Current Report Filing (8-k)

01 Giugno 2022 - 10:27PM

Edgar (US Regulatory)

RAYMOND JAMES FINANCIAL INC Depositary Shares, each representing a 1/40th interest in a share of 6.75% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred Stock Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock false 0000720005 --10-30 0000720005 2022-06-01 2022-06-01 0000720005 us-gaap:CommonStockMember 2022-06-01 2022-06-01 0000720005 us-gaap:SeriesAPreferredStockMember 2022-06-01 2022-06-01 0000720005 us-gaap:SeriesBPreferredStockMember 2022-06-01 2022-06-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

June 1, 2022

Date of Report (date of earliest event reported)

RAYMOND JAMES FINANCIAL, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Florida |

|

1-9109 |

|

59-1517485 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

|

|

|

|

|

|

|

| 880 Carillon Parkway |

|

St. Petersburg |

|

Florida |

|

33716 |

| (Address of principal executive offices) |

|

|

|

|

|

(Zip Code) |

(727) 567-1000

(Registrant’s telephone number, including area code)

None

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

|

|

|

|

|

| Title of each class: |

|

Trading Symbol(s) |

|

Name of each exchange on which registered: |

| Common Stock, $.01 par value |

|

RJF |

|

New York Stock Exchange |

| Depositary Shares, each representing a 1/40th interest in a share of 6.75% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred Stock |

|

RJF PrA |

|

New York Stock Exchange |

| Depositary Shares, each representing a 1/40th interest in a share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock |

|

RJF PrB |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act (17 CFR 230.405) or Rule 12b-2 of the Exchange Act (17 CFR 240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Introductory Note

This Current Report on Form 8-K is being filed in connection with the closing on June 1, 2022 (the “Closing Date”) of the mergers pursuant to the Agreement and Plan of Merger, dated October 20, 2021 (the “Merger Agreement”), among Raymond James Financial, Inc. (NYSE: RJF), a Florida corporation (“Raymond James”), TriState Capital Holdings, Inc. (NASDAQ: TSC), a Pennsylvania corporation (“TriState Capital”), Macaroon One LLC, a Florida limited liability company and direct, wholly-owned subsidiary of Raymond James (“Merger Sub 1”), and Macaroon Two LLC, a Florida limited liability company and direct, wholly-owned subsidiary of Raymond James (“Merger Sub 2” and, together with Merger Sub 1, “Merger Subs”).

| Item 2.01 |

Completion of Acquisition or Disposition of Assets. |

On June 1, 2022, Raymond James completed its previously announced acquisition of TriState Capital pursuant to the Merger Agreement. On the Closing Date, (a) Merger Sub 1 merged with and into TriState Capital (the “First Merger”), with TriState Capital as the surviving entity in the First Merger, and (b) immediately following the First Merger, the surviving entity in the First Merger merged with and into Merger Sub 2 (the “Second Merger” and, together with the First Merger, the “Mergers”), with Merger Sub 2 as the surviving entity in the Second Merger. Upon closing of the Second Merger, the separate existence of TriState Capital ceased.

Pursuant to the terms set forth in the Merger Agreement, at the effective time of the First Merger (the “First Effective Time”):

| |

• |

|

Each share of the common stock, no par value, of TriState Capital (the “TSC Common Stock”) issued and outstanding immediately prior to the First Effective Time, including each outstanding unvested restricted stock award (each, a “TSC Restricted Share”) then held by a non-employee director of the Board of Directors of TriState Capital (each, a “Director Restricted Share”), and except for certain shares of TSC Common Stock held by Raymond James or TriState Capital, was converted into the right to receive (i) $6.00 in cash (the “Cash Consideration”) and (ii) 0.25 shares (the “Exchange Ratio”; and such shares, the “Stock Consideration”) of the common stock, par value $0.01 per share, of Raymond James (the “RJF Common Stock”), plus, if applicable, cash in lieu of fractional shares of RJF Common Stock. |

| |

• |

|

Each share of 6.75% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred Stock, no par value, of TriState Capital (“TSC Series A Preferred Stock”) issued and outstanding immediately prior to the First Effective Time was converted into the right to receive a share of a newly created series of preferred stock of Raymond James, par value $0.10 per share (“RJF Preferred Stock”), having powers, preferences and special rights that are not materially less favorable than those of the TSC Series A Preferred Stock (designated as Raymond James’s 6.75% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred Stock and referred to herein as “RJF Series A Preferred Stock”). |

| |

• |

|

Each share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock, no par value, of TriState Capital (“TSC Series B Preferred Stock”) issued and outstanding immediately prior to the First Effective Time was converted into the right to receive a share of a newly created series of RJF Preferred Stock, having powers, preferences and special rights that are not materially less favorable than those of the TSC Series B Preferred Stock (designated as Raymond James’s 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock and referred to herein as “RJF Series B Preferred Stock”). |

| |

• |

|

Each share of Series C Perpetual Non-Cumulative Convertible Non-Voting Preferred Stock, no par value, of TriState Capital (“TSC Series C Preferred Stock”) issued and outstanding immediately prior to the First Effective Time was converted into the right to receive $30.00 in cash multiplied by the number of shares of non-voting common stock, no par value, of TriState Capital such share of TSC Series C Preferred Stock was convertible into pursuant to the terms of the certificate of designations with respect to the TSC Series C Preferred Stock. |

| |

• |

|

Those certain warrants to purchase 922,438 shares of TSC Common Stock (the “Warrants”) were automatically converted into the right to receive a cash payment equal to the product of (i) the number of shares of TSC Common Stock subject to such Warrants, multiplied by (ii) $30.00 minus the applicable exercise price per share of TSC Common Stock subject to such Warrants. |

| |

• |

|

Each outstanding option to purchase shares of TSC Common Stock (each, a “TSC Option”) was converted into the right to receive a cash payment equal to the product (rounded down to the nearest whole number) of the number of shares of TSC Common Stock subject to such TSC Option immediately prior to the First Effective Time and (i) (A) the amount of the Cash Consideration, plus (B) the Exchange Ratio multiplied by the Average Purchaser Share Price (defined below) (this clause (i), the “Option Payout Amount”), minus (ii) the exercise price per share of the TSC Common Stock subject to such TSC Option. If any TSC Option had an exercise price greater than or equal to the Option Payout Amount, such TSC Option ceased to be outstanding, was cancelled and ceased to exist and the holder of such TSC Option was not entitled to payment of any consideration therefor. “Average Purchaser Share Price” means the average of the per share volume weighted average trading prices of RJF Common Stock on the New York Stock Exchange (as reported in the Eastern Edition of The Wall Street Journal, or if not reported thereby, another authoritative source) for ten (10) trading days ending on the third (3rd) business day prior to the Closing Date. |

| |

• |

|

Each outstanding unvested TSC Restricted Share, except any Director Restricted Share, was converted into a number of restricted shares of RJF Common Stock (each, an “RJF Restricted Share”) equal to the Equity Award Conversion Amount (defined below) (rounded down to the nearest whole number). The term “Equity Award Conversion Amount” means (i) the Exchange Ratio plus (ii) the quotient of (A) the Cash Consideration divided by (B) the Average Purchaser Share Price. |

In addition, at the First Effective Time, each outstanding TriState Capital depositary share representing a 1/40th interest in a share of TSC Series A Preferred Stock or TSC Series B Preferred Stock was converted into a Raymond James depositary share representing a 1/40th interest in a share of the applicable series of new Raymond James Preferred Stock.

The foregoing description of the Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement, which is attached hereto as Exhibit 2.1 and is incorporated herein by reference.

The issuance of RJF Common Stock, RJF Preferred Stock and Depositary Shares (as defined below) in connection with the Mergers was registered under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to a registration statement on Form S-4 (File No. 333-261647) filed by Raymond James with the Securities and Exchange Commission (the “SEC”) and declared effective on January 25, 2022 (the “Registration Statement”). The proxy statement/prospectus included in the Registration Statement contains additional information about the Merger Agreement and the transactions contemplated thereby.

| Item 2.03 |

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant |

In connection with the Mergers, on June 1, 2022, Raymond James assumed TriState Capital’s obligations with respect to $97,500,000 in aggregate principal amount of 5.75% Fixed-to-Floating Rate Subordinated Notes due 2030 (the “Notes”).

The supplemental indenture pursuant to which Raymond James assumed the Notes, as well as the original indenture, and supplemental indentures thereto, pursuant to which the Notes were issued, have not been filed herewith pursuant to Item 601(b)(4)(v) of Regulation S-K under the Securities Act. Raymond James agrees to furnish a copy of such indentures to the SEC upon request.

| Item 3.03 |

Material Modifications to Rights of Security Holders |

In connection with the consummation of the Mergers, Raymond James filed two articles of amendment with the Florida Department of State for the purpose of amending its articles of incorporation to fix the designations, preferences, limitations and relative rights of the RJF Series A Preferred Stock and RJF Series B Preferred Stock. The articles of amendment became effective on May 31, 2022.

The description of the new RJF Preferred Stock under the section of the proxy statement/prospectus filed by Raymond James with the SEC on January 25, 2022 entitled “Description of New Raymond James Preferred Stock” is incorporated herein by reference.

At the First Effective Time, Raymond James issued 40,250 shares of RJF Series A Preferred Stock to former holders of TSC Series A Preferred Stock and issued 80,500 shares of RJF Series B Preferred Stock to former holders of TSC Series B Preferred Stock. In connection with the issuance of the RJF Preferred Stock, Raymond James entered into amendments, each dated as of June 1, 2022, assuming the Deposit Agreements, dated as of March 20, 2018 and May 29, 2019, respectively, each among TriState Capital, Computershare Inc., Computershare Trust Company, N.A. and the holders from time to time of

the depositary receipts described therein (as amended, the “Deposit Agreements”). Pursuant to the Deposit Agreements, Raymond James issued (a) 1,610,000 depositary shares of Raymond James, each representing a 1/40th interest in a share of RJF Series A Preferred Stock, and (b) 3,220,000 depositary shares of Raymond James, each representing a 1/40th interest in a share of RJF Series B Preferred Stock (collectively, the “Depositary Shares”).

The foregoing descriptions of the terms of the RJF Preferred Stock and the Depositary Shares is qualified in its entirety by reference to the full text of the articles of amendment, which were filed as Exhibits 3.3 and 3.4 to Raymond James’s Registration Statement on Form 8-A, filed with the SEC on May 31, 2022, and incorporated by reference herein, and the Deposit Agreements, as amended, which were filed as Exhibits 4.1-4.4 to Raymond James’s Registration Statement on Form 8-A, filed with the SEC on May 31, 2022, and incorporated by reference herein.

The information set forth under Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

| Item 5.03 |

Amendments to Articles of Incorporation or Bylaws; Change in Fiscal Year |

Information set forth under Item 3.03 of this Current Report on Form 8-K is incorporated herein by reference.

| Item 7.01 |

Regulation FD Disclosure |

On June 1, 2022, Raymond James issued a press release announcing the completion of the Mergers, a copy of which is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

On June 1, 2022, Raymond James issued a press release announcing that the Board of Directors of Raymond James had declared a quarterly dividend of $0.421875 per depositary share of 6.75% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred Stock (NYSE: RJF PrA) and $0.3984375 per depositary share of 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock (NYSE: RJF PrB), in each case payable on July 1, 2022, to holders of record as of June 15, 2022. A copy of the press release is furnished as Exhibit 99.2 to this Current Report on Form 8-K.

The information in this Item 7.01 of this Current Report on Form 8-K, including Exhibits 99.1 and 99.2 hereto, is being “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference into any filing of Raymond James with the SEC, whether made before or after the date hereof, regardless of any general incorporation language in such filings (unless Raymond James specifically states that the information or exhibit in this particular report is incorporated by reference).

| Item 9.01. |

Financial Statements and Exhibits |

| (a) |

Financial statements of business acquired |

The financial statements of TriState Capital required by Item 9.01(a) of Form 8-K will be filed by amendment to this Current Report on Form 8-K not later than 71 calendar days after the date this Current Report on Form 8-K was required to be filed.

| (b) |

Pro forma financial information |

The pro forma financial information required by Item 9.01(b) of Form 8-K will be filed by amendment to this Current Report on Form 8-K no later than 71 calendar days after the date this Current Report on Form 8-K was required to be filed.

(d) Exhibits. The following are filed as exhibits to this report:

|

|

|

| Exhibit

No. |

|

Description |

|

|

| 2.1 |

|

Agreement and Plan of Merger, dated October 20, 2021, among Raymond James Financial, Inc., Macaroon One LLC, Macaroon Two LLC and TriState Capital Holdings, Inc. (incorporated by reference to Exhibit 2.1 to the Current Report on Form 8-K of Raymond James Financial, Inc., filed with the Securities and Exchange Commission on October 26, 2021) |

|

|

| 3.1 |

|

Amended and Restated Articles of Incorporation of Raymond James Financial, Inc. as filed with the Secretary of State of Florida on February 28, 2022 (incorporated by reference to Exhibit 3.1 to the Quarterly Report on Form 10-Q of Raymond James Financial, Inc., filed with the Securities and Exchange Commission on May 9, 2022) |

|

|

| 3.2 |

|

Amended and Restated By-Laws of Raymond James Financial, Inc., reflecting amendments adopted by the Board of Directors on December 2, 2020 (incorporated by reference to Exhibit 3.1 to the Current Report on Form 8-K of Raymond James Financial, Inc., filed with the Securities and Exchange Commission on December 8, 2020) |

|

|

| 3.3 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation of Raymond James Financial, Inc. relating to the Raymond James Financial, Inc. 6.75% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred Stock, $0.10 par value per share (incorporated by reference to Exhibit 3.3 to the Registration Statement on Form 8-A of Raymond James Financial, Inc., filed with the Securities and Exchange Commission on May 31, 2022) |

|

|

| 3.4 |

|

Articles of Amendment to the Amended and Restated Articles of Incorporation of Raymond James Financial, Inc. relating to the Raymond James Financial, Inc. 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock, $0.10 par value per share (incorporated by reference to Exhibit 3.4 to the Registration Statement on Form 8-A of Raymond James Financial, Inc., filed with the Securities and Exchange Commission on May 31, 2022) |

|

|

| 4.1 |

|

Deposit Agreement among TriState Capital Holdings, Inc., Computershare Inc., Computershare Trust Company, N.A. and the holders from time to time of the depositary receipts described therein relating to 6.75% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred Stock (incorporated by reference to Exhibit 4.1 to the Registration Statement on Form 8-A of Raymond James Financial, Inc., filed with the Securities and Exchange Commission on May 31, 2022) |

|

|

| 4.2 |

|

Form of First Amendment to Deposit Agreement among Raymond James Financial, Inc., TriState Capital Holdings, Inc., Computershare Inc., Computershare Trust Company, N.A. and the holders from time to time of the depositary receipts described therein relating to 6.75% Fixed-to-Floating Rate Series A Non-Cumulative Perpetual Preferred Stock (incorporated by reference to Exhibit 4.2 to the Registration Statement on Form 8-A of Raymond James Financial, Inc., filed with the Securities and Exchange Commission on May 31, 2022) |

|

|

|

| 4.3 |

|

Deposit Agreement among TriState Capital Holdings, Inc., Computershare Inc., Computershare Trust Company, N.A. and the holders from time to time of the depositary receipts described therein relating to 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock (incorporated by reference to Exhibit 4.3 the Registration Statement on Form 8-A of Raymond James Financial, Inc., filed with the Securities and Exchange Commission on May 31, 2022) |

|

|

| 4.4 |

|

Form of First Amendment to Deposit Agreement among Raymond James Financial, Inc., TriState Capital Holdings, Inc., Computershare Inc., Computershare Trust Company, N.A. and the holders from time to time of the depositary receipts described therein relating to 6.375% Fixed-to-Floating Rate Series B Non-Cumulative Perpetual Preferred Stock (incorporated by reference to Exhibit 4.4 to the Registration Statement on Form 8-A of Raymond James Financial, Inc., filed with the Securities and Exchange Commission on May 31, 2022) |

|

|

| 4.5 |

|

Form of Depositary Receipt—Series A (included as part of Exhibit 4.2) |

|

|

| 4.6 |

|

Form of Depositary Receipt—Series B (included as part of Exhibit 4.4) |

|

|

| 99.1 |

|

Press Release, dated June 1, 2022, related to the closing of the Mergers |

|

|

| 99.2 |

|

Press Release, dated June 1, 2022, related to the declaration of quarterly dividends |

|

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

RAYMOND JAMES FINANCIAL, INC. |

|

|

|

|

| Date: June 1, 2022 |

|

|

|

By: |

|

/s/ Paul M. Shoukry |

|

|

|

|

|

|

Paul M. Shoukry |

|

|

|

|

|

|

Chief Financial Officer and Treasurer |

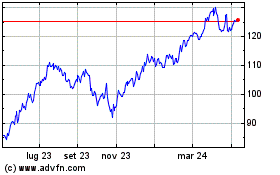

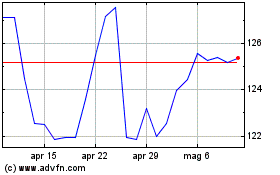

Grafico Azioni Raymond James Financial (NYSE:RJF)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Raymond James Financial (NYSE:RJF)

Storico

Da Apr 2023 a Apr 2024