SEC Fines Wells Fargo Broker $7 Million Over Suspicious Activity Reporting

20 Maggio 2022 - 5:00PM

Dow Jones News

By Dean Seal

The broker-dealer arm of Wells Fargo & Co. will pay the U.S.

Securities and Exchange Commission a $7 million fine to resolve

allegations that it failed to file at least 34 suspicious activity

reports in recent years.

Wells Fargo Advisers neither admits nor denies claims that it

failed to test a new version of its internal anti-money laundering

transaction monitoring system which, after being adopted in January

2019, was unable to reconcile different country codes used to

monitor foreign wire transfers.

As a result, the broker-dealer failed to flag at least 25

suspicious transactions involving wire transfers to or from foreign

countries that it considered to pose a moderate or high risk for

illegal money movements, such as money laundering or terrorist

financing, the SEC said.

The Wall Street regulator also alleges that Wells Fargo Advisers

didn't file at least nine other suspicious activity reports since

April 2017 due to failures in processing wire transfer data into

its anti-money laundering tracking system in certain situations,

like during bank holidays that didn't have a corresponding

brokerage holiday.

"This matter refers to legacy issues that impacted a transaction

monitoring system and the issues were resolved promptly upon

discovery," Wells Fargo Advisers said in a statement.

Write to Dean Seal at dean.seal@wsj.com

(END) Dow Jones Newswires

May 20, 2022 10:45 ET (14:45 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

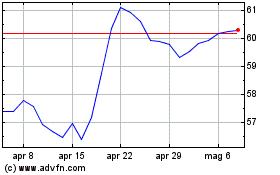

Grafico Azioni Wells Fargo (NYSE:WFC)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni Wells Fargo (NYSE:WFC)

Storico

Da Apr 2023 a Apr 2024