Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

16 Novembre 2022 - 12:39PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULES 13a-16 OR 15d-16 UNDER

THE SECURITIES EXCHANGE ACT OF 1934

Dated November 16, 2022

Commission File Number: 001-10086

VODAFONE GROUP

PUBLIC LIMITED COMPANY

(Translation of registrant’s name into English)

VODAFONE HOUSE, THE CONNECTION, NEWBURY, BERKSHIRE,

RG14 2FN, ENGLAND

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form

20-F x Form

40-F ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check mark if the registrant is submitting

the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

This Report on Form 6-K contains a Stock Exchange Announcement dated

16 November 2022 entitled ‘SHARE BUYBACK PROGRAMME’.

RNS Number : 6108G

Vodafone Group Plc

16 November 2022

16 November 2022

SHARE BUYBACK PROGRAMME

In March 2019, Vodafone Group Plc ('Vodafone')

issued a two-tranche mandatory convertible bond ('MCB'), the first tranche of which (£1,720,000,000 1.20 per cent. Subordinated

Mandatory Convertible Bonds; ISIN XS1960588850) matured on 12 March 2021, and the second tranche of which (£1,720,000,000 1.50 per

cent.; ISIN XS1960589668) matured on 12 March 2022. On 9 March 2022 Vodafone announced that it had concluded its share buyback programme

in relation to the first tranche of the MCB, neutralising the dilution that occurred on conversion of the first tranche of the MCB into

Vodafone ordinary shares in March 2021. In order to satisfy the conversion of the second tranche of the MCB, 1,518,629,693 shares were

issued from existing shares held in treasury. Between 17 March 2022 and 15 November 2022, Vodafone undertook an irrevocable and non-discretionary

share buy-back programme to reduce the issued share capital of Vodafone to partially offset the increase in the issued share capital as

a result of the maturing of the second tranche of the MCB. Vodafone today announces it will commence a new irrevocable and non-discretionary

share buy-back programme (the 'New Programme'). The sole purpose of the New Programme is to further reduce the issued share capital of

Vodafone to offset the increase in the issued share capital as a result of the maturing of the second tranche of the MCB. Following completion

of the New Programme, the increase in the issued share capital as a result of the maturing of the second tranche of the MCB will be fully

offset.

Further details of the New Programme

Vodafone has given irrevocable and non-discretionary

instructions to Goldman Sachs International ('Goldman Sachs') in relation to the New Programme, which will commence on 16 November 2022

and will end no later than 15 March 2023 (the 'Designated Period'). Goldman Sachs will act as principal during the New Programme and will

make its trading decisions concerning the timing of the purchases of Vodafone's ordinary shares independently of Vodafone.

The number of ordinary shares permitted to be purchased

by Vodafone, pursuant to the authority granted by the shareholders at the Annual General Meeting of Vodafone on 26 July 2022 (the '2022

AGM'), is 2,816,463,347 ordinary shares. The number of ordinary shares to be purchased under the New Programme will not exceed 504,185,187

ordinary shares and is therefore within the 2022 AGM approved limit. The purchased shares will be held as treasury shares. The maximum

amount allocated to the New Programme is £580 million (considering money received or paid under the accompanying option

structure).

Any purchases of ordinary shares by Vodafone in

relation to this announcement will be made on the London Stock Exchange and effected within certain pre-set parameters and in accordance

with the authority granted by shareholders at the 2022 AGM, the Market Abuse Regulation 596/2014 as it forms part of domestic law by virtue

of section 3 of the European Union (Withdrawal) Act 2018 (as amended) and Chapter 12 of the Listing Rules and will be discontinued in

the event Vodafone ceases to have the necessary general authority to repurchase ordinary shares.

Details of the authority granted at the 2022 AGM

can be found on our website under: https://investors.vodafone.com/sites/vodafone-ir/files/2022-07/vodafone-result-of-agm-2022.pdf

Details of the mandatory convertible bond can also

be found on our website under:

https://otp.tools.investis.com/Utilities/PDFDownload.aspx?Newsid=1237908

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

| |

VODAFONE GROUP |

| |

PUBLIC LIMITED COMPANY |

| |

(Registrant) |

| |

|

| Date: November 16, 2022 |

By: |

/s/ R E S MARTIN |

| |

Name: |

Rosemary E S Martin |

| |

Title: |

Group General Counsel and Company Secretary |

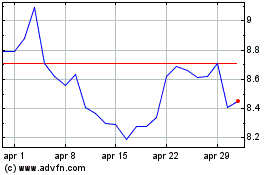

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Mar 2024 a Apr 2024

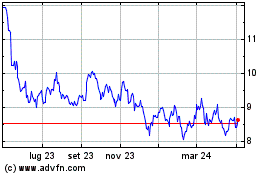

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Apr 2023 a Apr 2024