Munich Re Cuts Guidance on Investment Returns Amid Economic Slowdown, Rising Rates -- Update

09 Agosto 2022 - 9:17AM

Dow Jones News

By Ed Frankl

Muenchener Rueckversicherungs-Gesellschaft AG said Tuesday that

it was cutting its full-year guidance for return on investment on a

cooling economy and higher rates, though profit and premiums beat

second-quarter expectations as it overcame bigger losses.

The German reinsurer downgraded part of its full-year guidance

after its investment result tumbled to 971 million euros ($990

million) in the second quarter from EUR1.93 billion in the same

period last year, which it blamed on impairment losses on equities,

triggered by falling equity markets.

Its key measurement of investment gain or losses--return on

investment, or RoI--fell to 1.6% in the quarter from 3.1% last

year, Munich Re said.

The company now anticipates in 2022 a RoI of more than 2.0%

compared with more than 2.5% previously, hit by falling share

prices and higher interest rates, but kept its other targets

including a net profit of EUR3.3 billion for 2022.

However, higher interest rates in the long term should allow

Munich Re to take advantage of better returns on bonds, it

said.

In quarterly results, the Bavarian company reported net profit

of EUR768 million in the three months to the end of June, down from

EUR1.11 billion a year earlier.

Gross premiums written came to EUR15.85 billion, up 8.3% on

year, Munich Re said.

That compared with expectations of EUR719 million for net profit

and EUR15.8 billion for gross written premiums, according to

analysts' estimates provided by the company.

However, reinsurance losses rose in the second quarter on year,

with major losses--those in excess of EUR10 million--climbing to

EUR575 million from EUR432 million last year.

The company took EUR90 million in second-quarter losses from the

impact of Russia's invasion of Ukraine, and around EUR200 million

for it in the year to date.

Natural-catastrophe losses grew nearly 25%, with the costliest

natural disaster for Munich Re the drought in South America, with

losses at around EUR130 million.

Profits at its reinsurance arm fell almost 50% to EUR608 million

due to a negative RoI, it said.

However, July renewals showed premium growth of 6%, though the

company said it is being cautious in calculating future loss

expectations due to higher inflation.

Its solvency ratio, a measure of financial strength, rose to

252% from 227% at the end of 2021, above the company's optimum

range, it said.

Munich Re also made currency gains of EUR485 million owing to a

lift in the U.S. dollar, it added.

In uncertain times, the company is increasing the share of

earnings generated by "less-cyclical business", Chief Executive

Joachim Wenning said.

Referring to a period of an upswing in the market, including

higher premiums, he added: "Now is the time to seize opportunities

in markets that are continuing to harden."

Write to Ed Frankl at edward.frankl@dowjones.com

(END) Dow Jones Newswires

August 09, 2022 03:02 ET (07:02 GMT)

Copyright (c) 2022 Dow Jones & Company, Inc.

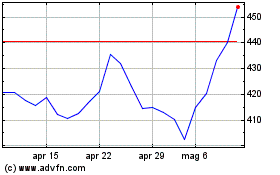

Grafico Azioni Muenchener Rueckversiche... (TG:MUV2)

Storico

Da Mar 2024 a Apr 2024

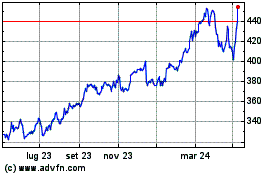

Grafico Azioni Muenchener Rueckversiche... (TG:MUV2)

Storico

Da Apr 2023 a Apr 2024