BASF to Further Cut Costs in Germany After 4Q Earnings Declined -- Update

24 Febbraio 2023 - 10:12AM

Dow Jones News

By Pierre Bertrand

BASF SE said Friday that it is implementing further cost-saving

measures and would cut jobs at its Ludwigshafen facility as the

German chemical company seeks to reduce costs after a year which

saw earnings fall.

The company said it was carrying out structural measures at

Ludwigshafen designed to lower costs by more than 200 million euros

($211.9 million) a year by the end of 2026.

BASF said it would close its TDI plant, including the precursor

plants for DNT and TDA, its caprolactam plant, including one of two

ammonia plants and associated fertilizer facilities, and reduce its

adipic acid production capacity and close its cyclohexanol,

cyclohexanone and soda ash plants at Ludwigshafen in a bid to

improve the competitiveness of the facility.

The measure will affect around 700 production positions and

relates to 10 percent of the asset replacement value of the site,

BASF said.

The actions are in addition to a previously announced cost

saving program BASF is implementing to save EUR500 million annually

in non-production areas by the end of 2024, which the company said

Friday would affect around 2,600 jobs.

BASF said it made a EUR4.85 billion net loss in the fourth

quarter of 2022 compared with EUR898 million in the last quarter of

2021, on sales that declined 2.3% to EUR19.32 billion.

Earnings before interest and taxes before special items declined

in the fourth quarter were EUR373 million, compared with EUR1.23

billion in the prior-year period.

Net profit for 2022 amounted to a EUR627 million net loss,

compared with a 2021 profit of EUR5.52 billion.

BASF said its net income was hit by what it called exceptionally

high impairments related to its shareholding in Wintershall Dea

AG.

The company booked around EUR6.3 billion in special charges in

2022 mainly from non-cash-effective impairment losses due to the

deconsolidation of Wintershall Dea's Russian exploration and

production activities, it said.

The company proposed a flat dividend of EUR3.40 a share and said

separately that it has terminated its share buyback program ahead

of schedule.

BASF anticipates a weak first half of 2023 with an improvement

expected in the second half.

BASF said that for 2023, it is expecting to make between EUR84

billion and EUR87 billion in sales and between EUR4.8 billion and

EUR5.4 billion in earnings before interest and taxes before special

items.

Write to Pierre Bertrand at pierre.bertrand@wsj.com

(END) Dow Jones Newswires

February 24, 2023 03:57 ET (08:57 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

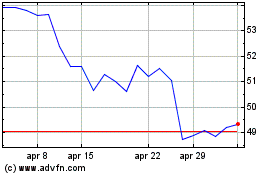

Grafico Azioni BASF (TG:BAS)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni BASF (TG:BAS)

Storico

Da Apr 2023 a Apr 2024