TIDMFOUR

RNS Number : 7307U

4imprint Group PLC

01 April 2019

4imprint Group plc (the "Company")

Publication and Posting of 2018 Annual Report and Accounts

The Company has published its 2018 Annual Report and Accounts,

together with a Notice of Annual General Meeting and Form of

Proxy.

These documents have been posted to shareholders.

Copies of the Annual Report and Notice of Annual General Meeting

are available on the Company's website,

http://investors.4imprint.com.

Copies of the Annual Report, Notice of Annual General Meeting

and Form of Proxy have been submitted to the National Storage

Mechanism and will shortly be available at

www.morningstar.co.uk/uk/NSM.

The Annual General Meeting of the Company will be held at 11.00

on 7 May 2019 at the offices of Peel Hunt, Moor House, 120 London

Wall, London EC2Y 5ET.

A condensed set of the financial statements for the 52 weeks

ended 29 December 2018 together with information on important

events that occurred during that financial period and their impact

on the financial statements were contained in the Final Results RNS

announcement made on 5 March 2019. That information, together with

the information set out in the appendices to this announcement,

which is extracted from the Annual Report, constitute the material

required by DTR 6.3.5R which is required to be communicated to the

media in full unedited text through a Regulatory Information

Service. This announcement is not a substitute for reading the

Annual Report.

In the appendices "Group" is 4imprint Group plc and its

subsidiaries.

For further information, please contact:

Andrew Scull

Company Secretary

4imprint Group plc

Tel: 020 3709 9680

Appendices

A. Statement of Directors' Responsibilities in respect of the Financial Statements

The Directors are responsible for preparing the Annual Report

and the financial statements in accordance with applicable law and

regulation.

Company law requires the Directors to prepare financial

statements for each financial 52 week period. Under that law the

Directors have prepared the Group financial statements in

accordance with International Financial Reporting Standards (IFRSs)

as adopted by the European Union and company financial statements

in accordance with International Financial Reporting Standards

(IFRSs) as adopted by the European Union. Under company law the

Directors must not approve the financial statements unless they are

satisfied that they give a true and fair view of the state of

affairs of the Group and Company and of the profit or loss of the

Group and Company for that period. In preparing the financial

statements, the Directors are required to:

-- select suitable accounting policies and then apply them

consistently;

-- state whether applicable IFRSs as adopted by the European

Union have been followed for the Group financial statements and

IFRSs as adopted by the European Union have been followed for the

Company financial statements, subject to any material departures

disclosed and explained in the financial statements;

-- make judgments and accounting estimates that are reasonable

and prudent; and

-- prepare the financial statements on the going concern basis

unless it is inappropriate to presume that the Group and Company

will continue in business.

The Directors are also responsible for safeguarding the assets

of the Group and Company and hence for taking reasonable steps for

the prevention and detection of fraud and other irregularities.

The Directors are responsible for keeping adequate accounting

records that are sufficient to show and explain the Group and

Company's transactions and disclose with reasonable accuracy at any

time the financial position of the Group and Company and enable

them to ensure that the financial statements and the Directors'

Remuneration Report comply with the Companies Act 2006 and, as

regards the Group financial statements, Article 4 of the IAS

Regulation.

The Directors are responsible for the maintenance and integrity

of the Company's website. Legislation in the United Kingdom

governing the preparation and dissemination of financial statements

may differ from legislation in other jurisdictions.

Andrew Scull

Company Secretary

5 March 2019

B. Principal risks and uncertainties

The list below is extracted in full and unedited from the Annual

Report and Accounts 2018, pages 20 to 25. Page references below are

to pages in the Annual Report and Accounts 2018.

4imprint's business model means that it may be affected by a

number of risks, not all of which are within its control. Outlined

below are the current principal potential risks and uncertainties

to the successful delivery of the Group's strategic goals. The list

is not exhaustive and other, as yet unidentified, factors may have

an adverse effect.

Economic and market risks

Macroeconomic conditions

Description of risk

The business conducts most of its operations in North America

and would be affected by a downturn in general economic

conditions in this region or negative effects from tension

in international trade. In previous economic downturns,

the promotional products market has typically softened

broadly in line with the general economy.

Potential impact

* Customer acquisition and retention could fall, Link to strategy

impacting revenue in current and future periods. (R) Organic revenue growth

(R) Cash generation and

profitability

* The growth and profitability levels called for in the

Group strategic plan may not be achieved.

* Cash generation could be reduced broadly

corresponding to a reduction in profitability.

Mitigating activities

* Management monitors economic and market conditions to Direction

ensure that appropriate and timely adjustments are (R) On a broad level

made to marketing and other budgets. market conditions to

date have remained quite

stable

* The customer proposition in terms of promotions, (R) = Unchanged

price, value and quality of product can be adjusted

to resonate with customer requirements and budgets in

the prevailing economic climate.

* The Group's balance sheet funding policy (see page

18) aims to provide operational and financial

flexibility to facilitate continued investment in the

business through different economic cycles.

Competition

Description of risk

The promotional products markets in which the business

operates are intensely competitive and the rapid development

of internet commerce, digital marketing and online marketplaces

may allow competitors to reach a broader audience. In addition,

new or disruptive business models looking to break down

the prevailing distributor/supplier structure in the promotional

products industry may be developed by existing competitors

or new entrants.

Potential impact

* Aggressive competitive activity could result in Link to strategy

pressure on prices, margin erosion and loss of market (R) Market leadership

share. All of these factors could impair the growth (R) Organic revenue

of the business and therefore impact the financial growth

results. (R) Cash generation

and profitability

* The Group's strategy based on achieving organic

growth in fragmented markets may need to be

reassessed.

Mitigating activities

* An open-minded culture and an appetite for technology Direction

are encouraged, with the aim of positioning the (R) The competitive

business at the forefront of innovation in the landscape to date has

industry. been relatively consistent

in our main markets

(R) = Unchanged

* Management closely monitors competitive activity in

the marketplace.

* Price, satisfaction and service level guarantees are

an integral part of the customer proposition.

Customer surveys and market research are used to

gauge customer satisfaction and perception, and the

causes of any negative indications are investigated

and addressed rapidly.

Currency exchange

Description of risk

There is some exposure to currency exchange risk. Although

the business trades predominantly in US dollars, it also

transacts business in Canadian dollars, Sterling and Euros,

leading to some currency risk on trading. In addition,

Head Office costs, pension scheme commitments and dividends

are payable in Sterling, consequently the business may

be adversely impacted by movements in the Sterling/US dollar

exchange rate when it repatriates cash to the UK.

Potential impact

* The financial results of trading operations, and Link to strategy

therefore overall profitability, may be negatively (R) Cash generation and

affected. profitability

(R) Capital structure

(R) Shareholder value

* The financial condition and cash position of the

Group may differ materially from expectations. In an

extreme scenario, the Group's strategic objectives

around capital structure and core dividend

commitments could be disrupted.

Mitigating activities

* The Group reports its results in US dollars, Direction

minimising currency impact on reported revenue, (R) Political instability,

operating profit and net assets since trading interest rate policy

operations are concentrated largely in North America. (US) and Brexit concerns

(UK) may lead to increased

volatility in currency

* The Group can use forward contracts to hedge markets

anticipated cash receipts from its overseas (R) Increased

operations, giving some certainty of amounts

receivable in Sterling.

Operational risks

Business facility disruption

Description of risk

The 4imprint business model means that operations are concentrated

in centralised office and distribution facilities. The

performance of the business could be adversely affected

if activities at one of these facilities were to be disrupted,

for example, by fire, flood, loss of power or internet/telecommunication

failure.

Potential impact

* The inability to service customer orders over any Link to strategy

extended period would result in significant revenue (R) Market leadership

loss, deterioration of customer acquisition and (R) Organic revenue growth

retention metrics and diminished return on marketing (R) Cash generation and

investment. profitability

* The Group's reputation for excellent service and

reliability may be damaged.

Mitigating activities

* Back-up and business continuity procedures are in Direction

place to ensure that customer service disruption is (R) No significant change

minimised. This includes customer service resource in the nature or likelihood

based at a separate location and team members working of these risks

from home, (R) = Unchanged

* Websites are cloud-based, and data is backed up

immediately to off-site servers.

* Relationships are maintained with third party

embroidery contractors to provide backup in the event

of facility unavailability.

Disruption to the product supply chain or delivery service

Description of risk

As a consequence of the Group's drop-ship distribution

model, trading operations could be interrupted if (i) the

activities of a key supplier were disrupted and it was

not possible to source an alternative supplier in the short

term; or (ii) the primary parcel delivery partner used

by the business suffered significantly degraded service

levels. As the Group continues to grow, the volume of orders

placed with individual suppliers becomes significant.

Potential impact

* Inability to fulfil customer orders would lead to Link to strategy

lost revenue and a negative impact on customer (R) Market leadership

acquisition and retention statistics. (R) Organic revenue growth

(R) Cash generation and

profitability

* The Group's reputation for excellent service and

reliability may be damaged.

Mitigating activities

* A rigorous selection process is in place for key Direction

suppliers, with evaluation and monitoring of quality, (R) Risk inherent in

production capability and capacity, ethical standards increasing supplier concentration

and financial stability. (R) Increased

* Wherever possible, relationships are maintained with

suitable alternative suppliers for each product

category.

* Secondary relationships are in place with alternative

parcel carriers.

Disturbance in established marketing techniques

Description of risk

The success of the business relies on its ability to attract

new and retain existing customers through a variety of

marketing techniques. These methods may become less effective

as follows:

Offline: The flow of print catalogues and sample packages

would be disrupted by the incapacity of the US Postal Service

to make deliveries, for example due to natural disasters

or labour activism.

Online: Search engines are an important source for channelling

customer activity to 4imprint's websites. The efficiency

of search engine marketing could be adversely affected

if the search engines were to modify their algorithms or

otherwise make substantial changes to their practices.

Potential impact

* If sustained over anything more than a short time Link to strategy

period, an externally-driven decrease in the (R) Market leadership

effectiveness of key marketing techniques would cause (R) Organic revenue

damage to the customer file as customer acquisition growth

and retention fall. This would affect order flow and (R) Cash generation

revenue in the short term and the productivity of the and profitability

customer file over a longer period, impacting growth

prospects.

Mitigating activities

* Offline: Developments in the US Postal Service are Direction

closely monitored through industry associations and (R) Successful marketing

lobbying groups. Alternative parcel carriers are diversification in 2018

continuously evaluated. via the introduction

of the brand marketing

investment

* Online: Management stays very close to new (R) Decreased

developments and emerging technologies in the online

space. Efforts are focused on anticipating changes

and ensuring compliance with both the requirements of

providers and applicable laws.

* The Marketing team constantly tests and evaluates new

marketing techniques and opportunities in order to

broaden the overall marketing portfolio and to reduce

the dominance of any one constituent element. An

example is the brand marketing campaign launched

during 2018.

Reliance on key personnel

Description of risk

Performance depends on the ability of the business to continue

to attract, motivate and retain key staff. These individuals

possess sales and marketing, merchandising, supply chain,

IT, financial and general management skills that are key

to the continued successful operation of the business.

Potential impact

* The loss of key employees or inability to attract Link to strategy

appropriate talent could adversely affect the Group's (R) Market leadership/revenue

ability to meet its strategic objectives, with a growth

consequent negative impact on future results. (R) Cash generation

and profitability

(R) Shareholder value

Mitigating activities

* The business is proactive in aiming to deliver a Direction

first class working environment. In addition, (R) The business has

competitive employment terms and incentive plans are been able to attract

designed with a view to attracting and retaining key and retain appropriate

personnel. talent

(R) = Unchanged

Technological risks

Failure or interruption of information technology systems

and infrastructure

Description of risk

The business is highly dependent on the efficient functioning

of its IT infrastructure. An interruption or degradation

of services at any 4imprint operational facility would

affect critical order processing systems and thereby compromise

the ability of the business to deliver on its customer

service proposition.

Potential impact

* In the short term, orders would be lost and delivery Link to strategy

deadlines missed, decreasing the efficiency of (R) Market leadership

marketing investment and impacting customer (R) Organic revenue growth

acquisition and retention. (R) Cash generation and

profitability

* Revenue and profitability are directly related to

order flow and would be adversely affected as a

consequence of a major IT failure.

* Depending on the severity of the incident, longer

term reputational damage could result.

Mitigating activities

* There is significant ongoing investment in both the Direction

IT team supporting the business and the hardware and (R) The IT platform is

software system requirements for a stable and secure mature, and performance

operating platform. has been efficient and

resilient

(R) = Unchanged

* Back-up and recovery processes are in place,

including immediate replication of data to an

alternative site, to minimise the impact of

information technology interruption.

* Cloud-based hosting for eCommerce and other back end

functionality.

Failure to adapt to new technological innovations

Description of risk

The operating platforms of the business may not be able

to respond and adapt to rapid changes in technology. If

the development of websites and customer-facing applications

for alternative devices and platforms is slow or ineffective

the business could lose competitive edge. In addition,

the development of order processing, supplier-facing and

data analytics technologies could fail to deliver the improvements

in speed, ease and efficiency necessary to attract and

retain a productive customer base.

Potential impact

* If the business fails to adapt to new technologies Link to strategy

and therefore falls behind in the marketplace, it may (R) Market leadership

fail to capture the number of new customers and (R) Organic revenue growth

retain existing customers at the rate required to

deliver the growth rates called for in the Group's

strategic plan.

Mitigating activities

* Management has a keen awareness of the need to keep Direction

pace with the rapidly changing and continuously (R) Innovation remains

evolving technological landscape. a priority

(R) = Unchanged

* An appetite for technological innovation is

encouraged in the business. Sustained investment is

made in the development of both outward-facing and

back office systems.

Security of customer data

Description of risk

Unauthorised access to and misappropriation of customer

data could lead to reputational damage and loss of customer

confidence. This is a rapidly changing environment, with

new threats emerging on an almost daily basis.

Potential impact

* A significant security breach could lead to Link to strategy

litigation and losses, with a costly rectification (R) Cash generation

process. In addition, it might be damaging to the and profitability

Group's reputation and brand. (R) Shareholder value

* An event of this nature might result in significant

expense, impacting the Group's ability to meet its

strategic objectives.

Mitigating activities

* The business employs experienced IT staff whose focus Direction

is to mitigate IT security violations. Investment in (R) The general incidence

software and other resources in this area continues and publicity around

to be a priority. cyber-crime continues

to increase

(R) Increased

* Due to the ever-evolving nature of the threat,

emerging cyber risks are addressed by the IT security

team on a case-by-case basis.

* Technical and physical controls are in place to

mitigate unauthorised access to customer data and

there is an ongoing investment process in place to

maintain and enhance the integrity and efficiency of

the IT infrastructure and its security.

C. Related party transactions

There are no related party transactions requiring

disclosure.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

ACSUAVSRKOASRAR

(END) Dow Jones Newswires

April 01, 2019 10:57 ET (14:57 GMT)

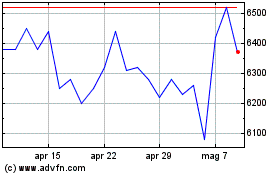

Grafico Azioni 4imprint (LSE:FOUR)

Storico

Da Mar 2024 a Apr 2024

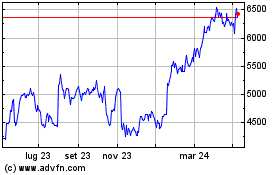

Grafico Azioni 4imprint (LSE:FOUR)

Storico

Da Apr 2023 a Apr 2024