In conjunction with Annuity Awareness Month,

new data says retirees would go back in time to choose investments

that provide a steady stream of income as well as to plan better

for inflation and volatility.

According to a recent study from Lincoln Financial Group (NYSE:

LNC), more than 60% of retirees would like to go back and plan

differently for their retirement if they could.2 Overwhelmingly,

retirees wish they’d started saving earlier and saved more for

retirement. Other “would’ve, could’ve, should’ve” reflections

include choosing investments that provide a steady stream of

income, with 63% reporting they’d like to receive an automatic

paycheck from their retirement assets; and planning better for the

unexpected like inflation and volatility, with 85% interested in

investing in solutions that protect them from losses during market

volatility.

Lincoln Financial released this new data just ahead of

Annuity Awareness Month, which is recognized through June,

to reinforce the role annuities can play in holistic financial

planning as tools to help provide lifetime income and protect and

grow retirement savings no matter how the market performs.

Annuities are investments issued by insurance companies that can

help investors build savings, with options to ensure a continued

income stream, like a “retirement paycheck,” that will last

throughout their lifetime. There are many different types of

annuities and diverse optional benefits that can be used to add

customization based on an investor’s unique wants and needs.

Investors can learn more about annuities by accessing educational

resources from the Alliance for Lifetime Income, or by visiting

LincolnFinancial.com to be connected with a financial

professional.

“There aren't many opportunities for a do-over when it comes to

retirement planning. Yet, two of the major concerns that retirees

voiced in our study – guaranteed income and protection from loss –

can be addressed with annuities,” said Tim Seifert, senior vice

president and head of Retirement Solutions Distribution at Lincoln

Financial. “With a record number of Americans set to retire next

year3, Annuities Awareness Month is a good time for investors to

work with a financial professional to understand how and why

incorporating annuities into their financial strategies can help

them retire confidently without regret.”

Lincoln Financial offers a broad and innovative portfolio of

annuity solutions, including the top-selling indexed variable

annuity, Lincoln Level Advantage®, which has helped more than

115,000 investors protect and grow their portfolios since launching

five years ago.

About Lincoln Financial Group Lincoln Financial Group

provides advice and solutions that help people take charge of their

financial lives with confidence and optimism. Today, approximately

16 million customers trust our retirement, insurance and wealth

protection expertise to help address their lifestyle, savings and

income goals, and guard against long-term care expenses.

Headquartered in Radnor, Pennsylvania, Lincoln Financial Group is

the marketing name for Lincoln National Corporation (NYSE:LNC) and

its affiliates. The company had $290 billion in end-of-period

account balances net of reinsurance as of March 31, 2023. Lincoln

Financial Group is a committed corporate citizen included on major

sustainability indices including the Dow Jones Sustainability Index

North America and ranks among Newsweek’s Most Responsible

Companies. Dedicated to diversity, equity and inclusion, we are

included on transparency benchmarking tools such as the Corporate

Equality Index, the Disability Equality Index and the Bloomberg

Gender-Equality Index. Committed to providing our employees with

flexible work arrangements, we were named to FlexJobs’ list of the

Top 100 Companies to Watch for Remote Jobs in 2022. With a long and

rich legacy of acting ethically, telling the truth and speaking up

for what is right, Lincoln was recognized as one of Ethisphere’s

2022 World’s Most Ethical Companies®. We create opportunities for

early career talent through our intern development program, which

ranks among WayUp and Yello’s annual list of Top 100 Internship

Programs. Learn more at: www.LincolnFinancial.com. Follow us on

Facebook, Twitter, LinkedIn, and Instagram. Sign up for email

alerts at http://newsroom.lfg.com.

Important Information: Lincoln Financial Group®

affiliates, their distributors, and their respective employees,

representatives, and/or insurance agents do not provide tax,

accounting, or legal advice. Please consult an independent advisor

as to any tax, accounting, or legal statements made herein.

Lincoln Level Advantage® indexed variable annuity is a long-term

investment product designed for retirement purposes. There are no

explicit fees associated with the indexed-linked account options

available. There are associated fees with the variable annuity

subaccounts, which include a product charge, and administrative

fees. Annuities are subject to market risk including loss of

principal. Withdrawals are subject to ordinary income tax treatment

and, if taken prior to age 59½ in nonqualified contracts, may be

subject to an additional 10% federal tax.

Indexed-linked variable annuity products are complex insurance

and investment vehicles and are subject to surrender charges for

early withdrawals. Please reference the prospectus for information

about the levels of protection available and other important

product information.

The risk of loss occurs each time you move into a new indexed

account after the end of an indexed term. The protection level

option selected in the indexed account helps protect you from some

downside risk. If the negative return is in excess of the

protection level selected, there is a risk of loss of

principal.

Investors are advised to consider the investment objectives,

risks, and charges and expenses of the variable annuity and its

underlying investment options carefully before investing. The

applicable prospectuses contain this and other important

information about the variable annuity and its underlying

investment options. Please call 888-868-2583 for free prospectuses.

Read them carefully before investing or sending money. Products and

features are subject to state availability.

Lincoln Level Advantage® indexed variable annuities (contract

form 30070-B and state variations) are issued by The Lincoln

National Life Insurance Company, Fort Wayne, IN, and distributed by

Lincoln Financial Distributors, Inc., a broker-dealer. The

Lincoln National Life Insurance Company does not solicit business

in the state of New York, nor is it authorized to do so.

All contract and rider guarantees, including those for

optional benefits, payment from the indexed accounts, or annuity

payout rates, are subject to the claims-paying ability of the

issuing insurance company. They are not backed by the

broker-dealer or insurance agency from which this annuity is

purchased, or any affiliates of those entities other than the

issuing company affiliates, and none makes any representations or

guarantees regarding the claims-paying ability of the issuer.

This product and the components and features contained within

are not available in all states or firms.

There is no additional tax-deferral benefit for an annuity

contract purchased in an IRA or other tax-qualified plan.

Contract form 30070-BID in Idaho.

Not available in New York.

Lincoln Financial Group is the marketing name for Lincoln

National Corporation and its affiliates. Affiliates are separately

responsible for their own financial and contractual

obligations.

© 2023 Lincoln National Corporation. All rights reserved.

LCN-5693890-051823

_______________ 1 Source: Lincoln Financial, Consumer Sentiment

Tracker, 2023. 2 Source: Lincoln Financial, Consumer Sentiment

Tracker, 2023. 3 Source: Lincoln Financial & the Alliance for

Lifetime Income, “America’s Peak 65 milestone,” 2022.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230525005148/en/

Media: Sarah Boxler, sarah.boxler@lfg.com

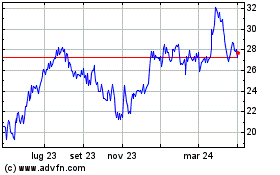

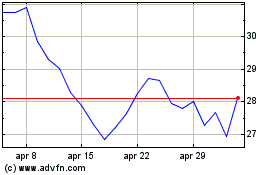

Grafico Azioni Lincoln National (NYSE:LNC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Lincoln National (NYSE:LNC)

Storico

Da Apr 2023 a Apr 2024