Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

22 Novembre 2022 - 12:04PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of November, 2022

Commission File Number: 001-09531

Telefónica, S.A.

(Translation of registrant's name into English)

Distrito Telefónica, Ronda de la Comunicación s/n,

28050 Madrid, Spain

+34 91-482 87 00

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telefónica, S.A.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Sequential Page Number |

| | |

| 1. | Telefónica: Result of the Tender Offer | 2 |

TELEFÓNICA, S.A., in compliance with the Securities Market legislation, hereby communicates the following

OTHER RELEVANT INFORMATION

Further to the communication made on 14 November 2022, Telefónica Europe B.V. (the "Issuer") announces the final results of the invitations to holders of its outstanding (i) EUR 1,000,000,000 Undated 5.5 Year Non-Call Deeply Subordinated Guaranteed Fixed Rate Reset Securities (ISIN: XS1731823255; the "EUR Mar 2023 Notes"), and (ii) EUR 1,250,000,000 Undated 5.7 Year Non-Call Deeply Subordinated Guaranteed Fixed Rate Reset Securities (ISIN XS1795406575; the "EUR Sep 2023 Notes") (each a "Series" and together the "Notes") irrevocably guaranteed by Telefónica, S.A. (the "Guarantor"), to tender such Notes for purchase by the Issuer for cash (each such invitation, an "Offer" and together the "Offers").

The Offers were made on the terms and subject to the conditions contained in the tender offer memorandum dated 14 November 2022 (the "Tender Offer Memorandum") and are subject to the offer restrictions more fully described in the Tender Offer Memorandum. Capitalised terms used and not otherwise defined in this announcement have the meanings given in the Tender Offer Memorandum.

The final results of the Offers are as follow:

| | | | | | | | | | | | | | | | | | | | |

| Description of Notes | First Call Date | Aggregate Principal Amount Outstanding | Purchase Price |

Pro-ration factor (if any and subject to adjustment, as applicable) | Priority | Aggregate Principal Amount of Notes of each Series accepted for purchase |

EUR 1,000,000,000 Undated 5.5 Year Non-Call Deeply Subordinated Guaranteed Fixed Rate Reset Securities (the "EUR Mar 2023 Notes")

Current Coupon: 2.625 per cent. | 7 March 2023 | EUR 676,400,000 | EUR 100,000 per EUR 100,000 | N/A | 1 | EUR 547,400,000 |

EUR 1,250,000,000 Undated 5.7 Year Non-Call Deeply Subordinated Guaranteed Fixed Rate Reset Securities (the "EUR Sep 2023 Notes")

Current Coupon: 3.00 per cent. |

4 September 2023 |

EUR 823,600,000 |

EUR 98,250 per EUR 100,000 |

29.411% |

2 |

EUR 73,600,000 |

The Offers remain subject to the conditions and restrictions set out in the Tender Offer Memorandum.

Whether the Issuer will purchase any Notes validly tendered in the Offers is subject, without limitation, to the satisfaction of the New Financing Condition. Subject to the satisfaction (or waiver) of the New Financing Condition, the expected Settlement Date is 24 November 2022.

Following the settlement of the Offers and subsequent cancellation of the repurchased Notes, more than 75 per cent. of the initial aggregate principal amount of the EUR Mar 2023 Notes will have been purchased and cancelled by the Issuer. Pursuant to the terms and conditions of the EUR Mar 2023 Notes, the Issuer will therefore have the option to redeem (after providing the required notice) all of the remaining outstanding EUR Mar 2023 Notes (in whole but not in part) at their principal amount plus any interest accrued to, but excluding, the relevant day on which the EUR Mar 2023 Notes become due for early redemption in accordance with the Conditions and any Arrears of Interest (as defined in the Conditions). The Issuer may exercise this option following the settlement of the Tender Offer.

All Notes repurchased pursuant to the Offers will be cancelled.

Madrid, 22 November 2022

Neither the Offer, the Tender Offer Memorandum nor this announcement constitute an offer of securities to the public under Regulation (EU) 2017/1129 of the European Parliament and of the Council or a tender offer in Spain under the restated text of the Spanish Securities Market Act approved by Royal Legislative Decree 4/2015, of 23 October and under Royal Decree 1066/2007, of 27 July, all of them as amended, and any regulation issued thereunder. Accordingly, neither the Tender Offer Memorandum nor this announcement has been and will not be submitted for approval nor approved by the Spanish Securities Market Regulator (Comisión Nacional del Mercado de Valores).

Not for distribution in or into or to any person located or resident in the United States, its territories and possessions (including Puerto Rico, the U.S. Virgin Islands, Guam, American Samoa, Wake Island and the Northern Mariana Islands, any state of the United States and the District of Columbia) (the "United States") or to any U.S. person or into any other jurisdiction where it is unlawful to distribute this announcement.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | Telefónica, S.A. |

| Date: | November 22, 2022 | | By: | /s/ Pablo de Carvajal González |

| | | | Name: | Pablo de Carvajal González |

| | | | Title: | Secretary to the Board of Directors |

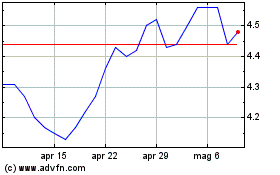

Grafico Azioni Telefonica (NYSE:TEF)

Storico

Da Mar 2024 a Apr 2024

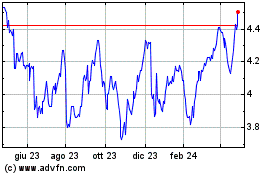

Grafico Azioni Telefonica (NYSE:TEF)

Storico

Da Apr 2023 a Apr 2024