Capital Power, Manulife to Buy Midland Cogeneration From Omers

12 Luglio 2022 - 3:09PM

Dow Jones News

By Colin Kellaher

Capital Power Corp. on Tuesday said it is teaming with Manulife

Investment Management to buy a 1,633-megawatt natural gas

combined-cycle cogeneration facility in the U.S. in a deal valued

at $894 million, including the assumption of $521 million of

project level debt.

The companies are acquiring MCV Holding Co., which owns the

Midland Cogeneration plant in Michigan, from Omers Infrastructure

Management, the infrastructure-investment arm of the Ontario

Municipal Employees Retirement System, and its co-investors in a

deal slated to close in the third quarter.

Capital Power, an Edmonton, Alberta, wholesale power producer,

and Manulife, on behalf of its Manulife Infrastructure Fund II,

will each contribute about $186 million under a joint-venture

agreement, Capital Power said.

The company said the Midland plant is largest gas-fired

cogeneration facility in the U.S. and is a critical asset to

support grid reliability during the transition to renewables.

Capital Power said it plans to finance its portion of the

transaction with cash on hand and its credit facilities, adding

that it won't need to access the equity markets.

Omers acquired the Midland plant in 2012.

Write to Colin Kellaher at colin.kellaher@wsj.com

(END) Dow Jones Newswires

July 12, 2022 08:54 ET (12:54 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

Grafico Azioni Manulife Financial (TSX:MFC)

Storico

Da Mar 2024 a Apr 2024

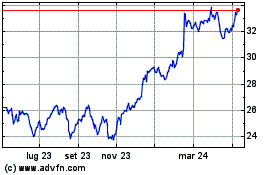

Grafico Azioni Manulife Financial (TSX:MFC)

Storico

Da Apr 2023 a Apr 2024