88 Energy Limited 88 Energy Commences Trading on the US OTCQB (2115Z)

21 Gennaio 2022 - 8:00AM

UK Regulatory

TIDM88E

RNS Number : 2115Z

88 Energy Limited

21 January 2022

21 January 2022

88 Energy Commences Trading on the US OTCQB

Highlights

-- Official quotation and trading on to the US OTCQB market from 19 January 2022, code: EEENF

-- Delivers North American investors enhanced accessibility and liquidity in 88 Energy trading

-- B.Riley FBR Inc appointed as OTCQB Sponsor

-- Depositary Trust Company (DTC) eligibility application in progress

88 Energy Limited (ASX:88E, AIM:88E, OTC:EEENF) ( 88 Energy or

the Company ) is pleased to advise that its application to join the

OTCQB Market in the United States has been accepted and the

Company's shares are now listed for trading under the code EEENF.

The OTCQB Venture Market is for entrepreneurial and development

stage US and international companies.

The Company's primary listing will continue to be the Australian

Securities Exchange ( ASX ), with its secondary listing on the AIM

market of the London Stock Exchange ( AIM ) in the United Kingdom

also retained.

The OTCQB Market has robust financial reporting and corporate

governance requirements. All these requirements are effectively

satisfied by 88 Energy through its ongoing compliance with ASX

Listing Rules and the AIM Rules.

88 Energy sought OTCQB quotation to provide North American

investors with enhanced accessibility and liquidity in trading of

the Company's shares. The quotation delivers 88 Energy access to

one of the largest investment markets in the world at relatively

nominal cost (compared to traditional major exchanges) and with

practically no additional compliance requirements.

No new shares in the Company are being issued in connection with

commencement of trading on the OTCQB Market. Existing ordinary

shares of 88 Energy may now also be traded on the OTCQB Market and

investors can find real-time quotes and market information on the

OTC Markets website ( www.otcmarkets.com/stock/EEENF/overview

).

The Company is in the process of applying to the Depository

Trust Company ( DTC ) for DTC eligibility, which essentially

facilitates the trading of securities by individual investors that

use self-managed online broking accounts (such as TD Ameritrade and

E-Trade), as opposed to trading through full-service brokers.

Pending DTC eligibility, trading of the shares is implemented by

brokers acting as market makers.

88 Energy has appointed B.Riley FBR Inc as its OTCQB Sponsor for

the purposes of this market making. A list of other brokers

operating on the OTC Markets is available from the following link:

https://www.otcmarkets.com/otc-link/broker-dealer-directory .

Managing Director, Ashley Gilbert, commented:

"The OTCQB quotation provides 88 Energy with access to the

world's largest investment market. Given 88 Energy's portfolio of

oil and gas assets is focused solely on the North Slope of Alaska,

it was an obvious next step to upgrade to the OTCQB market,

especially given the strong trade in 88 Energy stock through the

OTC pink sheets throughout 2021.

88 Energy is at an exciting stage with the anticipated spud of

the Merlin-2 appraisal well in February 2022, as well as the

significant activity planned across our portfolio in 2022, so we

are excited to be broadening our exposure in the global investment

community. Joining the OTCQB Market will be matched with an active

investor engagement program, to ensure our investment case and

growth prospects are well understood amongst all current and

prospective shareholders in 88 Energy."

This announcement has been authorised by the Board.

Media and Investor Relations:

88 Energy Ltd

Ashley Gilbert, Managing Director

Tel: +61 8 9485 0990

Email:investor-relations@88energy.com

Finlay Thomson , Investor Relations Tel: +44 7976 248471

Fivemark Partners , Investor and Tel: +61 410 276 744

Media Relations Tel: +61 422 602 720

Andrew Edge / Michael Vaughan

EurozHartleys Ltd Tel: +61 8 9268 2829

Dale Bryan

Cenkos Securities Tel: +44 131 220 6939

Neil McDonald / Derrick Lee

ABOUT OTCQB Market

OTC Markets Group Inc. (OTCQX: OTCM) operates the OTCQX(R) Best

Market, the OTCQB(R) Venture Market and the Pink(R) Open Market for

10,000 U.S. and global securities. Through OTC Link(R) ATS and OTC

Link ECN, OTC Markets connect a diverse network of broker-dealers

that provide liquidity and execution services. OTC Markets enable

investors to easily trade through the broker of their choice and

empower companies to improve the quality of information available

for investors.

OTC Link ATS and OTC Link ECN are operated by OTC Link LLC,

member FINRA/SIPC and SEC regulated ATS.

There are currently more than 10,500 securities traded on the

OTC Markets with approximately US$375 billion annual volume, of

which approximately 1000 securities trading on the OTCQB Venture

Market with over US$40 billion total market capitalisation.

www.otcmarkets.com

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

MSCBBMFTMTJTMPT

(END) Dow Jones Newswires

January 21, 2022 02:00 ET (07:00 GMT)

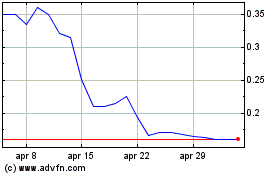

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Mar 2024 a Apr 2024

Grafico Azioni 88 Energy (LSE:88E)

Storico

Da Apr 2023 a Apr 2024