Free Writing Prospectus - Filing Under Securities Act Rules 163/433 (fwp)

20 Luglio 2022 - 4:23PM

Edgar (US Regulatory)

Filed Pursuant to Rule 433

Registration No. 333-237082

Medium-Term Notes, Series AA

$1,750,000,000 4.548% Fixed-to-Floating Rate Notes due

July 22, 2028

Final Terms and Conditions

July 19, 2022

|

|

|

| Issuer: |

|

U.S. Bancorp |

|

|

| Note Type: |

|

SEC Registered Senior Notes |

|

|

| Expected Ratings*: |

|

A2 (Negative) (Moody’s) / A+ (Negative) (S&P) / A+ (Stable) (Fitch) / AA (Stable) (DBRS) |

|

|

| Principal Amount: |

|

$1,750,000,000 |

|

|

| Pricing Date: |

|

July 19, 2022 |

|

|

| Settlement Date: |

|

July 22, 2022 (T+3) |

|

|

| Maturity Date: |

|

July 22, 2028 |

|

|

| Reset Date: |

|

July 22, 2027 |

|

|

| Fixed Rate Period: |

|

From and including the Settlement Date to, but excluding, the Reset Date. |

|

|

| Floating Rate Period: |

|

From and including the Reset Date to, but excluding, the Maturity Date. |

|

|

| Fixed Interest Rate: |

|

4.548% per annum payable in arrears for each semi-annual Interest Period during the fixed rate period. |

|

|

| Floating Interest Rate: |

|

Floating Rate Benchmark as determined on the applicable Interest Determination Date plus the Spread per annum payable in arrears for each quarterly Interest Period during the floating rate period. |

|

|

| Spread: |

|

166 basis points |

|

|

| Floating Rate Benchmark: |

|

A compounded average of daily SOFR determined for each quarterly Interest Period during the floating rate period calculated in accordance with the terms and provisions set forth under “Description of Notes—Floating Rate

Notes—Base Rates—SOFR” in U.S. Bancorp’s prospectus supplement dated March 11, 2020 and “Supplemental Description of the Notes—Interest Rates; Floating Rate Benchmark” in the pricing supplement to

which this offering of notes relates. |

|

|

| Interest Determination Date: |

|

The business day immediately preceding the applicable Interest Payment Date during the floating rate period. |

|

|

| Interest Periods: |

|

With respect to the fixed rate period, each semi-annual period from, and including, an Interest Payment Date (or, in the case of the first Interest Period during the fixed rate period, the Settlement Date) to, but excluding, the

next Interest Payment Date (or, in the case of the final Interest Period during the fixed rate period, the Reset Date). |

|

|

|

|

|

With respect to the floating rate period, each quarterly period from, and including, an Interest Payment Date (or, in the case of the first Interest Period during the floating rate period, the Reset Date) to, but excluding, the next

Interest Payment Date (or, in the case of the final Interest Period during the floating rate period, the Maturity Date or, if the notes are redeemed earlier, the redemption date). |

|

|

| Interest Payment Dates: |

|

January 22 and July 22 of each year, beginning on January 22, 2023 and ending on the Reset Date, with respect to the fixed rate period.

January 22, April 22, July 22, and October 22 of each year, beginning on October 22,

2027 and ending on the Maturity Date, with respect to the floating rate period. |

|

|

| Day Count Convention: |

|

30/360, with respect to the fixed rate period.

Actual/360, with respect to the floating rate period. |

|

|

| Business Days: |

|

New York |

|

|

| Business Day Convention: |

|

Following Unadjusted Business Day Convention, with respect to the fixed rate period.

Modified Following Unadjusted Business Day Convention, with respect to the floating rate period. |

|

|

| Optional Redemption: |

|

The Issuer may redeem the notes at its option, (a) in whole, but not in part, on the Reset Date, or (b) in whole at any time or in part from time to time, on or after June 22, 2028 (one month prior to the Maturity

Date) and prior to the Maturity Date, in each case, upon at least 10 but not more than 60 days’ prior written notice to holders of the notes at a redemption price equal to 100% of the principal amount of the notes to be redeemed, plus accrued

and unpaid interest, if any, thereon to, but excluding, the applicable redemption date. |

|

|

| Benchmark Treasury: |

|

UST 3.250% Notes due June 30, 2027 |

|

|

| Benchmark Yield: |

|

3.148% |

|

|

| Reoffer Spread: |

|

+140 basis points |

|

|

| Reoffer Yield: |

|

4.548% |

|

|

| Price to Public: |

|

100.000% |

|

|

| Gross Spread: |

|

0.150% |

|

|

| All-In Price: |

|

99.850% |

|

|

| Net Proceeds to Issuer: |

|

$1,747,375,000 |

|

|

| CUSIP: |

|

91159HJF8 |

|

|

| Joint Book-Running Managers: |

|

U.S. Bancorp Investments, Inc. Barclays Capital

Inc. Goldman Sachs & Co. LLC |

|

|

| Co-Managers: |

|

Blaylock Van, LLC Drexel Hamilton,

LLC |

| * |

A securities rating is not a recommendation to buy, sell or hold securities and may be subject to revision

or withdrawal at any time. |

The offering is being made pursuant to an effective registration statement on Form S-3 (including a prospectus supplement and a prospectus, registration statement No. 333-237082), filed with the U.S. Securities and Exchange Commission (the

“SEC”). Before you invest, you should read the prospectus supplement and the prospectus and other documents the issuer has filed with the SEC for more complete information about the issuer and this offering. You may obtain these documents

for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the joint book-running managers can arrange to send you the prospectus supplement and the prospectus if you request them by contacting U.S. Bancorp Investments, Inc.

toll-free at 1-877-558-2607, Barclays Capital Inc. toll-free at

1-888-603-5847 or Goldman Sachs & Co. LLC toll free at 1-866-471-2526.

The issuer expects that delivery of the notes will be made against payment therefor on or about

July 22, 2022, which is the third business day following the date of this final term sheet (such settlement being referred to as “T+3”). Under Rule 15c6-1 of the Securities Exchange Act of 1934,

as amended, trades in the secondary market generally are required to settle in two business days, unless the parties to a trade expressly agree otherwise. Accordingly, purchasers who wish to trade the notes prior to the second business day before

delivery of the notes will be required, by virtue of the fact that the notes initially will settle in T+3, to specify alternative settlement arrangements to prevent a failed settlement.

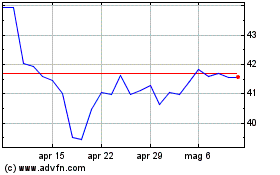

Grafico Azioni US Bancorp (NYSE:USB)

Storico

Da Mar 2024 a Apr 2024

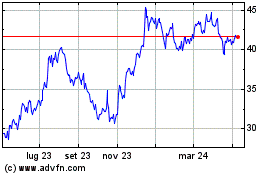

Grafico Azioni US Bancorp (NYSE:USB)

Storico

Da Apr 2023 a Apr 2024