The Prudential Insurance Company of America has been selected in

an industry-first multiemployer plan pension risk transfer (PRT),

to fulfill retirement benefit promises for the Sound Retirement

Trust, a Seattle-based joint labor-management board of trustees

that provides grocery workers of contributing employers with

retirement benefits.

The transaction will settle approximately $221 million of Sound

Retirement Trust pension liabilities and provide added retirement

security for approximately 8,700 retirees and their

beneficiaries.

“Prudential is proud to help protect the life’s work of these

Sound Retirement Trust retirees, who literally spent their careers

helping to feed Americans,” said Glenn O’Brien, head of

Institutional Retirement Strategies Distribution at Prudential. “We

are excited for the opportunity to apply Prudential’s deep

retirement experience and leadership to help these individuals have

a secure retirement, so they can live a better life, longer.”

Multiemployer pension plans, like the one sponsored by the board

of trustees of Sound Retirement Trust, are retirement programs

jointly offered by contributing employers and labor unions and are

often referred to as Taft-Hartley plans. The Taft-Hartley Act of

1947 allows employers in the same industry, such as construction or

transportation, or in this case, the retail food industry, to

contribute to a retirement plan for union members based on a

collective bargaining agreement. Under these plans, union workers

can transfer from job to job with minimal disruption in retirement

plan participation, as long as their employers have bargained to

contribute to the same retirement plan.

“The decision to purchase a group annuity contract to cover

8,700 United Food and Commercial Workers (UFCW) retirees of the

Sound Retirement Trust was determined over a year of careful due

diligence and deliberation,” said union trustee and president of

UFCW Local 3000, Faye Guenther. “Prudential was selected because of

its historic track record as one of the safest annuity providers to

guarantee pension benefit payments in the United States.”

“The thoughtful approach by the board of trustees resulted in a

win-win for their retirees. The retirees who will receive payments

from Prudential benefit from having their benefits secured by one

of the leading providers in the PRT industry,” said Michael Clark,

chief commercial officer at Agilis and annuity placement consultant

to the board for this transaction. “For the participants that

remain in the multiemployer plan, they benefit from the improved

net cash flow and reduced funded status risk.”

Under the terms of the agreement in this transaction, The

Prudential Insurance Company of America, a subsidiary of Prudential

Financial, Inc. (NYSE: PRU) will assume responsibility for paying

retirement benefits to this transaction’s population of Sound

Retirement Trust retirees and their beneficiaries beginning Sept.

1, 2024.

Prudential has been an innovator and leader in the pension risk

transfer market since 1928, collaborating with clients to deliver

solutions that meet each organization’s unique needs to help them

de-risk and meet their financial objectives.

Prudential revolutionized the modern pension risk transfer

market with its pioneering pension buyouts with General Motors and

Verizon in 2012. Many similar transactions followed, including HP

Inc. in 2021, IBM in 2022 and, most recently, Shell USA and a

second transaction with Verizon in 2024.

ABOUT PRUDENTIAL

Prudential Financial, Inc. (NYSE: PRU), a global financial

services leader and premier active global investment manager with

approximately $1.5 trillion in assets under management as of June

30, 2024, has operations in the United States, Asia, Europe, and

Latin America. Prudential’s diverse and talented employees help

make lives better and create financial opportunity for more people

by expanding access to investing, insurance, and retirement

security. Prudential’s iconic Rock symbol has stood for strength,

stability, expertise, and innovation for nearly 150 years. For more

information, please visit news.prudential.com.

With nearly 100 years of retirement experience, the Retirement

Strategies team at Prudential delivers industry-leading solutions

for growth and protection to more than 2.5 million individual and

institutional customers.1 The business expands access to retirement

security through its Individual Retirement protected accumulation

and income strategies and its Institutional Retirement lines of

business spanning U.S. Pension Risk Transfer, International

Reinsurance, Stable Value, and Structured Settlements.

1 As of June 30, 2024.

© 2024 Prudential Financial, Inc. and its related entities.

Prudential, Prudential Retirement Strategies, the Prudential logo,

the Rock symbol and Rock Solid are service marks of PFI and its

related entities, registered in many jurisdictions worldwide.

Insurance products are issued by The Prudential Insurance

Company of America (PICA), Newark, New Jersey. PICA is a Prudential

Financial company. PICA is solely responsible for its financial

condition and contractual obligations.

ABOUT SOUND RETIREMENT TRUST

The Sound Retirement Trust provides employees across Washington

state with benefits for their retirement through a defined benefit

pension plan. The Sound Retirement Trust is sponsored and

administered by a joint labor-management board of trustees. The

members of UFCW 3000 are over 50,000 members working in grocery,

retail, health care, and other industries across Washington state,

northeast Oregon, and northern Idaho. UFCW 3000 is a chartered

member of UFCW International with over 1.4 million workers in North

America.

ABOUT AGILIS

Agilis provides actuarial and investment consulting using a

strategic approach to create innovative solutions for its clients,

leading them on the journey through implementation. Focused on

solutions entailing outsourced CIO (OCIO), actuarial and investment

consulting, derivatives management, specialty investment management

strategies, pension administration services, annuity buyouts and

plan terminations, and pooled employer 401(k) consulting, Agilis

finds dynamic solutions that create financial momentum for its

clients and create breakthrough strategies to seize growth

opportunities. For more information, please visit agilis.llc.

1082198-00001-00

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240828891562/en/

MEDIA CONTACT – PRUDENTIAL Claire Currie 973-802-4040

claire.currie@prudential.com

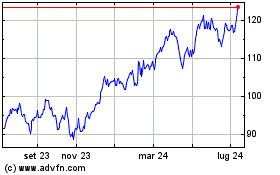

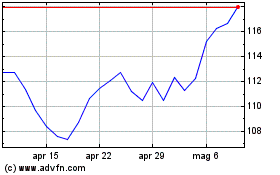

Grafico Azioni Prudential Financial (NYSE:PRU)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Prudential Financial (NYSE:PRU)

Storico

Da Nov 2023 a Nov 2024