY22.

Organic growth is calculated for revenue metrics,

as follows:

|

-

|

Revenue

|

|

|

|

|

-

|

Service revenue;

|

|

|

|

|

-

|

Mobile service revenue;

|

|

|

|

|

-

|

Fixed service revenue;

|

|

|

|

|

-

|

Retail service revenue;

|

|

|

|

|

-

|

Vodafone Business service revenue; and

|

|

|

|

|

-

|

Financial Services revenue in South Africa.

|

Whilst organic growth is not intended to be a substitute

for reported growth, nor is it superior to reported growth, we believe that the measure provides useful and necessary information to investors

and other interested parties for the following reasons:

|

-

|

It provides additional information on underlying growth of the business without the effect of certain

factors unrelated to its operating performance;

|

|

|

|

|

-

|

It is used for internal performance analysis; and

|

|

|

|

|

-

|

It facilitates comparability of underlying growth with other companies (although the term “organic”

is not a defined term under GAAP and may not, therefore, be comparable with similarly titled measures reported by other companies).

|

We have not provided a comparative in respect of

organic growth rates as the current rates describe the change between the beginning and end of the current period, with such changes being

explained by the commentary in this document. If comparatives were provided, significant sections of the commentary for prior periods

would also need to be included, reducing the usefulness and transparency of this document.

Quarter

ended 31 December 2021

|

|

|

Q3 FY22

|

|

|

Q3 FY21

|

|

|

Reported

growth

|

|

|

M&A and

Other

|

|

|

Foreign

exchange

|

|

|

Organic

growth*

|

|

|

|

|

€m

|

|

|

€m

|

|

|

%

|

|

|

pps

|

|

|

pps

|

|

|

%

|

|

|

Service revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Germany

|

|

|

2,936

|

|

|

|

2,912

|

|

|

|

0.8

|

|

|

|

0.3

|

|

|

|

–

|

|

|

|

1.1

|

|

|

Mobile service revenue

|

|

|

1,301

|

|

|

|

1,279

|

|

|

|

1.7

|

|

|

|

-

|

|

|

|

–

|

|

|

|

1.7

|

|

|

Fixed service revenue

|

|

|

1,635

|

|

|

|

1,633

|

|

|

|

0.1

|

|

|

|

0.6

|

|

|

|

–

|

|

|

|

0.7

|

|

|

Italy

|

|

|

1,107

|

|

|

|

1,125

|

|

|

|

(1.6

|

)

|

|

|

0.3

|

|

|

|

–

|

|

|

|

(1.3

|

)

|

|

Mobile service revenue

|

|

|

794

|

|

|

|

818

|

|

|

|

(2.9

|

)

|

|

|

-

|

|

|

|

–

|

|

|

|

(2.9

|

)

|

|

Fixed service revenue

|

|

|

313

|

|

|

|

307

|

|

|

|

2.0

|

|

|

|

1.1

|

|

|

|

–

|

|

|

|

3.1

|

|

|

UK

|

|

|

1,292

|

|

|

|

1,216

|

|

|

|

6.3

|

|

|

|

1.1

|

|

|

|

(6.5

|

)

|

|

|

0.9

|

|

|

Mobile service revenue

|

|

|

928

|

|

|

|

848

|

|

|

|

9.4

|

|

|

|

–

|

|

|

|

(6.8

|

)

|

|

|

2.6

|

|

|

Fixed service revenue

|

|

|

364

|

|

|

|

368

|

|

|

|

(1.1

|

)

|

|

|

3.5

|

|

|

|

(5.7

|

)

|

|

|

(3.3

|

)

|

|

Spain

|

|

|

940

|

|

|

|

957

|

|

|

|

(1.8

|

)

|

|

|

0.2

|

|

|

|

–

|

|

|

|

(1.6

|

)

|

|

Other Europe

|

|

|

1,257

|

|

|

|

1,215

|

|

|

|

3.5

|

|

|

|

0.2

|

|

|

|

(0.8

|

)

|

|

|

2.9

|

|

|

Vodacom

|

|

|

1,172

|

|

|

|

1,056

|

|

|

|

11.0

|

|

|

|

–

|

|

|

|

(6.6

|

)

|

|

|

4.4

|

|

|

Other Markets

|

|

|

867

|

|

|

|

806

|

|

|

|

7.6

|

|

|

|

–

|

|

|

|

12.2

|

|

|

|

19.8

|

|

|

Vantage Towers

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Common Functions

|

|

|

136

|

|

|

|

115

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eliminations

|

|

|

(60

|

)

|

|

|

(45

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total service revenue

|

|

|

9,647

|

|

|

|

9,357

|

|

|

|

3.1

|

|

|

|

0.4

|

|

|

|

(0.8

|

)

|

|

|

2.7

|

|

|

Other revenue

|

|

|

2,037

|

|

|

|

1,844

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

11,684

|

|

|

|

11,201

|

|

|

|

4.3

|

|

|

|

0.2

|

|

|

|

(0.8

|

)

|

|

|

3.7

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other growth metrics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vodafone Business - Service revenue

|

|

|

2,604

|

|

|

|

2,567

|

|

|

|

1.4

|

|

|

|

0.7

|

|

|

|

(1.5

|

)

|

|

|

0.6

|

|

|

South Africa - Financial Services revenue

|

|

|

39

|

|

|

|

33

|

|

|

|

18.2

|

|

|

|

–

|

|

|

|

(6.5

|

)

|

|

|

11.7

|

|

|

Germany - Retail service revenue

|

|

|

2,871

|

|

|

|

2,832

|

|

|

|

1.4

|

|

|

|

0.3

|

|

|

|

–

|

|

|

|

1.7

|

|

Quarter ended

30 September 2021

|

|

|

Q2 FY22

|

|

|

Q2 FY21

|

|

|

Reported growth

|

|

|

M&A and Other

|

|

|

Foreign exchange

|

|

|

Organic growth*

|

|

|

|

|

€m

|

|

|

€m

|

|

|

%

|

|

|

pps

|

|

|

pps

|

|

|

%

|

|

|

Service revenue

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Germany

|

|

|

2,905

|

|

|

|

2,883

|

|

|

|

0.8

|

|

|

|

0.2

|

|

|

|

–

|

|

|

|

1.0

|

|

|

Mobile service revenue

|

|

|

1,287

|

|

|

|

1,277

|

|

|

|

0.8

|

|

|

|

–

|

|

|

|

–

|

|

|

|

0.8

|

|

|

Fixed service revenue

|

|

|

1,618

|

|

|

|

1,606

|

|

|

|

0.7

|

|

|

|

0.5

|

|

|

|

–

|

|

|

|

1.2

|

|

|

Italy

|

|

|

1,111

|

|

|

|

1,129

|

|

|

|

(1.6

|

)

|

|

|

0.2

|

|

|

|

–

|

|

|

|

(1.4

|

)

|

|

Mobile service revenue

|

|

|

807

|

|

|

|

823

|

|

|

|

(1.9

|

)

|

|

|

–

|

|

|

|

–

|

|

|

|

(1.9

|

)

|

|

Fixed service revenue

|

|

|

304

|

|

|

|

306

|

|

|

|

(0.7

|

)

|

|

|

0.8

|

|

|

|

–

|

|

|

|

0.1

|

|

|

UK

|

|

|

1,265

|

|

|

|

1,208

|

|

|

|

4.7

|

|

|

|

1.6

|

|

|

|

(5.7

|

)

|

|

|

0.6

|

|

|

Mobile service revenue

|

|

|

902

|

|

|

|

854

|

|

|

|

5.6

|

|

|

|

1.0

|

|

|

|

(5.6

|

)

|

|

|

1.0

|

|

|

Fixed service revenue

|

|

|

363

|

|

|

|

354

|

|

|

|

2.5

|

|

|

|

3.0

|

|

|

|

(5.8

|

)

|

|

|

(0.3

|

)

|

|

Spain

|

|

|

941

|

|

|

|

960

|

|

|

|

(2.0

|

)

|

|

|

0.1

|

|

|

|

–

|

|

|

|

(1.9

|

)

|

|

Other Europe

|

|

|

1,274

|

|

|

|

1,240

|

|

|

|

2.7

|

|

|

|

0.1

|

|

|

|

(0.4

|

)

|

|

|

2.4

|

|

|

Vodacom

|

|

|

1,145

|

|

|

|

999

|

|

|

|

14.6

|

|

|

|

–

|

|

|

|

(11.5

|

)

|

|

|

3.1

|

|

|

Other Markets

|

|

|

923

|

|

|

|

839

|

|

|

|

10.0

|

|

|

|

–

|

|

|

|

9.7

|

|

|

|

19.7

|

|

|

Vantage Towers

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

|

–

|

|

|

Common Functions

|

|

|

127

|

|

|

|

110

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Eliminations

|

|

|

(71

|

)

|

|

|

(60

|

)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total service revenue

|

|

|

9,620

|

|

|

|

9,308

|

|

|

|

3.4

|

|

|

|

0.4

|

|

|

|

(1.4

|

)

|

|

|

2.4

|

|

|

Other revenue

|

|

|

1,768

|

|

|

|

1,613

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenue

|

|

|

11,388

|

|

|

|

10,921

|

|

|

|

4.3

|

|

|

|

0.1

|

|

|

|

(1.5

|

)

|

|

|

2.9

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Other growth metrics

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Vodafone Business - Service revenue

|

|

|

2,544

|

|

|

|

2,520

|

|

|

|

1.0

|

|

|

|

1.0

|

|

|

|

(1.9

|

)

|

|

|

0.1

|

|

|

Germany - Retail service revenue

|

|

|

2,836

|

|

|

|

2,802

|

|

|

|

1.2

|

|

|

|

0.3

|

|

|

|

–

|

|

|

|

1.5

|

|

Definitions

|

Term

|

|

Definition

|

|

Africa

|

|

Comprises the

Vodacom Group and businesses in Egypt and Ghana.

|

|

ARPU

|

|

Average revenue

per user, defined as customer revenue and incoming revenue divided by average customers.

|

|

Churn

|

|

Total gross

customer disconnections in the period divided by the average total customers in the period.

|

|

Common

Functions

|

|

Comprises central

teams and business functions.

|

|

Converged

customer

|

|

A customer

who receives fixed and mobile services (also known as unified communications) on a single bill or who receives a discount across

both bills.

|

|

Eliminations

|

|

Refers to the

removal of intercompany transactions to derive the consolidated financial statements.

|

|

Europe

|

|

Comprises the

Group’s European businesses and the UK.

|

|

Financial

services revenue

|

|

Financial services

revenue includes fees generated from the provision of advanced airtime, overdraft, financing and lending facilities, as well as merchant

payments and the sale of insurance products (e.g. device insurance, life insurance and funeral cover).

|

|

Fixed

service revenue

|

|

Service revenue

(see below) relating to the provision of fixed line and carrier services.

|

|

GAAP

|

|

Generally Accepted

Accounting Principles.

|

|

IFRS

|

|

International

Financial Reporting Standard.

|

|

Incoming

revenue

|

|

Comprises revenue

from termination rates for voice and messaging to Vodafone customers.

|

|

Internet

of Things (‘IoT’)

|

|

The network

of physical objects embedded with electronics, software, sensors, and network connectivity, including built-in mobile SIM cards,

that enables these objects to collect data and exchange communications with one another or a database.

|

|

Mobile

service revenue

|

|

Service revenue

(see below) relating to the provision of mobile services.

|

|

MVNO

|

|

Mobile Virtual

Network Operator.

|

|

Next

generation networks (‘NGN’)

|

|

Fibre or cable

networks typically providing high-speed broadband over 30Mbps.

|

|

Other

Europe

|

|

Other Europe

markets include Portugal, Ireland, Greece, Romania, Czech Republic, Hungary and Albania.

|

|

Other

Markets

|

|

Other Markets

comprise Turkey, Egypt and Ghana.

|

|

Other

revenue

|

|

Other revenue

includes connection fees, equipment revenue, interest income and lease revenue.

|

|

Reported

growth

|

|

Reported growth

is based on amounts reported in euros and determined under IFRS.

|

|

Retail

revenue

|

|

Retail revenue

comprises service revenue (see below) excluding Mobile Virtual Network Operator (‘MVNO’) and Fixed Virtual Network Operator

(‘FVNO’) wholesale revenue.

|

|

Revenue

|

|

The total of

Service revenue (defined below) and Other revenue (defined above).

|

|

Roaming

and Visitor

|

|

Roaming: allows

customers to make calls, send and receive texts and data on our and other operators’ mobile networks, usually while travelling

abroad. Visitors: revenue received from other operators or markets when their customers roam on one of our markets’ networks.

|

|

Service

revenue

|

|

Service revenue

is all revenue related to the provision of or ongoing services including but not limited to, monthly access changes, airtime usage,

roaming, incoming and outgoing network usage by non-Vodafone customers and interconnect charges for incoming calls.

|

|

SME

|

|

Small and medium

sized enterprises.

|

|

Vodafone

Business

|

|

Vodafone Business

is part of the Group and partners with businesses of every size to provide a range of business-related services.

|

Notes

|

1.

|

References to Vodafone are to Vodafone Group Plc and references to Vodafone Group are to Vodafone Group

Plc and its subsidiaries unless otherwise stated. Vodafone, the Vodafone Speech Mark Devices, Vodacom and Together we can are trade marks

owned by Vodafone. Vantage Towers is a trade mark owned by Vantage Towers A.G. Other product and company names mentioned herein may be

the trade marks of their respective owners.

|

|

2.

|

All growth rates reflect a comparison to the quarter ended 31 December 2020 unless otherwise stated.

|

|

3.

|

References to “Q2” and “Q3” are to the three months ended 30 September 2021 and

31 December 2021, respectively, unless otherwise stated. References to the “year”, “financial year” or “FY22”

are to the financial year ending 31 March 2022. References to the “last year”, “last financial year” or “FY21”

are to the financial year ended 31 March 2021 unless otherwise stated.

|

|

4.

|

Vodacom refers to the Group’s interest in Vodacom Group Limited (‘Vodacom’) as well

as its operations, including subsidiaries in South Africa, DRC, Tanzania, Mozambique and Lesotho.

|

|

5.

|

Quarterly historical information is provided in a spreadsheet available at https://investors.vodafone.com/reports-information/results-reports-presentations

|

|

6.

|

This trading update contains references to our and our affiliates’ websites. Information on any

website is not incorporated into this update and should not be considered part of this update.

|

Forward-looking

statements and other matters

This report contains “forward-looking statements”

within the meaning of the US Private Securities Litigation Reform Act of 1995 with respect to the Group’s financial condition, results

of operations and businesses and certain of the Group’s plans and objectives.

In particular, such forward-looking statements

include, but are not limited to, statements with respect to: expectations regarding the Group’s financial condition or results of

operations and the guidance for Adjusted EBITDAaL and Adjusted free cash flow for the financial year ending 31 March 2022; the Group’s

sustainable business strategy and 2025 targets; expectations for the Group’s future performance generally; expectations regarding

the operating environment and market conditions and trends, including customer usage, competitive position and macroeconomic pressures,

price trends and opportunities in specific geographic markets; intentions and expectations regarding the development, launch and expansion

of products, services and technologies, either introduced by Vodafone or by Vodafone in conjunction with third parties or by third parties

independently, including the launch of VodaPay; expectations regarding the Group’s environmental targets, expectations regarding

the integration or performance of current and future investments, associates, joint ventures, non-controlled interests and newly acquired

businesses.

Forward-looking statements are sometimes, but not

always, identified by their use of a date in the future or such words as “will”, “anticipates”, “could”,

“may”, “should”, “expects”, “believes”, “intends”, “plans” or

“targets” (including in their negative form or other variations). By their nature, forward-looking statements are inherently

predictive, speculative and involve risk and uncertainty because they relate to events and depend on circumstances that may or may not

occur in the future. There are a number of factors that could cause actual results and developments to differ materially from those expressed

or implied by these forward-looking statements. These factors include, but are not limited to, the following: external cyber-attacks,

insider threats or supplier breaches; general economic and political conditions including as a consequence of the COVID-19 pandemic, of

the jurisdictions in which the Group operates, including as a result of Brexit, and changes to the associated legal, regulatory and tax

environments; increased competition; increased disintermediation; levels of investment in network capacity and the Group’s ability

to deploy new technologies, products and services; rapid changes to existing products and services and the inability of new products and

services to perform in accordance with expectations; the ability of the Group to integrate new technologies, products and services with

existing networks, technologies, products and services; the Group’s ability to generate and grow revenue; a lower than expected

impact of new or existing products, services or technologies on the Group’s future revenue, cost structure and capital expenditure

outlays; slower than expected customer growth, reduced customer retention, reductions or changes in customer spending and increased pricing

pressure; the Group’s ability to extend and expand its spectrum position to support ongoing growth in customer demand for mobile

data services; the Group’s ability to secure the timely delivery of high-quality products from suppliers; loss of suppliers, disruption

of supply chains and greater than anticipated prices of new mobile handsets; changes in the costs to the Group of, or the rates the Group

my charge for, terminations and roaming minutes; the impact of a failure or significant interruption to the Group’s telecommunications,

networks, IT systems or data protection systems; the Group’s ability to realise expected benefits from acquisitions, partnerships,

joint ventures, franchises, brand licences, platform sharing or other arrangements with third parties; acquisitions and divestment of

Group businesses and assets and the pursuit of new, unexpected strategic opportunities; the Group’s ability to integrate acquired

business or assets; the extent of any future write-downs or impairment charges on the Group’s assets, or restructuring charges incurred

as a result of an acquisition or disposition; a developments in the Group’s financial condition, earnings and distributable funds

and other factors that the Board takes into account in determining the level of dividends; the Group’s ability to satisfy working

capital requirements; changes in foreign exchange rates; changes in the regulatory framework in which the Group operates; the impact of

legal or other proceedings against the Group or other companies in the communications industry and changes in statutory tax rates and

profit mix.

Furthermore, a review of the reasons why actual

results and developments may differ materially from the expectations disclosed or implied within forward-looking statements can be found

under “Forward-looking statements” and “Principal risk factors and uncertainties” in the Group’s annual

report for the financial year ended 31 March 2021. The annual report can be found on the Group’s website (https://investors.vodafone.com/reports-information/latest-annual-results).

All subsequent written or oral forward-looking statements attributable to the Company or any member of the Group or any persons acting

on their behalf are expressly qualified in their entirety by the factors referred to above. No assurances can be given that the forward-looking

statements in this document will be realised. Any forward-looking statements are made of the date of this presentation. Subject to compliance

with applicable law and regulations, Vodafone does not intend to update these forward-looking statements and does not undertake any obligation

to do so.

Copyright © Vodafone Group 2022

-End-

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

|

|

VODAFONE

GROUP

|

|

|

PUBLIC LIMITED

COMPANY

|

|

|

(Registrant)

|

|

Dated: February 2, 2022

|

By:

|

/s/

R E S MARTIN

|

|

|

Name:

Rosemary E S Martin

|

|

|

Title:

Group General Counsel and Company Secretary

|

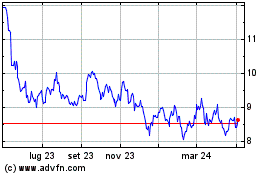

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Mar 2024 a Apr 2024

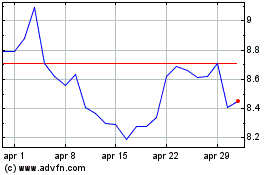

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Apr 2023 a Apr 2024