New Lincoln Financial Group Study Finds More Women Are Setting Financial Goals and Could Benefit From a Financial Wellness Mindset

23 Marzo 2023 - 2:00PM

Business Wire

Company’s research also reinforces the role

financial advice can play in helping women achieve financial

security

A new study finds women are taking steps in the right direction

toward strengthening their financial future and could benefit from

a comprehensive look at their overall financial wellness. Lincoln

Financial Group’s (NYSE: LNC) Consumer Sentiment Tracker found that

72% of women report setting financial goals this year, with women

identifying a few top areas of focus including earning

more/increasing income (48%), paying off debt (45%), creating or

sticking to a budget (42%) and increasing or maintaining emergency

savings (40%).

Financial Health is a Mindset

“Our research shows that women are committed to creating

positive outcomes, but may be focused on competing financial

goals,” said Sharon Scanlon, senior vice president, Customer

Experience, Marketing and Transformation, Lincoln Financial Group.

“The key is to not view our finances through a fragmented and

number-driven lens, but to evaluate our overall financial wellness,

which is the intersection of all these needs and a barometer for

how we’re progressing. By shifting our attention to the bigger

picture, we can get active in our financial lives, make more

informed decisions to help us lower financial stress and achieve

financial security.”

Lincoln’s study went on to reveal that women feel a sense of

financial security when they have stability: living within their

means, protecting against the unexpected, no debt and predictable

income. In many respects, women and men are aligned in how they

define financial security, but women are much more likely to say it

means protection against the unexpected for themselves and their

loved ones (61% of women vs. 46% of men).

“Financial products and solutions can help you achieve your

financial goals, as well as make a profound difference in the lives

of the people who matter most to you,” said Scanlon. “Check to see

if your employer offers financial wellness tools and resources that

can help you assess your particular situation and create a

financial plan, one that takes basic budgeting and saving to the

next level by considering every aspect of your financial life.”

Women Want Financial Advice

Financial professionals can also play an important role in

financial success, especially for those seeking a greater

understanding of insurance and retirement solutions designed to

strengthen financial health and offer protection. According to

Lincoln’s research, 71% of women are increasingly looking for and

open to financial planning advice. More than a quarter of women who

do not currently work with a financial professional would like to

discuss the following topics:

- Retirement savings planning (33%)

- Retirement income planning (31%)

- Cash management/budgeting (29%)

- Debt management (27%)

- Insurance--life, health, disability, etc. (28%)

From increasing savings in a workplace retirement plan to

protecting their paycheck in the event of an unplanned illness or

injury, women can implement a variety of strategies to create a

financial cushion and prioritize their long-term financial

future.

“A financial professional can provide the personalized guidance

that helps women become better-positioned to achieve their unique

financial goals, protect their families and enjoy financial

security—and that’s at the heart of financial wellness,” said

Scanlon.

Visit www.lfg.com for more tools and resources.

Consumer Sentiment Tracker 2022 Methodology The goal of

this research is to gauge consumer sentiment on a variety of

financial topics. Data was collected in March, April, May, June,

July, September, October and November 2022 using the Qualtrics

survey platform. Responses were collected from a total of 1,000+

U.S. adults each month. The sample included quotas to be

representative of the total U.S. adult population.

About Lincoln Financial Group Lincoln Financial Group

provides advice and solutions that help people take charge of their

financial lives with confidence and optimism. Today, approximately

16 million customers trust our retirement, insurance and wealth

protection expertise to help address their lifestyle, savings and

income goals, and guard against long-term care expenses.

Headquartered in Radnor, Pennsylvania, Lincoln Financial Group is

the marketing name for Lincoln National Corporation (NYSE:LNC) and

its affiliates. The company had $282 billion in end-of-period

account values as of December 31, 2022. Lincoln Financial Group is

a committed corporate citizen and is included on the Dow Jones

Sustainability Index North America and ranks among Newsweek’s Most

Responsible Companies. Dedicated to diversity, equity and

inclusion, we are included on transparency benchmarking tools such

as the Corporate Equality Index, the Disability Equality Index and

the Bloomberg Gender-Equality Index. Committed to providing our

employees with flexible work arrangements, we were named to

FlexJobs’ list of the Top 100 Companies to Watch for Remote Jobs in

2022 and 2023. With a long and rich legacy of acting ethically,

telling the truth and speaking up for what is right, Lincoln was

recognized as one of Ethisphere’s 2022 World’s Most Ethical

Companies®. We create opportunities for early career talent through

our intern development program, which ranks among WayUp and Yello’s

annual list of Top 100 Internship Programs. Learn more at:

www.LincolnFinancial.com. Follow us on Facebook, Twitter, LinkedIn,

and Instagram. Sign up for email alerts at

http://newsroom.lfg.com.

LCN-5538127-032223

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230323005203/en/

Media: Holly Fair Lincoln

Financial Group 484-583-1632 Holly.fair@lfg.com

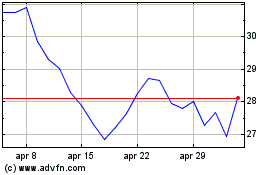

Grafico Azioni Lincoln National (NYSE:LNC)

Storico

Da Mar 2024 a Apr 2024

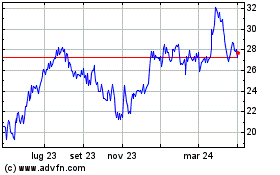

Grafico Azioni Lincoln National (NYSE:LNC)

Storico

Da Apr 2023 a Apr 2024