Notice of Exempt Solicitation. Definitive Material. (px14a6g)

05 Maggio 2023 - 7:29PM

Edgar (US Regulatory)

United States Securities and

Exchange Commission

Washington, D.C. 20549

NOTICE OF EXEMPT SOLICITATION

Pursuant to Rule 14a-103

Name of the Registrant: ExxonMobil

Corporation

Name of persons relying on

exemption: Mercy Investment Services, Inc.

Address of persons relying

on exemption:

2039 North Geyer Road, Saint

Louis, MO 63131

Written materials are submitted

pursuant to Rule 14a-6(g) (1) promulgated under the Securities Exchange Act of 1934. Submission is not required of this filer under the

terms of the Rule, but is made voluntarily in the interest of public disclosure and consideration of these important issues.

ExxonMobil Corporation

Vote FOR: Proxy Ballot

Item #10

Report on Worst-case Spill

for Exxon’s Guyana Offshore Drilling Operations

Annual Meeting: May 31,

2023

CONTACT: Mary Minette,

Mercy Investment Services | mminette@Mercyinvestments.org

Court Ruling in Guyana

Specifies Unlimited Liability for Exxon in An Oil Spill

Demonstrates Need for Ballot

Item #10

We write

to fellow ExxonMobil shareholders to inform you of a recent development concerning Ballot Item Number 10, the shareholder proposal requesting

a report on the costs and impacts of a worst-case oil spill from the Company’s Guyana offshore oil drilling operations.

On May 3,

2023, the ExxonMobil subsidiary operating in Guyana, Esso Exploration and Production Guyana Limited, received an Enforcement Notice from

the Supreme Court of Guyana as a result of a lawsuit filed by civil society organizations in Guyana.

The judgment came from the

Honorable Justice Sandil Kissoon of the Supreme Court of Judicature of Guyana in Collins v. EPA. Justice Kissoon determined that ExxonMobil

has failed to comply with the Financial Assurance obligation stipulated in its environmental permit, and

that within the next 30 days, ExxonMobil as the parent company of the Guyana subsidiary must provide unlimited insurance coverage

to safeguard Guyana against the “grave potential danger and consequences to the State and citizens” of an oil spill occurring

in the absence of such financial assurances. Failure to comply with the court order would result in the suspension of the Company’s

environmental permit.

The

court also asserted manipulation by the company, and “found on evidence before it that ESSO Exploration and Production Guyana

Limited [the ExxonMobil subsidiary] was engaged in a disingenuous attempt which was calculated to deceive when it sought to dilute its

liabilities and settled obligations stipulated and expressed in clear unambiguous terms” of the environmental permit.

The decision

affirms that the parent Company’s obligations under the environmental permit require it to assume unlimited liability for all

costs of “clean up, restoration and compensation for any damages caused by a discharge or any contaminant.” The Court noted

the existing guarantee to the extent of $2 billion “does not fulfill the obligation” of the permit or even what is “considered

environmental liability insurance as is customary in the international petroleum industry.”

The Supreme

Court of Guyana also criticized the lack of enforcement of these terms by Guyana’s EPA that placed Guyana “and its people

in grave potential danger of calamitous disaster.”

For

the Company to provide an unlimited Parent Company Guarantee Agreement to Guyana clarifies the scope of material liabilities that could

fall upon ExxonMobil from these operations. For comparison, estimates suggest the BP Macondo oil spill has cost BP and its drilling

partners at least $71 billion to mitigate the disaster’s effects.1

Even this figure may continue to increase over time, as the company’s settlement with individuals who filed medical claims immediately

after the accident could cost BP well into the future, with more recent lawsuits filed by hundreds of individuals with late-occurring

health effects still pending.2

1

https://www.nola.com/news/business/bp-and-its-partners-have-spent-71-billion-over-10-years-on-deepwater-horizon-disaster/article_ca773cc0-80f4-11ea-8fbe-ffa77e5297bd.html#:~:text=BP%20and%20its%20partners%20have,%7C%20Business%20News%20%7C%20nola.com

2

https://www.nola.com/news/business/bp-and-its-partners-have-spent-71-billion-over-10-years-on-deepwater-horizon-disaster/article_ca773cc0-80f4-11ea-8fbe-ffa77e5297bd.html#:~:text=BP%20and%20its%20partners%20have,%7C%20Business%20News%20%7C%20nola.com;

See also, https://www.fox10tv.com/2022/07/08/12-years-later-bp-still-fighting-hundreds-lawsuits-over-deepwater-horizon-spill/

Ballot Item

Number 10 seeks disclosures that would allow investors to better evaluate the scope of potential liability associated with a worst-case

spill.

Asset managers and other

fiduciaries that seek to exercise due diligence in managing portfolio risks would be well advised to vote in favor of this proposal, bringing

into clearer transparency the potential costs and risks associated with a worst-case spill scenario in Guyana.

Therefore, we urge investors

to vote “FOR” on Ballot Item Number 10 on the Company’s proxy statement.

THE FOREGOING INFORMATION MAY BE DISSEMINATED

TO SHAREHOLDERS VIA TELEPHONE, U.S. MAIL, E-MAIL, CERTAIN WEBSITES AND CERTAIN SOCIAL MEDIA VENUES, AND SHOULD NOT BE CONSTRUED AS INVESTMENT

ADVICE OR AS A SOLICITATION OF AUTHORITY TO VOTE YOUR PROXY. PROXY CARDS WILL NOT BE ACCEPTED BY MERCY INVESTMENT SERVICES. TO VOTE YOUR

PROXY, PLEASE FOLLOW THE INSTRUCTIONS ON THE COMPANY’S PROXY CARD.

3

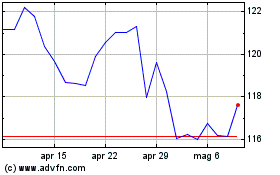

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Mar 2024 a Apr 2024

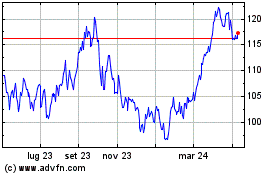

Grafico Azioni Exxon Mobil (NYSE:XOM)

Storico

Da Apr 2023 a Apr 2024