Current Report Filing (8-k)

01 Maggio 2023 - 1:29PM

Edgar (US Regulatory)

0001281761falsefalse00012817612023-05-012023-05-010001281761us-gaap:CommonStockMember2023-05-012023-05-010001281761us-gaap:SeriesBPreferredStockMember2023-05-012023-05-010001281761us-gaap:SeriesCPreferredStockMember2023-05-012023-05-010001281761us-gaap:SeriesEPreferredStockMember2023-05-012023-05-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): May 1, 2023

REGIONS FINANCIAL CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-34034 | | 63-0589368 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

1900 Fifth Avenue North

Birmingham, Alabama 35203

(Address, including zip code, of principal executive office)

Registrant’s telephone number, including area code: (800) 734-4667

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock, $.01 par value | | RF | | New York Stock Exchange |

| Depositary Shares, each representing a 1/40th Interest in a Share of | | | | |

| 6.375% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series B | | RF PRB | | New York Stock Exchange |

| Depositary Shares, each representing a 1/40th Interest in a Share of | | | | |

| 5.700% Fixed-to-Floating Rate Non-Cumulative Perpetual Preferred Stock, Series C | | RF PRC | | New York Stock Exchange |

| Depositary Shares, each representing a 1/40th Interest in a Share of | | | | |

| 4.45% Non-Cumulative Perpetual Preferred Stock, Series E | | RF PRE | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR 230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01 Regulation FD Disclosure.

Regions Financial Corporation (“Regions” or the “Company”) executives will make various presentations regarding, among other things, the Company’s operations and performance, to institutional investors at various meetings and events during the months of May and June 2023.

A copy of the materials to be used at these various meetings and events (the “Presentation Materials”) is being furnished as Exhibit 99.1 to this report, substantially in the form intended to be used. Exhibit 99.1 is incorporated by reference under this Item 7.01. Such Presentation Materials are also available on Regions’ website at www.regions.com.

Certain Revised Expectations for Fiscal Year 2023

Included in the Presentation Materials are revised expectations for fiscal year 2023 Adjusted Non-Interest Expense and Adjusted Operating Leverage (see pages 25 and 58), which have been updated from the expectations included in the visual presentation that was posted on Regions’ website and furnished as Exhibit 99.3 to Regions’ April 21, 2023 Current Report on Form 8-K and which were discussed during the Company’s audio webcast on the same day. The updated expectations are due primarily to an increase in the Company’s estimate of operational losses resulting from check fraud and reflect the most current information available to management, which, due to the dynamic nature of this industry-wide issue, has changed since the prior reporting. Regions remains vigilant in our efforts to combat fraud, and we are committed to the mitigation of these losses, while continuing to be a source of stability to our customers and supporting their banking needs.

In accordance with general instruction B.2. of Form 8-K, the information included in and incorporated by reference under this Item 7.01 is being furnished and shall not be deemed filed for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as may be expressly set forth by specific reference in any such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description of Exhibit |

| | |

| 99.1 | | Copy of Presentation Materials that Regions Financial Corporation intends to provide to institutional investors at various meetings during the months of May and June 2023. |

| 104 | | Cover Page Interactive Data (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| REGIONS FINANCIAL CORPORATION |

| |

| By: | | /s/ Karin K. Allen |

| Name: | | Karin K. Allen |

| Title: | | Executive Vice President and Assistant Controller (Chief Accounting Officer and Authorized Officer) |

Date: May 1, 2023

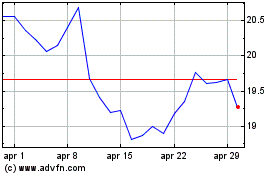

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Regions Financial (NYSE:RF)

Storico

Da Apr 2023 a Apr 2024