Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

15 Novembre 2022 - 11:28PM

Edgar (US Regulatory)

|

|

|

| Final Term Sheet To preliminary prospectus

supplement dated November 15, 2022 (To prospectus dated

September 25, 2020) |

|

Filed pursuant to Rule 433

Registration number 333-249058

November 15, 2022 |

Lincoln National Corporation

20,000,000 Depositary Shares, each representing a 1/1,000th interest in a share of

9.000% Non-Cumulative Preferred Stock, Series D

Final Term Sheet, dated November 15, 2022

|

|

|

| Issuer: |

|

Lincoln National Corporation (“Issuer”) |

|

|

| Title of Securities: |

|

Depositary Shares (the “Depositary Shares”), each representing a 1/1,000th interest in a share of the Issuer’s 9.000% Non-Cumulative Preferred Stock, Series D (the

“Preferred Shares”) |

|

|

| Number of Depositary Shares: |

|

20,000,000 (corresponding to 20,000 Preferred Shares) |

|

|

| Liquidation Preference: |

|

$25,000 liquidation preference per Preferred Share (equivalent to $25.00 per Depositary Share), plus any declared and unpaid dividends, without accumulation of any undeclared dividends |

|

|

| Format: |

|

SEC Registered |

|

|

| Trade Date: |

|

November 15, 2022 |

|

|

| Settlement Date (T+5)*: |

|

November 22, 2022 |

|

|

| Maturity Date: |

|

Perpetual |

|

|

| Price to the Public: |

|

$25.00 per Depositary Share |

|

|

| Underwriting Discount: |

|

$0.7875 per Depositary Share (Retail) $0.2500

per Depositary Share (Institutional) |

|

|

| Net Proceeds (after Underwriting Discount and before Expenses): |

|

$24.2125 per Depositary Share (Retail) $24.7500

per Depositary Share (Institutional) $494,731,250 total |

|

|

| Dividend Rate: |

|

9.000% per year on the stated amount of $25,000 for each Preferred Share |

|

|

| Dividend Payment Dates: |

|

When, as and if declared by the Issuer’s board of directors (or a duly authorized committee thereof), the Issuer will pay dividends on a non-cumulative basis quarterly in arrears on the

first day of March, June, September and December of each year commencing on March 1, 2023 |

|

|

|

| Optional Redemption: |

|

The Issuer may, at its option, redeem the Preferred Shares:

• in whole but not in part, at any time prior to December 1, 2027, within 90 days after the

occurrence of a rating agency event at a redemption price equal to 102% of the stated amount of a share of Series C Preferred Stock (initially, $25,500 per share of Series C Preferred Stock, equivalent to $25.50 per Depositary Share), plus an amount

equal to any dividends per share that have accrued but not been declared and paid for the then-current dividend period to, but excluding, such redemption date; and

• (i) in whole but not in part, at any time prior to December 1, 2027, within 90 days after the

occurrence of a regulatory capital event, or (ii) in whole or in part, at any time or from time to time, on or after December 1, 2027, in each case, at a redemption price equal to the stated amount of a share of Series C Preferred Stock

(initially, $25,000 per share of Series C Preferred Stock, equivalent to $25.00 per Depositary Share), plus an amount equal to any dividends per share that have accrued but not been declared and paid for the then-current dividend period to, but

excluding, such redemption date |

|

|

| CUSIP/ISIN: |

|

534187885 / US5341878859 |

|

|

| Day Count Convention: |

|

30/360 |

|

|

| Listing: |

|

Application will be made to list the Depositary Shares on the New York Stock Exchange |

|

|

| Ratings** (expected): |

|

Baa3 (Moody’s) / BBB- (S&P) / BBB- (Fitch) |

|

|

| Concurrent Offering: |

|

Concurrently with this offering, the Issuer is also offering 500,000 depositary shares, each representing a 1/25th interest in a share of the Issuer’s 9.250% Fixed Rate Reset

Non-Cumulative Preferred Stock, Series C, with a liquidation preference of $25,000 per share ($1,000.00 per depositary share) (the “Concurrent Preferred Offering”). The Concurrent Preferred Offering

is being made by means of a separate prospectus supplement and not by means of the prospectus supplement to which this pricing term sheet relates. This communication is not an offer to sell or a solicitation of an offer to buy any securities being

offered in the Concurrent Preferred Offering. The closing of this offering and the Concurrent Preferred Offering are not conditioned on each other. |

|

|

| Joint Book-Running Managers: |

|

BofA Securities, Inc. Goldman Sachs &

Co. LLC J.P. Morgan Securities LLC Morgan Stanley &

Co. LLC Wells Fargo Securities, LLC |

|

|

| Co-Manager: |

|

Citigroup Global Markets Inc. |

The issuer has filed a registration statement (including a prospectus) with the SEC for the offering to

which this communication relates. Before you invest, you should read the prospectus in that registration statement and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may get

these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the issuer, any underwriter or any dealer participating in the offering will arrange to send you the prospectus if you request it by calling BofA

Securities, Inc. toll-free at 1-800-294-1322, Goldman Sachs & Co. LLC toll-free at 1-866-471-2526, J.P. Morgan Securities LLC toll-free at

1-212-834-4533, Morgan Stanley & Co. LLC toll-free at 1-800-584-6837 or Wells Fargo Securities, LLC toll-free at 1-800-645-3751.

| * |

It is expected that delivery of the Depositary Shares will be made against payment therefor on or about

November 22, 2022, which is five business days following the date of pricing of the Depositary Shares (this settlement cycle being referred to as “T+5”). Under Rule 15c6-1 of the Securities

Exchange Act of 1934, as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to any such trade expressly agree otherwise. Accordingly, purchasers who wish to trade their Depositary Shares

prior to their date of delivery may be required, by virtue of the fact that the Depositary Shares initially will settle in T+5, to specify an alternate settlement cycle at the time of any such trade to prevent a failed settlement. Purchasers of

Depositary Shares who wish to trade such Depositary Shares prior to their date of delivery should consult their own advisors. |

| ** |

An explanation of the significance of ratings may be obtained from the rating agencies. Generally, rating

agencies base their ratings on such material and information, and such of their own investigations, studies and assumptions, as they deem appropriate. The ratings of the Depositary Shares should be evaluated independently from similar ratings of

other securities. A credit rating of a security is not a recommendation to buy, sell or hold securities and may be subject to review, revision, suspension, reduction or withdrawal at any time by the assigning rating agency. |

Any disclaimers or other notices that may appear below are not applicable to this communication and should be disregarded. Such disclaimers or other

notices were automatically generated as a result of this communication being sent via Bloomberg or another email system.

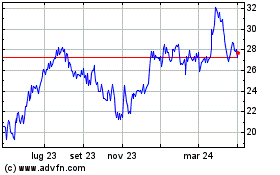

Grafico Azioni Lincoln National (NYSE:LNC)

Storico

Da Mar 2024 a Apr 2024

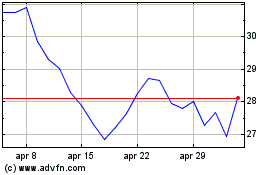

Grafico Azioni Lincoln National (NYSE:LNC)

Storico

Da Apr 2023 a Apr 2024