AM Best has downgraded the Financial Strength Rating

(FSR) to A (Excellent) from A+ (Superior) and the Long-Term Issuer

Credit Ratings (Long-Term ICR) to “a+” (Excellent) from “aa-”

(Superior) of The Lincoln National Life Insurance Company and its

wholly owned subsidiary, Lincoln Life & Annuity Company of New

York (Syracuse, NY). These companies are the key life/health

insurance subsidiaries of Lincoln National Corporation (LNC)

(headquartered in Radnor, PA) [NYSE: LNC] and are referred to

collectively as Lincoln Financial Group (Lincoln). The outlook of

the Long-Term ICR has been revised to negative from stable, while

the outlook of the FSR is stable.

Additionally, AM Best has downgraded the Long-Term ICR to “bbb+”

(Good) from “a-” (Excellent) of LNC. The outlook of these ratings

has been revised to negative from stable.

Lastly, AM Best has downgraded the Long-Term ICR to “a”

(Excellent) from “a+” (Excellent) and affirmed the FSR of A

(Excellent) of First Penn-Pacific Life Insurance Company (FPP). The

outlook of these ratings was revised to negative from stable.

(Please see below for a detailed listing of the Long-and Short-Term

IRs.)

The ratings of Lincoln reflect its balance sheet strength, which

AM Best currently assesses as very strong, as well as its strong

operating performance, favorable business profile and appropriate

enterprise risk management (ERM).

The ratings downgrade of Lincoln reflects a reduction in its ERM

assessment to appropriate from very strong due to the recent

volatility in capital, as well as the reactive nature of the

company’s capital maintenance initiatives. AM Best believes that

the revised ERM assessment is indicative of the company’s elevated

risk profile, which requires an enhanced level of risk management

capabilities. AM Best notes that Lincoln continues to maintain an

extensive risk management framework with a focus on stress testing

and operational risks and will be upgrading its hedging program to

better protect statutory capital during stressed market

environments.

The negative outlook reflects pressure on Lincoln’s balance

sheet strength position due to a change in assumptions in the

company’s universal life (UL) insurance block of business; this

resulted in a significant GAAP unlocking charge in third-quarter

2022 and a goodwill write-down of approximately $634 million

related to its variable UL block of business. In addition,

risk-adjusted capital, as measured by Best’s Capital Adequacy Ratio

(BCAR), has declined due to an expected statutory capital charge of

approximately $550 million to be recorded during fourth-quarter

2022 as part of the company’s UL assumption update. In addition,

risk-adjusted capital was negatively impacted from equity market

volatility over the past year.

AM Best will continue to monitor Lincoln’s ability to execute on

its capital management initiatives designed to rebuild its capital

position. These initiatives include several opportunities such as a

potential block reinsurance transaction, indefinitely pausing its

share-buyback program, as well as a preferred equity capital raise.

A failure to execute on these initiatives may result in a negative

rating action.

Lincoln’s operating performance remains within the strong

assessment category and AM Best notes that the unlocking charge

also adversely impacted earnings, resulting in a significant

third-quarter operating loss. The company has experienced favorable

premium growth in recent periods and earnings are expected to

benefit from a rising interest rate environment. However, earnings

may continue to be pressured by a volatile equity market, which has

reduced the level of fee income from assets under management in

recent periods. The ratings of FPP reflect its balance sheet

strength, which AM Best assesses as very strong, as well as its

adequate operating performance, limited business profile, its

appropriate ERM and the benefits it receives as a subsidiary of

LNC. The downgrade and negative outlook reflect the reduced

financial strength of its parent. AM Best notes that FPP’s

liability profile primarily consists of term life and current

assumption UL policies and believes that FPP will continue to

contribute a moderate amount of earnings to Lincoln over the near

to medium-term as it continues to operate in run-off.

The following Long-Term IRs have been downgraded with the

outlooks revised to negative from stable:

Lincoln National Corporation— — to “bbb” (Good) from “bbb+”

(Good) on $562,034,000 million LIBOR + 236 bps subordinated notes,

due 2066 — to “bbb” (Good) from “bbb+” (Good) on $432,743,000

million LIBOR + 204 bps subordinated notes, due 2067

The following Long-Term IRs have been downgraded with the

outlooks revised to negative from stable:

Lincoln National Corporation— — to “bbb+” (Good) from “a-”

(Excellent) on $500 million 4.00% senior unsecured notes, due 2023

— to “bbb+” (Good) from “a-” (Excellent) on $300 million 3.35%

senior unsecured notes, due 2025 — to “bbb+” (Good) from “a-”

(Excellent) on $400 million 3.625% senior unsecured notes, due 2026

— to “bbb+” (Good) from “a-” (Excellent) on $500 million 3.8%

senior unsecured notes, due 2028 — to “bbb+” (Good) from “a-”

(Excellent) on $500 million 3.05% senior unsecured notes, due 2030

— to “bbb+” (Good) from “a-” (Excellent) on $500 million 3.40%

senior unsecured notes, due 2031 — to “bbb+” (Good) from “a-”

(Excellent) on $300 million 3.40% senior unsecured notes, due 2032

— to “bbb+” (Good) from “a-” (Excellent) on $500 million 6.15%

senior unsecured notes, due 2036 — to “bbb+” (Good) from “a-”

(Excellent) on $375 million 6.30% senior unsecured notes, due 2037

— to “bbb+” (Good) from “a-” (Excellent) on $500 million 7.00%

senior unsecured notes, due 2040 — to “bbb+” (Good) from “a-”

(Excellent) on $450 million 4.35% senior unsecured notes, due 2048

— to “bbb+” (Good) from “a-” (Excellent) on $300 million 4.375%

senior unsecured notes, due 2050 — to “bbb-” (Good) from “bbb”

(Good) on $800 million LIBOR + 236 bps junior subordinated capital

securities, due 2066 ($160 million outstanding) — to “bbb-” (Good)

from “bbb” (Good) on $500 million LIBOR + 204 bps junior

subordinated capital securities, due 2067 ($58 million

outstanding)

The following Short-Term IR has been downgraded:

Lincoln National Corporation— — to AMB-2 (Satisfactory) from

AMB-1 (Outstanding) on commercial paper

The following indicative Long-Term IRs on securities available

under a universal shelf registration have been downgraded with the

outlooks revised to negative from stable:

Lincoln National Corporation— — to “bbb+” (Good) from “a-”

(Excellent) on senior unsecured notes — to “bbb” (Good) from “bbb+”

(Good) on subordinated notes — to “bbb-” (Good) from “bbb” (Good)

on preferred stock — to “bbb-” (Good) from “bbb” (Good) on junior

subordinated notes

This press release relates to Credit Ratings that have been

published on AM Best’s website. For all rating information relating

to the release and pertinent disclosures, including details of the

office responsible for issuing each of the individual ratings

referenced in this release, please see AM Best’s Recent

Rating Activity web page. For additional information

regarding the use and limitations of Credit Rating opinions, please

view Guide to Best's Credit Ratings. For information

on the proper use of Best’s Credit Ratings, Best’s Performance

Assessments, Best’s Preliminary Credit Assessments and AM Best

press releases, please view Guide to Proper Use of Best’s

Ratings & Assessments.

AM Best is a global credit rating agency, news publisher and

data analytics provider specializing in the insurance industry.

Headquartered in the United States, the company does business in

over 100 countries with regional offices in London, Amsterdam,

Dubai, Hong Kong, Singapore and Mexico City. For more information,

visit www.ambest.com.

Copyright © 2022 by A.M. Best Rating

Services, Inc. and/or its affiliates. ALL RIGHTS RESERVED.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20221109005735/en/

Shauna Nelson Senior Financial Analyst +1 908

439 2200, ext. 5365 shauna.nelson@ambest.com

Michael Adams Associate Director +1 908 439

2200, ext. 5133 michael.adams@ambest.com

Christopher Sharkey Manager, Public Relations

+1 908 439 2200, ext. 5159

christopher.sharkey@ambest.com

Al Slavin Communications Specialist +1 908 439

2200, ext. 5098 al.slavin@ambest.com

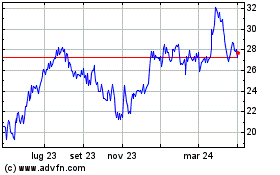

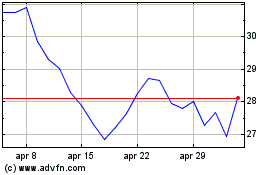

Grafico Azioni Lincoln National (NYSE:LNC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lincoln National (NYSE:LNC)

Storico

Da Apr 2023 a Apr 2024