TIDMFOUR

RNS Number : 8063R

4imprint Group PLC

05 March 2019

5 March 2019

4imprint Group plc

Final results for the period ended 29 December 2018

4imprint Group plc (the "Group"), the leading direct marketer of

promotional products, today announces its final results for the 52

weeks ended 29 December 2018.

Highlights

2017

2018 (restated)

Financial $m $m Change

-------- ------------

Revenue 738.42 627.52 +18%

Underlying* profit before tax 45.59 41.91 +9%

Profit before tax 44.15 40.66 +9%

------------------------------------ -------- ------------ ---------------

Underlying* basic EPS (cents)

Basic EPS (cents) 129.77 106.74 +22%

Proposed total dividend per share 125.61 103.15 +22%

(cents)

70.00 58.10 +20%

Proposed total dividend per share

(pence) 53.15 42.58 +25%

Supplementary dividend (cents) - 60.00 -

Supplementary dividend (pence) - 43.17 -

------------------------------------ -------- ------------ ---------------

* Underlying is before defined benefit pension charges and

exceptional items.

Underlying has been restated to include share option

charges.

Operational

* Organic revenue growth

* Revenue + $110.9m (+18%)

* 1,389,000 total orders processed (+17%)

* 279,000 new customers acquired; stable retention

rates

* Execution of Group strategy

- Brand awareness initiative successfully launched in 2018

- Ahead of plan to hit revenue target of $1bn by 2022

- $5m capital investment in Oshkosh distribution centre

in 2019

* Financial discipline

* Cash balance $27.5m at year-end

* 20% increase in regular dividend

Paul Moody, Chairman said:

"Our business model is highly focused and our market opportunity

remains substantial. The successful initial execution of the brand

building initiative in 2018 leaves the Group in a good position to

meet its strategic goals. Trading results in the first few weeks of

2019 have been encouraging."

For further information, please contact:

4imprint Group plc MHP Communications

Tel. + 44 (0) 20 3709 9680 Tel. + 44 (0) 20 3128 8156

Kevin Lyons-Tarr - CEO Katie Hunt

David Seekings - CFO Nessyah Hart

Chairman's Statement

2018 was a memorable year for 4imprint. The Group's operational

and financial performance represents substantial progress towards

our target of achieving $1bn in Group revenue by 2022.

Group revenue in 2018 was $738.4m, an increase of 18% over the

prior year comparative of $627.5m. Consistent with our strategy,

all of this revenue growth was organic. Underlying operating profit

before tax was $45.6m, 9% higher than 2017. This financial

performance is particularly rewarding given that we had positioned

2018 as an 'investment' year, initially guiding towards a revenue

growth percentage in the low teens and underlying operating profit

essentially flat against 2017.

This time last year we announced an exciting new project to

heighten the awareness and strength of the 4imprint brand. Our plan

involved significant incremental expenditure on different marketing

techniques, including the integration of traditional broadcast

media such as TV and radio into our overall marketing portfolio.

The results so far from the brand development programme have

exceeded our expectations, with tangible and immediate gains in

customer order activity contributing directly to the Group's strong

financial performance.

Order volumes increased sharply in the second quarter of the

year, stretching our customer service and back office resource. In

typical fashion, our team members responded to the challenge with a

relentless focus on the detail of every order. I would like to

express the Board's appreciation and thanks to each member of our

highly professional team for their efforts both during this period

and throughout the year. We are also grateful to our supplier

partners whose support was invaluable at this time of rapid

growth.

Profit before tax at $44.1m was up 9% over prior year. Profit

after tax of $35.2m improved by 22% over 2017, driven principally

by the beneficial effects of US tax reform. Accordingly, basic

earnings per share rose by 22% to 125.61c.

Our business model is highly cash-generative and consequently

the Group remains well financed, with a 2018 year-end cash balance

of $27.5m, (2017: $30.8m), even after absorbing the payment in May

2018 of a supplementary dividend amounting to $16.3m.

In view of the Group's sustained growth trajectory, the Board

has accelerated by a year further planned expansion at its

distribution centre in Oshkosh, Wisconsin. The capital cost in 2019

will be around $5m.

At the half-year the Board declared an interim dividend per

share of 20.80c, an increase of 15% over 2017. In view of the

Group's performance in the second half of the year and in line with

our balance sheet funding and capital allocation guidelines, the

Board is pleased to recommend a final dividend per share of 49.20c,

an increase of 23%, giving a total paid and proposed 2018 regular

dividend of 70.00c, up 20% over prior year.

Outlook

Our business model is highly focused and our market opportunity

remains substantial. The successful initial execution of the brand

building initiative in 2018 leaves the Group in a good position to

meet its strategic goals. Trading results in the first few weeks of

2019 have been encouraging.

Paul Moody

Chairman

5 March 2019

Chief Executive's Review

2018 2017

Revenue $m $m

------------------------------ ------- ------------ -----

North America 714.56 608.00 +18%

UK and Ireland 23.86 19.52 +22%

Total 738.42 627.52 +18%

------------------------------ ------- ------------ -----

2017

2018 (restated)

Underlying* operating profit $m $m

------------------------------ ------- ------------ -----

Direct Marketing operations 49.63 45.64 +9%

Head Office (3.45) (3.06) +13%

Share option related charges (0.82) (0.55) +49%

Underlying operating profit 45.36 42.03 +8%

------------------------------ ------- ------------ -----

Operating profit 44.32 41.28 +7%

------------------------------ ------- ------------ -----

Underlying profit is included because the Directors consider

this gives a measure of the underlying performance of the ongoing

business.

* Underlying is before defined benefit pension charges and

exceptional items.

Underlying has been restated to include share option

charges.

2018 was a successful year for the Group.

Twelve months ago, we set out our plan to make a significant new

marketing investment. This involved the addition of a brand

component, principally TV and radio, to our marketing portfolio.

Our aim was to extend our reach by cultivating awareness of the

4imprint brand as 'the' source for promotional products. We had

performed extensive research to identify our target customer and

their needs, and to analyse 4imprint's competitive position in the

market. As a result, we were confident in our direction, but

uncertain of the timeframe over which brand-based advertising would

produce meaningful revenue benefits. In addition, we were careful

to point out that this investment would be incremental and as such

would not involve a re-allocation of funds away from our existing,

proven marketing engine. In consequence, we guided to 2018 numbers

showing continued revenue growth but flat year-on-year operating

profit to reflect the investment phase of this new initiative.

The Group's actual performance in 2018 exceeded these early

expectations. Beginning in March 2018, this evolution of our

strategy produced immediate and tangible gains, including material

increases in both direct website traffic and in online

searches/interest in "4imprint". This produced considerable

momentum in the customer file, leading to financial results ahead

of our original projections.

279,000 new customers were acquired across the Group in 2018,

driving orders from new customers up 14% over prior year (compared

to an increase of 5% in 2017). Orders from existing customers

increased over 2017 by 19% (prior year comparative 16%) including

important early signs that the change in the marketing mix is

yielding customers with retention characteristics conforming to our

target customer 'sweet spot'. In total our customer service teams

processed 1,389,000 individually customised and usually

time-sensitive orders, an increase of 17% over 2017.

Our North American business enjoyed robust trading throughout

the year, particularly after the launch of the brand marketing

programme in March 2018. Our presence continues to expand in the US

and Canadian markets, which are both serviced from a central office

in Oshkosh, Wisconsin. Revenue growth over prior year was 18%,

compared to estimated total industry growth of about 5%.

Our UK business, based in Manchester, also delivered an

excellent result. Revenue was up 22% over prior year, benefitting

from some exchange rate impact but still up a healthy 18% in

Sterling.

The Group aggregate gross margin percentage in 2018 was

consistent throughout the year at around 0.7% lower than 2017. At

the half-year we reported that various factors contributed to this,

including the impact of a rapid increase in order volumes after the

launch of the branding campaign. This placed some strain on our

operational capacity and supplier/delivery arrangements, resulting

in elevated levels of expedited freight costs and other

credits/adjustments made to ensure that we were able to deliver on

our promise of excellent service. These operational factors were

largely addressed by mid-year. A similar margin percentage effect

was felt in the second half, driven principally by stronger than

anticipated order volume in the already rapidly growing apparel

category, where margins are typically lower than average. This

shift in mix towards the apparel category and also within that

category towards higher value items resulted in most of the margin

movement in the second half. Overall, our approach to pricing has

not changed, and we expect that our gross margin percentage will

stabilise in 2019.

Revenue per marketing dollar was $5.63 in 2018 compared to $5.67

in 2017. Given the investment in brand marketing in the year this

is a very satisfactory result, equipping us with a broader base and

more flexibility to adjust the balance within the marketing

portfolio moving forward.

Underlying operating profit, excluding Head Office expenses and

share option related charges, increased over prior year by $4.0m to

$49.6m, a 9% increase. This is lower than the percentage increase

in revenue, reflecting the incremental brand advertising expense

and a slightly lower gross margin percentage, offset by some

gearing effect from selling costs and other overheads in the

trading businesses rising at a rate lower than the increase in

revenue.

Head office costs rose by 13% compared to 2017, with the

increase accounted for largely by incentive compensation and

exchange effects on costs incurred in Sterling.

Share option related expense increased by 49%, driven by

enrollment in our popular employee share option (SAYE or US

equivalent) plans and executive awards made under the 2015

Incentive Plan.

Overall, the Group underlying operating margin percentage for

2018 was 6.14%, compared to 6.70% in 2017. In the context of the

marketing investment made in 2018 and the delivery of underlying

operating profit $3.3m higher than our original expectations for

the year, we are happy with this result. We enter 2019 as a much

larger business with a fundamentally strengthened array of tools

and techniques with which to drive further organic growth.

In contemplation of further revenue growth, we have accelerated

by a year a planned expansion of our distribution centre in

Oshkosh. Construction work has already commenced and should be

completed by mid-year 2019, at a capital cost of around $5m. Our

business model remains highly cash-generative and the project will

be financed out of in-year cash flow.

The markets in which we operate are fragmented and our share is

still small. Our strategic goal of achieving $1bn in revenue by

2022 is firmly in sight.

Financial Review

2017 2017

2018 Underlying* 2018 (restated)

Underlying* (restated) Total Total

$m $m $m $m

--------------------------------- ------------- ------------- ------- ------------

Underlying operating profit 45.36 42.03 45.36 42.03

Exceptional items (0.72) (0.46)

Defined benefit pension charges (0.72) (0.79)

Net finance income/(expense) 0.23 (0.12) 0.23 (0.12)

Profit before tax 45.59 41.91 44.15 40.66

--------------------------------- ------------- ------------- ------- ------------

* Underlying is before defined benefit pension charges and

exceptional items.

Underlying has been restated to include share option

charges.

Operating result

Group revenue in 2018 was $738.42m (2017: $627.52m), a

year-over-year increase of 18%. Underlying operating profit before

tax was $45.59m (2017: $41.91m), 9% higher than prior year.

IFRS15 'Revenue from Contracts with Customers', was implemented

from the start of the accounting period. The resulting adjustments

have a minimal impact on the full year financial results of the

Group, reducing revenue by $1.2m and operating profit by $0.3m. The

impact for 2017 would have been $0.7m revenue reduction and $0.2m

operating profit reduction. We therefore chose the transition

option of an opening net equity adjustment over the restatement of

prior periods. This resulted in a reduction in net equity of

$1.0m.

In prior results announcements we excluded share option related

charges from our definition of underlying operating profit. On the

basis that share-based payments are now relatively stable and

relate directly to the continuing operations of the Group, we have

decided to change our presentation to include these charges within

underlying operating profit. The relevant comparatives have been

restated.

Foreign exchange

The primary US dollar exchange rates relevant to the Group's

2018 results were as follows:

2018 2017

Period end Average Period end Average

Sterling 1.27 1.34 1.35 1.29

Canadian dollars 0.73 0.77 0.80 0.77

------------------ ----------- -------- ----------- --------

The Group reports in US dollars, its primary trading currency.

It also transacts business in Canadian dollars, Sterling and Euros.

Sterling/US dollar is the exchange rate most likely to impact the

Group's financial performance.

The primary foreign exchange considerations relevant to the

Group's operations are as follows:

-- 97% of the Group's revenue is in US dollars, the Group's

reporting currency, hence translational risk in the income

statement is low. The net impact on the 2018 income statement from

trading currency movements was not material to the Group's

results.

-- Most of the constituent elements of the Group balance sheet

are US dollar-based. The main exception is the Sterling-based

defined benefit pension liability. Currency movements produced an

exchange gain on the pension liability in the year of $1.0m.

-- The Group's business model is characterised by strong cash

generation, mostly in US dollars. However its primary applications

of post-tax cash are Shareholder dividends, pension contributions

and some Head Office costs, all of which are paid in Sterling. As

such, the Group's cash position is sensitive to Sterling/US dollar

exchange movements. By way of example, using actual exchange rates,

the weakening of Sterling against the US dollar during 2018 meant

that every US$1m converted to Sterling was worth around GBP48,000

more at the 2018 closing rate compared to the 2017 closing

rate.

Share option charges

A total of $0.82m (2017: $0.55m) was charged in the year in

respect of IFRS 2 'Share-based Payments'. This was made up of

elements from: (i) executive awards made under the 2015 Incentive

Plan; (ii) charges relating to the 2016 UK SAYE and the 2016 US

ESPP plans; and (iii) options granted under the 2018 US ESPP

plan.

Current options and awards outstanding are 133,366 shares under

the UK SAYE and US ESPP plans and 55,481 shares under the 2015

Incentive Plan. Awards under the 2015 Incentive Plan in respect of

2018 are anticipated to be made in late March 2019.

Exceptional items

An exceptional item of $0.72m was charged in the year. This

related to past service costs resulting from Guaranteed Minimum

Pension equalisation in our defined benefit pension scheme

following the Lloyds case (see note 2). In 2017 $0.46m was charged

to exceptional items relating to a pension risk reduction project

that has now been completed.

Net finance income

Net finance income for the year was $0.23m (2017: expense of

$0.12m). The year-over-year positive swing of $0.35m reflects lower

non-utilisation fees on committed lines of credit and improving

yields on cash deposits.

Taxation

The tax charge for the year was $8.95m (2017: $11.73m), giving

an effective tax rate of 20% (2017: 29%). The charge comprised

current tax of $8.17m, representing tax payable in the USA, and a

deferred tax charge of $0.78m. The material decrease in overall

rate between years was due principally to significant changes in

the US federal corporate tax rate following US tax reform

legislation enacted in December 2017.

The tax charge relating to underlying profit before tax was

$9.23m (2017: $11.97m), an effective tax rate of 20% (2017:

29%).

Earnings per share

Underlying basic earnings per share was 129.77c, (2017:

106.74c), an increase of 22%. This reflects the 9% increase in

underlying profit before tax, amplified by the beneficial effect of

US tax reform on the Group's effective tax rate, with a

substantially similar weighted average number of shares in issue

compared to 2017.

Basic earnings per share was 125.61c (2017: 103.15c), also an

increase of 22%.

Dividends

Dividends are determined in US dollars and paid in Sterling,

converted at the exchange rate on the date that the dividend is

determined.

The Board has proposed a final dividend of 49.20c (2017: 40.00c)

which, together with the interim dividend of 20.80c, gives a total

paid and proposed regular dividend relating to 2018 of 70.00c, an

increase of 20% compared to prior year.

The final dividend has been converted to Sterling at an exchange

rate of GBP1.00/$1.319 (2017: GBP1.00/$1.390). This results in a

final dividend payable to Shareholders of 37.30p (2017: 28.78p),

which, combined with the interim dividend paid of 15.85p, gives a

total dividend for the year of 53.15p, an increase of 25% compared

to prior year.

The final dividend will be paid on 15 May 2019 to Shareholders

on the register at the close of business on 5 April 2019.

Defined benefit pension plan

The Group sponsors a legacy defined benefit pension plan which

has been closed to new members and future accruals for many years.

This plan is the successor arrangement to the previous, much larger

defined benefit scheme which was successfully de-risked and

wound-up in December 2017. The new plan has equivalent benefits to

the previous scheme, and currently has 95 pensioners and 292

deferred members.

At 29 December 2018, the net deficit of the plan on an IAS 19

basis was $15.02m, compared to $18.11m at 30 December 2017. At 29

December 2018 gross scheme liabilities under IAS 19 were $33.10m,

and assets were $18.08m.

The change in deficit is analysed as follows:

$m

------------------------------------------------------------------------ --------

IAS 19 deficit at 31 December 2017 (18.11)

Company contributions to the scheme 3.93

Pension administration costs (0.32)

Pension costs - exceptional (0.72)

Pension finance charge (0.40)

Re-measurement loss due to changes in assumptions and return on assets (0.37)

Exchange gain 0.97

------------------------------------------------------------------------ --------

IAS 19 deficit at 29 December 2018 (15.02)

------------------------------------------------------------------------ --------

The net liability reduced by $3.09m in the year, driven

primarily by employer's contributions of $3.93m. Return on assets

was below expectations, but was largely offset by improving

financial assumptions and an exchange gain. In Sterling, the net

deficit decreased by GBP1.57m in the year to GBP11.83m.

A full actuarial valuation was performed in respect of the plan

in September 2016. Following this valuation a new deficit recovery

contribution schedule was agreed with the Trustee. Under this

agreement, contributions of GBP2.25m per annum were payable by the

Company. These contributions commenced on 1 July 2017, and rise by

3% per annum, with the first increase applied in July 2018. The

agreement is for a period of 5 years 7 months until 31 January

2023, at which point the funding shortfall is expected to be

eliminated. In addition, and consistent with previous practice, an

annual allowance of GBP0.25m will be paid to the Plan towards the

costs of its administration and management.

Additionally, the Company is committed to funding agreed

transfer values out of the Plan, at a funding rate of 50% of the

transfer value. $0.56m was paid in 2018 in respect of transfers out

of the Plan.

Cash flow

The Group had net cash of $27.48m at 29 December 2018, a

decrease of $3.29m over the 30 December 2017 balance of

$30.77m.

Cash flow in the period is summarised as follows:

2017

2018 (restated)

$m $m

----------------------------------------- -------- ------------

Underlying operating profit 45.36 42.03

Share option related charges 0.81 0.55

Depreciation and amortisation 2.65 2.51

Change in working capital (3.19) (0.46)

Capital expenditure (2.86) (2.36)

----------------------------------------- -------- ------------

Underlying operating cash flow 42.77 42.27

Tax and interest (7.62) (12.87)

Defined benefit pension contributions (3.93) (3.67)

Own share transactions (0.47) (1.36)

Exceptional items (0.05) (0.05)

Exchange (loss)/gain (1.01) 0.62

Free cash flow 29.69 24.94

Dividends to Shareholders (32.98) (15.85)

----------------------------------------- -------- ------------

Net cash (outflow)/inflow in the period (3.29) 9.09

----------------------------------------- -------- ------------

Underlying has been restated to include share option

charges.

The Group's cash flow performance remained strong in 2018. The

business model is efficient in working capital usage and typically

has low fixed capital requirements. The operating cash conversion

rate for the year was 94%.

$29.69m of free cash flow was generated in the period, (2017:

$24.94m), evidencing the beneficial effects of US tax reform.

Dividends to Shareholders includes the supplementary dividend of

60.00c per share paid in May 2018.

Balance sheet and Shareholders' funds

Net assets at 29 December 2018 were $43.27m, compared to $42.09m

at 30 December 2017. The balance sheet is summarised as

follows:

29 December 30 December

2018 2017

$m $m

---------------------------------- ------------ ------------

Non-current assets 25.73 25.88

Working capital 5.85 3.99

Net cash 27.48 30.77

Pension deficit (15.02) (18.11)

Other assets/(liabilities) - net (0.77) (0.44)

Net assets 43.27 42.09

---------------------------------- ------------ ------------

Shareholders' funds increased by $1.18m, comprising: net profit

in the period of $35.19m; $(0.43)m of exchange losses; net $nil of

pension related movements; $0.87m of net share option related

movements; $1.72m of proceeds from options exercised; $(2.18)m

relating to purchase of own shares; $(32.98)m equity dividends paid

to Shareholders; and an adjustment to opening net equity of

$(1.01)m arising from the implementation of IFRS15, (see note

9).

Balance sheet funding

The Board is committed to aligning the Group's funding with its

strategic priorities. This requires a stable, secure and flexible

balance sheet through the cycle. The Group will therefore typically

remain ungeared and hold a net cash position.

The Board's funding guidelines aim to provide operational and

financial flexibility:

-- to facilitate continued investment in marketing, people and

technology through different economic cycles, recognising that an

economic downturn typically represents a market share opportunity

for the business;

-- to protect the ability of the business to act swiftly as

growth opportunities arise in accordance with the Group's capital

allocation guidelines;

-- to underpin a commitment to Shareholders through the

maintenance of regular interim and final dividend payments; and

-- to meet our pension contribution commitments as they fall due.

The quantum of the net cash position target at each year-end

will be influenced broadly by reference to the investment

requirements of the business, and the subsequent year's anticipated

full year ordinary dividend and pension payment obligations.

The Board will keep these guidelines under review and is

prepared to be flexible if circumstances warrant.

Capital allocation

The Board's capital allocation framework is designed to deliver

increasing Shareholder value, driven by the execution of the

Group's growth strategy. The Group's capital allocation priorities

are:

-- Organic growth investments

o Either capital projects or those expensed in the income

statement

o Market share opportunities in existing markets

-- Interim and final dividend payments

o Increasing broadly in line with earnings per share through the

cycle

o Aim to at least maintain dividend per share in a downturn

-- Residual legacy pension funding

o In line with agreed deficit recovery funding schedule

o Further de-risking initiatives, if viable

-- Mergers & acquisitions

o Not a near term priority

o Opportunities that would support organic growth

-- Other Shareholder distributions

o Quantified by reference to cash over and above balance sheet

funding requirement

o Supplementary dividends most likely method; other methods may

be considered

Treasury policy

The financial requirements of the Group are managed through a

centralised treasury policy. The Group operates cash pooling

arrangements for its North American operations. Forward contracts

may be taken out to buy or sell currencies relating to specific

receivables and payables as well as remittances from overseas

subsidiaries. There were no forward contracts open at the period

end or prior period end. The Group holds the majority of its cash

with its principal US and UK bankers.

The Group has $20.5m of working capital facilities with its

principal US bank, JPMorgan Chase, N.A. The interest rate is US$

LIBOR plus 1.5%, and the facilities expire on 31 May 2020 ($20.0m

US facility) and 31 August 2019 ($0.5m Canadian facility). In

addition, an overdraft facility of GBP1.0m, with an interest rate

of bank base rate plus 2.0%, is available from the Group's

principal UK bank, Lloyds Bank plc.

Critical accounting policies

Critical accounting policies are those that require significant

judgments or estimates and potentially result in materially

different results under different assumptions or conditions. It is

considered that the only critical accounting policy is in respect

of pensions.

Brexit risk

The uncertainty surrounding the Brexit process is unhelpful.

Overall, however, we consider that the nature and geography of the

Group's operations, with 97% of the Group's revenue originating in

North America, leave it in a strong position to absorb any negative

effects.

The most likely impact - that from exchange rate volatility - is

addressed in our risk matrix which is available on the Company's

corporate website http://investors.4imprint.com.

We do not consider that Brexit creates any real change in the

Group's principal risks and uncertainties, nor does it have any

material effect on our evaluation of going concern or viability

analysis.

Our UK business (3% of Group revenue), may be affected by any

general economic malaise due to Brexit. In addition, if Brexit

results in any significant depreciation in the value of Sterling,

imported product would likely become more expensive, potentially

squeezing margins or choking demand if price increases are passed

on to customers. Also, under a "no deal" scenario suppliers may

experience difficulties with imports held up at ports and sales to

EU customers amounting to around GBP1m per year may become subject

to tariffs, additional administration and resulting delays.

Our remaining legacy defined benefit pension liability could be

negatively impacted if Brexit results in lower bond yields,

affecting discount rate assumptions in the plan valuation, or

leading to falls in the value of investments held in the plan.

Kevin Lyons-Tarr David Seekings

Chief Executive Officer Chief Financial Officer

5 March 2019

Group Income Statement for the 52 weeks ended 29 December

2018

2018 2017

Note $'000 $'000

------------------------------------------- ---- --------- ---------

Revenue 1 738,418 627,518

Operating expenses (694,096) (586,234)

Operating profit before exceptional items 45,043 41,738

Exceptional items 2 (721) (454)

------------------------------------------- ---- --------- ---------

Operating profit 1 44,322 41,284

Finance income 250 3

Finance costs (23) (125)

Pension finance charge (403) (503)

------------------------------------------- ---- --------- ---------

Net finance cost (176) (625)

Profit before tax 44,146 40,659

Taxation 3 (8,952) (11,734)

------------------------------------------- ---- --------- ---------

Profit for the period 35,194 28,925

------------------------------------------- ---- --------- ---------

Cents Cents

------------------------------------------- ---- --------- ---------

Earnings per share

Basic 4 125.61 103.15

Diluted 4 125.22 102.84

Underlying basic 4 129.77 106.74

------------------------------------------- ---- --------- ---------

Underlying has been restated to include share option

charges.

Group Statement of Comprehensive Income for the 52 weeks ended

29 December 2018

2018 2017

Note $'000 $'000

Profit for the period 35,194 28,925

----------------------------------------------------- ---- ------- ------

Other comprehensive (expense)/income

Items that may be reclassified subsequently

to the income statement:

Currency translation differences (434) (559)

Items that will not be reclassified subsequently

to the income statement:

Re-measurement gains on post-employment obligations 6 1,582 88

Return on pension scheme assets (excluding

interest income) 6 (1,951) 343

Tax relating to components of other comprehensive

income 390 495

Effect of change in UK tax rate (21) 17

Total other comprehensive (expense)/income

net of tax (434) 384

----------------------------------------------------- ---- ------- ------

Total comprehensive income for the period 34,760 29,309

----------------------------------------------------- ---- ------- ------

Group Balance Sheet at 29 December 2018

2018 2017

Note $'000 $'000

------------------------------- ---- -------- --------

Non-current assets

Property, plant and equipment 19,012 18,829

Intangible assets 1,084 1,138

Deferred tax assets 5,636 5,912

25,732 25,879

------------------------------- ---- -------- --------

Current assets

Inventories 9,878 5,356

Trade and other receivables 46,228 46,309

Current tax debtor 644 472

Cash and cash equivalents 27,484 30,767

------------------------------- ---- -------- --------

84,234 82,904

------------------------------- ---- -------- --------

Current liabilities

Trade and other payables (50,252) (47,675)

Current tax creditor (500) -

Provisions - (146)

------------------------------- ---- -------- --------

(50,752) (47,821)

------------------------------- ---- -------- --------

Net current assets 33,482 35,083

------------------------------- ---- -------- --------

Non-current liabilities

Retirement benefit obligations 6 (15,016) (18,106)

Deferred tax liability (931) (763)

(15,947) (18,869)

------------------------------- ---- -------- --------

Net assets 43,267 42,093

------------------------------- ---- -------- --------

Shareholders' equity

Share capital 18,842 18,842

Share premium reserve 68,451 68,451

Other reserves 5,427 5,861

Retained earnings (49,453) (51,061)

------------------------------- ---- -------- --------

Total Shareholders' equity 43,267 42,093

------------------------------- ---- -------- --------

Group Statement of Changes in Shareholders' Equity for the 52

weeks ended 29 December 2018

Retained earnings

-----------------------

Share

Share premium Other Profit Total

capital reserve reserves Own shares and loss equity

$'000 $'000 $'000 $'000 $'000 $'000

----------------------------------------- --------- -------- --------- ------------ --------- --------

Balance at 1 January 2017 18,842 68,451 6,420 (422) (63,966) 29,325

Profit for the period 28,925 28,925

Other comprehensive income/(expense)

Currency translation differences (559) (559)

Re-measurement gains on post-employment

obligations 431 431

Deferred tax relating to post-employment

obligations (83) (83)

Deferred tax relating to losses 578 578

Effect of change in UK tax

rate 17 17

Total comprehensive income (559) 29,868 29,309

----------------------------------------- --------- -------- --------- ------------ --------- --------

Proceeds from options exercised 19 19

Own shares utilised 101 (101) -

Own shares purchased (1,378) (1,378)

Share-based payment charge 545 545

Deferred tax relating to share

options 33 33

Deferred tax relating to losses 110 110

Effect of change in tax rates (25) (25)

Dividends (15,845) (15,845)

----------------------------------------- --------- -------- --------- ------------ --------- --------

Balance at 30 December 2017 18,842 68,451 5,861 (1,699) (49,362) 42,093

Adjustments for changes in

accounting policy

(note 9) (1,011) (1,011)

----------------------------------------- --------- -------- --------- ------------ --------- --------

Balance at 31 December 2017

after adjustments 18,842 68,451 5,861 (1,699) (50,373) 41,082

----------------------------------------- --------- -------- --------- ------------ --------- --------

Profit for the period 35,194 35,194

Other comprehensive income/(expense)

Currency translation differences (434) (434)

Re-measurement losses on post-employment

obligations (369) (369)

Deferred tax relating to post-employment

obligations 69 69

Deferred tax relating to losses 321 321

Effect of change in tax rates (21) (21)

Total comprehensive income (434) 35,194 34,760

----------------------------------------- --------- -------- --------- ------------ --------- --------

Proceeds from options exercised 1,722 1,722

Own shares utilised 2,420 (2,420) -

Own shares purchased (2,187) (2,187)

Share-based payment charge 808 808

Deferred tax relating to share

options 6 6

Deferred tax relating to losses 60 60

Dividends (32,984) (32,984)

----------------------------------------- --------- -------- --------- ------------ --------- --------

Balance at 29 December 2018 18,842 68,451 5,427 (1,466) (47,987) 43,267

----------------------------------------- --------- -------- --------- ------------ --------- --------

Group Cash Flow Statement for the 52 weeks ended 29 December

2018

2018 2017

Note $'000 $'000

------------------------------------------------ ---- -------- --------

Cash flows from operating activities

Cash generated from operations 7 41,651 40,901

Tax paid (7,844) (12,751)

Finance income received 250 3

Finance costs paid (23) (125)

Net cash generated from operating activities 34,034 28,028

------------------------------------------------ ---- -------- --------

Cash flows from investing activities

Purchases of property, plant and equipment (2,492) (1,844)

Purchases of intangible assets (395) (518)

Proceeds from sale of property, plant and

equipment 32 3

Net cash used in investing activities (2,855) (2,359)

------------------------------------------------ ---- -------- --------

Cash flows from financing activities

Proceeds from share options exercised 1,722 19

Purchase of own shares (2,187) (1,378)

Dividends paid to Shareholders 5 (32,984) (15,845)

------------------------------------------------ ---- -------- --------

Net cash used in financing activities (33,449) (17,204)

------------------------------------------------ ---- -------- --------

Net movement in cash and cash equivalents (2,270) 8,465

Cash and cash equivalents at beginning of

the period 30,767 21,683

Exchange (losses)/gains on cash and cash

equivalents (1,013) 619

------------------------------------------------ ---- -------- --------

Cash and cash equivalents at end of the period 27,484 30,767

------------------------------------------------ ---- -------- --------

Analysis of cash and cash equivalents

Cash at bank and in hand 23,648 28,709

Short-term deposits 3,836 2,058

------------------------------------------------ ---- -------- --------

27,484 30,767

------------------------------------------------ ---- -------- --------

General information

4imprint Group plc, registered number 177991, is a public

limited company incorporated in England and Wales, domiciled in the

UK and listed on the London Stock Exchange. Its registered office

is 25 Southampton Buildings, London WC2A 1AL.

The Group presents the consolidated financial statements in US

dollars and numbers are shown in US dollars thousands. A

substantial portion of the Group's revenue and earnings are

denominated in US dollars and the Board is of the opinion that a US

dollar presentation gives a more meaningful view of the Group's

financial performance and position.

Accounting policies

The principal accounting policies adopted in the preparation of

these financial statements are those that will be set out in the

Group's Annual Report and Accounts 2018. These policies have been

consistently applied to all the periods presented, apart from those

affected by the implementation of IFRS 15 'Revenue from Contracts

with Customers' and IFRS 9 'Financial Instruments'. IFRS 15 impacts

the accounting policies for revenue. For timing of revenue

recognition, the consideration is now on meeting performance

obligations, both contractual and implied, rather than risks and

rewards of ownership. When weighing performance obligations against

risks and rewards of ownership and taking into account implied

promises in our business model, it has been concluded that all

revenue should now be recognised at the time of receipt by the

customer rather than on shipment. IFRS 9 impacts the classification

and measurement of financial assets and liabilities. The impact of

these changes on the Group in these financial statements is

minimal. For trade receivables we have moved to an expected loss

method of providing for future impairment, but there has been only

a minor increase in the provision. On initial application of IFRS 9

there has been no change in measurement of financial assets or

financial liabilities. The financial impacts of these two policy

changes are shown in note 9. Other accounting standards effective

for the first time in the period have had no impact on the Group's

financial statements.

Basis of preparation

This announcement was approved by the Board of Directors on 5

March 2019. The financial information in this announcement does not

constitute the Group's statutory accounts for the periods ended 29

December 2018 or 30 December 2017 but it is derived from those

accounts. Statutory accounts for 30 December 2017 have been

delivered to the Registrar of Companies, and those for 29 December

2018 will be delivered after the Annual General Meeting. The

auditors have reported on those accounts. Their reports were

unqualified, did not include a reference to any matters to which

the auditors drew attention by way of emphasis without qualifying

their report and did not contain a statement under section 498(2)

or (3) of the Companies Act 2006.

The audited consolidated financial statements from which these

results are extracted have been prepared under the historical cost

convention in accordance with IFRS (International Financial

Reporting Standards) as adopted by the EU, IFRS IC interpretations

and those parts of the Companies Act 2006 applicable to companies

reporting under IFRS. The standards used are those published by the

International Accounting Standards Board (IASB) and endorsed by the

EU and effective at the time of preparing these financial

statements (March 2019).

After making enquiries, the Directors have reasonable

expectations that the Group has adequate resources to continue to

operate for a period of at least twelve months from the date these

financial statements were approved. Accordingly, they continue to

adopt the going concern basis in preparing the consolidated

financial statements.

Use of assumptions and estimates

The preparation of the consolidated financial statements

requires management to make judgments, estimates and assumptions

that affect the application of policies and reported amounts of

assets, liabilities, income and expenses. The estimates and

associated assumptions are based on historical experiences and

various other factors that are believed to be reasonable under the

circumstances, the results of which form the basis of making

judgments about carrying values of assets and liabilities that are

not readily apparent from other sources. Actual results may differ

from these estimates. The key estimates are in respect of the

present value of the pension scheme obligations and the quantum of

tax losses recognised in the deferred tax asset. The assumptions

used for the pension scheme obligations are disclosed in note 6 and

the tax losses are recognised to the extent that the Directors

consider it probable that future taxable profits will be available

against which the losses can be utilised.

Critical accounting policies

Critical accounting policies are those that require significant

judgments or estimates and potentially result in materially

different results under different assumptions or conditions.

Management considers the following to be the only critical

accounting policy:

Pensions

As disclosed in note 6, the Group sponsors a defined benefit

pension scheme closed to new members and future accruals. Period

end recognition of the liabilities under this scheme and the

return on assets held to fund these liabilities require a number

of significant actuarial assumptions to be made including inflation

rate, discount rate and mortality rates. Small changes in assumptions

can have a significant impact on the expense recorded in the

income statement and on the pension liability in the balance

sheet.

1 Segmental reporting

The chief operating decision maker has been identified as the

Board of Directors and the segmental analysis is presented based on

the Group's internal reporting to the Board.

At 29 December 2018, the results of the Group are reported as

one primary operating segment plus share option related charges and

the costs of the Head Office:

Revenue

2018 2017

$'000 $'000

North America 714,554 607,997

UK and Ireland 23,864 19,521

------------------------------------------------- -------- --------

Total revenue from sale of promotional products 738,418 627,518

------------------------------------------------- -------- --------

Profit Underlying* Total

2018 2017 2018 2017

$'000 $'000 $'000 $'000

4imprint Direct Marketing 49,632 45,639 49,632 45,639

Head Office (3,454) (3,059) (3,454) (3,059)

Share option related charges (819) (551) (819) (551)

----------------------------------------------- --------- --------- -------- ---------

Underlying operating profit 45,359 42,029 45,359 42,029

Exceptional items (note 2) (721) (454)

Defined benefit pension scheme administration

costs (note 6) (316) (291)

----------------------------------------------- --------- --------- -------- ---------

Operating profit 45,359 42,029 44,322 41,284

Net finance income/(expense) 227 (122) 227 (122)

Pension finance charge (note 6) (403) (503)

----------------------------------------------- --------- --------- -------- ---------

Profit before tax 45,586 41,907 44,146 40,659

Taxation (9,226) (11,974) (8,952) (11,734)

----------------------------------------------- --------- --------- -------- ---------

Profit after tax 36,360 29,933 35,194 28,925

----------------------------------------------- --------- --------- -------- ---------

*Underlying has been restated to include share option

charges.

The Directors consider that underlying operating profit gives a

measure of the performance of the business by excluding one-off

charges and costs relating to a legacy defined benefit scheme, the

beneficiaries of which were employed by businesses disposed of by

the Group.

2 Exceptional items

2018 2017

$'000 $'000

------------------------------------------------------ ------- -------

Past service costs re defined benefit pension scheme

pensioner GMP equalisation 721 -

Pension buy-out costs - 454

721 454

------------------------------------------------------ ------- -------

The past service costs result from the High Court judgment in

the Lloyds case on 26 October 2018, which confirmed that the

equalisation of benefits between male and female members of the

defined benefit plan at retirement extends to Guaranteed Minimum

Pensions ("GMP"). The charge is an estimate calculated by the

Company's actuaries, based on key high-level data from the Plan's

last full actuarial valuation and the legal position as understood

at the date of these financial statements. The actual result may

differ from this estimate.

Pension buy-out costs include $nil (2017: $378,000) incurred and

paid by the defined benefit pension scheme, in respect of the

buy-out.

3 Taxation

2018 2017

$'000 $'000

Current tax

UK tax - current - -

Overseas tax - current 8,212 12,326

Overseas tax - prior periods (41) (12)

--------------------------------------------------- ------- -------

Total current tax 8,171 12,314

--------------------------------------------------- ------- -------

Deferred tax

Origination and reversal of temporary differences 803 (664)

Adjustment in respect of prior periods (22) 84

Total deferred tax 781 (580)

Taxation 8,952 11,734

--------------------------------------------------- ------- -------

The tax for the period is different to the standard rate of

corporation tax in the respective countries of operation. The

differences are explained below:

2018 2017

$'000 $'000

---------------------------------------------------------- -------- --------

Profit before tax 44,146 40,659

Profit before tax for each country of operation

multiplied by rate of corporation tax applicable

in the respective countries 10,452 13,775

Effects of:

Adjustments in respect of prior periods (63) 72

Expenses not deductible for tax purposes and non-taxable

income 105 87

Other differences (164) (105)

Effect of tax rate changes on deferred tax balances - (482)

Utilisation of tax losses not previously recognised (1,378) (1,613)

Taxation 8,952 11,734

---------------------------------------------------------- -------- --------

The main rate of UK corporation tax will reduce to 17% from 1

April 2020. The net deferred tax asset at 29 December 2018 has been

calculated at a tax rate of 19% in respect of UK deferred tax items

which are expected to reverse before 2020 and 17% in respect of UK

deferred tax items expected to reverse thereafter.

The US federal tax rate was reduced to 21% from 1 January 2018.

US deferred tax items have been calculated at the 21% rate.

The amount of current tax recognised directly in Shareholders'

equity in 2018 was $nil (2017: $nil).

No current tax was recognised in other comprehensive income

(2017: $nil).

4 Earnings per share

Basic, diluted and underlying

The basic, diluted and underlying earnings per share are

calculated based on the following data:

2018 2017

$'000 $'000

Profit after tax 35,194 28,925

------------------ ------- -------

2018 2017

Number Number

'000 '000

----------------------------------------------- -------- -------------

Basic weighted average number of shares 28,018 28,042

Adjustment for employee share options 88 84

----------------------------------------------- -------- -------------

Diluted weighted average number of shares 28,106 28,126

----------------------------------------------- -------- -------------

2018 2017

Cents Cents

----------------------------------------------- -------- -------------

Basic earnings per share 125.61 103.15

----------------------------------------------- -------- -------------

Diluted earnings per share 125.22 102.84

----------------------------------------------- -------- -------------

2018

2017

(restated)

$'000 $'000

Profit before tax 44,146 40,659

Adjustments:

Exceptional items (note 2) 721 454

Defined benefit pension scheme administration

costs 316 291

Pension finance charge 403 503

----------------------------------------------- -------- -------------

Underlying profit before tax 45,586 41,907

Taxation (note 3) (8,952) (11,734)

Tax relating to above adjustments (274) (240)

----------------------------------------------- -------- -------------

Underlying profit after tax 36,360 29,933

----------------------------------------------- -------- -------------

2018 2017

Cents Cents

----------------------------------------------- -------- -------------

Underlying basic earnings per share 129.77 106.74

----------------------------------------------- -------- -------------

Underlying diluted basic earnings per share 129.37 106.42

----------------------------------------------- -------- -------------

Underlying has been restated to include share option

charges.

The basic weighted average number of shares excludes shares held

in the 4imprint Group plc employee share trusts. The effect of this

is to reduce the average by 67,125 (2017: 43,104).

The basic earnings per share is calculated based on the profit

for the financial period divided by the basic weighted average

number of shares.

For diluted earnings per share, the basic weighted average

number of ordinary shares in issue is adjusted to assume conversion

of all potential dilutive ordinary shares. The potential dilutive

ordinary shares relate to those share options granted to employees

where the exercise price is less than the average market price of

the Company's ordinary shares and are likely to vest at the balance

sheet date.

The underlying basic earnings per share is calculated before the

after-tax effect of exceptional items and defined benefit pension

charges and is included because the Directors consider this gives a

measure of the underlying performance of the ongoing business.

5 Dividends

2018 2017

Equity dividends - ordinary shares $'000 $'000

---------------------------------------- ------ ------

Interim paid: 20.80c (2017: 18.10c) 5,848 5,166

Supplementary paid: 60.00c (2017: nil) 16,282 -

Final paid: 40.00c (2017: 36.18c) 10,854 10,679

---------------------------------------- ------ ------

32,984 15,845

---------------------------------------- ------ ------

In addition, the Directors are proposing a final dividend in

respect of the period ended 29 December 2018 of 49.20c (37.30p)

per, which will absorb an estimated $13.8m of Shareholders'

funds. Subject to Shareholder approval at the AGM, these dividends

are payable on 15 May 2019 to Shareholders who are on the register

of members at close of business on 5 April 2019. These financial

statements do not reflect these proposed dividends.

6 Employee pension schemes

The Group operates defined contribution plans for its UK and US

employees. The regular contributions are charged to the income

statement as they are incurred. The charges recognised in the

income statement are:

2018 2017

$'000 $'000

----------------------------------------- ---- ---- ------- -------

Defined contribution plans - employers'

contributions 1,356 1,161

----------------------------------------------------- ------- -------

The Group also sponsors a UK defined benefit pension scheme

which is closed to new members and future accrual.

The amounts recognised in the income statement are as

follows:

2018 2017

$'000 $'000

---------------------------------------------- ------ ------

Administration costs paid by the scheme 316 291

Pension finance charge 403 503

Exceptional items - past service costs re GMP

equalisation 721 -

Exceptional items - buy-out costs paid by the

scheme - 378

Total defined benefit pension charge 1,440 1,172

---------------------------------------------- ------ ------

The amounts recognised in the balance sheet comprise:

2018 2017

$'000 $'000

----------------------------------------------- --------- ---------

Present value of funded obligations (33,103) (36,739)

Fair value of scheme assets 18,087 18,633

----------------------------------------------- --------- ---------

Net liability recognised in the balance sheet (15,016) (18,106)

----------------------------------------------- --------- ---------

A full actuarial valuation was undertaken as at 30 September

2016 in accordance with the scheme funding requirements of the

Pensions Act 2004. This actuarial valuation showed a deficit of

GBP14.9m. A recovery plan has been signed under which the Company

agreed a schedule of contributions with the Trustee. The recovery

plan period is 5 years 7 months and under the plan contributions of

GBP2.25m per annum are payable by the Company. These contributions

commenced on 1 July 2017. This amount rises annually by 3%. In

addition an annual allowance of GBP0.25m is payable towards costs

of administration of the scheme.

For the purposes of IAS 19, numbers from the actuarial valuation

as at 30 September 2016, which was carried out by a qualified

independent actuary, have been updated on an approximate basis to

29 December 2018. There have been no changes in the valuation

methodology adopted for this period's disclosures compared to the

previous period's disclosures.

The principal assumptions applied by the actuaries, as

determined by the Directors, at each period end were:

2018 2017

----------------------------------------- ------ ------

Rate of increase in pensions in payment 3.10% 3.05%

Rate of increase in deferred pensions 2.10% 2.05%

Discount rate 2.80% 2.50%

Inflation assumption - RPI 3.20% 3.15%

- CPI 2.10% 2.05%

----------------------------------------- ------ ------

The mortality assumptions adopted at 29 December 2018 reflect

the most recent version of the tables used in the last triennial

valuation. The assumptions imply the following life expectancies at

age 65:

2018 2017

------------------------ --------- ---------

Male currently age 40 23.4 yrs 23.3 yrs

Female currently age 40 25.3 yrs 25.3 yrs

Male currently age 65 21.9 yrs 21.9 yrs

Female currently age 65 23.8 yrs 23.7 yrs

------------------------ --------- ---------

Changes in the present value of the net defined benefit

obligation are as follows:

Present Fair value

value of of scheme

obligations assets Net obligation

$'000 $'000 $'000

------------ ---------- --------------

Balance at 1 January 2017 (34,357) 15,067 (19,290)

Administration costs paid by the scheme (291) - (291)

Exceptional items - buy-out costs paid

by the scheme (378) - (378)

Interest (expense)/income (941) 438 (503)

Return on scheme assets (excluding interest

income) - 343 343

Re-measurement gains due to changes in

demographic assumptions 611 - 611

Re-measurement losses due to changes in

financial assumptions (523) - (523)

Contributions by employer - 3,675 3,675

Benefits paid 2,465 (2,465) -

Exchange (loss)/gain (3,325) 1,575 (1,750)

-------------------------------------------- ------------ ---------- --------------

Balance at 30 December 2017 (36,739) 18,633 (18,106)

Administration costs paid by the scheme (316) - (316)

Exceptional items - past service costs

re GMP equalisation (721) - (721)

Interest (expense)/income (889) 486 (403)

Return on scheme assets (excluding interest

income) - (1,951) (1,951)

Re-measurement gains due to changes in

financial assumptions 1,582 - 1,582

Contributions by employer - 3,932 3,932

Benefits paid 1,848 (1,848) -

Exchange gain/(loss) 2,132 (1,165) 967

-------------------------------------------- ------------ ---------- --------------

Balance at 29 December 2018 (33,103) 18,087 (15,016)

-------------------------------------------- ------------ ---------- --------------

7 Cash generated from operations

2018 2017

$'000 $'000

------------------------------------------------ ------- -------

Operating profit 44,322 41,284

Adjustments for:

Depreciation charge 2,200 2,048

Amortisation of intangibles 445 464

Loss on disposal of fixed assets 7 4

Exceptional non-cash items 721 378

(Decrease)/increase in exceptional accrual (52) 19

Share option charges 808 545

Defined benefit pension administration charge 316 291

Contributions to defined benefit pension scheme (3,932) (3,675)

Changes in working capital:

Increase in inventories (2,266) (1,176)

Increase in trade and other receivables (2,422) (6,324)

Increase in trade and other payables 1,504 7,043

Cash generated from operations 41,651 40,901

------------------------------------------------ ------- -------

8 Related party transactions

The Group did not participate in any related party

transactions.

9 Impact of new accounting standards

The implementation of IFRS 9 has had no material impact on the

financial results of the Group. The simplified expected loss model

for the trade receivables bad debt provisions results in an

immaterial increase in the provision. Trade and other receivables,

together with cash and cash equivalents, were categorised as 'Loans

and Receivables' under IAS39 and measured at amortised cost. This

category does not exist in IFRS9, but these items continue to be

measured at amortised cost. Additionally, there were no derivative

instruments at this or the prior period end. The Group's financial

instruments basis of valuation is unchanged from prior year.

The implementation of IFRS 15's performance obligations

requirement has resulted in a revision to the period end cut off

procedure for revenue recognition, to recognise revenue only when

the goods have been physically received by the customer. This

change has little full year on year impact on the financial results

of the Group (2017: $0.2m operating profit reduction) and so the

decision was taken to take advantage of the option not to restate

prior periods. This results in an opening adjustment to reduce net

equity by $1,011,000 as follows:

Opening

30 Dec Opening 31 Dec

2017 IFRS 2017

Balance sheet As reported 15 adjustment Revised

$'000 $'000 $'000

-------------------------------- ------------- --------------- ---------

Non-current assets 25,879 - 25,879

Current assets

Inventories 5,356 2,584 7,940

Trade and other receivables 46,309 (2,657) 43,652

Current tax 472 - 472

Cash and cash equivalents 30,767 - 30,767

-------------------------------- ------------- --------------- ---------

82,904 (73) 82,831

-------------------------------- ------------- --------------- ---------

Current liabilities

Trade and other payables (47,675) (1,203) (48,878)

Provisions (146) - (146)

(47,821) (1,203) (49,024)

-------------------------------- ------------- --------------- ---------

Net current assets 35,083 (1,276) 33,807

-------------------------------- ------------- --------------- ---------

Non-current liabilities

Retirement benefit obligations (18,106) - (18,106)

Deferred tax liability (763) 265 (498)

-------------------------------- ------------- --------------- ---------

(18,869) 265 (18,604)

Net assets 42,093 (1,011) 41,082

-------------------------------- ------------- --------------- ---------

The impact on the year-end balance sheet and results for the

period are as follows:

29 Dec

29 Dec IFRS 15 2018

Balance sheet 2018 adjustment As reported

$'000 $'000 $'000

-------------------------------- --------- ------------ -------------

Non-current assets 25,732 - 25,732

Current assets

Inventories 6,890 2,988 9,878

Trade and other receivables 50,065 (3,837) 46,228

Current tax 644 - 644

Cash and cash equivalents 27,484 - 27,484

-------------------------------- --------- ------------ -------------

85,083 (849) 84,234

-------------------------------- --------- ------------ -------------

Current liabilities

Trade and other payables (49,483) (769) (50,252)

Current tax (840) 340 (500)

(50,323) (429) (50,752)

-------------------------------- --------- ------------ -------------

Net current assets 34,760 (1,278) 33,482

-------------------------------- --------- ------------ -------------

Non-current liabilities

Retirement benefit obligations (15,016) - (15,016)

Deferred tax liability (931) - (931)

-------------------------------- --------- ------------ -------------

(15,947) - (15,947)

Net assets 44,545 (1,278) 43,267

-------------------------------- --------- ------------ -------------

IFRS 52 weeks

52 weeks 15 adjustment ended

ended 29 Dec

29 Dec 2018

Income statement 2018 As reported

$'000 $'000 $'000

------------------------ ---------- --------------- -------------

Revenue 739,646 (1,228) 738,418

Operating expenses (694,982) 886 (694,096)

------------------------ ---------- --------------- -------------

Operating profit 44,664 (342) 44,322

------------------------ ---------- --------------- -------------

Finance income 250 - 250

Finance costs (23) - (23)

Pension finance charge (403) - (403)

------------------------ ---------- --------------- -------------

Net finance cost (176) - (176)

------------------------ ---------- --------------- -------------

Profit before tax 44,488 (342) 44,146

Taxation (9,027) 75 (8,952)

------------------------ ---------- --------------- -------------

Profit for the period 35,461 (267) 35,194

------------------------ ---------- --------------- -------------

Earnings per share

Basic 126.57 125.61

Diluted 126.17 125.22

------------------------ ---------- --------------- -------------

10 Principal risks and uncertainties

The principal risks and uncertainties which the business faces

are: macroeconomic conditions; competition; currency exchange;

business facility disruption; disruption to the product supply

chain or delivery service; disturbance in established marketing

techniques; reliance on key personnel; failure or interruption of

IT systems and infrastructure; failure to adapt to new

technological innovations; and security of customer data. A full

description of these risks and the mitigating actions taken by the

Group is available on the Company's corporate website

http://investors.4imprint.com.

Statement of Directors' responsibilities

Each of the Directors confirms that, to the best of their

knowledge:

-- the financial statements within the full Annual Report and

Accounts from which the financial information within this Final

Results Announcement has been extracted, have been prepared in

accordance with IFRSs as adopted by the EU, give a true and fair

view of the assets, liabilities, financial position and profit of

the Company and the undertakings included in the consolidation

taken as a whole; and

-- the Chief Executive's Review and Financial Review, and

Principal risks and uncertainties (note 10) include a fair review

of the development and performance of the business and the position

of the Company and the undertakings included in the consolidation

taken as a whole, together with a description of the principal

risks and uncertainties that it faces.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

FR USAWRKSAORAR

(END) Dow Jones Newswires

March 05, 2019 02:00 ET (07:00 GMT)

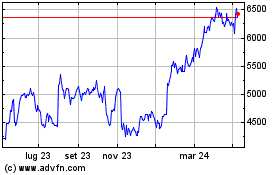

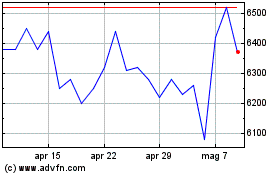

Grafico Azioni 4imprint (LSE:FOUR)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni 4imprint (LSE:FOUR)

Storico

Da Apr 2023 a Apr 2024