Report of Foreign Issuer Pursuant to Rule 13a-16 or 15d-16 (6-k)

25 Gennaio 2023 - 7:26PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Form 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January, 2023

Commission File Number: 001-09531

Telefónica, S.A.

(Translation of registrant's name into English)

Distrito Telefónica, Ronda de la Comunicación s/n,

28050 Madrid, Spain

+34 91-482 87 00

(Address of principal executive offices)

Indicate by check mark whether the registrant files or will file annual reports under cover of Form 20-F or Form 40-F:

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1):

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7):

Telefónica, S.A.

TABLE OF CONTENTS

| | | | | | | | |

| Item | | Sequential Page Number |

| | |

| 1. | Telefónica: Issuance of Debt | 2 |

TELEFÓNICA, S.A. (“Telefónica”), in compliance with the Securities Market legislation, hereby communicates the following

OTHER RELEVANT INFORMATION

Further to the communication made on 25 January 2023, it is hereby announced that TELEFÓNICA EUROPE B.V. (the "Issuer"), the Dutch subsidiary of Telefónica, S.A., has today priced and closed the terms and conditions of an issuance of undated deeply subordinated guaranteed fixed rate reset securities, with the subordinated guarantee of Telefónica, S.A., for an aggregate nominal amount of EUR 1,000,000,000 and intended to be issued as green bonds (EUR 1,000,000,000 Undated 7.25 Year Non-Call Deeply Subordinated Guaranteed Fixed Rate Reset Securities (Green Bond) unconditionally and irrevocably guaranteed on a subordinated basis by Telefónica, S.A.) (the "Securities").

The main terms and conditions of the Securities are as follows:

The issue price of the Securities is fixed at 100% of their face value. The Securities will bear interest at a fixed rate of 6.135% per annum from (and including) 2 February 2023 up to (but excluding) 3 May 2030.

From (and including) 3 May 2030, the Securities will bear interest at a fixed rate of interest equal to the applicable 7 year Swap Rate plus a margin of:

•3.347% per year from (and including) 3 May 2030 to (but excluding) 3 May 2033;

•3.597% per year from (and including) 3 May 2033 to (but excluding) 3 May 2050; and

•4.347% per year from (and including) 3 May 2050.

Interest shall be payable annually in arrear starting on 3 May 2024 (long first coupon).

The Securities will have a face value per unit of 100,000 euros and will be perpetual, although they will be subject to a call option exercisable by the Issuer on certain dates and at any time upon the occurrence of certain events as set out in the terms and conditions of the Securities. In addition, the Securities may be redeemed at any time at the redemption price (Make Whole Redemption Amount) to be calculated in accordance with the terms and conditions of the Securities. The Issuer may defer payment of the interest accrued on the Securities at its sole discretion (the "Deferred Interest") without triggering an event of default. The Deferred Interest will in turn accrue interest and will be payable at the option of the Issuer at any time or on a compulsory basis in certain circumstances as set out in the terms and conditions of the Securities.

The Securities will be governed by English Law, and it is envisaged that they will be listed and admitted to trading on the Global Exchange Market (GEM), the multilateral trading facility of the Irish Stock Exchange plc, trading as Euronext Dublin.

The issue is addressed exclusively at professional clients and eligible counterparties.

The Securities will be subscribed for and paid up on the closing date, which is envisaged to take place on or about 2 February 2023, subject to entering into a subscription agreement with the Joint Bookrunners and the rest of the agreements relating to the issue, and subject to compliance with the conditions set out in the subscription agreement.

An amount equal to the net proceeds of the issue of the Securities will be subject to specific eligibility criteria to be applied to finance new or refinance existing projects, as detailed in Telefónica's Sustainable Development Goals Framework (the "SDG Framework"). The SDG Framework is in accordance with the Green Bond Principles 2018, Social Bond Principles 2020 and Sustainability Bond Guidelines 2018, each published by the International Capital Market Association.

Madrid, 25 January 2023.

This announcement is neither an offer to sell nor a solicitation of an offer to buy any of the securities referred to herein and shall not constitute an offer, solicitation nor sale in any jurisdiction in which such offer, solicitation or sale is unlawful - including but not limited to the United States, its territories and possessions (the "United States"), Australia, Canada or Japan.

The securities referred to herein have not been and will not be registered under the United States Securities Act of 1933 ("Securities Act"), as amended, or any state securities laws, and may not be offered or sold in the United States absent registration or pursuant to an exemption from the registration requirements of the Securities Act and in accordance with applicable state securities laws.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| | | | | | | | | | | | | | | | | |

| | Telefónica, S.A. |

| Date: | January 25, 2023 | | By: | /s/ Pablo de Carvajal González |

| | | | Name: | Pablo de Carvajal González |

| | | | Title: | Secretary to the Board of Directors |

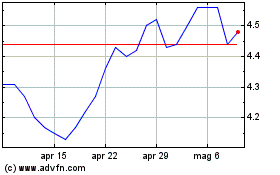

Grafico Azioni Telefonica (NYSE:TEF)

Storico

Da Mar 2024 a Apr 2024

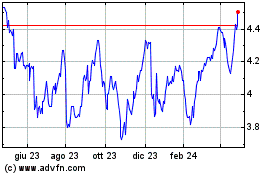

Grafico Azioni Telefonica (NYSE:TEF)

Storico

Da Apr 2023 a Apr 2024