Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

16 Giugno 2022 - 7:43PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of June, 2022

Commission File Number: 001-09531

Telefónica, S.A.

(Translation of registrant's name into English)

Distrito Telefónica, Ronda de la Comunicación s/n,

28050 Madrid, Spain

3491-482 87 00

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telefónica, S.A.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Sequential Page Number |

| | |

| 1. | Telefónica: Scrip dividend result | 2 |

TELEFÓNICA, S.A. (hereinafter, Telefónica) in compliance with the Securities Market legislation, hereby communicates the following

OTHER RELEVANT INFORMATION

Further the communication published on May 25, 2022, Telefónica, S.A. informs that on June 14, 2022 the free-of charge allotment rights trading period for the capital increase with charge to reserves related to the shareholder compensation by means of a scrip dividend (“Telefónica’s Flexible Dividend”), ended.

The shareholders of 25.54% of the free-of-charge allotment rights have accepted the purchase commitment assumed by Telefónica, S.A. The gross amount to be paid by Telefónica, S.A. for these rights amounts to 213,174,854.42 euros. Telefónica, S.A. has waived the rights thus acquired, that have been amortized.

On the other hand, the shareholders of 74.46% of the free-of-charge allotment rights have opted to receive new shares of Telefónica S.A. Therefore, the final number of ordinary shares with a nominal value of 1 euro issued in the capital increase is 135,464,591, corresponding to 2.40% of the share capital, being the amount of the capital increase 135,464,591 euros. As a result, the amount of the share capital of Telefónica, S.A. after the capital increase has been set at 5,775,237,554 euros, divided into 5,775,237,554 shares.

Also, it is expected that the new shares will be admitted to listing on the four Spanish Stock Exchanges and will be traded on the Spanish Automated Quotation System (Sistema de Interconexión Bursátil Español) next, June 23, 2022 so that the ordinary trading of the new shares in Spain will begin on, June 24, 2022. The admission to listing of the new shares on the different foreign Stock Exchanges where Telefónica, S.A. is listed will also be requested.

Madrid, June 16, 2022

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | Telefónica, S.A. |

| Date: | June 16, 2022 | | By: | /s/ Pablo de Carvajal González |

| | | | Name: | Pablo de Carvajal González |

| | | | Title: | Secretary to the Board of Directors |

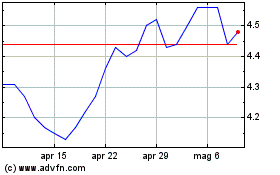

Grafico Azioni Telefonica (NYSE:TEF)

Storico

Da Mar 2024 a Apr 2024

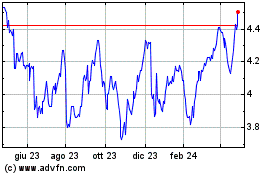

Grafico Azioni Telefonica (NYSE:TEF)

Storico

Da Apr 2023 a Apr 2024