Allstate Announces March 2022 and First Quarter 2022 Catastrophe Losses, Prior Year Reserve Reestimates and Implemented Auto Rates

21 Aprile 2022 - 10:38PM

Business Wire

The Allstate Corporation (NYSE: ALL) today announced estimated

catastrophe losses for the month of March of $227 million or $179

million, after-tax. March catastrophe losses included six events,

primarily tornado and wind in Texas and the southeast, estimated at

$246 million, plus favorable reserve reestimates for prior events.

Catastrophe losses for the first quarter totaled $462 million,

pre-tax.

Inflationary trends continue to adversely impact both current

and prior report year incurred severity and loss reserve estimates.

As a result, beginning with this month’s release, we are further

expanding reporting transparency by disclosing quarterly

non-catastrophe prior year reserve reestimates (favorable or

unfavorable) in the release issued for the final month of each

quarter. For the first quarter of 2022, unfavorable non-catastrophe

prior year reserve reestimates totaled approximately $160 million

and were primarily driven by both auto physical damage and bodily

injury severity. Prior year reestimates reflect the impact of rapid

increases in loss costs since the second quarter of 2021. We also

continue to experience the impact of elevated severity inflation in

the current report year, with Allstate brand report year incurred

severity on property damage and bodily injury coverages estimated

to increase by 11.0% and 8.0%, respectively, relative to 2021.

“Given the ongoing loss-cost impacts of the current inflationary

environment, Allstate has increased the magnitude of auto rate

increases we expect to implement throughout 2022. In March,

Allstate brand implemented rate increases averaged 9.8% across 15

locations, resulting in total Allstate brand insurance premium

impact of 1.4%. National General implemented rate increases

averaged 3.8% across 7 locations in the month. In the Allstate

brand, we have implemented 53 rate increases averaging

approximately 8.2% across 41 locations since the beginning of the

fourth quarter 2021. These locations represent approximately 62% of

2021 Allstate brand auto written premiums. The increase to Allstate

brand total auto insurance written premiums of approximately 6.5%

implemented over this six-month period will be earned throughout

this year and into 2023,” said Mario Rizzo, Chief Financial Officer

of The Allstate Corporation. Our implemented auto rate exhibit has

been posted on allstateinvestors.com.

Financial information, including material announcements about

The Allstate Corporation, is routinely posted on

www.allstateinvestors.com.

Forward-Looking Statements

This news release contains “forward-looking statements” that

anticipate results based on our estimates, assumptions and plans

that are subject to uncertainty. These statements are made subject

to the safe-harbor provisions of the Private Securities Litigation

Reform Act of 1995. These forward-looking statements do not relate

strictly to historical or current facts and may be identified by

their use of words like “plans,” “seeks,” “expects,” “will,”

“should,” “anticipates,” “estimates,” “intends,” “believes,”

“likely,” “targets” and other words with similar meanings. We

believe these statements are based on reasonable estimates,

assumptions and plans. However, if the estimates, assumptions or

plans underlying the forward-looking statements prove inaccurate or

if other risks or uncertainties arise, actual results could differ

materially from those communicated in these forward-looking

statements. Factors that could cause actual results to differ

materially from those expressed in, or implied by, the

forward-looking statements may be found in our filings with the

U.S. Securities and Exchange Commission, including the “Risk

Factors” section in our most recent annual report on Form 10-K.

Forward-looking statements are as of the date on which they are

made, and we assume no obligation to update or revise any

forward-looking statement.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220421006125/en/

Al Scott Media Relations (847) 402-5600

Mark Nogal Investor Relations (847) 402-2800

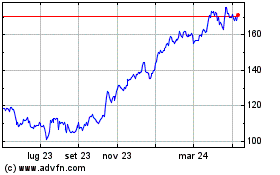

Grafico Azioni Allstate (NYSE:ALL)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Allstate (NYSE:ALL)

Storico

Da Apr 2023 a Apr 2024