Exxon Says Strong Dollar Trimmed Earnings in Chemical Segment -- Currency Comment

31 Gennaio 2023 - 4:09PM

Dow Jones News

By Paulo Trevisani

Exxon Mobil Corporation said Tuesday a strong dollar contributed

to a decline in earnings last year in the chemical-products

segment, even as foreign exchange had a favorable effect

elsewhere.

The company reported earnings of $3.5 billion in 2022, down from

$7 billion in 2021, in the chemical segment. It said the decline

was due, in part, to "foreign exchange effects from a stronger U.S.

dollar."

Exxon said FX was also a headwind in specialty products, where

earnings fell to $2.4 billion from $3.3 billion.

On the other hand, Exxon said foreign exchange was a favorable

factor in the energy-products segment, were it reported full-year

earnings of $15 billion, reversing a $300 million loss in 2021.

The WSJ Dollar Index rose 7.8% in 2022, according to Dow Jones

Market Data.

Write to Paulo Trevisani at paulo.trevisani@wsj.com

(END) Dow Jones Newswires

January 31, 2023 09:54 ET (14:54 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

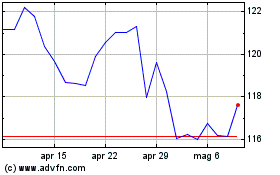

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Mar 2024 a Apr 2024

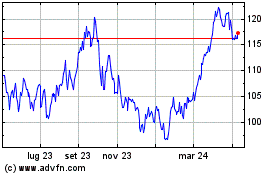

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Apr 2023 a Apr 2024