UNITED STATES

SECURITIES AND

EXCHANGE COMMISSION

Washington, D.C.

20549

Form 6-K

REPORT OF FOREIGN

PRIVATE ISSUER

PURSUANT TO RULES

13a-16 OR 15d-16 UNDER

THE SECURITIES

EXCHANGE ACT OF 1934

Dated February 1,

2023

Commission File Number:

001-10086

VODAFONE GROUP

PUBLIC LIMITED

COMPANY

(Translation of registrant’s

name into English)

VODAFONE HOUSE, THE

CONNECTION, NEWBURY, BERKSHIRE, RG14 2FN, ENGLAND

(Address of principal

executive offices)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form

20-F x Form

40-F ¨

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1): ¨

Indicate by check

mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7): ¨

This Report on Form 6-K contains a Stock

Exchange Announcement dated 01 February 2023 entitled ‘Vodafone Group Plc ⫶ Q3 FY23 Trading Update’.

RNS Number : 4906O

Vodafone Group

Plc

01 February

2023

Vodafone Group Plc ⫶ Q3

FY23 trading update

1 February 2023

Europe slowing

as expected, resilient performance in Africa

| · | Group

service revenue growth of 1.8%* (Q2: 2.5%*), with the slowdown in quarterly trend driven

by Europe |

| | |

| · | In

Europe, declines in Germany, Italy and Spain partially offset by good growth in UK and Other

Europe. Quarterly trend impacted by lower roaming growth and phasing of Business revenue

in FY22 |

| | |

| · | Portfolio

progress: Vantage Towers strategic co-control partnership progressing towards completion,

Vodafone Hungary disposal completed, transfer of Vodafone Egypt to Vodacom completed |

| | |

Q3 FY23 | | |

Q3 FY22 | | |

Reported | | |

Organic | |

| Q3 performance summary | |

€m | | |

€m | | |

growth

% | | |

growth

% 1 | |

| Service revenue | |

| 9,520 | | |

| 9,647 | | |

| (1.3 | ) | |

| 1.8 | * |

| - of which Germany | |

| 2,882 | | |

| 2,936 | | |

| (1.8 | ) | |

| (1.8 | )* |

| Other revenue | |

| 2,118 | | |

| 2,037 | | |

| | | |

| | |

| Total revenue | |

| 11,638 | | |

| 11,684 | | |

| (0.4 | ) | |

| 2.7 | * |

* represents organic growth. See page 2. ǀ 1. Non-GAAP measure. See page 7.

| · | Service

revenue in Turkey increased by 52.9%* (Q2: 43.9%*), driven by high inflation. Group service

revenue growth excluding Turkey was 0.5%* (Q2: 1.4%*) |

| · | Broadening

price actions across Europe, with 8 markets now operating inflation-linked pricing models

|

| · | Vodafone

Business service revenue growth of 2.4%* (Q2: 3.4%*), driven by digital services |

| · | Growth

in Africa driven by data and financial services. We now have 73.5 million financial services

customers in Africa (including Safaricom) |

| · | Continuing

to target updated FY23 guidance: Adjusted EBITDAaL €15.0 – 15.2 billion and Adjusted

FCF c.€5.1 billion |

Margherita

Della Valle, Group Chief Executive, commented:

“Although

we’re continuing to target our financial guidance for the year, the recent decline in revenue in Europe shows we can do better.

We need to do more for our customers by delivering quality connectivity in an easy way. We’ve already taken action, including simplifying

our structure to give local markets full autonomy and accountability to make the best commercial decisions for their customers. In addition,

we now have initiatives underway to generate around half of our €1 billion cost savings target. There is more to do and our focus

is to provide a better service to our customers, become a simpler business and deliver growth.”

|

For

more information, please contact:

| Investor Relations | |

Media Relations |

| | |

|

| Investors.vodafone.com | |

Vodafone.com/media/contact |

| ir@vodafone.co.uk | |

GroupMedia@vodafone.com |

Registered Office:

Vodafone House, The Connection, Newbury, Berkshire RG14 2FN, England. Registered in England No. 1833679

A webcast Q&A

session will be held at 10:00 GMT on 1 February 2023. The webcast and supporting information can be accessed at investors.vodafone.com

| Vodafone Group Plc ⫶ Q3 FY23 trading update |

|

Performance

review ⫶ Europe slowing, resilient performance in Africa

| · | Group

service revenue growth of 1.8%* (Q2: 2.5%*), with the slowdown in quarterly trend driven

by Europe |

| · | In

Europe, declines in Germany, Italy and Spain partially offset by good growth in UK and

Other Europe. Quarterly trend impacted by lower roaming growth and phasing of Business revenue

in FY22 |

| · | Germany

service revenue declined by 1.8%* (Q2: -1.1%*), largely reflecting customer losses since

H2 FY22 related to the implementation of new sector legislation |

| · | Service

revenue in Turkey increased by 52.9%* (Q2: 43.9%*), driven by high inflation. Group service

revenue growth excluding Turkey was 0.5%* (Q2: 1.4%*) |

| |

| Organic growth |

| |

| All amounts marked with an ‘*’ in this document represent organic growth which presents performance on a comparable basis, excluding the impact of foreign exchange rates, mergers and acquisitions, the hyperinflation adjustment in Turkey and other adjustments to improve the comparability of results between periods. Organic growth figures are non-GAAP measures. See non-GAAP measures on page 7 for more information. |

Geographic performance summary

| | |

| | |

| | |

| | |

| | |

Other | | |

| | |

Other | | |

Vantage | | |

Common | | |

Elimi- | | |

| |

| | |

Germany | | |

Italy | | |

UK | | |

Spain | | |

Europe | | |

Vodacom | | |

Markets1 | | |

Towers | | |

Functions | | |

nations | | |

Group | |

| Q3 FY23 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service revenue | |

| 2,882 | | |

| 1,071 | | |

| 1,327 | | |

| 858 | | |

| 1,275 | | |

| 1,234 | | |

| 802 | | |

| – | | |

| 134 | | |

| (63 | ) | |

| 9,520 | |

| Other revenue | |

| 465 | | |

| 153 | | |

| 423 | | |

| 113 | | |

| 214 | | |

| 380 | | |

| 136 | | |

| 329 | | |

| 227 | | |

| (322 | ) | |

| 2,118 | |

| Total revenue (€m) | |

| 3,347 | | |

| 1,224 | | |

| 1,750 | | |

| 971 | | |

| 1,489 | | |

| 1,614 | | |

| 938 | | |

| 329 | | |

| 361 | | |

| (385 | ) | |

| 11,638 | |

| Organic service revenue growth (%)2 | |

| (1.8 | )% | |

| (3.3 | )% | |

| 5.3 | % | |

| (8.7 | )% | |

| 2.1 | % | |

| 3.5 | % | |

| 34.1 | % | |

| – | | |

| | | |

| | | |

| 1.8 | % |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Q3 FY22 | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Service revenue | |

| 2,936 | | |

| 1,107 | | |

| 1,292 | | |

| 940 | | |

| 1,257 | | |

| 1,172 | | |

| 867 | | |

| – | | |

| 136 | | |

| (60 | ) | |

| 9,647 | |

| Other revenue | |

| 437 | | |

| 149 | | |

| 445 | | |

| 137 | | |

| 190 | | |

| 354 | | |

| 105 | | |

| 312 | | |

| 213 | | |

| (305 | ) | |

| 2,037 | |

| Total revenue (€m) | |

| 3,373 | | |

| 1,256 | | |

| 1,737 | | |

| 1,077 | | |

| 1,447 | | |

| 1,526 | | |

| 972 | | |

| 312 | | |

| 349 | | |

| (365 | ) | |

| 11,684 | |

| | |

FY22 | | |

FY23 | |

| Organic

service revenue growth %2 | |

| Q1 | | |

| Q2 | | |

| H1 | | |

| Q3 | | |

| Q4 | | |

| H2 | | |

| Total | | |

| Q1 | | |

| Q2 | | |

| H1 | | |

| Q3 | |

| Germany | |

| 1.4 | | |

| 1.0 | | |

| 1.2 | | |

| 1.1 | | |

| 0.8 | | |

| 1.0 | | |

| 1.1 | | |

| (0.5 | ) | |

| (1.1 | ) | |

| (0.8 | ) | |

| (1.8 | ) |

| Italy | |

| (3.6 | ) | |

| (1.4 | ) | |

| (2.5 | ) | |

| (1.3 | ) | |

| (0.8 | ) | |

| (1.0 | ) | |

| (1.8 | ) | |

| (2.3 | ) | |

| (3.4 | ) | |

| (2.8 | ) | |

| (3.3 | ) |

| UK | |

| 2.5 | | |

| 0.6 | | |

| 1.2 | | |

| 0.9 | | |

| 2.0 | | |

| 1.4 | | |

| 1.3 | | |

| 6.5 | | |

| 6.9 | | |

| 6.7 | | |

| 5.3 | |

| Spain | |

| 0.8 | | |

| (1.9 | ) | |

| (0.6 | ) | |

| (1.6 | ) | |

| (5.1 | ) | |

| (3.4 | ) | |

| (2.0 | ) | |

| (3.0 | ) | |

| (6.0 | ) | |

| (4.5 | ) | |

| (8.7 | ) |

| Other Europe | |

| 4.2 | | |

| 2.4 | | |

| 3.3 | | |

| 2.9 | | |

| 2.7 | | |

| 2.8 | | |

| 3.0 | | |

| 2.5 | | |

| 2.9 | | |

| 2.7 | | |

| 2.1 | |

| Vodacom | |

| 7.9 | | |

| 3.1 | | |

| 5.4 | | |

| 4.4 | | |

| 3.1 | | |

| 3.7 | | |

| 4.6 | | |

| 2.9 | | |

| 4.8 | | |

| 3.9 | | |

| 3.5 | |

| Other

Markets1 | |

| 18.4 | | |

| 19.7 | | |

| 19.1 | | |

| 19.8 | | |

| 19.8 | | |

| 19.8 | | |

| 19.4 | | |

| 24.7 | | |

| 26.7 | | |

| 25.7 | | |

| 34.1 | |

| Vantage Towers | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Group | |

| 3.3 | | |

| 2.4 | | |

| 2.8 | | |

| 2.7 | | |

| 2.0 | | |

| 2.3 | | |

| 2.6 | | |

| 2.5 | | |

| 2.5 | | |

| 2.5 | | |

| 1.8 | |

Downloadable performance information is available

at: https://investors.vodafone.com/reports-information/results-reports-presentations

Notes:

| 1. | Includes Egypt. |

| 2. | Organic service revenue growth is a non-GAAP measure. See page 7 for more information. |

| Vodafone Group Plc ⫶ Q3 FY23 trading update |

|

Germany

⫶ Continued impact from commercial underperformance

Service revenue declined by 1.8%* (Q2: -1.1%*),

primarily due to the impact of customer losses since H2 FY22 related to the implementation of new sector legislation. The quarter-on-quarter

slowdown was driven by lower growth in roaming and visitor revenue, and a stronger Business performance in Q3 last year.

Fixed service revenue declined by 2.0%* (Q2: -1.7%*),

primarily due to a lower broadband customer base as a result of specific operational challenges related to the implementation of policies

to comply with the Telecommunications Act, which are now largely resolved. In October, we announced an enhanced product portfolio supporting

customer upselling and ARPU growth from new customers. Consumer and Business customers can now benefit from up to five times higher upload

speeds, flat rate phone calls, and no upfront connection fees, in return for a higher monthly fee. Our cable broadband customer base declined

by 25,000 and we lost 14,000 DSL broadband customers, partly reflecting our decision to increase retail prices. Our TV customer base declined

by 112,000 in the quarter, and our converged customer base remained broadly stable at 2.3 million converged Consumer accounts. Half of

our cable broadband customers now subscribe to speeds of at least 250Mbps and Gigabit speeds are available to 24.1 million households

across our network.

Mobile service revenue declined by 1.7%* (Q2: -0.4%*),

driven by a lower customer base, a continued reduction in MVNO revenue, lower ARPU reflecting mobile termination rate cuts, and a change

in sales channel mix towards indirect customer acquisition and service providers. The quarter-on-quarter slowdown was primarily driven

by lower growth in roaming and visitor revenue. We added 8,000 contract customers during the quarter and reduced mobile promotions which

supported ARPU from new Vodafone customers. Mobile contract churn increased by 1.0 percentage point year-on-year to 13.3%, driven by higher

service provider churn and the termination of two public sector contracts.

Italy, UK, Spain

and Other Europe ⫶ Continued growth in the UK and Other Europe

Italy

Service revenue declined by 3.3%* (Q2: -3.4%*)

as a result of continued price pressure in the mobile value segment and a lower contribution to growth from MVNO revenue. These factors

were partly offset by strong Business demand for connectivity and digital services, and targeted pricing actions which are supporting

mobile ARPU.

In mobile, our second brand ‘ho.’ continued

to grow, with 52,000 net additions, and now has 3.0 million customers. Our fixed line broadband customer base decreased by 15,000 customers,

however, Business demand for both connectivity and digital services was strong, with encouraging customer take up of the Business voucher

programme, a local initiative related to the EU Recovery and Resilience Facility that subsidises high-speed broadband connectivity. Our

Consumer converged customer base remained stable at 1.3 million, with 55% of our broadband customers now converged.

In October, we launched our new 5G fixed-wireless

service and now cover around 3.2 million households. This complements our 4G fixed-wireless access products, which cover 2.2 million households.

We added 8,000 fixed-wireless access customers, which are included in our mobile customer base.

UK

Service revenue increased by 5.3%* (Q2: 6.9%*),

driven by good customer growth and price increases. The change in quarterly trends primarily reflects lower roaming and visitor revenue

growth, and ARPU dilution from retail price competition.

In mobile, we added 94,000 contract customers during

the quarter, supported by a strong commercial execution during the iPhone and Black Friday trading periods. Contract churn increased by

0.9 percentage points year-on-year to 13.4%, primarily driven by a public sector Business customer cancelling low-usage SIMs. Our

digital sales mix also continued to improve, increasing by 3 percentage points year-on-year to 36% of total sales in the period.

In fixed, our broadband base increased by 47,000

in the quarter and we now have 1.2 million broadband customers, more than half of which are converged. Through our partnerships with CityFibre

and Openreach we are able to reach over 10.5 million households with full fibre broadband, more than any other provider in the UK. We

also announced the extension of our exclusive retail partnership with Currys, covering almost 300 stores as well as digital channels,

with a renewed focus to growing beyond mobile with home broadband and connected devices for around the home.

Spain

Service revenue declined by 8.7%* (Q2: -6.0%*)

due to continued price competition in the value segment, a lower customer base, and a reduction in mobile termination rates. The deterioration

in quarterly trends was driven by lower roaming and visitor revenue growth, strong Business demand in the prior year period, and the phasing

of price increases which were implemented in Q2 in the prior year, compared to Q4 this year.

Mobile contract churn

improved by 3.0 percentage points year-on-year to 18.6% in the quarter, supported by simplified and more transparent plans, as well as

operational improvement measures. In September 2022, we announced that tariffs will be increased in line with CPI for Consumer, SME

and SOHO customers with Vodafone branded contracts, effective as of mid-January, and on an annual basis thereafter. Our mobile contract

customer base declined by 19,000, reflecting the initial impact of the announced price increases. Our broadband customer base also declined

by 27,000, reflecting the communication of price increases and the ongoing DSL shutdown. Our converged customer base declined by

6,000 and is 2.2 million.

On 12 January 2023, we announced that Spain

will become part of the ‘Europe Cluster’, managed by Serpil Timuray, CEO Europe Cluster. Colman Deegan, CEO of Vodafone Spain,

has decided to step down as CEO effective 31 March 2023 and his successor will be appointed in due course.

Other Europe

Service revenue increased by 2.1%* (Q2: 2.9%*),

with growth in all markets other than Romania, which was impacted by a reduction in mobile termination rates. The slowdown in quarterly

trends was driven by lower growth in roaming and visitor revenue.

In Portugal, we maintained our good commercial

momentum and added 49,000 mobile contract customers and 14,000 fixed broadband customers during the quarter. In Greece we added 57,000

mobile contract customers and 27,000 prepaid customers.

In Ireland, service revenue increased due to continued

customer base growth. We added 15,000 mobile contract customers during the quarter and our mobile contract loyalty remained strong, with

churn at 9.0%. In December, Vodafone Ireland acquired 160Mhz of spectrum across four bands with a 20-year licence through to 2042 for

€48 million. The spectrum will enable us to significantly expand network capacity to meet growing demand for reliable, high-quality

voice and data services.

In September 2022, we announced that we had

entered into an agreement to buy Portugal's fourth largest converged operator, Nowo Communications, from Llorca JVCO Limited, the owner

of Masmovil Ibercom S.A.. The transaction is conditional on regulatory approval, and we continue to expect completion in the first half

of this calendar year.

On 9 January 2023, we announced that 4iG Public

Limited Company and Corvinus Zrt (a Hungarian state holding company) completed due diligence and entered into binding terms in relation

to the sale of 100% of Vodafone Hungary. The transaction completed on 31 January 2023 and Vodafone Group has received a total consideration

of HUF 660 billion (€1.7 billion).

Vodacom

⫶ Strong demand for financial services and continued growth in data usage

Vodacom’s service revenue grew by 3.5%* (Q2:

4.8%*), due to strong demand for mobile data and continued growth in both financial services and our customer base. The slowdown in quarterly

trends was driven by a lower rate of growth in Vodacom’s international markets, primarily a result of a natural disaster and fuel

supply challenges in the Democratic Republic of Congo.

In South Africa, service revenue growth was driven

by mobile contract price increases, a good commercial performance in the Consumer segment and higher data usage, partially offset by lower

wholesale revenue. We added 132,000 mobile contract customers during the quarter, benefitting from a successful summer campaign and best-in-class

network resilience and availability as we successfully managed challenges with nationwide electricity supply. Across the overall active

mobile customer base, 74.9% of our customers are now using data services. Financial services revenue in South Africa grew by 12.5%* to

€45 million, benefitting from continued demand for our insurance services and ‘Airtime advance’, a product that allows

prepaid customers to receive airtime or data in advance of topping up. Our ‘super-app’ VodaPay has already reached 2.7 million

registered users and celebrated its one-year launch anniversary in the quarter.

In Vodacom’s international markets, service

revenue growth was supported by data usage and higher M-Pesa transaction volumes, notably in Tanzania, following reductions in levies

on mobile money transactions introduced in the prior year. The slowdown in quarterly trends was driven by slower growth in the Democratic

Republic of Congo due to severe flooding and fuel supply challenges in the country, which impacted network availability. Our mobile customer

base in Vodacom’s international markets is 48.1 million with 60.5% of our active customer base using data services. M-Pesa revenue

as a share of service revenue improved by 2.8 percentage points year-on-year to 25.7%. M-Pesa transaction volume increased by 14.0% during

the quarter.

Other Markets ⫶

Turkey, Egypt and Ghana

Service revenue grew 34.1%* (Q2: 26.7%) reflecting

a higher contribution from Turkey, impacted by accelerating inflation, as well as the continued growth of our customer base and higher

ARPU.

Service revenue growth in Turkey was driven by

ongoing repricing actions to reflect high inflation, continued customer base growth, and higher roaming and visitor revenue. We maintained

our good commercial momentum, adding 439,000 mobile contract customers during the quarter, including migrations from prepaid customers.

Service revenue in Egypt continued to grow strongly,

reflecting another quarter of good customer base growth and increased mobile data usage.

On 13 December 2022, Vodafone completed the

transfer of its 55% shareholding in Vodafone Egypt to Vodacom. This transfer simplifies the management of our African assets. Vodafone

Egypt will benefit from closer co-operation with Vodacom, enabling it to accelerate growth in financial services and IoT. Vodafone received

cash proceeds of €577 million and 242 million shares in Vodacom in exchange for Vodafone’s shareholding in Vodafone Egypt.

Following completion, Vodafone’s shareholding in Vodacom has increased from 60.5% to 65.1%. Vodafone Egypt will be included within

the Vodacom reporting segment from 1 April 2023.

Hyperinflationary accounting in Turkey

Turkey was designated as a hyperinflationary economy

on 1 April 2022 in line with IAS 29 'Financial Reporting in Hyperinflationary Economies’. During the quarter, service revenue

in Turkey increased by 52.9%* (Q2: 43.9%*) due to ongoing repricing actions to reflect inflation. Organic growth metrics exclude the impact

of the hyperinflation adjustment in Turkey in the quarter. Group service revenue growth excluding Turkey was 0.5%* (Q2: 1.4%*).

Vantage Towers

⫶ Voluntary takeover offer completed

Total revenue increased

to €329 million during the quarter, with 440 new tenancies added during the period, keeping the tenancy ratio stable at 1.45x.

Vantage Towers reached a number of new partnership agreements with customers during the quarter. Vantage Towers reported its results on

31 January 2023.

On

9 November 2022, we announced that we had entered into a strategic co-control partnership with GIP and KKR for Vantage Towers. Following

completion of the voluntary takeover offer for the outstanding Vantage Towers shares, the new joint venture, Oak Holdings GmbH, is expected

to hold a 89.3% stake in Vantage Towers. As stated on 9 November 2022, Oak Holdings and Vantage Towers AG will now work towards

the implementation of a Domination and Profit and Loss Transfer Agreement. The transaction is expected to close in the first half of

calendar 2023 following the receipt of all regulatory clearances. Further detail on the transaction is available here: investors.vodafone.com/reports-information/results-reports-presentations

and here: angebot.wpueg.de/oak/.

Additional resources

| Topic | |

Link |

| Digital services & outstanding experience | |

investors.vodafone.com/digital-services |

| Leading gigabit networks | |

investors.vodafone.com/vtbriefing |

| Vodafone Business | |

investors.vodafone.com/vbbriefing |

| Vantage Towers | |

vantagetowers.com |

| Vodacom | |

vodacom.com |

| ESG Reporting Suite | |

|

| Board conversations | |

investors.vodafone.com/videos |

| ESG Addendum | |

investors.vodafone.com/esgaddendum |

| ESG A-Z | |

investors.vodafone.com/esga-z |

| TCFD | |

investors.vodafone.com/tcfd |

| SASB | |

investors.vodafone.com/sasb |

Non-GAAP

measures

In the discussion of the Group’s reported

operating results, non-GAAP measures are presented to provide readers with additional financial information that is regularly reviewed

by management. This additional information presented is not uniformly defined by all companies including those in the Group’s industry.

Accordingly, it may not be comparable with similarly-titled measures and disclosures by other companies. Additionally, certain information

presented is derived from amounts calculated in accordance with IFRS but is not itself a measure defined under GAAP. Such measures should

not be viewed in isolation or as an alternative to the equivalent GAAP measure.

The non-GAAP measures discussed in this document

are listed below.

| Non-GAAP measure | |

Defined on page | |

Closest equivalent GAAP

measure | |

Reconciled on page |

| Performance metrics | |

| |

| |

|

| Organic revenue growth | |

Page 7 | |

Revenue | |

Page 8 |

| Organic service revenue growth | |

Page 7 | |

Service revenue | |

Page 8 |

| Organic mobile service revenue growth | |

Page 7 | |

Service revenue | |

Page 8 |

| Organic fixed service revenue growth | |

Page 7 | |

Service revenue | |

Page 8 |

| Organic Group service revenue growth excluding Turkey | |

Page 7 | |

Service revenue | |

Page 8 |

| Organic Vodafone Business service revenue growth | |

Page 7 | |

Service revenue | |

Page 8 |

| Organic financial services revenue growth in South Africa | |

Page 7 | |

Service revenue | |

Page 8 |

Definition and use of organic growth measures

All amounts marked with an ‘*’ in this

document represent organic growth which presents performance on a comparable basis, excluding the impact of foreign exchange rates, mergers

and acquisitions, the hyperinflation adjustment in Turkey and other adjustments to improve the comparability of results between periods.

Organic growth is calculated for revenue metrics,

as follows:

| - | Group service revenue excluding Turkey; |

| - | Vodafone Business service revenue; and |

| - | Financial services revenue in South Africa. |

Whilst organic growth is not intended to be a substitute

for reported growth, nor is it superior to reported growth, we believe that the measure provides useful and necessary information to investors

and other interested parties for the following reasons:

| - | It provides additional information on underlying growth of the business without the effect of certain

factors unrelated to its operating performance; |

| - | It is used for internal performance analysis; and |

| - | It facilitates comparability of underlying growth with other companies (although the term “organic”

is not a defined term under GAAP and may not, therefore, be comparable with similarly titled measures reported by other companies). |

We have not provided a comparative in respect of

organic growth rates as the current rates describe the change between the beginning and end of the current period, with such changes being

explained by the commentary in this document. If comparatives were provided, significant sections of the commentary for prior periods

would also need to be included, reducing the usefulness and transparency of this document.

Quarter ended 31 December 2022

| | |

| | |

| | |

Reported | | |

M&A and | | |

Foreign | | |

Organic | |

| | |

Q3 FY23 | | |

Q3 FY22 | | |

growth | | |

Other | | |

exchange | | |

growth* | |

| | |

€m | | |

€m | | |

% | | |

pps | | |

pps | | |

% | |

| Service revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Germany | |

| 2,882 | | |

| 2,936 | | |

| (1.8 | ) | |

| - | | |

| – | | |

| (1.8 | ) |

| Mobile service revenue | |

| 1,279 | | |

| 1,301 | | |

| (1.7 | ) | |

| - | | |

| – | | |

| (1.7 | ) |

| Fixed service revenue | |

| 1,603 | | |

| 1,635 | | |

| (2.0 | ) | |

| – | | |

| – | | |

| (2.0 | ) |

| Italy | |

| 1,071 | | |

| 1,107 | | |

| (3.3 | ) | |

| - | | |

| – | | |

| (3.3 | ) |

| Mobile service revenue | |

| 750 | | |

| 794 | | |

| (5.5 | ) | |

| (0.2 | ) | |

| – | | |

| (5.7 | ) |

| Fixed service revenue | |

| 321 | | |

| 313 | | |

| 2.6 | | |

| 0.1 | | |

| – | | |

| 2.7 | |

| UK | |

| 1,327 | | |

| 1,292 | | |

| 2.7 | | |

| – | | |

| 2.6 | | |

| 5.3 | |

| Mobile service revenue | |

| 977 | | |

| 928 | | |

| 5.3 | | |

| – | | |

| 2.8 | | |

| 8.1 | |

| Fixed service revenue | |

| 350 | | |

| 364 | | |

| (3.8 | ) | |

| – | | |

| 2.2 | | |

| (1.6 | ) |

| Spain | |

| 858 | | |

| 940 | | |

| (8.7 | ) | |

| – | | |

| – | | |

| (8.7 | ) |

| Other Europe | |

| 1,275 | | |

| 1,257 | | |

| 1.4 | | |

| – | | |

| 0.7 | | |

| 2.1 | |

| Vodacom | |

| 1,234 | | |

| 1,172 | | |

| 5.3 | | |

| – | | |

| (1.8 | ) | |

| 3.5 | |

| Other Markets1 | |

| 802 | | |

| 867 | | |

| (7.5 | ) | |

| 4.0 | | |

| 37.6 | | |

| 34.1 | |

| Vantage Towers | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Common Functions | |

| 134 | | |

| 136 | | |

| | | |

| | | |

| | | |

| | |

| Eliminations | |

| (63 | ) | |

| (60 | ) | |

| | | |

| | | |

| | | |

| | |

| Total service revenue | |

| 9,520 | | |

| 9,647 | | |

| (1.3 | ) | |

| 0.3 | | |

| 2.8 | | |

| 1.8 | |

| Other revenue | |

| 2,118 | | |

| 2,037 | | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| 11,638 | | |

| 11,684 | | |

| (0.4 | ) | |

| 0.3 | | |

| 2.8 | | |

| 2.7 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other growth metrics | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Group service revenue excluding Turkey | |

| 9,193 | | |

| 9,299 | | |

| (1.1 | ) | |

| - | | |

| 1.6 | | |

| 0.5 | |

| Vodafone Turkey - Service revenue | |

| 334 | | |

| 355 | | |

| (5.9 | ) | |

| 10.6 | | |

| 48.2 | | |

| 52.9 | |

| Vodafone Business - Service revenue | |

| 2,602 | | |

| 2,604 | | |

| (0.1 | ) | |

| 0.5 | | |

| 2.0 | | |

| 2.4 | |

| South Africa - Financial services revenue | |

| 45 | | |

| 39 | | |

| 15.4 | | |

| (3.3 | ) | |

| 0.4 | | |

| 12.5 | |

Quarter ended 30 September 2022

| | |

| | |

| | |

Reported | | |

M&A and | | |

Foreign | | |

Organic | |

| | |

Q2 FY23 | | |

Q2 FY22 | | |

growth | | |

Other | | |

exchange | | |

growth* | |

| | |

€m | | |

€m | | |

% | | |

pps | | |

pps | | |

% | |

| Service revenue | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Germany | |

| 2,873 | | |

| 2,905 | | |

| (1.1 | ) | |

| – | | |

| – | | |

| (1.1 | ) |

| Mobile service revenue | |

| 1,282 | | |

| 1,287 | | |

| (0.4 | ) | |

| – | | |

| – | | |

| (0.4 | ) |

| Fixed service revenue | |

| 1,591 | | |

| 1,618 | | |

| (1.7 | ) | |

| – | | |

| – | | |

| (1.7 | ) |

| Italy | |

| 1,073 | | |

| 1,111 | | |

| (3.4 | ) | |

| – | | |

| – | | |

| (3.4 | ) |

| Mobile service revenue | |

| 762 | | |

| 807 | | |

| (5.6 | ) | |

| – | | |

| – | | |

| (5.6 | ) |

| Fixed service revenue | |

| 311 | | |

| 304 | | |

| 2.3 | | |

| 0.3 | | |

| – | | |

| 2.6 | |

| UK | |

| 1,352 | | |

| 1,265 | | |

| 6.9 | | |

| – | | |

| – | | |

| 6.9 | |

| Mobile service revenue | |

| 1,000 | | |

| 902 | | |

| 10.9 | | |

| – | | |

| (0.1 | ) | |

| 10.8 | |

| Fixed service revenue | |

| 352 | | |

| 363 | | |

| (3.0 | ) | |

| – | | |

| 0.1 | | |

| (2.9 | ) |

| Spain | |

| 884 | | |

| 941 | | |

| (6.1 | ) | |

| 0.1 | | |

| – | | |

| (6.0 | ) |

| Other Europe | |

| 1,298 | | |

| 1,274 | | |

| 1.9 | | |

| – | | |

| 1.0 | | |

| 2.9 | |

| Vodacom | |

| 1,258 | | |

| 1,145 | | |

| 9.9 | | |

| – | | |

| (5.1 | ) | |

| 4.8 | |

| Other Markets1 | |

| 907 | | |

| 923 | | |

| (1.7 | ) | |

| (2.2 | ) | |

| 30.6 | | |

| 26.7 | |

| Vantage Towers | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | | |

| – | |

| Common Functions | |

| 140 | | |

| 127 | | |

| | | |

| | | |

| | | |

| | |

| Eliminations | |

| (92 | ) | |

| (71 | ) | |

| | | |

| | | |

| | | |

| | |

| Total service revenue | |

| 9,693 | | |

| 9,620 | | |

| 0.8 | | |

| (0.1 | ) | |

| 1.8 | | |

| 2.5 | |

| Other revenue | |

| 1,959 | | |

| 1,768 | | |

| | | |

| | | |

| | | |

| | |

| Revenue | |

| 11,652 | | |

| 11,388 | | |

| 2.3 | | |

| (0.2 | ) | |

| 2.0 | | |

| 4.1 | |

| | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Other growth metrics | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Group service revenue excluding Turkey | |

| 9,344 | | |

| 9,201 | | |

| 1.6 | | |

| – | | |

| (0.2 | ) | |

| 1.4 | |

| Vodafone Turkey - Service revenue | |

| 360 | | |

| 430 | | |

| (16.3 | ) | |

| (6.5 | ) | |

| 66.7 | | |

| 43.9 | |

| Vodafone Business - Service revenue | |

| 2,591 | | |

| 2,544 | | |

| 1.8 | | |

| 0.5 | | |

| 1.1 | | |

| 3.4 | |

| South Africa - Financial services revenue | |

| 42 | | |

| 33 | | |

| 27.3 | | |

| – | | |

| (15.7 | ) | |

| 11.6 | |

Note:

Definitions

Key terms are defined below. See page 7 for

the location of definitions for non-GAAP measures.

| Term | |

Definition |

| Adjusted EBITDAaL | |

Adjusted EBITDAaL is operating profit after depreciation on lease-related right of use assets and interest on leases but excluding depreciation, amortisation and gains/losses on disposal of owned assets and excluding share of results of equity accounted associates and joint ventures, impairment losses, restructuring costs arising from discrete restructuring plans, other income and expense and significant items that are not considered by management to be reflective of the underlying performance of the Group. |

| Adjusted free cash flow (‘Adjusted FCF’) | |

Adjusted free cash flow is Free cash flow before licences and spectrum, restructuring costs arising from discrete restructuring plans, integration capital additions and working capital related items, M&A and Vantage Towers growth capital expenditure. |

| Africa | |

Comprises the Vodacom Group and businesses in Egypt and Ghana. |

| ARPU | |

Average revenue per user, defined as customer revenue and incoming revenue divided by average customers. |

| Churn | |

Total gross customer disconnections in the period divided by the average total customers in the period. |

| Common Functions | |

Comprises central teams and business functions. |

| Converged customer | |

A customer who receives fixed and mobile services (also known as unified communications) on a single bill or who receives a discount across both bills. |

| Eliminations | |

Refers to the removal of intercompany transactions to derive the consolidated financial statements. |

| Europe | |

Comprises the Group’s European businesses and the UK. |

| Financial services revenue | |

Financial services revenue includes fees generated from the provision of advanced airtime, overdraft, financing and lending facilities, as well as merchant payments and the sale of insurance products (e.g. device insurance, life insurance and funeral cover). |

| Fixed service revenue | |

Service revenue (see below) relating to the provision of fixed line and carrier services. |

| GAAP | |

Generally Accepted Accounting Principles. |

| IFRS | |

International Financial Reporting Standards. |

| Internet of Things (‘IoT’) | |

The network of physical objects embedded with electronics, software, sensors, and network connectivity, including built-in mobile SIM cards, that enables these objects to collect data and exchange communications with one another or a database. |

| Mobile service revenue | |

Service revenue (see below) relating to the provision of mobile services. |

| MVNO | |

Mobile Virtual Network Operator: companies that provide mobile phone services under wholesale contracts with a mobile network operator, but do not have their own licence or spectrum or the infrastructure required to operate a network. |

| Other Europe | |

Other Europe markets include Portugal, Ireland, Greece, Romania, Czech Republic, Hungary and Albania. |

| Other Markets | |

Other Markets comprise Turkey, Egypt and Ghana. |

| Other revenue | |

Other revenue principally includes equipment revenue, interest income, income from partner market arrangements and lease revenue, including in respect of the lease out of passive tower infrastructure. |

| Reported growth | |

Reported growth is based on amounts reported in euros and determined under IFRS. |

| Revenue | |

The total of Service revenue (defined below) and Other revenue (defined above). |

| Roaming and Visitor | |

Roaming: allows customers to make calls, send and receive texts and data on our and other operators’ mobile networks, usually while travelling abroad. Visitor: revenue received from other operators or markets when their customers roam on one of our markets’ networks. |

| Service revenue | |

Service revenue is all revenue related to the provision of ongoing services to the Group’s Consumer and Business customers, together with roaming revenue, revenue from incoming and outgoing network usage by non-Vodafone customers and interconnect charges for incoming calls. |

| Vodafone Business | |

Vodafone Business is part of the Group and partners with businesses of every size to provide a range of business-related services. |

Notes

| 1. | References to Vodafone are to Vodafone Group Plc and references to Vodafone Group are to Vodafone Group

Plc and its subsidiaries unless otherwise stated. Vodafone, the Vodafone Speech Mark Devices, Vodacom and Together we can are trade marks

owned by Vodafone. Vantage Towers is a trade mark owned by Vantage Towers A.G. Other product and company names mentioned herein may be

the trade marks of their respective owners. |

| 2. | All growth rates reflect a comparison to the quarter ended 31 December 2021 unless otherwise stated. |

| 3. | References to “Q1”, “Q2”, “Q3” and “Q4” are to the three

months ended 30 June, 30 September, 31 December and 31 March, respectively. References to “H1” and “H2” are

to the six month periods ended 30 September and 31 March, respectively. References to the “last year”, “last financial

year” or “FY22” are to the financial year ended 31 March 2022. References to “FY23“ are to the financial

year ending 31 March 2023. |

| 4. | Vodacom refers to the Group’s interest in Vodacom Group Limited (‘Vodacom’) as well

as its operations, including subsidiaries in South Africa, DRC, Tanzania, Mozambique and Lesotho. On 13 December 2022, Vodafone completed

the transfer of its 55% shareholding in Vodafone Egypt to Vodacom. Vodafone Egypt will be included within the Vodacom reporting segment

from 1 April 2023. |

| 5. | Quarterly historical information is provided in a spreadsheet available at https://investors.vodafone.com/reports-information/results-reports-presentations |

| 6. | This document contains references to our and our affiliates’ websites. Information on any website

is not incorporated into this update and should not be considered part of this update. |

Forward-looking

statements and other matters

This report contains “forward-looking statements”

within the meaning of the US Private Securities Litigation Reform Act of 1995 with respect to the Group’s financial condition, results

of operations and businesses and certain of the Group’s plans and objectives.

In particular, such forward-looking statements

include, but are not limited to, statements with respect to: expectations regarding the Group’s financial condition or results of

operations and the guidance for Adjusted EBITDAaL and Adjusted free cash flow for the financial year ending 31 March 2023; the Group’s

cost savings target; the sale of Vodafone Egypt; the Vantage Towers strategic co-control partnership; the spectrum acquisition by Vodafone

Ireland; the acquisition of Nowo Communications; expectations for the Group’s future performance generally; expectations regarding

the operating environment and market conditions and trends, including customer usage, competitive position and macroeconomic pressures,

price trends and opportunities in specific geographic markets; intentions and expectations regarding the development, launch and expansion

of products, services and technologies, either introduced by Vodafone or by Vodafone in conjunction with third parties or by third parties

independently; expectations regarding the integration or performance of current and future investments, associates, joint ventures, non-controlled

interests and newly acquired businesses.

Forward-looking statements are sometimes, but

not always, identified by their use of a date in the future or such words as “will”, “anticipates”,

“could”, “may”, “should”, “expects”, “believes”, “intends”,

“plans” or “targets” (including in their negative form or other variations). By their nature,

forward-looking statements are inherently predictive, speculative and involve risk and uncertainty because they relate to events and

depend on circumstances that may or may not occur in the future. There are a number of factors that could cause actual results and

developments to differ materially from those expressed or implied by these forward-looking statements. These factors include, but

are not limited to, the following: external cyber-attacks, insider threats or supplier breaches; general economic and political

conditions including as a consequence of the ongoing war in Ukraine as well as in jurisdictions in which the Group operates, and

changes to the associated legal, regulatory and tax environments; inflation; increased competition; increased disintermediation;

levels of investment in network capacity and the Group’s ability to deploy new technologies, products and services;

infrastructure competitiveness; rapid changes to existing products and services and the inability of new products and services to

perform in accordance with expectations; the ability of the Group to integrate new technologies, products and services with existing

networks, technologies, products and services; the Group’s ability to generate and grow revenue; a lower than expected impact

of new or existing products, services or technologies on the Group’s future revenue, cost structure and capital expenditure

outlays; slower than expected customer growth, reduced customer retention, reductions or changes in customer spending and increased

pricing pressure; the Group’s ability to extend and expand its spectrum position to support ongoing growth in customer demand

for mobile data services; the Group’s ability to secure the timely delivery of high-quality products from suppliers; loss of

suppliers, disruption of supply chains and greater than anticipated prices of new mobile handsets; changes in the costs to the Group

of, or the rates the Group my charge for, terminations and roaming minutes; the impact of a failure or significant interruption to

the Group’s telecommunications, networks, IT systems or data protection systems; the Group’s ability to realise

expected benefits from acquisitions, partnerships, joint ventures, franchises, brand licences, platform sharing or other

arrangements with third parties or portfolio transformation; acquisitions and divestment of Group businesses and assets and the

pursuit of new, unexpected strategic opportunities; the Group’s ability to integrate acquired business or assets; the extent

of any future write-downs or impairment charges on the Group’s assets, or restructuring charges incurred as a result of an

acquisition or disposition; developments in the Group’s financial condition, earnings and distributable funds and other

factors that the Board takes into account in determining the level of dividends; the Group’s ability to satisfy working

capital requirements; changes in foreign exchange rates; changes in the regulatory framework in which the Group operates; the impact

of legal or other proceedings against the Group or other companies in the communications industry and changes in statutory tax rates

and profit mix.

Furthermore, a review of the reasons why actual

results and developments may differ materially from the expectations disclosed or implied within forward-looking statements can be found

under “Forward-looking statements” and “Principal risk factors and uncertainties” in the Group’s Annual

Report for the financial year ended 31 March 2022 and under “Risk factors” in the Group’s H1 FY23 results for the

six month period ended 30 September 2022. The Annual Report can be found on the Group’s website (https://investors.vodafone.com/reports-information).

All subsequent written or oral forward-looking statements attributable to the Company or any member of the Group or any persons acting

on their behalf are expressly qualified in their entirety by the factors referred to above. No assurances can be given that the forward-looking

statements in this document will be realised. Any forward-looking statements are made as of the date of this presentation. Subject to

compliance with applicable law and regulations, Vodafone does not intend to update these forward-looking statements and does not undertake

any obligation to do so.

Copyright © Vodafone Group 2023

-End-

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorised.

| |

VODAFONE

GROUP |

| |

PUBLIC LIMITED

COMPANY |

| |

(Registrant) |

| Date: February 01, 2023 |

By: |

/s/

R E S MARTIN |

| |

Name:

Rosemary E S Martin |

| |

Title:

Group General Counsel and Company Secretary |

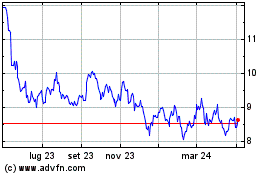

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Mar 2024 a Apr 2024

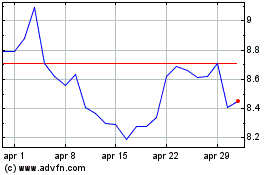

Grafico Azioni Vodafone (NASDAQ:VOD)

Storico

Da Apr 2023 a Apr 2024