United States Securities and Exchange

Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

Name of the Registrant:

International Business Machines Corporation

Name of persons relying

on exemption: Clean Yield Asset Management

Address of persons

relying on exemption: 16 Beaver Meadow Road Norwich, VT 05055

Written materials

are submitted pursuant to Rule 14a-6(g)(1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this filer

under the terms of the Rule, but is made voluntarily in the interest of public disclosure and consideration of these important issues.

PROXY MEMORANDUM

| TO: |

International Business Machines Corporation Shareholders |

| RE: |

Item No. 8 (“Stockholder Proposal Requesting a Public Report on Harassment and Discrimination Prevention Efforts”) |

| DATE: |

March 17, 2023 |

| CONTACT: |

Molly Betournay, molly@cleanyield.com |

This is not a solicitation of authority to vote your proxy. Please

DO NOT send us your proxy card; Clean Yield Asset Management is not able to vote your proxies, nor does this communication contemplate

such an event. Clean Yield Asset Management urges shareholders to vote for Item No. 8 following the instructions provided on management's

proxy mailing.

Clean Yield Asset Management urges shareholders to vote YES on Item

No. 8 on the International Business Machines Corporation (IBM) 2023 proxy ballot. The resolved clause states as follows:

Resolved:

Shareholders request the Board of Directors commission an independent

review of the effectiveness and outcomes of the Company's efforts to prevent harassment and discrimination against its protected classes

of employees and issue a public report summarizing the findings.

Supporting Statement:

In its discretion, the Board may wish to consider including in the

report disclosures such as these:

| ● | the total number and aggregate costs associated with disputes settled by the Company related to harassment or discrimination in the

previous three years; |

| ● | the total number of pending harassment or discrimination complaints the Company is seeking to resolve through internal processes,

arbitration, or litigation; |

| ● | the total number and aggregate costs associated with contracts that include exit or other agreements where concealment clauses that

restrict discussions of harassment or discrimination are present; and |

| ● | an estimate of the number of claims which may be made public, should existing nondisclosure or arbitration agreements be made null

by changing legislation. |

The report should not include the names or details of settlements without

consent and should be prepared at a reasonable cost and omit any information that is proprietary, privileged, or violative of contractual

obligations.

About Clean Yield Asset Management

Clean Yield Asset Management (“Clean Yield”) is an investment

firm based in Norwich, VT, specializing in socially responsible asset management. We have filed this shareholder proposal on behalf of

our client, the Jay Stanley Weisfeld Trust, a long-term shareholder in IBM, because we are concerned that IBM’s use of concealment

clauses may mask patterns of employment discrimination and, in doing so, put shareholder value at risk.

Background to the Proposal

At IBM’s April 2022 Annual Meeting of Stockholders, 64.7% of

IBM investors supported a shareholder resolution filed by Clean Yield Asset Management asking that IBM’s Board of Directors prepare

a public report assessing the potential risks to the company associated with its use of concealment clauses in the context of harassment,

discrimination, and other unlawful acts.

This resolution was made necessary by the company’s ongoing use

of concealment clauses, particularly non-disclosure and arbitration requirements at severance. In February 2023, IBM released a document

entitled “Report on Concealment Clauses.” In the assessment of the proponent, the report addresses neither the core concerns

of the 2022 proposal nor the requests made in this 2023 proposal that IBM conduct an independent review of the effectiveness and outcomes

of the Company's efforts to prevent harassment and discrimination against its protected classes of employees.

Rationale in Support of This Proposal

| 1) | Current reporting does not address investor concerns. |

| 2) | Public data is at odds with IBM’s claims. |

| 3) | The company’s practices remain unclear. |

| 4) | IBM’s apparent use of concealment clauses remains a significant concern. |

| 5) | Investors benefit from accountability systems within companies. |

Current Reporting Does Not Address Investor Concerns

The use of concealment clauses in employment and post-employment contracts

is concerning, as these clauses obfuscate from external parties, such as investors, the extent to which harassment and discrimination

are occurring in the company’s workplaces. Given that these practices remain in place at IBM, the intention of this 2023 resolution,

in its request that an independent review be conducted of IBM’s efforts to prevent harassment and discrimination, is to provide

assurance to investors that IBM’s internal practices are effective. Unfortunately, confidence in IBM’s harassment and discrimination

prevention programs has been harmed by a number of significant allegations of discrimination at the company.

1) Company report fails to address core workplace concerns.

The proponents believe that the “Report on Concealment Clauses”

published by IBM in February 2023 and referenced in the statement of opposition to this proposal as having fulfilled the request of the

proposal does not provide substantive additional information or insights to address the core concerns raised in the 2022 proposal. Much

of this information had already been shared with investors through the company’s statement of opposition to a 2022 resolution1

that requested that “the Board of Directors prepare a public report assessing the potential risks to the company associated with

its use of concealment clauses in the context of harassment, discrimination and other unlawful acts.”

64.7% of shareholders supported the 2022 resolution. However, IBM’s

“Report on Concealment Clauses” does not appear to be responsive to the requests made by investors in the 2022 resolution,

nor to the request of the current resolution seeking independent assessment of the effectiveness of IBM’s workplace equity programs.

Instead, the report that the Company published appears to be an elongated version of IBM’s statement in opposition to the 2022 proposal,

which had also detailed the company’s policies and procedures, that concealment clauses are applied only post-employment

and that the Board has oversight of IBM’s culture and work environment. The reporting requested by this resolution, which would

provide data to indicate the effectiveness and outcomes of the company's efforts to prevent harassment and discrimination against its

protected classes of employees, is not included in this report.

2) No independent review has been conducted.

This resolution requests “an independent review of the effectiveness

and outcomes of the Company's efforts to prevent harassment and discrimination against its protected classes of employees and issue a

public report summarizing the findings.” No independent review appears to have been conducted. An independent review is important,

as concealment clauses may benefit and protect management, to the detriment of investors and other stakeholders.

3) No quantitative data has been provided.

IBM, in its statement against this proposal, states that it has addressed

the concerns raised in the proposal through the publication of its “Report on Concealment Clauses.” It does not do so. Specifically,

the resolution suggests that IBM provide the following:

| ● | the total number and aggregate costs associated with disputes settled by the Company related to harassment or discrimination in the

previous three years; |

| ● | the total number of pending harassment or discrimination complaints the Company is seeking to resolve through internal processes,

arbitration, or litigation; |

| ● | the total number and aggregate costs associated with contracts that include exit or other agreements where concealment clauses that

restrict discussions of harassment or discrimination are present; and |

| ● | an estimate of the number of claims which may be made public, should existing nondisclosure or arbitration agreements be made null

by changing legislation. |

While the report states that IBM uses confidentiality in post-employment

agreements in limited circumstances, the company provides no additional information about the “limited” circumstances in which

these clauses are used.

_____________________________

1

https://www.sec.gov/Archives/edgar/data/51143/000110465922031075/tm2122634-2_def14a.htm

2 https://www.nytimes.com/2022/02/12/business/economy/ibm-age-discrimination.html

3 https://www.reuters.com/legal/litigation/judge-upholds-ibm-workers-arbitration-pacts-age-bias-litigation-2022-07-14/

4 https://www.bloomberg.com/news/articles/2021-11-18/ibm-arbitration-gag-rules-are-illegal-fired-workers-say

5 https://www.nytimes.com/2022/02/12/business/economy/ibm-age-discrimination.html

6 https://www.dol.gov/sites/dolgov/files/OFCCP/foia/files/2021093-IBM-R00207936-MA-CA-Redacted.pdf

7 https://www.hrdive.com/news/jury-awards-11m-to-ibm-manager-fired-after-reporting-discrimination/598983/

8 https://wraltechwire.com/2020/06/17/report-ibm-settles-lawsuit-with-black-software-salesman-over-2-4m-in-commissions/

9 https://www.law360.com/articles/1235969/ibm-inks-80k-deal-to-settle-ex-worker-s-pregnancy-bias-suit

Public Data Is at Odds With IBM’s Claims

1) Media reports indicate that IBM’s arbitration use is not

limited to rare cases.

IBM states that it utilizes confidentiality in post-employment agreements

only in limited circumstances. However, it appears that their use may encompass a large number of former employees. According to The

New York Times, in 2014 the company began instituting mandatory arbitration on discrimination claims in order to receive severance

packages.2 In July 2022, 26 former IBM employees sought release from their requirement that they arbitrate employment-related

disputes,3 and it appears that hundreds of ex-employees have also been bound by arbitration.4

If the company also utilizes nondisclosure agreements, neither the

media nor IBM’s investors would be able to know this; that the agreements themselves are secret is often a definitional component

of these types of agreements.

2) IBM has faced a number of allegations of workplace discrimination.

IBM writes in its statement in opposition to this proposal, “IBM

does not tolerate discrimination or harassment and has clear policies, procedures and practices relating to the prevention of harassment

or bullying in the workplace.” Its “Report on Concealment Clauses” also speaks to a “decades-long culture that

does not tolerate discrimination or harassment, and has clear policies, procedures and practices in place to protect and support IBMers.”

However, the following serious allegations of discrimination have been reported in the media:

| ● | IBM has been accused of engaging in a pattern of discrimination against older workers in which they were targeted in layoffs. This

alleged discrimination included calling older employees “dinobabies” and referring to older female employees as a “dated

maternal workforce.” 5 |

| ● | In September 2021, the Department of Labor’s Office of Federal Contract Compliance Programs (OFCCP) found that IBM US Public

Service GBS engaged in pay discrimination against 115 female project managers.6 |

| ● | In April 2021, a jury awarded $11.1 million to a manager to who was wrongfully fired after raising claims of racial discrimination

in compensation.7 This settlement followed a June 2020 report that IBM allegedly paid $2.4 million over allegations of race

discrimination in sales commissions.8 |

| ● | In May 2020, IBM agreed to pay $80,000 to settle pregnancy discrimination claims.9 |

This lack of consistency, or explanation, between IBM’s statements

and what is available to investors through other sources is a key reason why an independent review of the effectiveness of IBM’s

efforts to prevent harassment and discrimination is requested.

The Company’s Practices Remain Unclear

The company claims that it does not use concealment clauses, while

also stating that it uses confidentiality provisions in post-employment agreements. This has created confusion for investors.

As defined in the shareholder resolutions, concealment clauses are

“employment or post-employment agreements, such as arbitration or nondisclosure agreements, that IBM asks employees or contractors

to sign which would limit their ability to discuss unlawful acts in the workplace, including harassment and discrimination.” In

the IBM Board’s statement of opposition and in IBM’s “Report on Concealment Clauses,”10 it writes that

“IBM does not require concealment clauses” [as a condition of employment]. However, it also states in these same documents

that “IBM uses confidentiality provisions in post-employment agreements in limited circumstances only where mutually agreed

by the parties and legally permitted.” [emphasis added]

The assumption is that while former employees may voluntarily sign

post-employment agreements with arbitration and NDA provisions at the point of severance, at this point in time, they may be concerned

about their finances. Therefore, while the signing of a severance agreement may not be required, an individual may be facing significant

financial incentives to sign this document. The extent of this financial incentive, should it exist, has not been shared by IBM. The release

of the aggregated costs of these types of agreements is suggested for inclusion in the requested report.

IBM’s Apparent Use of Concealment Clauses Remain a Significant

Concern

A number of risks are associated with the use of concealment clauses.

1) Risk of a possible surge in claims

IBM’s ongoing use of concealment clauses creates the risk of

a sudden surge of claims against the company should the laws change or other legal pathways emerge to invalidate post-employment concealment

clauses. When previously hidden discrimination or harassment problems surface, multiple employees may step forward at once, creating a

sudden and significant brand liability. Allegations of harassment or discrimination, once released, may significantly disrupt business

operations and undermine long-term business strategies, as occurred at Activision, 21st Century Fox, Alphabet, CBS, Intel, Nike, Pinterest,

Texas Instruments, Walt Disney, Wynn Resorts, and many others.

2) Risk of harm to relationship with employees

In addition to the IBM employees who have already sought relief from

arbitration clauses, this issue can easily escalate at a company where it is masking significant harassment or discrimination issues.

For instance, employees have protested the use of arbitration or other concealment clauses at other technology companies, including Activision,

Airbnb, eBay, Meta, Pinterest, and Riot Games.11 For years, Activision Blizzard reportedly withheld information from its board

of directors about sexual misconduct complaints, leading, once the problems surfaced, to significant negative press attention; several

government lawsuits alleging Activision Blizzard permitted a culture of sexual harassment, abuse, and discrimination; and multiple employee

walkouts. Since the controversy erupted, the company ended its use of forced arbitration in sexual harassment and discrimination claims.12

_____________________________

10 https://www.ibm.com/impact/pdf/Concealment%20Clause%20Report.pdf

11 https://www.theguardian.com/media/2021/oct/20/netflix-employees-activism-walkout-dave-chappelle-controversy

12 https://www.theverge.com/2021/10/28/22750450/activision-blizzard-ends-forced-arbitration-bobby-kotick-paycut

3) Risk of harm to brand perception

The use of concealment clauses for discrimination and harassment claims

has generated significant controversy, as the #MeToo and racial justice movements call attention to how provisions limiting workers’

(or former workers’) ability to speak freely about their experiences can perpetuate abuse and protect predators. Organized groups

of tech workers, members of Congress, and political candidates have all expressed opposition to mandatory arbitration and nondisclosure

agreements; press coverage has been abundant.

4) Risk of litigation

In 2020, in violation of their signed nondisclosure agreements, a number

of workers spoke to the press about experiences of racism and discriminatory pay at Pinterest.13 Shareholders ultimately sued

Pinterest executives, alleging a breach of fiduciary duty by “perpetrating or knowingly ignoring the long-standing and systemic

culture of discrimination and retaliation.”14 As part of its shareholder settlement agreement, Pinterest pledged $50

million to overhaul its workplace culture and promote diversity, and it agreed to release former employees from nondisclosure agreements.15

5) Risk that the use of concealment clauses undermines diversity

and inclusion programs

In February 2018, attorneys general from all 50 states signed a letter

calling for the end of mandatory arbitration in sexual harassment cases. They stated, “[C]oncerns arise from the secrecy requirements

of arbitration clauses, which disserve the public interest by keeping both the harassment complaints and any settlements confidential.

… Ending mandatory arbitration of sexual harassment claims would help to put a stop to the culture of silence that protects perpetrators

at the cost of their victims.”16

Significant concerns about arbitration’s appropriateness as a

forum for handling discrimination cases have been raised by the EEOC, the U.S. Government Accountability Office, and FINRA. For instance,

in 2016, the legal counsel at the EEOC observed that “The EEOC’s stance has always been that mandatory arbitration of employment

discrimination is bad: the secrecy, the lack of precedent.”17

The benefits of diverse and inclusive workplaces have been well documented.

Research on this topic includes, but is not limited to the following:

| ● | Credit Suisse, in a study of over 3,000 companies, found that companies with women representing more than 20% of managers have had

greater share price increases over the past decade than those companies with lower representations of women in management.18 |

| ● | McKinsey has found that companies in the top quartile for gender diversity in corporate leadership were 21% more likely to have above-average

profitability, compared to those companies in the bottom quartile. Similarly, leaders in racial and ethnic diversity were 33% more likely

to outperform industry peers on profitability than companies in the bottom quartile.19 |

| ● | A 2019 study of the S&P 500 by The Wall Street Journal found that the 20 most-diverse companies had an average annual five-year

stock return that was 5.8% higher than the 20 least-diverse companies.20 |

_____________________________

13 https://www.washingtonpost.com/technology/2020/07/03/pinterest-race-bias-black-employees/

14 https://www.institutionalinvestor.com/article/b1phvnsfffr2bp/Retirement-System-Sues-Pinterest-Board-and-Execs-Over-Discrimination

15 https://www.nytimes.com/2021/11/24/technology/pinterest-discrimination-settlement.html

16 http://myfloridalegal.com/webfiles.nsf/WF/HFIS-AVWMYN/$file/NAAG+letter+to+Congress+Sexual+Harassment+Mandatory+Arbitration.pdf

17 https://time.com/4540111/arbitration-clauses-sexual-harassment

18 https://www.cnbc.com/2019/10/14/female-leaders-may-boost-share-price-performance-credit-suisse-says.html

19 https://www.mckinsey.com/business-functions/organization/our-insights/delivering-through-diversity

20 https://www.wsj.com/articles/the-business-case-for-more-diversity-11572091200

| ● | Of particular relevance to IBM, a strong link seems to exist between diversity and innovation revenue. BCG has found that, after surveying

1,700 companies, companies with above-average diversity produced significantly greater percentages of revenue from products or services

launched within the previous three years than those with below-average diversity.21 |

6) Risks associated with a shifting legislative landscape

IBM is currently operating under a patchwork of state and international

laws. At the federal level, the Ending Forced Arbitration for Sexual Assault and Sexual Harassment Act and the Speak Out Act have banned

the use of arbitration and pre-dispute nondisclosure agreements for sexual assault and harassment. Within the states, California and Washington

have prohibited nondisclosure agreements from including any harassment or discrimination allegations.

7) Risk that IBM will lose talent to peers

Technology companies, with which IBM may compete for recruitment and

hiring, have moved away from the use of employee arbitration in claims of harassment or discrimination, or they have never required its

use. Many technology companies, including Alphabet, Apple, Microsoft, and Salesforce, have moved away from the use of these policies.

Investors Benefit from Accountability Systems within Companies.

Intrinsic to investments in public companies is the risk that company

managers’ goals do not align with those of the company’s investors. Concealment clauses also provide advantages to managers

and executives who wish to limit their own accountability and keep their actions hidden from external stakeholders; these clauses mask

true workplace conditions from external parties, increasing the risk of diverging investor and manager goals.

The use of concealment clauses raises concerns that corporate managers

are operating with a sense of impunity, and rather than relying on the successful implementation of best practices, they may be relying

on the ability of arbitration, nondisclosure agreements, and nondisparagement agreements to mask failures in their internal systems. In

addition, arbitration, in its ability to prohibit class-action lawsuits, reduces the incentive for companies to address smaller, yet potentially

widespread, problems within their human capital management systems.

CONCLUSION

While the company asserts that it uses concealment clauses only in

limited circumstances and that it has a “safe and productive work environment,” the EEOC’s concerns about age discrimination

at IBM, coupled with related lawsuits on behalf of former employees, suggest that IBM’s use of concealment clauses may be masking

concerning employment practices from the public eye. With concealment clauses in place, investors may be barred from understanding the

extent of significant human resources challenges within the company.

In order to remedy this lack of transparency, a majority of shareholders

in 2022 voted in favor of a report assessing the potential risks to the company associated with its use of concealment clauses in the

context of harassment, discrimination, and other unlawful acts. However, IBM has provided inadequate transparency regarding the effectiveness

and outcomes of its efforts to prevent harassment and discrimination.

_____________________________

21 https://www.forbes.com/sites/forbesinsights/2020/01/15/diversity-confirmed-to-boost-innovation-and-financial-results/

We urge you to vote in favor of Item 8 on the management’s proxy,

to provide investors with the needed information to assess the Company’s management of human capital risks.

***

For questions regarding Item No. 8, please contact Molly Betournay,

Clean Yield Asset Management, molly@cleanyield.com, (802)-526-2525.

This is not a solicitation of authority to vote your proxy. Please

DO NOT send us your proxy card; Clean Yield Asset Management is not able to vote your proxies, nor does this communication contemplate

such an event. Clean Yield Asset Management urges shareholders to vote for Item No. 8 following the instructions provided on management's

proxy mailing.

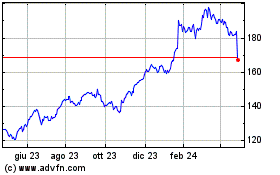

Grafico Azioni International Business M... (NYSE:IBM)

Storico

Da Mar 2024 a Apr 2024

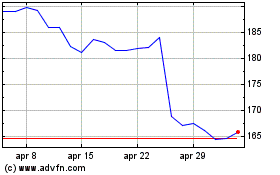

Grafico Azioni International Business M... (NYSE:IBM)

Storico

Da Apr 2023 a Apr 2024