New offering raises the bar on personalized advice at scale

to help savers reach retirement goals

PGIM,1 the $1.33 trillion global investment management business

of Prudential Financial, Inc. (NYSE: PRU), and iJoin, a leading

retirement plan technology innovator, have announced that the PGIM

RetireWell™ Managed Accounts — a highly personalized offering —

will soon be available to the growing list of iJoin-enabled

recordkeepers through its Managed Account Program (MAP)

marketplace. This integration leverages the power of the PGIM

RetireWell™ Advice Engine in combination with iJoin’s goals-based

user experience, portfolio allocation technology, and a plan

advisor’s investment lineup to enable a more holistic retirement

planning journey for plan participants.

This press release features multimedia. View

the full release here:

https://www.businesswire.com/news/home/20240930573133/en/

“The PGIM RetireWell Managed Accounts

were created to solve for the retirement challenge that American

workers face today — transforming savings into adequate,

sustainable retirement income.” -- Michael Miller, Head of PGIM DC

Solutions (Photo: Business Wire)

Configurable as a plan’s Qualified Default Investment

Alternative (QDIA) or via opt-in, PGIM RetireWell Managed Accounts

incorporate proprietary methodology and patent-pending technology

to create a personalized retirement strategy based on each

participant’s unique data, preferences and goals. Leveraging

iJoin’s sophisticated yet intuitive user experience, the PGIM

RetireWell Managed Account invites investors to fine-tune their

income goal by expressing risk tolerance preferences as well as

considering health-related priorities.

Michael Miller, head of PGIM DC Solutions, said: “The PGIM

RetireWell Managed Accounts were created to solve for the

retirement challenge that American workers face today —

transforming savings into an adequate, sustainable stream of

retirement income. PGIM’s highly personalized solution offers the

innovation employers need for better retirement outcomes for their

plan participants.”

Steve McCoy, CEO of iJoin, remarked: “We admire the significant

investment the PGIM team has made in developing an advisor-led

managed account experience that more holistically factors an

individual’s unique and changing circumstances. Together, we’re

able to present a highly differentiated user experience that

addresses underlying complexities while remaining intuitive.”

There is growing evidence that managed advice is desired by a

majority of plan participants2 and can lead to higher overall

savings rates.3

Since 2020, iJoin has integrated its data-driven, goals-based

participant experience with leading providers of managed account

programs, in-plan income, and IRA rollover solutions. Available

through a growing number of retirement plan recordkeepers,

financial advisors now enjoy unparalleled product choice with which

to make informed recommendations based on plan and participant

suitability.

The PGIM RetireWell Managed Accounts are part of PGIM

RetireWell™ Solutions, a suite of tools, products and solutions

developed to help defined contribution plan participants achieve

better retirement outcomes through holistic advice and

guidance.

Please contact PGIM DC Solutions for more program information

for plan recordkeepers and plan advisors.

ABOUT PGIM DC SOLUTIONS

As the retirement solutions provider of PGIM, PGIM DC Solutions

seeks to deliver innovative defined contribution solutions founded

on market-leading research and capabilities. Our highly experienced

team partners with clients on customized solutions to solve for

retirement income. As of June 30, 2024, PGIM has $170 billion in DC

assets under management and PGIM DC Solutions’ AUM is $1.3

billion.4

ABOUT PGIM

PGIM is the global asset management business of Prudential

Financial, Inc. (NYSE: PRU). In 41 offices across 18 countries, our

more than 1,400 investment professionals serve both retail and

institutional clients around the world.

As a leading global asset manager with $1.33 trillion in assets

under management,5 PGIM is built on a foundation of strength,

stability, and disciplined risk management. Our multi-affiliate

model allows us to deliver specialized expertise across key asset

classes with a focused investment approach. This gives our clients

a diversified suite of investment strategies and solutions with

global depth and scale across public and private asset classes,

including fixed income, equities, real estate, private credit, and

other alternatives. For more information, visit pgim.com.

Prudential Financial, Inc. (PFI) of the United States is not

affiliated in any manner with Prudential plc, incorporated in the

United Kingdom or with Prudential Assurance Company, a subsidiary

of M&G plc, incorporated in the United Kingdom. For more

information, please visit news.prudential.com.

ABOUT LDI-MAP, LLC (dba iJoin)

iJoin is a leading retirement plan infrastructure technology

partner supporting cost-efficient personalized managed account

programs, built-in plan health analytics and reporting tools,

financial education and wellness, access to guaranteed income

products, and IRA rollovers. We're built to help financial advisors

differentiate and win. LDI-MAP (d.b.a. iJoin) is a registered

investment advisor with the State of Arizona – 16430 N. Scottsdale

Road Suite 200, Scottsdale, AZ 85254. Learn more at

ijoinsuccess.com.

1 The term PGIM as used in this announcement includes PGIM DC

Solutions LLC, an indirect wholly owned subsidiary of PGIM,

Inc.

2 Source: The 2022 BlackRock Read on Retirement, 76% of plan

participants are interested in using a service that provides

personalized investment recommendations and manages their

investments on their behalf.

3 Source: Transamerica: Managed Accounts in Retirement Plans;

Measuring the impact of a personalized, goal-based retirement

strategy, 2023, page 6.

4 Reported data reflect the assets under management by PGIM and

its investment adviser affiliates for defined contribution

investment purposes only.

5 As of June 30, 2024

This material is being provided for informational or educational

purposes only and does not take into account the investment

objectives or financial situation of any client or prospective

clients. The information is not intended as investment advice and

is not a recommendation. Clients seeking information regarding

their particular investment needs should contact a financial

professional.

PGIM DC Solutions LLC ("PGIM DC Solutions") is an SEC-registered

investment adviser, a Delaware limited liability company, and an

indirect wholly-owned subsidiary of PGIM, Inc. ("PGIM"), the

principal asset management business of Prudential Financial, Inc.

("PFI") of the United States of America. PGIM DC Solutions is the

retirement solutions provider of PGIM and aims to provide

innovative defined contribution solutions founded on market leading

research and investment capabilities. Registration with the SEC

does not imply a certain level of skill or training. PGIM DC

Solutions does not establish or operate pension plans.

PGIM DC Solutions aims to help participants achieve their

retirement goals through their suite of “PGIM RetireWell™”

solutions. These solutions may include a range of investment

options including target date portfolios, retirement spending

strategies, and managed accounts powered by our proprietary advice

engine. There is no guarantee that investment or retirement goals

will be achieved. Use of the term “RetireWell” and any related

phrase is not intended to indicate that such goals will be

achieved.

© 2024 Prudential Financial, Inc. and its related entities.

Prudential, the Rock symbol, and the PGIM logo are service marks of

Prudential Financial, Inc. and its related entities, registered in

many jurisdictions worldwide.

PGIM DCS – 3888440

CONNECT WITH US: Visit pgim.com Follow on LinkedIn

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240930573133/en/

MEDIA CONTACTS PGIM: Kylie Scott +1 908 313 5332

kylie.scott@pgim.com iJoin: Alan Gross GSM Marketing + 1 904

565 2959 alan.gross@gsm.marketing

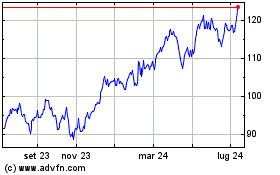

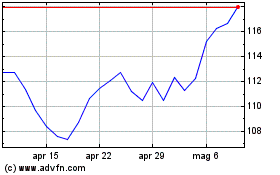

Grafico Azioni Prudential Financial (NYSE:PRU)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Prudential Financial (NYSE:PRU)

Storico

Da Nov 2023 a Nov 2024