ExxonMobil Guyana Advances Fifth Offshore Guyana Development

28 Aprile 2023 - 1:00AM

Business Wire

- Uaru project receives government approvals; production targeted

to begin in 2026

- Fifth Stabroek block development will have daily production

capacity of around 250,000 barrels

- $12.7 billion of additional investment in Guyana’s growing

energy industry

ExxonMobil made a final investment decision for the Uaru

development offshore Guyana after receiving required government and

regulatory approvals. The company expects Uaru, the fifth project

on Guyana’s offshore Stabroek block, to add approximately 250,000

barrels of daily capacity after a targeted startup in 2026.

“Our fifth, multi-billion-dollar investment in Guyana

exemplifies ExxonMobil’s long-term commitment to the country’s

sustained economic growth,” said Liam Mallon, president of the

ExxonMobil Upstream Company. “Our Guyana investments and unrivalled

development success continue to contribute to secure, reliable

global energy supplies at this critical time.”

The $12.7 billion Uaru project plans to include up to 10 drill

centers and 44 production and injection wells aimed at developing

an estimated resource of more than 800 million barrels of oil.

MODEC is constructing the Floating Production Storage and

Offloading (FPSO) vessel for the Uaru project, which will be called

the Errea Wittu. ExxonMobil is utilizing its diversified supplier

base to help reduce costs and safely accelerate development in its

Guyana operations. The company’s diverse supplier base includes

nearly 1,000 unique local Guyanese suppliers, exemplifying Guyana’s

growing in-country supply chain capabilities.

Two FPSOs, the Liza Destiny and Liza Unity, are currently

operating offshore Guyana and safely produced an average of 375,000

barrels of oil per day in the first quarter. A third FPSO, the

Prosperity, is expected to be operational later this year, adding

220,000 barrels of daily capacity from the Payara development.

ExxonMobil made a final investment decision on the fourth offshore

project, Yellowtail, last year. The company is targeting to have

six FPSOs online by the end of 2027, bringing Guyana’s production

capacity to more than 1.2 million barrels per day.

ExxonMobil’s Guyana developments are generating around 30% lower

greenhouse gas intensity than the average of ExxonMobil’s upstream

portfolio. According to the independent research firm Rystad

Energy, they are also among the best performing in world with

respect to emissions intensity, outpacing 75% of global oil and gas

producing assets.

ExxonMobil affiliate Esso Exploration and Production Guyana

Limited is operator and holds 45% interest in the Stabroek Block.

Hess Guyana Exploration Ltd. holds 30% interest and CNOOC Petroleum

Guyana Limited holds 25% interest.

About ExxonMobil

ExxonMobil, one of the largest publicly traded international

energy and petrochemical companies, creates solutions that improve

quality of life and meet society’s evolving needs.

The corporation’s primary businesses - Upstream, Product

Solutions and Low Carbon Solutions - provide products that enable

modern life, including energy, chemicals, lubricants, and lower

emissions technologies. ExxonMobil holds an industry-leading

portfolio of resources, and is one of the largest integrated fuels,

lubricants and chemical companies in the world.

In 2021, ExxonMobil announced Scope 1 and 2 greenhouse gas

emission-reduction plans for 2030 for operated assets, compared to

2016 levels. The plans are to achieve a 20-30% reduction in

corporate-wide greenhouse gas intensity; a 40-50% reduction in

greenhouse gas intensity of upstream operations; a 70-80% reduction

in corporate-wide methane intensity; and a 60-70% reduction in

corporate-wide flaring intensity.

With advancements in technology and the support of clear and

consistent government policies, ExxonMobil aims to achieve net-zero

Scope 1 and 2 greenhouse gas emissions from its operated assets by

2050. To learn more, visit exxonmobil.com, the Energy Factor, and

ExxonMobil’s Advancing Climate Solutions.

Follow us on Twitter and LinkedIn.

Cautionary Statement

Statements related to outlooks; projections; descriptions of

strategic, operating, and financial plans and objectives;

statements of future ambitions and plans; and other statements of

future events or conditions, are forward-looking statements.

Forward-looking statements are based on current expectations,

estimates, projections and assumptions at the time the statements

are made. Actual future results, including project plans,

schedules, costs, returns, and capacities; ultimate recoveries;

operating performance and demand projections could differ

materially due to changes in market conditions affecting the oil

and gas industry or long-term oil and gas price levels; political

or regulatory developments; reservoir performance; timely

completion of development projects; technical or operating factors;

the outcome of future commercial negotiations, including final

agreed terms and conditions; unforeseen technical or operating

difficulties and unplanned maintenance; and other factors discussed

under the heading "Factors Affecting Future Results" in the

Investor Information section of our website (www.exxonmobil.com)

and in Item 1A of our most recent Form 10-K. The term "project" as

used in this release can refer to a variety of different activities

and does not necessarily have the same meaning as under any

government payment transparency reports.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20230427005677/en/

Media Relations 972-940-6007

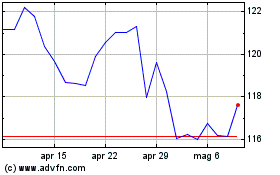

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Mar 2024 a Apr 2024

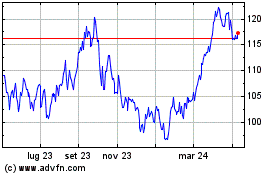

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Apr 2023 a Apr 2024