BASF to Implement Cost-Saving Plan After Lower-Than-Expected 3Q Earnings -- Update

12 Ottobre 2022 - 3:41PM

Dow Jones News

By Ed Frankl

BASF SE said Wednesday that it would put into action a new

cost-saving program worth half a billion euros a year amid a

deteriorating energy outlook and after a writedown on its stake in

the Nord Stream 1 gas pipeline forced third-quarter earnings below

expectations.

The German chemical giant said it would implement a cost-savings

plan worth 500 million euros ($485.3 million) annually in 2023 and

2024, as conditions worsen in Europe and what it called

significantly weaker earnings.

Earnings were especially worse in Germany, where third-quarter

results were negative, BASF said.

Overall, BASF's net income in the quarter to the end of

September was EUR909 million, down from EUR1.25 billion in the same

period of 2021.

The on-year fall was due to an impairment worth EUR740 million

on the partial write-down of its 73%-owned subsidiary Wintershall

Dea's stake in Nord Stream AG, which operates the Nord Stream 1

pipeline between Russia and Germany.

Sales, however, increased on year by 12% to EUR21.95 billion on

the back of higher prices, though volumes fell, it said.

Increased prices for raw materials and energy could only partly

be passed on through higher selling prices, BASF said.

The net profit was below consensus expectations provided by the

company of EUR1.11 billion, while sales ticked above views of

EUR21.08 billion.

Operating, service and research & development divisions, as

well as its corporate center, will be streamlined, with more than

half the savings at its main base at Ludwigshafen in western

Germany, it said.

While some cost savings possible in the short term will be

implemented immediately, others will be announced in the first

quarter of 2023, including reevaluating its Verbund production

strategy, the company added.

Employee representatives would be involved regarding the

different measures, BASF said.

The company, however, said its 2022 outlook was unchanged,

including earnings before interest and taxes before special items

of EUR6.8 billion-EUR7.2 billion.

Investors reacted positively to the news, with BASF shares in

Frankfurt rising 2.0% to EUR42.30 at 1300 GMT.

BASF is due to publish full third-quarter results on Oct.

26.

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

October 12, 2022 09:26 ET (13:26 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

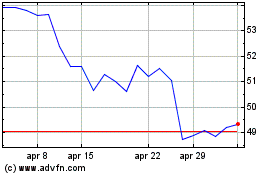

Grafico Azioni BASF (TG:BAS)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni BASF (TG:BAS)

Storico

Da Apr 2023 a Apr 2024