Stronger Gross Margin Drives Improved

Results

Rogers Corporation (NYSE:ROG) today announced financial results

for the second quarter of 2024.

"Solid execution contributed to results that were in line with

our second quarter expectations,” stated Colin Gouveia, Rogers'

President and CEO. "Sales were near the mid-point of our Q2

guidance, as stronger portable electronics and wireless

infrastructure revenues were tempered by lower general industrial

demand. We achieved record quarterly sales of our leading EV

battery solutions, but overall EV/HEV results were mixed as power

substrate sales declined due to elevated customer inventory levels.

Stronger gross margin results drove higher earnings and reflect the

structural cost improvements we have implemented in recent

quarters. We remain intently focused on executing our strategy to

grow the business and drive significant margin and profitability

improvements."

Financial Overview

GAAP Results (dollars in millions, except

per share amounts)

Q2 2024

Q1 2024

Q2 2023

Net Sales

$214.2

$213.4

$230.9

Gross Margin

34.1%

32.0%

34.5%

Operating Margin

5.3%

5.5%

12.1%

Net Income

$8.1

$7.8

$17.9

Net Income Margin

3.8%

3.7%

7.7%

Diluted Earnings Per Share

$0.44

$0.42

$0.96

Net Cash Provided by Operating

Activities

$22.9

$28.1

$15.7

Non-GAAP Results1 (dollars in millions,

except per share amounts)

Q2 2024

Q1 2024

Q2 2023

Adjusted Operating Margin

8.2%

7.5%

13.4%

Adjusted Net Income

$12.8

$10.9

$20.0

Adjusted Earnings Per Diluted Share

$0.69

$0.58

$1.07

Adjusted EBITDA

$31.9

$28.3

$43.7

Adjusted EBITDA Margin

14.9%

13.3%

18.9%

Free Cash Flow

$8.8

$18.7

$4.2

Net Sales by Operating Segment (dollars in

millions)

Q2 2024

Q1 2024

Q2 2023

Advanced Electronics Solutions (AES)

$115.5

$122.1

$130.2

Elastomeric Material Solutions (EMS)

$94.7

$85.7

$95.4

Other

$4.0

$5.6

$5.3

1 - A reconciliation of GAAP to non-GAAP

measures is provided in the schedules included below

Q2 2024 Summary of

Results

Net sales of $214.2 million increased 0.4% versus the prior

quarter resulting from higher sales in the EMS business unit. EMS

net sales increased by 10.5% primarily from higher EV/HEV and

portable electronics sales, partially offset by slightly lower

aerospace and defense (A&D) sales. AES net sales decreased by

5.4% primarily related to lower EV/HEV, industrial and A&D

sales, partially offset by higher wireless infrastructure sales.

Currency exchange rates unfavorably impacted total company net

sales in the second quarter of 2024 by $0.7 million compared to the

prior quarter.

Gross margin increased to 34.1% from 32.0% in the prior quarter

primarily from favorable product mix and reductions in

manufacturing costs.

Selling, general and administrative (SG&A) expenses

increased by $3.4 million from the prior quarter to $50.9 million.

The higher SG&A was primarily due to the timing of variable

compensation expenses and factory start-up costs.

GAAP operating margin of 5.3% decreased from 5.5% in the prior

quarter, primarily due to higher SG&A and restructuring

expenses. Adjusted operating margin of 8.2% increased by 70 basis

points versus the prior quarter.

GAAP earnings per diluted share were $0.44 compared to earnings

per diluted share of $0.42 in the previous quarter. On an adjusted

basis, earnings were $0.69 per diluted share compared to earnings

of $0.58 per diluted share in the prior quarter.

Ending cash and cash equivalents were $119.9 million, an

increase of $3.0 million versus the prior quarter. Net cash

provided by operating activities in the second quarter was $22.9

million and capital expenditures were $14.1 million.

Financial Outlook

(dollars in millions, except per share

amounts)

Q3 2024

Net Sales

$215 to $225

Gross Margin

34.0% to 35.0%

Earnings Per Diluted Share

$0.32 to $0.52

Adjusted Earnings Per Diluted Share1

$0.75 to $0.95

2024

Capital Expenditures

$55 to $65

1 - A reconciliation of GAAP to non-GAAP

measures is provided in the schedules included below

Conference Call and Additional

Information

A conference call to discuss the results for the first quarter

will take place today, Thursday, July 25, 2024 at 5:00 pm ET. A

live webcast of the event and the accompanying presentation can be

accessed on the Rogers Corporation website at

https://www.rogerscorp.com/investors.

About Rogers Corporation

Rogers Corporation (NYSE:ROG) is a global leader in engineered

materials to power, protect and connect our world. Rogers delivers

innovative solutions to help our customers solve their toughest

material challenges. Rogers’ advanced electronic and elastomeric

materials are used in applications for EV/HEV, automotive safety

and radar systems, mobile devices, renewable energy, wireless

infrastructure, energy-efficient motor drives, industrial equipment

and more. Headquartered in Chandler, Arizona, Rogers operates

manufacturing facilities in the United States, Asia and Europe,

with sales offices worldwide.

Safe Harbor Statement

Statements included in this release that are not a description

of historical facts are “forward-looking statements” within the

meaning of Section 27A of the Securities Act of 1933, as amended,

and Section 21E of the Securities Exchange Act of 1934, as amended.

Such statements are generally accompanied by words or phrases such

as “anticipate,” “assume,” “believe,” “could,” “estimate,”

“expect,” “foresee,” “goal,” “intend,” “may,” “plan,” “potential,”

“predict,” “project,” “should,” “seek,” “target” or similar

expressions that convey uncertainty as to the future events or

outcomes. Forward-looking statements are based on assumptions and

beliefs that we believe to be reasonable; however, assumed facts

almost always vary from actual results, and the differences between

assumed facts and actual results could be material depending upon

the circumstances. Where we express an expectation or belief as to

future results, that expectation or belief is expressed in good

faith and based on assumptions believed to have a reasonable basis.

This release contains forward-looking statements regarding our

plans, objectives, outlook, goals, strategies, future events,

future net sales or performance, capital expenditures, future

restructuring, plans or intentions relating to expansions, business

trends and other information that is not historical information.

All forward-looking statements are based upon information available

to us on the date of this release and are subject to risks,

uncertainties and other factors, many of which are outside of our

control, which could cause actual results to differ materially from

those indicated by the forward-looking statements. Other risks and

uncertainties that could cause such results to differ include the

following, without limitation: failure to capitalize on, volatility

within, or other adverse changes with respect to the Company's

growth drivers, such as delays in adoption or implementation of new

technologies; failure to successfully execute on our long-term

growth strategy as a standalone company; uncertain business,

economic and political conditions in the United States (U.S.) and

abroad, particularly in China, Germany, Belgium, England, South

Korea and Hungary, where we maintain significant manufacturing,

sales or administrative operations; the trade policy dynamics

between the U.S. and China reflected in trade agreement

negotiations and the imposition of tariffs and other trade

restrictions, as well as the potential for U.S.-China supply chain

decoupling; fluctuations in foreign currency exchange rates; our

ability to develop innovative products and the extent to which our

products are incorporated into end-user products and systems and

the extent to which end-user products and systems incorporating our

products achieve commercial success; the ability and willingness of

our sole or limited source suppliers to deliver certain key raw

materials, including commodities, to us in a timely and

cost-effective manner; intense global competition affecting both

our existing products and products currently under development;

business interruptions due to catastrophes or other similar events,

such as natural disasters, war, terrorism or public health crises;

the impact of sanctions, export controls and other foreign asset or

investment restrictions; failure to realize, or delays in the

realization of anticipated benefits of acquisitions and

divestitures due to, among other things, the existence of unknown

liabilities or difficulty integrating acquired businesses; our

ability to attract and retain management and skilled technical

personnel; our ability to protect our proprietary technology from

infringement by third parties and/or allegations that our

technology infringes third party rights; changes in effective tax

rates or tax laws and regulations in the jurisdictions in which we

operate; failure to comply with financial and restrictive covenants

in our credit agreement or restrictions on our operational and

financial flexibility due to such covenants; the outcome of ongoing

and future litigation, including our asbestos-related product

liability litigation; changes in environmental laws and regulations

applicable to our business; and disruptions in, or breaches of, our

information technology systems. Should any risks and uncertainties

develop into actual events, these developments could have a

material adverse effect on the Company. Our forward-looking

statements are expressly qualified by these cautionary statements,

which you should consider carefully. For additional information

about the risks, uncertainties and other factors that may affect

our business, please see our most recent annual report on Form 10-K

and any subsequent reports filed with the Securities and Exchange

Commission, including quarterly reports on Form 10-Q. Rogers

Corporation assumes no responsibility to update any forward-looking

statements contained herein except as required by law.

(Financial statements follow)

Condensed Consolidated

Statements of Operations (Unaudited)

Three Months Ended

Six Months Ended

(DOLLARS AND SHARES IN MILLIONS, EXCEPT

PER SHARE AMOUNTS)

June 30, 2024

June 30, 2023

June 30, 2024

June 30, 2023

Net sales

$

214.2

$

230.9

$

427.6

$

474.7

Cost of sales

141.1

151.3

286.3

315.4

Gross margin

73.1

79.6

141.3

159.3

Selling, general and administrative

expenses

50.9

46.2

98.4

106.3

Research and development expenses

9.5

8.1

18.4

17.7

Restructuring and impairment charges

1.4

3.9

1.5

14.4

Other operating (income) expense, net

—

(6.5

)

—

(6.7

)

Operating income

11.3

27.9

23.0

27.6

Equity income in unconsolidated joint

ventures

0.5

0.8

0.8

0.9

Other income (expense), net

0.3

(0.8

)

0.7

(0.7

)

Interest expense, net

(0.2

)

(2.8

)

(1.0

)

(6.3

)

Income before income tax

expense

11.9

25.1

23.5

21.5

Income tax expense

3.8

7.2

7.6

7.1

Net income

$

8.1

$

17.9

$

15.9

$

14.4

Basic earnings per share

$

0.44

$

0.96

$

0.85

$

0.77

Diluted earnings per share

$

0.44

$

0.96

$

0.85

$

0.77

Shares used in computing:

Basic earnings per share

18.6

18.6

18.6

18.6

Diluted earnings per share

18.6

18.7

18.6

18.7

Condensed Consolidated

Statements of Financial Position (Unaudited)

(DOLLARS AND SHARES IN MILLIONS, EXCEPT

PAR VALUE)

June 30, 2024

December 31, 2023

Assets

Current assets

Cash and cash equivalents

$

119.9

$

131.7

Accounts receivable, less allowance for

credit losses of $1.0 and $1.1

160.0

161.9

Contract assets

31.6

45.2

Inventories, net

150.8

153.5

Asbestos-related insurance receivables,

current portion

4.3

4.3

Other current assets

35.5

30.3

Total current assets

502.1

526.9

Property, plant and equipment, net of

accumulated depreciation of $393.2 and $385.7

365.7

366.3

Operating lease right-of-use assets

17.6

18.9

Goodwill

356.3

359.8

Other intangible assets, net of

amortization

117.2

123.9

Asbestos-related insurance receivables,

non-current portion

52.2

52.2

Investments in unconsolidated joint

ventures

9.7

11.1

Deferred income taxes

58.1

49.7

Other long-term assets

8.2

8.4

Total assets

$

1,487.1

$

1,517.2

Liabilities and Shareholders’

Equity

Current liabilities

Accounts payable

$

49.9

$

50.3

Accrued employee benefits and

compensation

30.9

31.1

Accrued income taxes payable

7.6

2.0

Operating lease obligations, current

portion

3.7

3.5

Asbestos-related liabilities, current

portion

5.5

5.5

Other accrued liabilities

18.9

24.0

Total current liabilities

116.5

116.4

Borrowings under revolving credit

facility

—

30.0

Operating lease obligations, non-current

portion

14.1

15.4

Asbestos-related liabilities, non-current

portion

55.8

56.0

Non-current income tax

7.5

7.2

Deferred income taxes

22.6

22.9

Other long-term liabilities

9.8

10.3

Shareholders’ equity

Capital stock - $1 par value; 50.0

authorized shares; 18.6 and 18.6 shares issued and outstanding

18.6

18.6

Additional paid-in capital

152.4

151.8

Retained earnings

1,170.9

1,155.0

Accumulated other comprehensive loss

(81.1

)

(66.4

)

Total shareholders' equity

1,260.8

1,259.0

Total liabilities and shareholders'

equity

$

1,487.1

$

1,517.2

Reconciliation of non-GAAP financial

measures to the comparable GAAP measures

Non-GAAP Financial Measures:

This earnings release includes the following financial measures

that are not presented in accordance with generally accepted

accounting principles in the United States of America (“GAAP”):

(1) Adjusted operating margin, which the Company defines as

operating margin excluding acquisition and related integration

costs, dispositions, intangible amortization, (gains) losses on the

sale or disposal of property, plant and equipment, restructuring,

severance, impairment and other related costs, non-routine

shareholder advisory costs, (income) costs associated with

terminated merger, UTIS fire (recoveries) charges and

asbestos-related charges (credits);

(2) Adjusted net income, which the Company defines as net income

(loss) excluding acquisition and related integration costs,

dispositions, intangible amortization, (gains) losses on the sale

or disposal of property, plant and equipment, restructuring,

severance, impairment and other related costs, non-routine

shareholder advisory costs, (income) costs associated with

terminated merger, UTIS fire (recoveries) charges, asbestos-related

charges (credits), pension settlement charges and the related

income tax effect on these items;

(3) Adjusted earnings per diluted share, which the Company

defines as earnings per diluted share excluding acquisition and

related integration costs, dispositions, intangible amortization,

(gains) losses on the sale or disposal of property, plant and

equipment, restructuring, severance, impairment and other related

costs, non-routine shareholder advisory costs, (income) costs

associated with terminated merger, UTIS fire (recoveries) charges,

asbestos-related charges (credits), pension settlement charges, and

the related income tax effect on these items, divided by adjusted

weighted average shares outstanding - diluted;

(4) Adjusted EBITDA, which the Company defines as net income

(loss) excluding acquisition and related integration costs,

dispositions, intangible amortization, (gains) losses on the sale

or disposal of property, plant and equipment, restructuring,

severance, impairment and other related costs, non-routine

shareholder advisory costs, (income) costs associated with

terminated merger, UTIS fire (recoveries) charges, asbestos-related

charges (credits), pension settlement charges, interest expense,

net, income tax expense (benefit), depreciation of fixed assets,

equity compensation expense, and the related income tax effect on

these items;

(5) Adjusted EBITDA Margin, which the Company defines as the

percentage that results from dividing Adjusted EBITDA by total net

sales;

(6) Free cash flow, which the Company defines as net cash

provided by (used in) operating activities less non-acquisition

capital expenditures.

Management believes adjusted operating margin, adjusted net

income, adjusted earnings per diluted share, adjusted EBITDA and

adjusted EBITDA margin are useful to investors because they allow

for comparison to the Company’s performance in prior periods

without the effect of items that, by their nature, tend to obscure

the Company’s core operating results due to potential variability

across periods based on the timing, frequency and magnitude of such

items. As a result, management believes that these measures enhance

the ability of investors to analyze trends in the Company’s

business and evaluate the Company’s performance relative to peer

companies. Management also believes free cash flow is useful to

investors as an additional way of viewing the Company's liquidity

and provides a more complete understanding of factors and trends

affecting the Company's cash flows. However, non-GAAP financial

measures have limitations as analytical tools and should not be

considered in isolation from, or as alternatives to, financial

measures prepared in accordance with GAAP. In addition, these

non-GAAP financial measures may differ from, and should not be

compared to, similarly named measures used by other companies.

Reconciliations of the differences between these non-GAAP financial

measures and their most directly comparable financial measures

calculated in accordance with GAAP are set forth below.

Reconciliation of GAAP Operating Margin to Adjusted Operating

Margin*:

2024

2023

Q2

Q1

Q2

GAAP Operating Margin

5.3

%

5.5

%

12.1

%

Acquisition & Divestiture Related

Costs:

Dispositions

—

%

—

%

—

%

Intangible Amortization

1.4

%

1.5

%

1.4

%

(Gain) Loss on Sale or Disposal of PPE

—

%

—

%

(0.2

)%

Restructuring, Business Realignment &

Other Cost Saving Initiatives:

Restructuring, Severance, Impairment &

Other Related Costs

1.4

%

0.5

%

2.0

%

Non-Routine Shareholder Advisory Costs

—

%

—

%

—

%

(Income) Costs Associated with Terminated

Merger

—

%

—

%

0.7

%

UTIS Fire (Recoveries) Charges

—

%

—

%

(2.6

)%

Total Adjustments

2.9

%

2.0

%

1.3

%

Adjusted Operating Margin

8.2

%

7.5

%

13.4

%

*Percentages in table may not add due to

rounding.

Reconciliation of GAAP Net Income to Adjusted Net

Income*:

2024

2023

(dollars in millions)

Q2

Q1

Q2

GAAP Net Income

$

8.1

$

7.8

$

17.9

Acquisition & Divestiture Related

Costs:

Dispositions

—

—

0.1

Intangible Amortization

3.1

3.1

3.3

(Gain) Loss on Sale or Disposal of PPE

—

—

(0.5

)

Restructuring, Business Realignment &

Other Cost Saving Initiatives:

Restructuring, Severance, Impairment &

Other Related Costs

3.1

1.1

4.6

Non-Routine Shareholder Advisory Costs

—

—

0.1

(Income) Costs Associated with Terminated

Merger

—

—

1.5

UTIS Fire (Recoveries) Charges

—

—

(5.9

)

Estimated Income Tax Impacts of

Adjustments

$

(1.5

)

$

(1.1

)

$

(1.0

)

Total Adjustments

$

4.7

$

3.1

$

2.2

Adjusted Net Income

$

12.8

$

10.9

$

20.0

*Values in table may not add due to

rounding.

Reconciliation of GAAP Earnings Per Diluted Share to Adjusted

Earnings Per Diluted Share*:

2024

2023

Q2

Q1

Q2

GAAP Earnings Per Diluted Share

$

0.44

$

0.42

$

0.96

Acquisition & Divestiture Related

Costs:

Dispositions

—

—

0.01

Intangible Amortization

0.17

0.17

0.18

(Gain) Loss on Sale or Disposal of PPE

—

—

(0.03

)

Restructuring, Business Realignment &

Other Cost Saving Initiatives:

Restructuring, Severance, Impairment &

Other Related Costs

0.17

0.06

0.25

Non-Routine Shareholder Advisory Costs

—

—

0.01

(Income) Costs Associated with Terminated

Merger

—

—

0.08

UTIS Fire (Recoveries) Charges

—

—

(0.32

)

Estimated Income Tax Impacts of

Adjustments

(0.08

)

(0.06

)

(0.05

)

Total Adjustments

$

0.25

$

0.17

$

0.13

Adjusted Earnings Per Diluted

Share

$

0.69

$

0.58

$

1.07

*Values in table may not add due to

rounding.

**Some amounts have been updated to

conform to current period presentation.

Reconciliation of GAAP Net Income to Adjusted

EBITDA*:

2024

2023

(dollars in millions)

Q2

Q1

Q2

GAAP Net Income

$

8.1

$

7.8

$

17.9

Acquisition & Divestiture Related

Costs:

Dispositions

—

—

0.1

Intangible Amortization

3.1

3.1

3.3

(Gain) Loss on Sale or Disposal of PPE

—

—

(0.5

)

Restructuring, Business Realignment &

Other Cost Saving Initiatives:

Restructuring, Severance, Impairment &

Other Related Costs

3.1

1.1

2.3

Non-Routine Shareholder Advisory Costs

—

—

0.1

(Income) Costs Associated with Terminated

Merger

—

—

1.0

UTIS Fire (Recoveries) Charges

—

—

(5.9

)

Interest Expense, net

0.2

0.8

2.8

Income Tax Expense

3.8

3.8

7.3

Depreciation

8.2

8.2

10.4

Equity Compensation

5.3

3.5

5.0

Total Adjustments

$

23.7

$

20.5

$

25.9

Adjusted EBITDA

$

31.9

$

28.3

$

43.7

*Values in table may not add due to

rounding.

Calculation of Adjusted EBITDA margin*:

2024

2023

(dollars in millions)

Q2

Q1

Q2

Adjusted EBITDA

$

31.9

$

28.3

$

43.7

Divided by Total Net Sales

214.2

213.4

230.8

Adjusted EBITDA Margin

14.9

%

13.3

%

18.9

%

*Values in table may not add due to

rounding.

Reconciliation of Net Cash Provided By (Used In) Operating

Activities to Free Cash Flow*:

2024

2023

(dollars in millions)

Q2

Q1

Q2

Net Cash Provided By (Used In)

Operating Activities

$

22.9

$

28.1

15.7

Non-Acquisition Capital Expenditures

(14.1

)

(9.4

)

(11.5

)

Free Cash Flow

$

8.8

$

18.7

$

4.2

*Values in table may not add due to

rounding.

Reconciliation of GAAP Earnings Per Diluted Share to Adjusted

Earnings Per Diluted Share Guidance for the 2024 Third

Quarter:

Guidance

Q3 2024

GAAP Earnings per Diluted Share

$0.32 to $0.52

Intangible Amortization

$0.13

Other Adjustments*

$0.30

Adjusted Earnings per Diluted

Share

$0.75 - $0.95

*Other adjustments includes expected

restructuring charges associated with the wind down of AES

manufacturing operations in our Evergem, Belgium facility

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240725352413/en/

Investor Contact: Steve Haymore Phone: 480-917-6026

Email: stephen.haymore@rogerscorporation.com

Website Address: https://www.rogerscorp.com

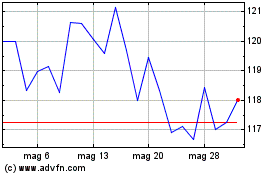

Grafico Azioni Rogers (NYSE:ROG)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Rogers (NYSE:ROG)

Storico

Da Nov 2023 a Nov 2024