U.S. Bank, LiquidX Collaborate to Simplify, Accelerate Supply-Chain Financing

10 Maggio 2022 - 3:00PM

Business Wire

Integrated solution will unlock valuable

working capital while helping to speed transactions and reduce

borrowing costs

U.S. Bank announced today that it has entered into a

collaboration agreement with trade-finance fintech LiquidX to help

expedite and simplify supply-chain transactions between suppliers

and buyers.

This collaboration – which comes at a time of unparalleled

stress in the global supply chain – will pair the bank’s strong

balance sheet with LiquidX’s streamlined platform technology to

help address supply-chain-finance friction and cash-flow challenges

facing many companies. Suppliers and buyers will be able to connect

their supply-chain systems directly to U.S. Bank and transact

through LiquidX’s easy-to-use platform. U.S. Bank financing

solutions delivered through this collaboration will enable

suppliers to be paid nearly immediately and buyers to receive

extended payment terms.

“With so many supply-chain challenges for businesses, we want to

help make the financing process as smooth as possible,” said Dan

Son, who oversees global trade and supply-chain finance at U.S.

Bank. “This new collaboration will deliver a single intuitive

interface that seamlessly connects suppliers, buyers and our bank

in the supply-chain ecosystem. As one of the most trusted banks in

the U.S., with some of the highest debt ratings, we can unlock

valuable working capital for our clients.”

The collaboration between U.S. Bank and LiquidX enhances

existing supply-chain-finance solutions currently available to U.S.

Bank clients. The Receivables Purchase Program allows sellers to

convert credit sales to immediate cash flows and reduce days sales

outstanding while extending payment terms for buyers. The Approved

Payables Financing Program helps buyers pay suppliers early,

reduces payment-processing costs, and gives suppliers faster and

more predictable access to cash.

“We are thrilled to enter this collaboration with U.S. Bank, one

of the country’s largest and most innovative banks, to deliver

much-needed liquidity to today’s supply chains,” said Jim Toffey,

CEO of LiquidX. “We are proud that our scalable and flexible

technology will make it easier, faster, and cheaper for U.S. Bank

and its corporate clients to transact.”

As supply-chain decisions become strategically critical for

businesses, Son said, innovative supply-chain-finance solutions

provide opportunities to strengthen vendor and client

relationships, reduce costs, and diversify sources of

working-capital funding. In addition, supply-chain-finance

solutions can advance other important company priorities, such as

Environmental, Social and Governance (ESG) initiatives by providing

financial incentives and greater access to working capital for

diverse suppliers.

About U.S. Bank

U.S. Bancorp, with approximately 70,000 employees and $587

billion in assets as of March 31, 2022, is the parent company of

U.S. Bank National Association. The Minneapolis-based company

serves millions of customers locally, nationally and globally

through a diversified mix of businesses: Consumer and Business

Banking; Payment Services; Corporate & Commercial Banking; and

Wealth Management and Investment Services. The company has been

recognized for its approach to digital innovation, social

responsibility, and customer service, including being named one of

the 2022 World’s Most Ethical Companies and Fortune’s most admired

superregional bank. Learn more at usbank.com/about.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20220510005368/en/

Todd Deutsch, U.S. Bank Public Affairs & Communications

todd.deutsch@usbank.com | 612.303.4148

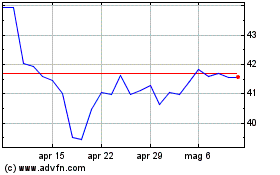

Grafico Azioni US Bancorp (NYSE:USB)

Storico

Da Mar 2024 a Apr 2024

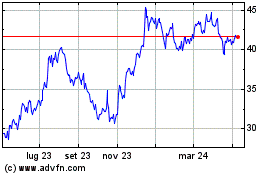

Grafico Azioni US Bancorp (NYSE:USB)

Storico

Da Apr 2023 a Apr 2024