Meta and Snap Shares Climb as FCC Seeks Ban on TikTok

07 Novembre 2022 - 2:33PM

Finscreener.org

Earlier this week, shares of

social media companies such as Snap

(NYSE:

SNAP) and Meta (NASDAQ:

META) gained pace after

the Federal Communications Commission (FCC) said the U.S.

government should ban TikTok, a China-based short-video

platform.

In an interview with Axios,

Republican Commissioner Brendan Carr claimed, “I don’t believe

there is a path forward for anything other than a ban."

According to a CNBC report, “The

Committee on Foreign Investment in the U.S. (CFIUS) in the Treasury

Department is reviewing the company’s (TikTok’s) potential national

security implications, given its ownership by a Chinese company,

ByteDance.”

There have been concerns over

data security risks associated with TikTok, and the government

administration in the U.S. has again raised this issue. However,

TikTok has confirmed it does not store the user data of its U.S.

customers in China.

TikTok has gained significant traction

TikTok initially revealed its

user details back in 2020 when the company challenged another ban

from the U.S. two years back. The TikTok platform was launched in

2017, and it managed to acquire 11 million users in the United

States by January 2018. This number rose to 27 million in the next

12 months and soared to 91 million by June 2020.

Comparatively, its monthly active

users globally rose from 85 million in Q1 of 2018 to a staggering

1.46 billion by Q2 of 2022. The company attracted 138 million users

from North America by the end of 2021.

TikTok was banned by India in

2020, which was one of its largest markets, as tensions between

China and India rose at the onset of COVID-19.

TikTok’s rising popularity has

shifted digital ad spending towards the platform and away from

Snapchat and Instagram. Due to TikTok’s rising competition, a

challenging macro-environment, and privacy changes from Apple,

revenue for Meta and Snap have decelerated at a rapid pace this

year.

In fact, Meta reported

two consecutive quarters

of revenue decline in Q3 as its

sales fell to $27.71 billion in the September quarter from $33.6

billion in Q4 of 2021. Analysts now expect

Meta’s sales to fall by 1.1% to

$116.6 billion in 2022, which will be the first year-over-year

decline for the social media giant.

Similarly, after sales soared by

more than 50% to $4.11 billion in 2021 for Snap, analysts expect

top-line growth to decelerate to just 12% in 2022 and to 9.2% in

2023.

Due to these reasons, Meta stock

and Snap stock are down 76% and 88%, respectively, below all-time

highs.

Can Snap and Meta stock make a comeback in the near

term?

Both Meta and Snap will need to

improve engagement rates on their platforms as they face growing

competition from the latest entrant on the block. Further, an

uncertain ad market and an inflationary environment, including

rising interest rates, will remain near-term challenges as

enterprises are likely to face a global recession in

2023.

The cracks on the Facebook wall

first appeared in late 2021 when the platform lost a million daily

active users in Q4 of last year. Loup Ventures managing partner

Gene Munster had then warned a drop in user growth would send a

shockwave to investors, and Meta

stock has consistently declined in the first ten months of

2022.

Brands are not motivated to

invest in ad placements in recent months as lagging supply chain

lead times have lowered ad budgets. Companies are not willing to

market products if these items are not going to hit retail

shelves.

It is going to be a rocky ride

for investors of Snap and Meta as these headwinds are unlikely to

abate in 2023.

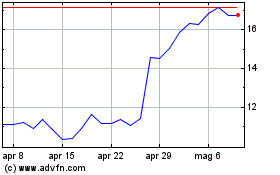

Grafico Azioni Snap (NYSE:SNAP)

Storico

Da Mar 2024 a Apr 2024

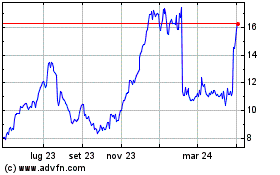

Grafico Azioni Snap (NYSE:SNAP)

Storico

Da Apr 2023 a Apr 2024